Graphite One announces potential EXIM funding for up to USD$895 million – Richard Mills

2025.09.05

Graphite One (TSXV:GPH, OTCQX:GPHOF) has received another show of support from the U.S. Export-Import Bank (EXIM) in the form of a USD$570 million Letter of Intent (LOI) to develop the company’s Graphite Creek mine in Alaska.

EXIM’s $570M LOI

Vancouver-based GPH announced Tuesday that EXIM has extended a non-binding LOI for up to $570M to advance the mine. This is on top of EXIM’s $325M non-binding LOI in 2024, for the construction of the company’s Ohio-based anode manufacturing plant.

Total EXIM support now reaches a potential USD 895 million dollars ($1,230,759,250 CAD), that’s almost a billion dollars of potential funding towards accomplishing G1’s plans for a circular economy of mine to battery to EV for the US graphite supply chain.

“EXIM’s extension of its LOI to our Company validates Graphite One’s strategy to develop a 100% U.S.-based advanced graphite materials supply chain,” Graphite One’s President and CEO Anthony Huston stated in the Sept. 2 news release. “The announcement follows the recent acceptance of our Graphite Creek project as a ‘covered project’ onto the Federal FAST-41 Permitting Dashboard and, along with G1’s two Department of Defense grants under the Defense Production Act and from the Defense Logistics Agency, underscores the U.S. Government’s keen understanding of the urgency to end the United States’ 100% dependence of foreign sources of graphite supply.”

G1 expects to submit a formal application to EXIM under both LOIs in 2026.

Agreement with European marketing firm

Also on Tuesday, Graphite One announced it has entered into an agreement with MCS Market Communication Service GmbH, an online marketing and investor relations firm based in Westfalen, Germany to provide marketing and investor relations services to enhance visibility with the European institutional and retail investment community.

Grants and loans

Two Department of Defense grants have been awarded to Graphite One, one for $37.5 million – paying 75% of the cost of the Feasibility Study, the other for $4.7 million — the latter to develop an alternative to the current firefighting foam used by the US military and civilian firefighting agencies, using graphite sourced from Graphite Creek.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

‘Covered project status’

On June 3 it was announced that the Graphite Creek project in Alaska — the upstream anchor for Graphite One’s complete US-based graphite supply chain — was accepted as a “covered project” on the US government’s “FAST-41 Permitting Dashboard”.

Graphite Creek is the first Alaskan mining project to be listed on the dashboard.

FAST-41 streamlines the permitting process by providing improved timeliness and predictability by establishing publicly posted timelines and procedures for federal agencies, reducing unpredictability in the permitting process. FAST-41 also provides issue resolution mechanisms, while the federal permitting dashboard allows all project stakeholders and the general public to track a project’s progress, including periods for public comment.

The Graphite Creek project is found on page 2 of the FAST-41 Covered Projects, which are listed in alphabetical order. The Department of Defense and the US Army Corps of Engineers are listed as the agencies responsible for the project, which has a status of “Planned”.

Feasibility Study

FAST-41 status follows publication of Graphite One’s Feasibility Study (FS) on April 23, which, with the support of the Department of Defense Production Act award ($37.5 million), was completed 15 months ahead of schedule.

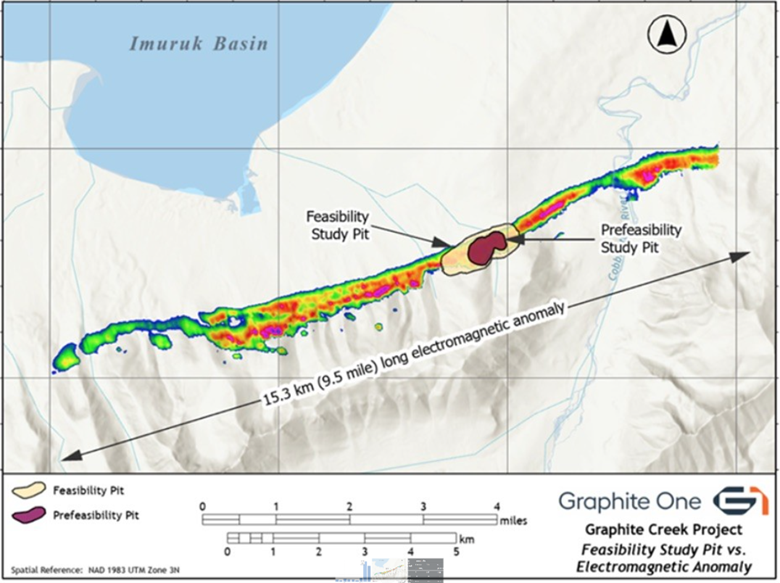

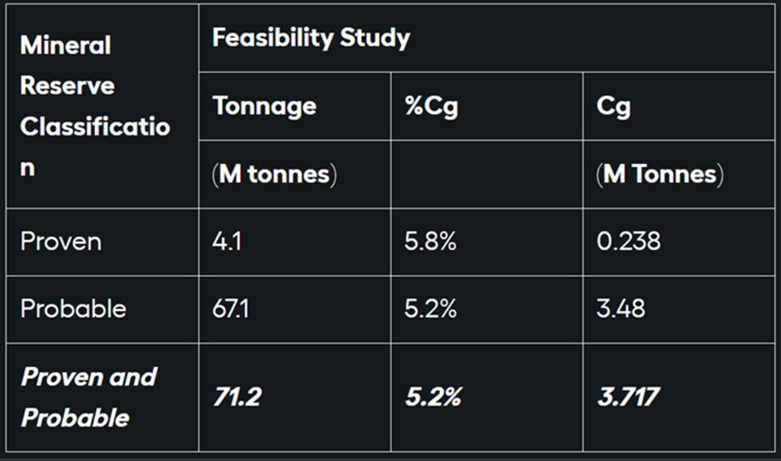

Annual graphite concentrate capacity of the Graphite Creek mine in the FS was increased from that in the 2022 Prefeasibility Study (PFS) from 53,000 tonnes per year (tpy) to 175,000 tpy while maintaining a 20-year mine life.

Thanks to the FS, the Graphite Creek project has entered the permitting phase with a production rate triple that was projected two years ago.

‘Circular economy’

Graphite One has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek in Alaska, the largest graphite deposit in the country and one of the biggest in the world.

Graphite One plans to develop a “circular economy” for graphite. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically — a US first.

Subject to financing, the company plans to invest $435 million to build a graphite product manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh. The plant would produce Active Anode Materials, first using synthetic graphite, and then, once the Graphite Creek mine is in production, using natural graphite.

Executive Orders

President Trump has signed several executive orders of relevance to Graphite One and Graphite Creek.

Regarding Trump’s March 20 executive order, Graphite One said it welcomes the EO, titled “Immediate Measures to Increase American Mineral Production.”

“This new Critical Minerals Executive Order serves as the strongest signal yet that the U.S. Government has not only recognized the national security need for critical minerals including graphite, but that there will now be a ‘whole of government’ engagement to accelerate domestic development,” Graphite One’s CEO Anthony Huston said.

The full text of the executive order can be found here, on the presidential actions page of the White House website.

The Critical Minerals EO follows three executive orders issued by President Trump on his first day in office: “Declaring a National Energy Emergency,” “Unleashing American Energy,” and “Unleashing Alaska’s Extraordinary Resource Potential” referenced in the Jan. 23 Graphite One press release.

The EO tasks the secretaries of defense, energy and interior with actions requiring responses within 10, 15, 30 and 45 days, and waives related legal requirements under the “national emergency” provision of the Defense Production Act (DPA).

The EO aligns with the focus on Alaska’s role in US resource development, hosting 49 of the 50 US government-designated critical minerals. As Alaska Governor Mike Dunleavy noted in his 2025 State of the State address, “the Graphite One deposit, the largest in North America, north of Nome, continues to move ahead with support from a Defense Department grant. Subject to securing project financing, construction could begin by 2027, and the mine could be producing as early as 2029.”

Achieving US security of graphite supply

Thanks to Graphite One, the US could soon have security of supply for a critical mineral that they are currently almost 100% reliant on China for.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

China accounts for 98% of announced anode manufacturing capacity expansions through 2030, according to the International Energy Agency.

China has imposed restrictions on Chinese graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Up to now, the US has had no security of supply for graphite. The country has reached a point where much more graphite needs to be discovered and mined in the US.

Graphite One could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite product manufacturing plant in Voltage Valley, Ohio.

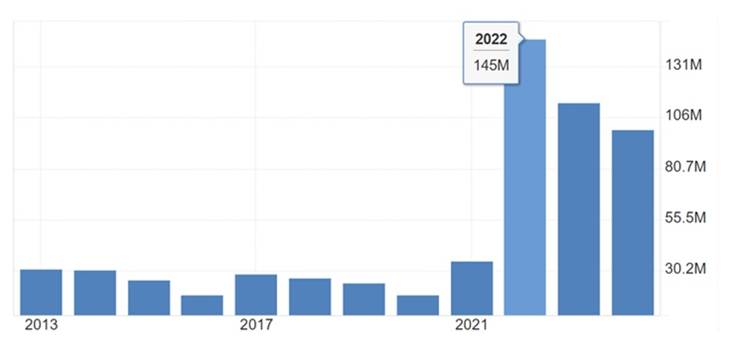

Consider: In 2024, the US imported 60,000 tonnes of natural graphite, of which 87.7% was flake and high purity.

The Feasibility Study anticipates tripling the production rate envisioned in the PFS, which would be 175,000 tonnes, meaning Graphite One could have the capacity to not only meet the US’s annual graphite needs, but have extra to stockpile, roughly 100,000 tonnes each year. This additional graphite could be put to domestic usage or built up to accommodate future demand growth.

All of this is based on the results of just 1.9 km of the 15.3-km-long geophysical anomaly. The resource remains open down dip and along strike to the east and west. Graphite Creek is now triple the size when the US Geological Survey reported three years ago that it was the largest flake graphite deposit in the US. And it could get even bigger with further exploration.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2025.09.03 share price: Cdn$0.74

Shares Outstanding: 146.2m

Market cap: Cdn$119.1m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Graphite One Inc. (TSX.V:GPH). GPH is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of GPH.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.