Gold and a gun

2019.11.28

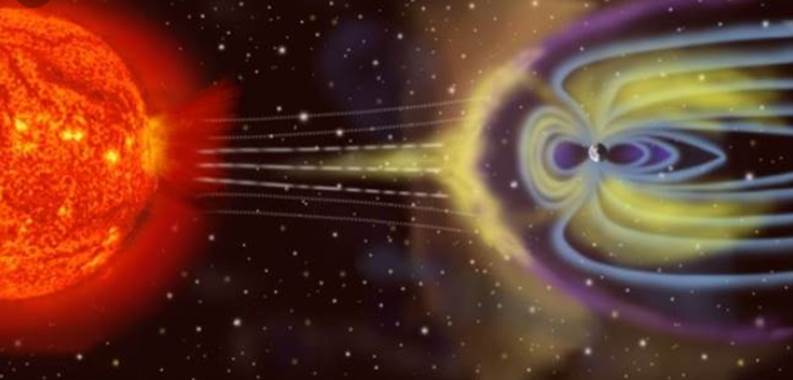

There are many extreme events that could do massive damage to planet Earth within hours, even seconds. Many are on the scale of the “Carrington Event” of 1859. This powerful solar storm, the largest ever recorded, was named after the British astronomer who saw in his telescope the solar flare associated with a “coronal mass ejection” that sped towards Earth. The Carrington Event lit up the skies in beautiful light displays similar to the aurora borealis, but it also caused global telegraph lines to spark and short out and set fire to telegraph offices in Europe and the US. Fortunately the low technology of the mid-19th century limited the damage.

It’s thought that, should an event of similar scale happen today, it would jeopardize global telecommunications, knock out orbiting satellites, destroy GPS, cellphone service and much of the power grid.

According to a study by the National Academy of Sciences, the next ‘event’ could knock out electrical and communication grids causing more than $2 trillion in damage globally. NASA said anything that plugs into a wall socket or electrical outlet could be disabled – and since everything we use is, somewhere along the line of its existence, eventually plugged in…well you get the idea.

Maybe we’re without our electrical and communications grids for years – think about that, think about facing, think about living without electricity for an extended indefinite period of time. You’ve just been knocked back to a pre-electric age and your ticket ‘back to the future’ does not have a departure time/date stamp.

What’s the chances of a Carrington magnitude event hitting us?

“In February 2014, physicist Pete Riley of Predictive Science Inc. published a paper in Space Weather entitled “On the probability of occurrence of extreme space weather events.” In it, he analyzed records of solar storms going back 50+ years. By extrapolating the frequency of ordinary storms to the extreme, he calculated the odds that a Carrington-class storm would hit Earth in the next ten years. The answer: 12%.” Pete Riley, Predictive Science, ‘On the probability of occurrence of extreme space weather events’

Imagine how this could affect the average citizen. How would they survive? Most wouldn’t. In this article we take a look at gold as protection against the unthinkable.

Life 100 years ago

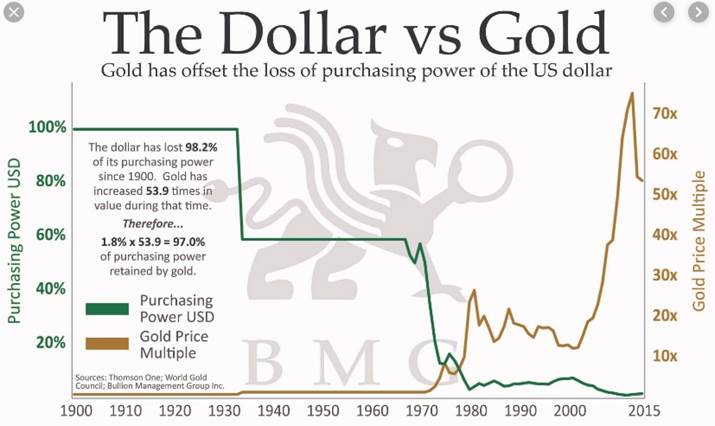

Gold is often thought of as a store of value. The precious metal is proven to have held its worth over time. Investors therefore see it as a way to preserve wealth, unlike paper or “fiat” currencies which are subject to inflationary pressures and over the years, lose their value.

In the U.S. there was an increase in inflation for every decade except the Depression when prices shrunk nearly 20%. The Bureau of Labor Statistics’ Consumer Price Index indicates that between 1860 and 2015, the dollar experienced 2.6% inflation every year, meaning that US$1 in 1860 was equivalent to $27.80 in 2015. The dollar has lost 98.2% of its purchasing power since 1900, while gold has become almost 54 times more valuable.

Rather than owning gold, these days most people consider their bank accounts, art, antiques and houses or apartments to be stores of value. The proof of having a good-sized pile of cash is a debit card, from which we control online bank accounts where we can add, withdraw and transfer funds with the click of a mouse. The certainty of electronic banking which has existed now for decades is rarely if ever questioned, let alone the credit/ debt monetary system it is based on.

We’ll get into some of the reasons why we shouldn’t take personal banking as we know it for granted, but for now, consider what people 100 years ago thought of as their store of value.

It definitely wasn’t a piece of plastic one could tap or swipe, instantly approving the transaction and withdrawing the money, or in many cases, deferring payment for as long as the cardholder doesn’t mind paying the exorbitant interest on it.

In 1910 less than 50% of the United States population lived in urban areas, compared to 80% today. Half of American families lived in rural areas or towns below 2,500 people. Those rich enough to own land (in 1920 there were about four times as many renters as owners), led a country life. Suburbs didn’t really exist until the 1950s. On the farm people kept animals (cows, goats, chickens) for food and grew much of their own produce.

Harvest time was a big deal and fall fairs were places for farming families to mingle and compare the fruits of their labor. Most people canned fruit and vegetables to get them through the long, cold winters. Hunting was popular not only for sport but for adding different sources of protein to the larder. Every farmer owned guns for protection. Thanksgiving, celebrated after the harvest, had a different meaning, being more about the bounty just stored for survival till next harvest.

For our ancestors their store of value was the family farm, the land, and everything they raised or grew from it.

Carrington Events

Now fast forward to our modern times, when gold is no longer used as currency, but as an investment. Nowadays the only people and institutions who own physical gold are central banks and those who distrust the monetary system – people who see gold as a hedge against inflation and want to own it as insurance against some calamity (eg. banking system collapse, war), when getting access to cash is difficult or impossible, and paper currencies plummet in value.

Most people think such an event is so unlikely, they disregard the idea of owning gold or returning to the “barbarous relic”, as economist John Maynard Keynes referred to the gold standard in his 1924 book on monetary reform, suggesting gold had outlived its usefulness.

In reality there are many instances in history of how gold came to the rescue of states on the verge of collapse, and a number of frankly terrifying scenarios that could destroy the meaning and value of today’s money in a heartbeat.

We can name five right off the bat.

In the 1970s after the fall of Saigon, hundreds of thousands of Vietnamese and Chinese living in south Vietnam fled to other parts of Asia and North America by land and sea. The refugees were driven out by a crippled economy and a discriminatory Communist government that re-unified north and south in 1976. Safe passage on a departing ship was paid for with gold, between 10 and 12 “taels” (1 tael=1.2 troy ounces) of 24-karat gold for an adult and half that for a child.

When a financial crisis gripped South Korea in 1997, decimating the Korean won, the IMF bailed the country out. Embarrassed at how their star Asian tiger economy was forced to accept a massive loan, South Koreans mobilized in a gold collection campaign to help pay off its debts. In four months of 1998, 227 tonnes of gold worth $2.13 billion were collected and melted into gold bars. The gold included investment coins, gold jewelry and even gold buttons sewed on traditional Korean clothing, allowing Korea to fully repay its debt to the IMF three years early.

Everybody loves gold, especially Argentinians, who often turn to the precious metal during economic crises, such as in 1989 when prices rose by 5,000%! Two years later the peso lost three-quarters of its value and bank accounts were frozen. Those that could, flocked to physical gold as a form of savings and wealth creation.

Another South American nation, Venezuela, has been plagued by a collapsing currency, the bolivar, hyperinflation, shortages and social unrest. Gold is reportedly being used to buy everyday goods or food, with thousands of Venezuelans heading to neighboring Colombia where they can receive higher-valued Colombian pesos for it. Cities close to the illegal gold mining area of Arco Minero del Orinoco have ditched bolivars and switched to gold as the main currency. The desperation of Venezuelan President Maduro was evident this summer, when the embattled leader spirited away 7.4 tons of gold reserves worth $300 million to sell in Uganda.

And then there’s Zimbabwe. The poster child for hyperinflation reached peak madness in January 2009 when a 100-trillion-dollar note was printed – the largest currency denomination ever issued. Citizens’ savings were completely wiped out, leading to food shortages and famine. Many were forced into illegal gold panning just to scrape together enough gold to barter for food. Cooking oil, soap and grain, all were exchanged for gold. “Without 0.3 grams of gold a day you would not survive. Without gold you would have died,” recounts a resident who fled Zimbabwe in 2008, quoted in Bullion Star.

As for current situations that could call for a flight to gold, there are both natural and man-made examples. Natural disasters include major earthquakes/ tsunamis, wildfires, asteroid strikes, solar storms, and storm surges that knock out electricity grids, all made worse and more frequent by climate change.

We’ve already mentioned the “Carrington Event” solar storm. Something similar almost occurred in 2012.

On July 23, 2012, the sun unleashed a massive cloud of plasma (aka coronal mass ejection) thought to be the most powerful solar storm in 150 years. This plasma cloud exploded from the sun and headed straight through Earth’s orbit – missing us by a week! Yep, if it had happened just a week before, the plasma cloud would have had a catastrophic encounter with Earth’s atmosphere.

According to a study by the National Academy of Sciences, the cloud could have knocked out electrical and communication grids causing more than $2 trillion in damage globally. NASA said anything that plugs into a wall socket or electrical outlet could have been disabled – and since everything we use is somewhere along the line plugged in, well, you get the idea.

We know from geology that huge asteroids or comets have slammed into the Earth at certain points in history; the one that hit the Sudbury Basin in Ontario created some of the richest deposits of nickel sulfides in the world. The Chicxulub crater underneath the Yucatan Peninsula in Mexico was formed by an even bigger asteroid estimated to be between 11 and 81 kilometers wide. Scientists believe the impact caused a mass extinction event during which three-quarters of plant and animals on Earth died, including all non-avian (bird-like) dinosaurs.

On April 13, 2029, the 1,110-foot asteroid 99942 Aphosis aka ‘God of Chaos’ will rip past the plant around 19,000 miles away, closer to Earth than some orbiting spacecraft, reports Newsweek. If such an asteroid were to collide with us, it would cause continental-wide devastation, according to Davide Farnocchia, a NASA astronomer cited by Newsweek.

The most dangerous scenarios though are man-made. Because they involve high-tech and digital weaponry, controlled by human beings, they are arguably more likely to occur than one-off natural disasters.

A super-EMP weapon is an enhanced hydrogen bomb that, detonated at high altitude, would attack all communications including cell and Internet coverage.

A blast 400 kilometers above the United States would unleash a flood of gamma rays, causing a massive electromagnetic pulse that fries all electronics on the US Mainland, including the entire system of electricity grids, telecommunications and cellular phones.

Peter Vincent Pry, a nuclear strategist formerly with the CIA, warned of the devastating effects an attack using an EMP warhead could have. Newsweek quotes Pry saying that In the worst case scenario, food in supermarkets would be consumed within three days and within 30 days national food supply in regional warehouses would begin to spoil, leading to an estimated 90 percent of the population perishing from ensuing starvation, disease and societal collapse.

North Korea already has satellites positioned perfectly for an attack of this nature and two Russian generals are on record saying plans for a Russian EMP hydrogen bomb were accidentally transferred to North Korea.

While a large-scale EMP attack has never been tried and remains theoretical, major cyber-attacks have been successfully executed.

Hackers now have the ability to breach even the most seemingly impenetrable corporate and governmental facilities. One of the earliest and most famous examples is the “Stuxnet worm”. First uncovered in 2010, the malicious computer worm targeted SCADA industrial systems and was known for causing substantial damage to Iran’s nuclear program. It worked by hitting programmable logic controllers (PLCs) which are used in factory automation, or centrifuges needed for separating nuclear material.

The U.S. energy industry has been targeted by hackers – including nuclear plants. The hackers known as Dragonfly, Energetic Bear or Berserk Bear tricked employees into opening Microsoft Word documents that harvest user names or passwords, reported the Financial Times. Symantec, the anti-virus software provider, warned that hackers could shut down parts of the electricity grid just as they did in regions of the Ukraine in 2015 and 2016.

In 2016 a hacker affiliated with the Iranian government allegedly targeted a dam in New York, just 30 miles north of Manhattan. According to Newsweek, The floodgate of the Bowman Avenue Dam is just 15 feet wide and two and a half feet tall, but cybersecurity experts say if the Iranians were able to access its control system, they could also likely get inside systems for more significant infrastructure, such as pipelines, mass transit systems and power grids.

In 2018 the Department of Homeland Security said Russia had infiltrated critical US infrastructure such as power plants, water facilities and gas pipelines. The DHS says hundreds of such incidents have occurred, though none have gone beyond scouting expeditions.

Earlier this year, US intelligence organizations included hacking the electrical grid as one of the most significant threats to national security. However according to an MIT study, it is impossible to fully protect the grid from cyber attacks.

Nearly as devastating as an attack on the collection of US power grids would be an attempt to shut down the Internet. (of course, if the entire grid failed there would be no power to computers, ergo no Internet) Is that actually possible? One way is to simply cut the cables that run under the ocean. If just one of the undersea fiber optic cables through which 99% of all Internet data is transmitted, were to be sabotaged, the Internet would be seriously compromised.

The United States is thought to have a program that cuts off the Internet in the event of a national emergency. Although that seems improbable, we know that governments have successfully censored or denied access to the ‘Net, including Tunisia, Egypt and Libya during the Arab Spring, and China with its “great firewall”. The DRC also blocked Internet access in 2015 after bloody clashes between opponents of President Joseph Kabila and police.

Earlier this month, authorities in Iran imposed a five-day Internet blackout. After it was lifted videos posted online showed Iran’s security forces shot and killed unarmed protesters during a crackdown on demonstrations. On Oct. 1, Iraq reportedly pulled the plug on its Internet, an act from which it has yet to recover.

CNET reports that in 2018 there were 196 documented Internet shutdowns in 25 countries, mostly in Asia and Africa; 134 took place in India.

Gold as money

So, imagine that you’re reading this article when suddenly all power to your home turns off. You soon discover it’s much worse than just a power disruption. No lights, water, NG, refrigeration, heat, AC, waste disposal, internet or cell phone. Your car or truck won’t turn over let alone start. Your whole neighborhood is without all the services you take for granted – the lights in the supermarket down the street are out.

Your only two means of communicating – Internet and cell phone – you got rid of your landline a long time ago, are now severed. You are figuratively, and literally, in the dark regarding your situation. So is everyone else.

Now you start to panic. What happened? No Emergency Alert. There are no storms outside, your country, at least you thought so, is not at war, no shaking from an earthquake. Two days later reality sets in, the gravity of the situation hits you and you ask yourself ‘how long will this last, am I prepared?’ You have enough food/ water to last about three more days.

Most frightening is blocked access to cash. Bank machines don’t work, your debit card is useless for taking out money and making purchases; all point-of-sale systems need electricity. Same with credit cards – there’s no way for a merchant to handle a card-based sale. Transactions have suddenly become cash-only, in a society where nobody carries cash anymore. Prices have skyrocketed, store shelves are empty.

You meet with your neighbors. Some knowledgeable individual thinks a solar storm bombarded the earth with its invisible magnetic waves – it’s the only way to explain the complete shutdown of everything. He thinks he read it may take years for services to be restored, if ever. There will be no help from the government or military bringing supplies.

You, and some of your neighbors, begin an exodus from city to country.

These are the people who understand everything they use to hold dear is gone. Their house, their antique car, their pictures, their bank accounts, their stocks and bonds. They no longer have value.

But there is a huge difference between you and your neighbors, you have a secret, one you are not about to tell. A couple of years ago a friend suggested you buy a few gold coins, for you know, just in case. In your head you tally up all the money you spent – it came to US$5,000.00. Not trusting the banks to hold it, you stashed the coins in a closet downstairs and had forgotten about them. Till now.

Grabbing your largest backpack from storage, you pack away most of your gold, leaving a few easily accessible small value 1/10th of an ounce coins, some clothes, all your food and water. There are armed gangs killing, stealing and raping, at choke points on the way out of town, you have a hunting rifle, lots of bullets, but you plan your route carefully.

In gold terminology, your store of value has changed. Your paper money is now useless, the only thing you own of value is those gold coins you sewed into your clothes and the rifle to keep them; they’re the only things that separates you from the 99% of the population that will rely on the charity of others to make it through this Carrington Event. Some will be okay; most will not – most will die.

With your gold you can buy food and water, shelter. Your newfound stores of value, gold and a gun, might get you to a safe haven.

Conclusion

“Civilizations have consistently used gold as a material of value. Perhaps modern societies would be well-served by looking at the properties of gold, to see why it has served as money for millennia, especially when someone’s wealth could disappear in a click.” Visual Capitalist

In our post-9/11 age, where the options of colossal damage to human life are limited only by the imaginations of the misguided, anything now seems possible.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.