Graphite One prepares sample battery material for EV Manufacturers’ analysis – Richard Mills

2023.01.13

The electrification of the global transportation system is one of the most important investing themes for the next several decades of the 21st century. In a bid to stop global warming governments across the globe are spending hundreds of billions of dollars to encourage consumers and businesses to switch their driving and car-buying habits from fossil-fueled to electric models. Automakers are also investing heavily in electrification, with just about every major carmaker offering new electric models.

According to Reuters, The world’s top automakers are planning to spend nearly $1.2 trillion through 2030 to develop and produce millions of electric vehicles, along with the batteries and raw materials to support that production, according to a Reuters analysis of public data and projections released by those companies.

The EV investment figure, which has not previously been published, dwarfs previous investment estimates by Reuters and is more than twice the most recent calculation published just a year ago [October 2021].

Graphite as anode material

The lithium-ion battery used to power electric vehicles is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

This is due to the fact that, with natural strength and stiffness, graphite is an excellent conductor of heat and electricity. Being the only other natural form of carbon besides diamonds, it is also stable over a wide range of temperatures, with a temperature resistance that goes above 3,500 degrees Celsius — same as the outer atmosphere of the sun!

Hence, graphite is considered indispensable to the global shift towards electric vehicles. There are currently no substitutes. It is also the largest component in batteries by weight, constituting 45% or more of the cell.

INN quoted Benchmark Mineral Intelligence data showing demand for natural graphite from the battery segment amounted to 400,000 tonnes in 2021, with that number expected to scale up to 3Mt by 2030.

Where are the EV makers going to find the graphite? Mined graphite production in 2021 amounted to 1 million tonnes, meaning a tripling of mine output could be required in just seven years.

Developing an EV industry from scratch

In a recent article by Bloomberg, it was pointed out that Dozens of companies have announced plans to open factories devoted to electric vehicle battery production, spurred by federal incentives and a growing market for cleaner cars.

New tax credits become available this month for making critical technologies, meaning “extra carrots for carmakers”, but it also means “an entire domestic industry must develop from scratch,” since no lithium-ion batteries are currently produced in the United States.

However, much is in the planning stages. And when I say much, I mean A LOT.

According to Bloomberg New Energy Finance, since 2009 there have been 882 battery manufacturing projects started or announced in the US, representing $108 billion in investment. Nearly 25% of those projects were rolled out in 2022.

Our research also found that global carmakers and established battery manufacturers have announced plans to invest at least $50 billion into at least 10 states to build EV assembly and battery plants since the start of 2021, and states have made commitments totaling at least $10.8 billion to lure those investments, according to a tally of publicly disclosed incentives by Bloomberg and Good Jobs First. That figure almost certainly underestimates the actual number.

For a breakdown by state, read US battery and EV plants galore. Georgia alone has announced 30 factories related to electric cars and batteries since 2020.

Demand > supply

For vehicle electrification to roll out globally, without supply interruptions, many EV components, not just for the battery but the wiring, the motor, the electronics, the body, etc. must be reliably sourced by automobile manufacturers. This represents a slew of battery, industrial and precious metals, including lithium, nickel, zinc, manganese, cobalt, copper, silver and graphite, that will all need to be sourced.

When it comes to graphite China is by far the biggest producer with nearly 80% of the world’s production. Due to weak environmental standards and low costs, China also controls almost all graphite processing. With no graphite production of its own, the US is 100% dependent on China for its battery-grade graphite.

China’s dominance of the graphite market could pose problems for Western auto and battery manufacturers, as demand for anode material is set to rise by over seven times this decade.

These companies will need to diversify their sources of graphite to reduce the risks of relying on one country for a critical battery material.

Indeed with most graphite coming from China, and all anodes in the lithium-ion battery currently requiring graphite, every country making these batteries needs to source it.

Consider: No matter where a battery is made, much of the graphite originates in China, and from there it either gets processed in China, or it moves to South Korea or Japan, for manufacturing by LG or Panasonic, for example.

China’s domination of the graphite space means that developing a domestic supply chain from scratch will not be easy.

The Bloomberg piece quotes the CEO of 6K, a company that makes cathode materials, stating that his American plant will produce 10 million kilograms of cathode material a year. But the chief executive estimates the US will need 50 times that amount to meet the vehicle demand by 2030.

AOTH decided to run some numbers, to figure out how much graphite that would entail. Here’s how I did the admittedly rough math:

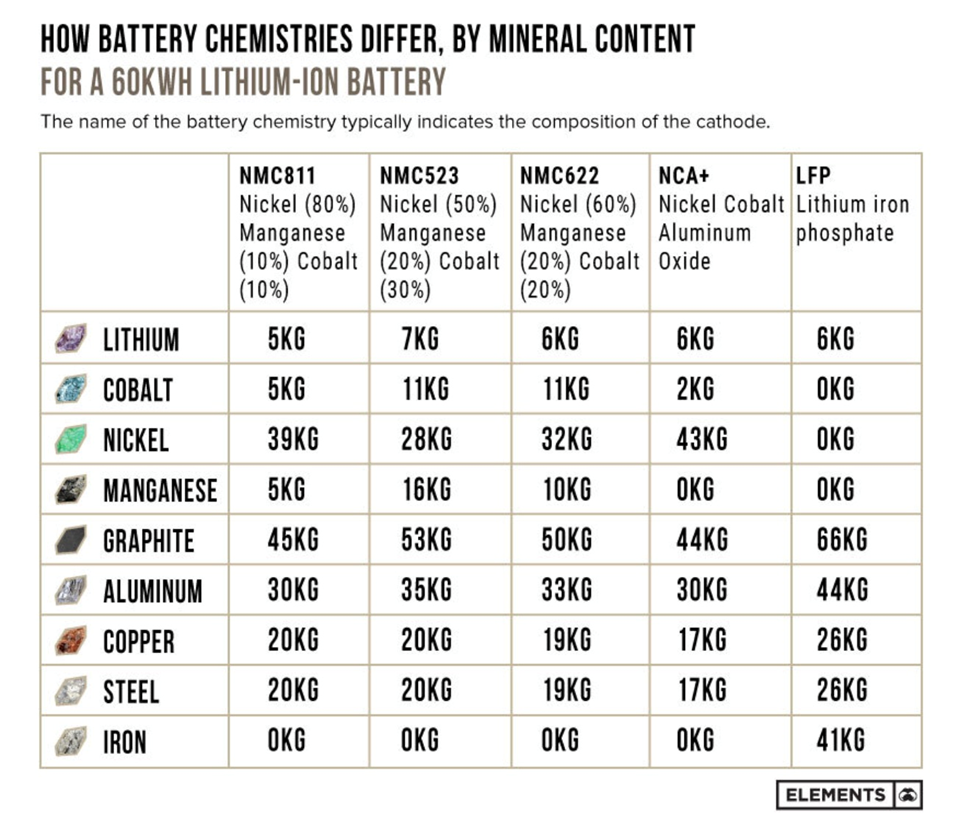

According to an infographic by Visual Capitalist, the cathode for one NMC 811 cathode, which 6K will produce, contains 5kg lithium, 39kg nickel, 5kg manganese, and 5kg cobalt for a total of 54kg of material per NMC 811 cathode. 10m kg divided by 54kg = 185,185 6K NMC cathodes.

There is, according to Visual Capitalist, 45kg of graphite needed, in the form of an anode, for every NMC 811 60KWH lithium-ion battery. That’s 9.2m kg (9.2t) of graphite, 185,185 x 45kg.

But 6K’s chief executive estimates that, just the US, will need 50 times that amount to meet EV demand by 2030.

These are impossible to achieve numbers in an implausible time frame.

But that does not mean that the US and pretty much every other government across the globe isn’t going pedal to the metal in trying to achieve electrification of their transportation systems, which obviously means a huge scramble for metals/minerals. But which is under the most supply pressure?

As the first in the lithium space in 2009 we’ve managed several successful speculations starting with Salares Lithium, then Lithium X, to our latest Cypress Development. Because I’m anticipating a huge price drop this year for lithium and consequently a rollover into the next poster child of the battery metal sector, and because the US is almost 100% dependant on China for its graphite and lithium-ion battery anodes, AOTH is now focusing mainly on graphite.

But I have to ask, how are they going to find all that graphite?

Graphite One Inc. (GPH, OTCQX:GPHOF)

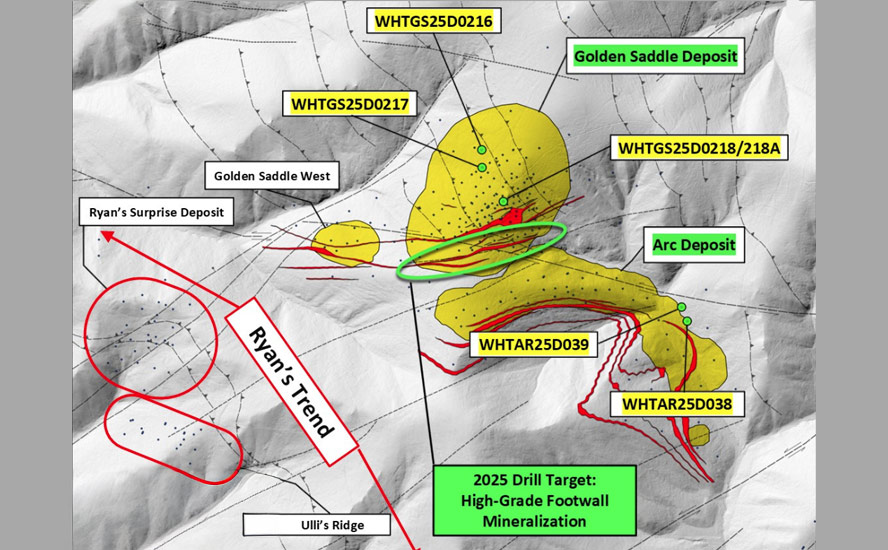

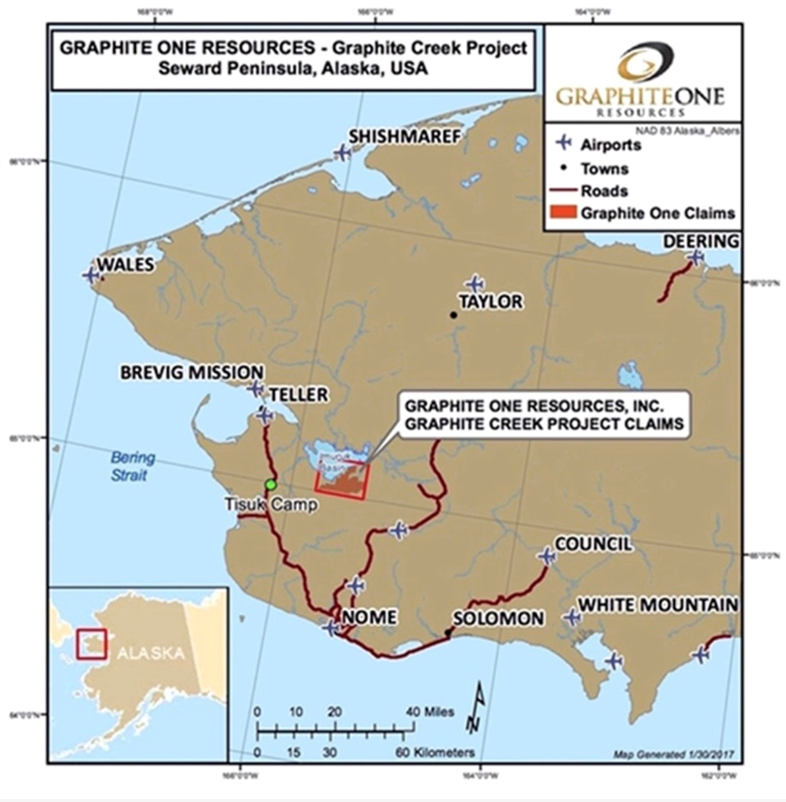

There is one company that almost certainly will have a role to play in developing a domestic electric-vehicle supply chain. Graphite One is advancing the Graphite Creek property, situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production. The US Geological Survey has cited Graphite Creek as the country’s largest known graphite deposit.

Last summer Graphite One underwent a major de-risking event with the release of the prefeasibility study (PFS) for its Graphite One Project. 2021 drilling has successfully upgraded the 2019 resource estimate, delivering nearly a 200% increase in measured and indicated resources.

The PFS also portrays the Graphite One Project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite product price of $7,301 per tonne.

The mine would produce, on average, 51,813 tonnes per year (tpy) of graphite concentrate for its projected 23-year mine life. The company itself would produce about 75,000 tpy of products, of which 49,600 tpy would be anode materials, 7,400 tpy purified graphite products, and 18,000 tpy unpurified graphite products.

The prefeas is based on exploration of only one square kilometer of the 16-km deposit, meaning GPH could easily crank up production by a factor several times the current (proposed) run rate of 2,860 tonnes per day. Drill results to date indicate the resource remains open down dip and along strike to the east and west.

Scale is important to Graphite One’s future customers; they will not want a fragmented supply chain.

The company says it intends to make a production decision upon the completion of a feasibility study. It’s my opinion that the feasibility study will incorporate much more of the deposit and will therefore envision a ramp-up of production, to the point where Graphite One could be not just a US supplier but a global supplier of anode material.

That would completely change the paradigm for Graphite One and catapult Graphite Creek into the top tier of graphite deposits worldwide.

Government incentives

In its Year in Review, Graphite One notes that, With the August, 2022, passage of the U.S. Inflation Reduction Act — for which U.S. federal tax guidance will be issued in March, 2023 — domestic content tax credits are available which could benefit Graphite One. The company expects to issue projections of the new federal tax credit impact once the guidance is published.

The act instituted, among other things:

- A tax credit to producers in the U.S. of anode materials equal to 10 per cent of the costs incurred with respect to the production of anode materials commencing Dec. 31, 2022, and reducing to 75 per cent, 50 per cent, 25 per cent and 0 per cent in 2030, 2031, 2032 and thereafter, respectively;

- A tax credit equal to 10 per cent of the costs incurred with respect to production of graphite purified to a minimum purity of 99.9 per cent graphitic carbon by mass — the phaseout provisions in 1 specifically do not apply;

- Only production in the United States qualifies for the tax credit.

Graphite One’s production is expected to qualify under the act for tax credits in both categories as it plans to produce both anode materials and purified graphite in the United States, as defined in the act.

Last year, the United States government invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now gain access to $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies.

The annual Defense Appropriations Bill, passed Dec. 15, 2022, includes funding for graphite as a rechargeable battery material, as well as natural graphite-based foam fire suppressant.

“We thank Senator [Lisa] Murkowski for being the leader in Congress on critical mineral issues, drawing a straight line from their domestic development to the defense technologies that safeguard national security,” Graphite One’s CEO Anthony Huston said. “Whether for lithium-ion batteries or a safer foam fire suppressant for defense or civilian use, it’s essential to develop Alaska’s rich graphite resources. The 2023 Defense Appropriations bill reflects that imperative.”

Anode sampling underway

Included in the Year in Review was an important development regarding Graphite One’s strategy to simultaneously develop a battery anode materials manufacturing facility in Washington State, and the Graphite Creek Mine in Alaska. Combined they are known as the Graphite One Project.

The company aims to become the first vertically integrated domestic producer to serve the nascent US electric vehicle battery market.

The Vancouver-headquartered company in April, 2022 announced a memorandum of understanding (MOU) with Sunrise (Guizhou) New Energy Material Co., Ltd., lithium-ion battery anode producer based in Guizhou Province, China.

The intent is to develop an agreement to share expertise and technology for the design, construction and operation of Graphite One’s proposed US-based graphite material manufacturing facility in Washington State — the second link in Graphite One’s planned US supply chain solution for advanced graphite products.

The third link in Graphite One’s US-based graphite supply chain involves battery materials recycler Lab 4 Inc. of Nova Scotia, Canada. Under an earlier MOU, GPH and Lab 4 will work collaboratively to design and build a recycling facility for end-of-life EV and lithium-ion batteries. Lab 4 provides laboratory and engineering support to mining companies with a focus on recycling graphite, manganese and other minerals.

According to Fortune Business Insights, the global lithium-ion battery recycling market is projected to grow from USD$1.7 billion in 2020 to $6.5 billion in 2028, at a CAGR of 18.5%.

The recycling facility will be located next to the Washington State manufacturing facility, and engineered to accept used EV batteries for feedstock.

Graphite One prepares sample battery material for EV Manufacturers’ analysis

Last year Sunrise started preparing anode materials for sample purposes from Graphite Creek concentrate, and in December 2022, Graphite One announced that concentrate is being used to prepare sample battery anode materials for two major electric vehicle (EV) manufacturers, while an artificial graphite anode sample is being prepared for a third EV company. Results are expected in the first of quarter of 2023.

This is a very crucial milestone for Graphite One in proving, a/ that its graphite end product is of sufficient quality to be battery-grade; and b/ that Graphite One is able to tailor its graphite processing to meet the specific graphite anode needs of its potential future clients.

Now we don’t want to speculate on who those companies are, but the fact that Graphite One describes them as “major EV manufacturers”, narrows the list down to a handful of American car companies, for now we’ll have to use our imagination to guess who they are.

Conclusion

Graphite is indispensable to the global shift towards electric vehicles. There are currently no substitutes. It is also the largest component in batteries by weight, the weight of graphite being almost equal to all the other major components – 54kg v 45kg graphite.

China is by far the biggest producer with nearly 80% of the world’s graphite production. China also controls almost all graphite processing. With no graphite production of its own, the US is almost 100% dependent on China for its battery-grade graphite and anodes. If the world is going to try and wean itself off fossil fuels powering its transportation sector, and switch to electricity stored in lithium-ion batteries it doesn’t make much sense to switch from one energy master, OPEC, to another, China.

The US government has finally recognized US critical minerals vulnerability. Graphite is included on a list of 35 critical minerals the US Geological Survey has deemed critical to the national economy and national security.

A number of incentives are being offered, such as tax credits through the Inflation Reduction Act, which Graphite One qualifies for, and $750 million under the Defense Production Act’s Title III fund.

In fact the Great American EV Revolution, expected by many to be years away, is here now and will continue for the foreseeable future.

Since 2009 there have been 882 battery manufacturing projects started or announced in the US, representing $108 billion in investment.

Global carmakers and battery manufacturers have, since the start of 2021, announced plans to invest at least $50 billion in a minimum of 10 states, to build EV assembly and battery plants. States have made commitments totaling at least $10.8 billion to lure those investments.

But this hurtling mass of demand is about to smash into the brick wall of supply.

Which means if the US is serious about ending its dependency on China, and follows through on plans to build a US-based anode manufacturing supply chain, Graphite One has to be involved.

It’s graphite concentrate is already being used to prepare sample battery anode materials for two major EV manufacturers, through Graphite One’s manufacturing partner, Sunrise New Energy Material Company. Sunrise is also preparing an artificial graphite anode sample for a third EV company. G1 says results are expected in the first quarter of this year

If these sample batches are successful, it will surely push Graphite One onto the radar of not only major EV and battery manufacturing companies, but major mining companies.

The possibility of US federal government grant money and results from EV manufacturers analysis of G1’s sample battery anode materials could mean exciting times ahead for Graphite One shareholders.

Lithium has always been the center stage actor, the mineral poster child of the electrification rush, and that’s completely understandable. That’s going to change. Graphite is unknown and unloved by most, and definitely off the radar screen of the herd, which to me, means opportunity is knocking.

Graphite One, and its nascent anode manufacturing supply chain, will become an important graphite producer for the United States.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$0.95, 2023.01.12

Shares Outstanding 83.3m

Market cap Cdn$104m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Graphite One Inc.( TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.