Gold as money gaining popularity, what’s in your wallet?

2022.05.04

The allure of gold goes back thousands of years.

Due to its unique properties, gold was one of the first metals discovered by mankind. The precious metal doesn’t rust or corrode, is malleable for artwork or jewelry, and conducts heat and electricity.

Gold is found at surface in flakes and nuggets, making it easily mineable. Historians agree the Egyptians were the first to make gold jewelry using the lost-wax method, around 3,600 BC. The funeral mask of King Tutankhamen is one of the most stunning examples of Egyptian goldsmithing. The Egyptians also learned how to alloy gold with other metals, to vary hardness and color.

Other ancient civilizations including the Incas, Aztecs and Muiscas used gold as an artistic medium or in religious ceremonies.

While gold was rare and valuable, it was also ideal for pressing into coins. Because gold coins were portable, private and permanent, they fit the early definition of a currency. Gold could be used as a medium of exchange, a unit of account, and a store of value.

The use of gold and silver for monetary purposes pre-dates the invention of writing in Sumer, the earliest known civilization in Mesopotamia, now south-central Iraq. While the Sumerians used shell rings and wheat for currency about 3,500 BC, by 2,700 BC silver had become the primary monetary standard, with gold playing a supporting role.

In neighboring Egypt, gold was the preferred money; ancient Egyptians reportedly produced a standardized “ring” money of gold, stamped by weight, meaning that by ancient Greece, gold and silver had been the primary high-level form of money for over 2,000 years.

The ancient Chinese, Lydians (in Turkey), Greeks and Romans all used gold as money. The Romans were the first civilization to employ gold as a currency across their vast empire.

Historical records show Emperor Julius Caesar brought back so much gold from a victorious campaign in Gaul (modern-day France) to give 200 coins to each of his soldiers and pay all of Rome’s debts. The Romans came up with the first water-based gold-mining methods including hydraulics, sluices, long toms and water wheels. They also mined underground using slaves and prison labor, and developed a roasting technique to separate the gold mineral from the ore.

While gold has served as currency for a number of early civilizations, there have also been attempts to substitute it with paper money, or to debase it with other less valuable metals.

One example is the Greek philosopher Plato, who recommended a local government-controlled “fiat” currency, likely made of iron, and the abolition of gold and silver coinage. For his suggestion, Plato was imprisoned, then temporarily sold to a slave market in Corinth. When the local tyrant tried to debase the coins, it was very unpopular.

Later, Plato’s student Aristotle advised Alexander the Great to stick with hard money, and for four uninterrupted centuries, the Greeks used silver coins.

When Marco Polo returned from China in 1295, among the items he brought back with him was paper currency. Although paper money by then had been used in China for 500 years, in 1294 when the King of Persia introduced the first unredeemable paper currency in the city of Tabriz, it apparently didn’t go well.

Looking back on centuries of paper money experiments in China, Nathan Lewis, author of ‘Gold: The Final Standard’, cites 14th century historian Ma Twan-lin, concluding that:

Paper should never be money (but) only employed as a representative sign of value existing in metals or produce … At first this was the mode in which paper currency was actually used among merchants. The government, borrowing this invention from private individuals, wished to a make a real money of paper, and thus the original contrivance was perverted.

Writing for Forbes in 2020, Lewis notes that over time, a pattern has emerged: countries that stuck with gold and silver proved to be successful, while those that either dabased their coins or used paper currencies, ran into problems. Examples of the former include the Byzantine Empire, whose solidus coin contained a consistent amount of gold for over 700 years; the Netherlands in the 17th century, whose global empire expanded, compared to Spain which debased its currency “into oblivion” ; the British pound which maintained unchanged parity with gold for over 200 years, @ 3 pounds 17 shillings 10 pence; and the United States which between 1914 and 1971 had the most reliable gold-based currency in the world.

As countries moved to paper money, they realized they could fix one unit of currency to a weight in gold, a system that became known as the gold standard. Britain was the first to adopt the gold standard, in 1717, and other countries soon followed suit. In the 19th century, all countries except China used it. Domestic currencies were freely convertible into gold at the fixed price and there was no restriction on the import or export of gold.

The United States operated under the gold standard until the Vietnam War, which brought renewed pressure on the dollar.

Since President Johnson refused to raise taxes to pay for social welfare reforms undertaken earlier, and the war in Vietnam, the US was running massive balance of payment deficits with the rest of the world. Speculation against the dollar intensified, and when other central banks became reluctant to accept dollars in settlement, the system began to break down.

In 1971 US President Nixon ended the convertibility of the dollar into gold for central banks, effectively demolishing the gold standard. The Bretton Woods system collapsed and gold was allowed to trade freely without a US dollar peg.

Today most paper currencies are fiat, in that they are not backed by a physical commodity like gold or silver, but rather by the government that issued it. For instance, the greenback is really nothing more than a piece of paper printed with government ink and imbued with the subjective value that a $1 bill is in fact worth the 100 cents the government says it is worth.

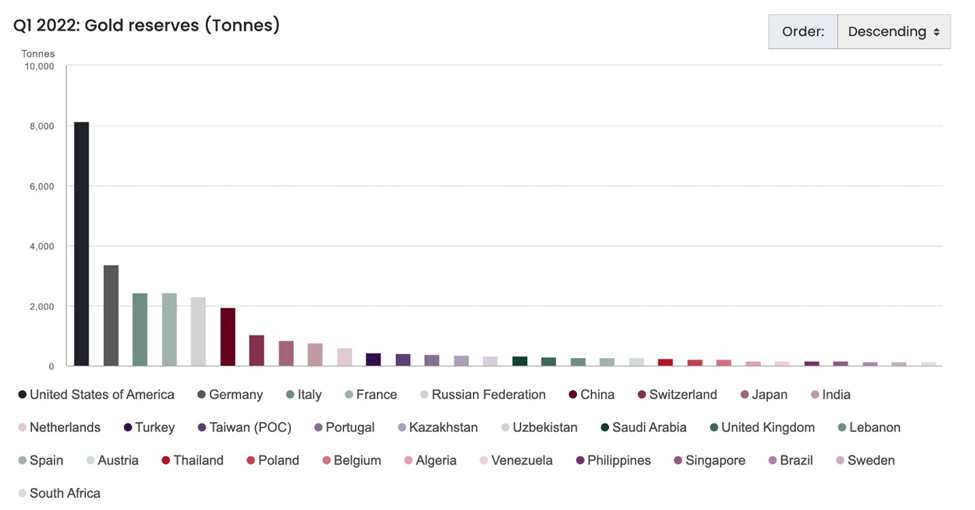

Central banks hold gold bullion among their foreign exchange reserves in secure bank vaults. According to the World Gold Council the US Federal Reserve holds 6,700 tonnes of gold – about half of the more than 12,000 tonnes of bullion the Fed stored in 1973.

The World Gold Council estimates there are about 190,000 tonnes of gold in circulation, and roughly 54,000 tonnes that could be mined economically. Gold that comes out of the ground is used in a number of ways, much of it made into jewelry — representing about 50% of demand. Around 40% is used for investment purposes; this includes gold purchased by central banks, gold ETFs and retail investors.

The value of gold is not so much in its price, but its rock-solid value.

Investors love gold because it tends to hold its value through time. They see gold as a way to preserve their wealth, unlike fiat currencies which are subject to inflationary pressures and over time, lose their value.

The precious metal is also bought as a hedge against what investors see as government policies that drag down the dollar and create inflation – such as the quantitative easing programs (i.e. money-printing) imposed by the US Federal Reserve, the European Central Bank and Japan. In other words, gold is an economic safe haven.

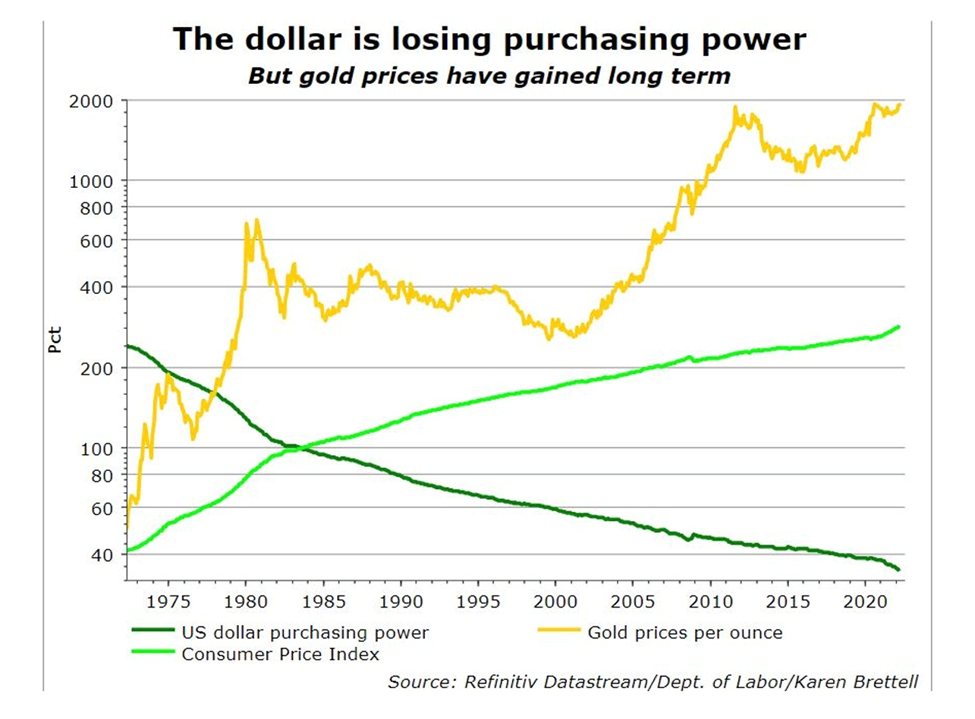

According to US government data, the US dollar has lost 86% of its purchasing power since 1971, the year Richard Nixon ended the gold standard. In comparison, gold prices have gained nearly 48x, from $40 an ounce to around $1,900, currently.

Some people disregard the idea of owning gold or returning to the “barbarous relic”, as economist John Maynard Keynes referred to the gold standard in his 1924 book on monetary reform, suggesting gold had outlived its usefulness.

In reality there are many instances of how gold came to the rescue of states on the verge of collapse, and a number of frankly terrifying scenarios that could destroy the value of today’s money in a heartbeat.

Historical examples include the fall of Saigon in the 1970s, when safe passage on a departing ship was paid for with 10 to 12 “taels” (1 tael = 1.2 troy ounces) of 24-karat gold for an adult and half that for a child; Argentina, where the precious metal is turned to during economic crises, such as in 1989 when prices rose by 5,000%; Venezuela, whose collapsing currency, the bolivar, has led to hyperinflation, shortages and social unrest, and where gold is used to buy food and everyday goods; and Zimbabwe. The poster child for hyperinflation reached peak madness in January 2009 when a 100-trillion-dollar note was printed — the largest currency denomination ever issued. People’s savings were completely wiped out, leading to food shortages and famine. Many were forced into illegal gold panning just to scrape together enough gold to barter for food. Cooking oil, soap and grain, all were exchanged for gold. “Without 0.3 grams of gold a day you would not survive. Without gold you would have died,” recounts a resident who fled Zimbabwe in 2008, quoted in Bullion Star.

The Russian Central Bank started significantly increasing its gold purchases in 2014, the year Russia was sanctioned by the United States for invading Crimea, the strategically important peninsula in southern Ukraine. The country’s gold pile is now the fifth largest in the world and valued at around $140 billion. Read more

Clearly Putin was directing the central bank to buy gold as insurance for a future scenario, like a war with Ukraine, when the country might need to sell gold to support a plunging ruble.

Three days after invading its neighbor, the Central Bank of Russia said it would resume buying gold from domestic producers following the imposition of sanctions. (the CBR stopped buying gold in 2020)

Western sanctions on Russia’s central bank have proven the vulnerability of any country holding cash in its foreign exchange reserves. Gold performs two jobs that fiat currencies, or any other financial innovation, cannot do; first, it acts as a safe haven in times of turmoil, second, as a store of value.

Russia hasn’t yet reached the point of having to liquidate its gold reserves or setting up a gold standard, but the fact that it has even has these options, to me speaks volumes about the continued importance of gold in a crisis.

When the proverbial shit hits the fan, when cash is trash and bills need paying, imports priced in US dollars must be bought, where do desperate people like Putin and Venezuela’s Maduro turn? They turn to gold.

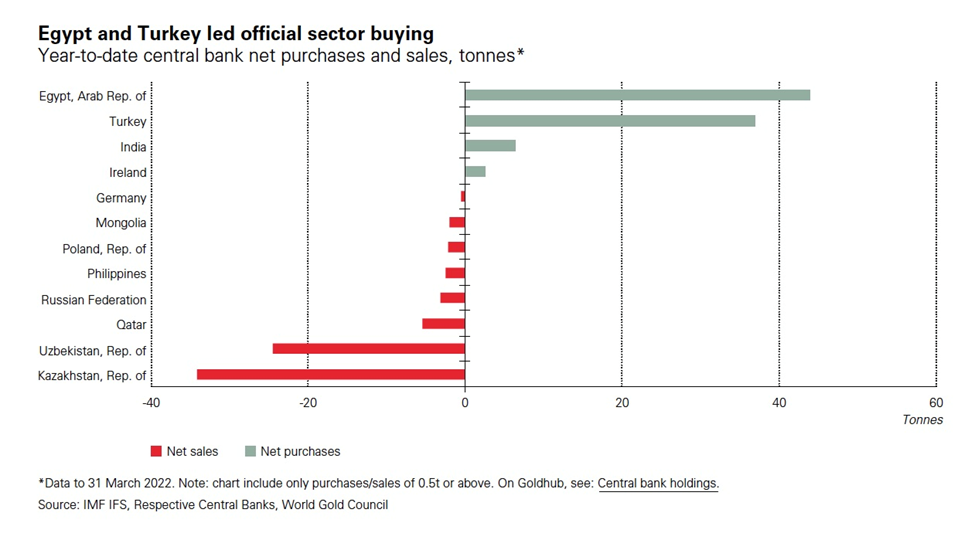

The first quarter of 2022 saw central banks increase their gold reserves by 84 tonnes, more than doubling the increase in the previous quarter, but less than the first quarter of 2021. According to the World Gold Council, “Activity in the sector was dominated by a limited number of central banks with a few large transactions tipping the balance.”

Egypt was the biggest buyer, reporting an increase of 44 tonnes, followed by Turkey at 37t. The majority of central bank gold sales in Q1 were from gold-producing nations Uzbekistan and Kazakhstan, taking profits from higher gold prices.

Gold-exchange traded funds are also holding their own, registering net inflows of 269 tonnes, valued at US$17 billion, in Q1. According to the WGC, this was the highest level of quarterly inflows since the third quarter of 2020, eclipsing the 173t of net outflows in 2021.

Beyond central banks, ETFs and investment purposes, gold is valued for its natural beauty and radiance. India and China are the two largest markets for gold jewelry.

In India it is said, “a marriage is not a marriage without gold.” Indians find it auspicious to give gold jewelry during the Diwali festival, which begins in October, and wedding season. Gold-shopping for the bride is thought to bring good fortune and invoke the blessings of a Hindu goddess. At nearly 20 million weddings a year, Indians’ annual demand for the precious metal exceeds 514 tonnes. Thus it is easy to see why the country’s private gold holdings are the largest in the world, a mind-boggling 24,000 tonnes. (almost as much as the world’s top 10 central bank holdings combined)

However in 2016 China overtook India as the world’s top buyer of gold jewelry. The country’s growing throng of affluent consumers is driving demand for gold rings, bracelets and necklaces, especially in January and February when many Chinese purchase gold jewelry as gifts for Chinese New Year. According to McKinsey & Company, by 2025 China will represent up to 44% of the global luxury jewelry market.

It is interesting to consider that, despite the continued use of the US dollar as the world’s reserve currency, and the, in my opinion inexplicable popularity of cryptocurrencies, gold remains a popular alternative investment vehicle.

According to the World Gold Council’s Consumer Research Report, released in late 2019, gold is the third most consistently bought investment (46%), behind savings accounts (78%) and life insurance (56%).

Of 18,000 people surveyed around the world including in China, India, Germany, Russia and North America, about their attitudes and buying habits towards the precious metal, 56% had bought gold jewelry, and 34% had purchased platinum rings, bracelets and necklaces.

The research also showed that two-thirds of retail investors believe that gold is a good safeguard against inflation and currency fluctuations, and 61% trust gold more than fiat (paper) currencies.

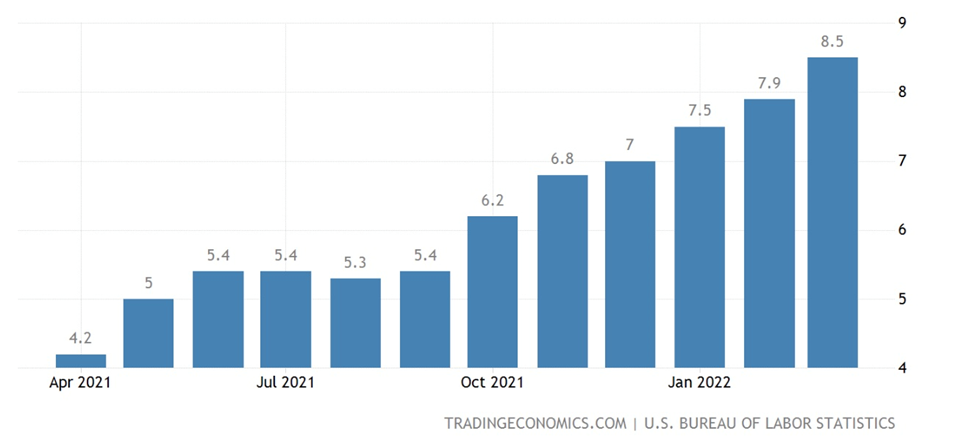

Gold’s role as an inflation hedge makes it particularly relevant to today’s economic reality. A combination of high energy prices, a shortage of metals, covid-related supply chain disruptions, and the war in Ukraine, have pushed inflation to multi-decade highs. In March the US CPI was 8.5% and in Canada it was 6.7%.

Inflation not only means an increase in the prices of goods and services, but a devaluation of the currency. This is because, with inflation it will take more dollars (or whatever the currency is) to purchase the same good or service in future. Unless your wages go up by the same amount as inflation, your buying power is being reduced.

Federal Reserve data shows that US dollars in circulation currently amount to $2.25 trillion, up from $1.8T in early 2020 and just over $800 billion in 2007. Too many dollars chasing too few goods and services, created “out of thin air” by the Fed, has created inflation — although as we have argued, the bigger factor is lack of supply, of energy, metals, food, etc.

As the Federal Reserve continues to engage in quantitative easing (the central bank only reduced its monthly program of buying Treasuries and mortgage-backed securities by $15 billion in November, meaning it continues to purchase $105 billion/mo), and the federal government keeps spending well beyond its means, Americans are increasingly turning to gold as an alternative to their devalued dollar.

According to recent Reuters story, Gold’s use as a currency started gaining traction after the financial crisis of 2007-2009 and has accelerated during the pandemic since 2020 as the government spent trillions, and the Federal Reserve bought unprecedented amounts of bonds in an effort to revive the economy.

While it will not challenge the primacy of the greenback, its use is growing fast. Innovations that allow people to use the metal for even the smallest daily transactions are helping to propel the movement.

In Utah, up to half of small businesses are now accepting “Goldbacks”. The bills infused with particles of gold come in denominations ranging from 1 to 50, where 1 is equal to 1/1,000th of an ounce, and 50 is 1/20th of an ounce.

The company’s president Jeremy Condon says they’ve sold around $30 million across the country, and he thinks that could grow to $1 billion over the next five to six years.

Then there’s Glint, a gold trading and investment app that is seeing strong demand for gold as a currency. Customers use the app to purchase gold, which is held in a vault in Switzerland, and spend their holdings using a Mastercard. CEO Jason Cozens told Reuters around half of its 105,000 customers are in the US, and that users have increased by 500%, in the first quarter of 2022 over the fourth quarter.

“The money we’re using in less than one person’s lifetime has lost most of its purchasing power and that’s what’s driving everything,” Cozens said. “You start thinking about, ‘Well why is money depreciating? Why is it outside of my control?’”

Concerns about inflation and a weakening of the dollar’s purchasing power have pushed more than a dozen US states to look at recognizing gold and silver coins as legal tender. In the United States, the Constitution allows for states to give their citizens the ability to settle debts in precious metals.

Utah has recognized gold and silver as legal tender since 2011, followed by Oklahoma and Arizona. A policy director for the Sound Money Defense League told Reuters that 41 states have wholly or partially exempted the metals from sales taxes, with another five considering legislation to do the same.

The group is also working with legislators to remove capital gains taxes.

Gold bars and coins are easily purchased through a bank, bullion exchange or online bullion dealer.

Gold vending machines have been available since 2010. Germany-based precious metals company Ex Orientale Lux AG, reportedly began exploring new mediums for buying and selling gold after consumer interest in the metal grew during the financial crisis. Its heavy-duty GOLD to Go ™ machines are built to withstand break-ins and small explosives. They dispense up to 10 gold products including Krugerrand coins, Canadian Gold Maples, and gold bars ranging from 1 to 250 grams. A touch screen provides information on products and pricing and a built-in scanner logs the user’s identification. Like a bank ATM, GOLD to Go ™ kiosks are outfitted with cash and credit card slots, along with cameras that record every transaction.

Conclusion

Gold may never replace bills and coins issued by government mints but the fact of the matter is that physical gold for investment purposes (bars and coins), gold ETFs and jewelry remain in high demand.

This is especially the case during our current period of excessive debt accumulation (government spending + quantitative easing), inflation at levels not seen since the 1980s, and the hit to consumers’ purchasing power, as the prices of goods and services for most households keep rising faster than wages/ salaries.

Gold continues to be a haven for investors and central banks during times of war, political upheaval, geopolitical tensions and economic uncertainty.

With all that is going on in the world, we believe the gold price, and physical gold investments, will continue to do well over the next few months.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.