Graphite One Announces Made in America plan to fast track US synthetic graphite EV battery anode production – Richard Mills

2023.12.16

Graphite One (TSXV:GPH, OTCQX:GPHOF) is advancing its Graphite Creek property, situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process. In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

The US Geological Survey has cited Graphite Creek as the country’s largest known graphite deposit, and one of the biggest in the world.

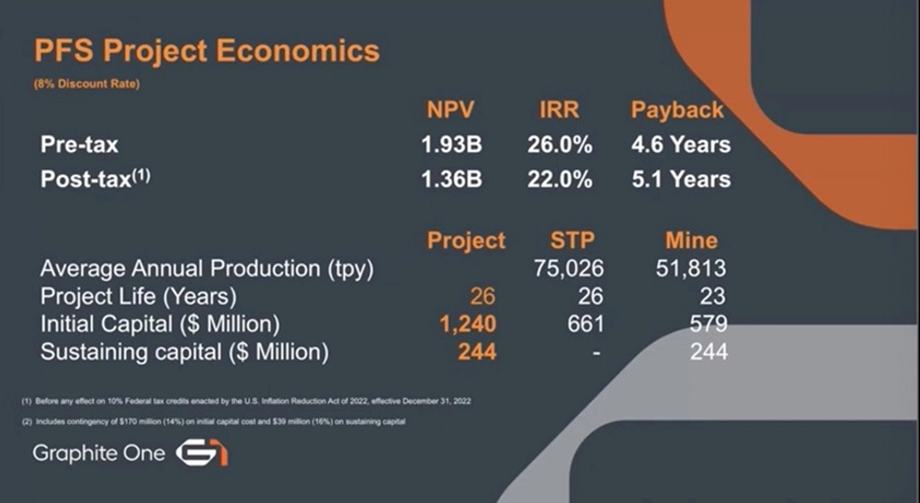

In the fall of 2022, Graphite One underwent a major de-risking event with the release of the prefeasibility study (PFS).

The PFS portrays the Graphite One Project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite price of $7,301 per tonne.

The mine would produce, on average, 51,813 tonnes per year (tpy) of graphite concentrate for its projected 23-year mine life. The company itself would produce about 75,000 tpy of products, of which 49,600 tpy would be anode materials, 7,400 tpy purified graphite products, and 18,000 tpy unpurified graphite products.

The PFS, which has a pre-tax net present value (NPV) of $1.9 billion, is based on exploration of only one square kilometer of the 16-km deposit

Graphite One’s aim is to become the first vertically integrated domestic graphite producer to serve the nascent US electric vehicle battery market.

The MOU outlines the terms in which Sunrise will share their expertise and technology with the company for the design, construction and operation of a proposed graphite material manufacturing facility in Washington State. The source material would initially be purchased graphite and later from the company’s Graphite Creek deposit it is developing in Alaska.

The US Department of Defense, the Alaska government and the Bering Straits Native Corporation (BSNC) have all committed to moving Graphite One’s vision of a US-based graphite materials supply chain forward.

In July, the DoD awarded GPH with a technology investment grant of $37.5 million under Title III of the Defense Production Act.

Graphite One Awarded $37.5 Million Department of Defense Grant Under the Defense Production Act

The company subsequently announced it had entered into a one-year $5 million loan agreement with Taiga Mining Company, its largest shareholder.

The proceeds will be used for infill drilling, as Graphite One moves towards its feasibility milestone. The company granted Taiga an option to purchase up to a 1% net smelter royalty (“NSR”) in increments of 0.25% for every $1.25 million advanced to the company on 133 claims owned or lease by the company, which was bought back for approximately $0.5 million on June 21, 2023. The option may be exercised at any time prior to maturity. If and when the option is exercised, the outstanding loan balance and accrued interest will be deemed the consideration paid for the purchase of the NSR.

Neither the grant nor the loan is dilutive to shareholders.

In September, Graphite One closed a US$2 million strategic investment by way of a private placement from Bering Straits Native Corporation, with an option to invest a further US$6 million over the next 12 months to support the development of Graphite Creek.

The BSNC investment follows multiple community meetings with residents and company officials during 2023, Graphite One said. It also bolsters Graphite One’s position and brings added credibility to the project. With the support of BSNC, the company can proceed with increased confidence as it strives to bring the Graphite Creek project to full-scale operations.

Also in September, Graphite One was awarded a $4.7 million contract from the Defense Logistics Agency (part of the US Department of Defense), to develop a graphite and graphene-based foam fire suppressant as an alternative to PFAS fire-suppressant materials, as required by US law.

Under a signed agreement, Vorbeck Materials Corp of Maryland is the primary sub-contractor on the DLA contract. Vorbeck is a global leader in graphene production and advanced graphene applications. Its graphene offering, VOR-X, can produce the material at large-scale levels and integrate it into numerous solutions.

2023 drilling — first assays

Graphite One plans to complete a total of 20,000 meters of drilling in 2023 and 2024 with the objective of increasing the annual concentrate production for the upcoming feasibility study (FS) compared to that assumed in the prefeasibility study (PFS).

The 2023 drill program was designed to double the measured and indicated resources and increase the inferred resource by infill drilling along trend to hole 22GC079. The results of the program will feed into the company’s FS, which contemplates increasing production from 50,000 tonnes of graphite concentrate per year as estimated in the PFS to more than 150,000 tonnes of graphite concentrate.

In October, Graphite One announced the completion of the 2023 drill program along with a selection of assay results. The program quadrupled the scope of 2022’s, with 57 holes completed for a total of 8,736 meters — the largest drill program in GPH’s history.

Five geotechnical holes were drilled for the purpose of evaluating construction sites or hydrology conditions. According to Graphite One, the remaining 52 holes all intersected visual graphite mineralization, and continued to demonstrate exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

The company anticipates that the remaining assays will be incorporated into the feasibility study, which is anticipated to be released in the fourth quarter of 2024.

Graphite material samples delivered

On April 27, 2023, Graphite One announced it received the first active anode material samples produced by Sunrise New Energy Material Co. Ltd., made from material sourced from Graphite Creek.

The samples were sent to the U.S. Department of Energy’s Pacific Northwest National Laboratory (PNNL) for additional testing. Sample material was also sent to a leading electric vehicle manufacturer for evaluation.

Sunrise produced the coated spherical natural graphite and secondary particle natural graphite from Graphite Creeks graphite concentrate.

Notably, a fast-charging artificial/ synthetic graphite anode material sample was also produced for, and sent to, North American EV battery companies.

Fast forward to this week, when G1 made two key announcements regarding its overarching strategy of becoming the first vertically integrated domestic graphite producer to serve the US electric vehicle battery market.

The Dec. 12 news release announces “the delivery of synthetic graphite anode material samples for analysis by U.S.-based global end-users. Three of the active anode material samples delivered are each designed to meet different lithium-ion battery requirements: high energy capacity above 360 mAh/g; fast charging above 4C; and cycle life above 6,000 cycles, respectively.”

The samples were prepared for Graphite One (G1) by Sunrise.

G1 sent artificial anode material to North American EV battery companies in April, three different material specifications were subsequentially requested for three different EV batteries, and Graphite One just delivered it to them.

Synthetic graphite plant in the works

The second part of Graphite One’s Dec. 12 news release refers to its updated plan to build a synthetic anode material production facility before manufacturing spherical graphite EV battery anodes from feedstock from the company’s Graphite Creek Mine. The plant would produce a range of synthetic anode materials, with the natural graphite anode production line added later once the company has successfully completed its feasibility study and the mine is fully permitted and operating.

“With the U.S. currently not producing any natural and synthetic anode materials, Graphite One has formulated a fast-track path-to-production strategy jump-starting our battery anode material production,” said Anthony Huston, Graphite One’s president and CEO. “In contrast to the typical resource development track, our strategic plan is to make Graphite One a synthetic anode material producer while Graphite Creek moves through permitting and into production. Ultimately, Graphite Creek’s natural graphite would supply our anode material facility alongside our synthetic production, to deliver a full range of natural and synthetic anode materials to EV customers, 100% manufactured in the United States.”

Huston continued: “Subject to financing and permitting requirements, we’re planning an early-stage commercial facility to produce a finishing and coating line for synthetic graphite by late 2025, with Phase 1 production of 25,000 tonnes of synthetic anode material by mid-2026 and rapid production growth from then on as market demand requires…

This is planned to be a direct path to revenue, even as we continue to develop our Graphite Creek natural graphite deposit.”

Technical licensing agreement

G1 and Sunrise are negotiating a technical license agreement to share expertise and technology for the design, construction, and operation of Graphite One’s proposed graphite material manufacturing facility in Washington State.

The news release states, “The TLA is intended to comply with the requirements of the U.S. Inflation Reduction Act (“IRA”) so that the use of the licensed technology itself to make Graphite One’s anode materials would not affect its customers’ eligibility to qualify for IRA tax credits.”

Keeping Chinese parts out of American EV’s

In an earlier interview, link above, I explained the IRA eligibility rules:

“New guidelines from the US Treasury, Internal Revenue Service and Department of Energy prohibit the use of parts made or assembled by what they call “foreign entities of concern” (FEOC). The term refers to companies based in China, Russia, North Korea or Iran, or with at least 25% voting interest, board membership or ownership by a government of one of those countries.

“Beginning in 2025, an eligible clean vehicle may not contain any critical minerals that were extracted, processed, or recycled by a FEOC.”

Pursuant to section 30D, FEOCs must be generally excluded from a vehicle battery’s supply chain in order for the vehicle to be potentially eligible for the (up to $7,500) tax credit. Specifically, section 30D(d)(7) excludes from credit eligibility vehicles that are:

- placed in service after December 31, 2024, with respect to which any of the applicable critical minerals contained in the battery of such vehicle… were extracted, processed, or recycled by a foreign entity of concern; or

- placed in service after December 31, 2023, with respect to which any of the components contained in the battery of such vehicle… were manufactured or assembled by a foreign entity of concern.

An agreement has to be in the form of a knowledge transfer, not a procurement. You cannot buy a solution in a box, a black box that comes over and gets bolted into a processing facility and nobody quite knows how it works.

“Effective control” is interpreted to mean an FEOC using technology licensing or contractual offtake terms to control an entity’s production and processing. A licensing agreement that is a true knowledge transfer arrangement may pass muster as control post-transfer would be attenuated. (Reuters, Dec. 5, 2023)

Conclusion

Back in April, Graphite One sent synthetic graphite material samples to North American EV battery companies.

This was a milestone achievement, a company first.

The samples were received and tested, and an order was placed for three different battery requirements, which Graphite One announced they have just delivered.

In the same release, G1 tells us they are not abandoning or even delaying their plan to build a graphite mine in Alaska; rather, they are pivoting to synthetic graphite production while the deposit is going through the necessary development stages.

If, and when, the deposit becomes a mine, Graphite One can begin producing spherical/natural graphite for anodes, alongside the synthetic graphite production line.

Throughout its next development steps, Graphite One, like all companies in the critical minerals space, and that includes automakers especially, will need to be cognizant of the rules in the Inflation Reduction Act. Not following them could result in disqualification from the act’s advantages, including a $7,500 consumer tax credit.

On a $40,000 to $60,000 EV this is not chump change. Not having that credit will dent a model’s competitiveness.

There just happens to be an example in the news this week. It was reported that Tesla, which has its electric-vehicle batteries in the United States made by Japan’s Panasonic and China’s CATL, says two of its models won’t qualify for the $7,500 federal tax credit as of Jan. 1, 2024. Instead, the Model 3 Rear-Wheel Drive and the Model 3 Long Range will see their tax credits cut in half, to $3,750.

The Inflation Reduction Act stipulates that vehicles using battery components that are 50% made or assembled in the US qualify for the first half of the tax credit, i.e. $3,750. The cars can only get the remaining half of the credit if their manufacturer sources at least 40% of their critical minerals from the US or its free trade partners, which don’t include China. If a company meets one or the other standard, the vehicle gets a half credit. (Yahoo Finance, Dec. 4, 2023)

The rules get tougher in 2024 and 2025. Beginning next year, a clean vehicle can’t contain any battery components manufactured or assembled by an FEOC, and the year after, it may not contain any critical minerals that were extracted, processed or recycled by an FEOC.

Yahoo Finance notes that, Back in June, the cheapest Tesla car, the rear-wheel drive Model 3, was able to switch from half the tax credit to full credit, likely due to a change in supplier or materials to meet the guidelines. While the latest reversal still offers half the credit, this may eventually be zeroed next year, unless Tesla is willing to source batteries from other countries — which are likely more expensive.

China is dominant in both the mining and processing of critical metals, which allows them to bully end users and raise prices. Last month, Beijing declared it would require export permits for graphite projects, to protect China’s national security. The more likely explanation is this was done in retaliation for the United States widening the curbs on Chinese access to US semiconductors.

I’m not sure how much effect the imposition of export permits will have on graphite exports in the short term. But Bloomberg said with these new graphite export curbs, South Korean firms that rely heavily on China for graphite imports would need to seek alternatives such as mines from the United States or Australia. Graphite deficits could start showing up as early as 2025 when new mines fail to meet demand. And the demand should be there as the electrification of the global transportation system continues. Graphite is the largest component of batteries by weight, it’s 45% of the cell. There is four times more graphite feedstock in each battery cell than lithium, and nine times more than cobalt.

Graphite One has the backing of the local Bering Straits Native Corporation and the US Department of Defense. The company received a US$4.7 million contract from the Defense Logistics Agency to develop graphite-based foam fire suppressants. Graphite One has also been awarded a US$37 million grant from the DoD.

Anthony Huston is the founder, CEO and a director. With his passion and vision, Huston has assembled one of the strongest, if not the strongest, boards in the junior resource sector. The company has political help and backing from the highest political offices in Alaska, the governor and senators.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2023.12.13 share price: Cdn$0.88

Shares Outstanding: 129.0m

Market cap: Cdn$116M

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH).

GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.