Getchell Gold prepares for Phase 1 drill program at Fondaway Canyon

2021.03.20

It is not very often that every hole of an exploration drill program returns gold intersections as good as or better than expected, but that is exactly what junior miner Getchell Gold Corp. (CSE:GTCH, OTCQB:GGLDF) has done so far from drilling at its Fondaway Canyon project in the world-famous mining state of Nevada.

About Fondaway Canyon

Fondaway Canyon is an advanced-stage gold property located in Churchill County, Nevada. The entire land package consists of 170 unpatented lode claims.

Fondaway Canyon has been the subject of multiple exploration campaigns in the late 1980s and early 1990s. Record shows 591 holes totaling nearly 50,000 meters have been drilled on the property.

The project area covers 12 known veins, including five mineralized areas — Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill — and seven untested targets.

In early 2020, Getchell signed a definitive option agreement with Canarc Resource Corp. to acquire the Fondaway Canyon project, along with the nearby Dixie Comstock properties.

Review of the most recent drill program by Canarc (2017) revealed significant intervals within a large resource, including 2.83 g/t Au over 65.4 m and 1.77 g/t Au over 62.9 m at the Colorado zone: and 1.01 g/t Au over 66.1 m at the Halfmoon zone.

A technical report released that year showed an estimated 409,000 oz of indicated resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au — for a combined 1.1 million oz.

Roughly 70% to 80% of those ounces are within the Colorado, Paperweight and Halfmoon zones, with the remainder found in parallel veins or splays off the main veins.

Mineralization at Fondaway Canyon is contained in a series of steeply dipping en-echelon quartz-sulfide shears outcropping at surface and extending laterally over 1,200 meters, with drill-proven depth extensions to greater than 400 meters.

When talking about the deposit earlier this year, Getchell confirmed the presence of two mineralized domains on this property: a higher-grade one based on drill intercepts grading >1 g/t Au; and an enveloping lower grade one based on drill intercepts grading >0.25 g/t Au. As such, the company aims to find its potential similarities with the world-famous Carlin-style gold system of Nevada, which is noted for its “invisible” nature.

Fall 2020 Drill Results

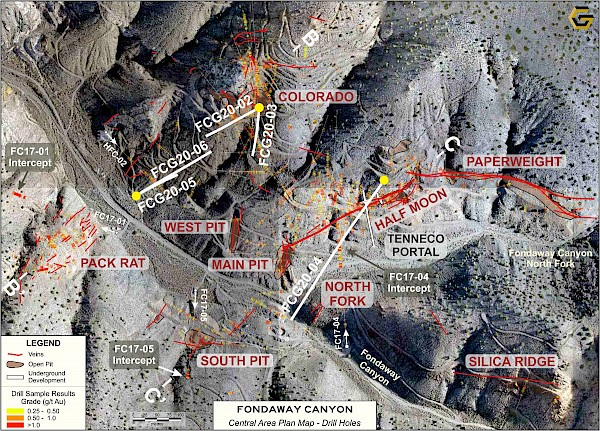

In November, the company completed a drill program to extend the known mineralization and to characterize it for resource modeling. Six holes were drilled for a total of nearly 2,000 meters.

Shortly after announcing the first set of results earlier this year, the company quickly released assays for the remaining three holes, all of which have intersected broad zones of gold mineralization and significantly extended the previously defined gold domains.

These drill holes were collared within the Central Target Area, which Getchell believes is the “nexus for the gold mineralizing system observed at the project.”

New North Fork Zone

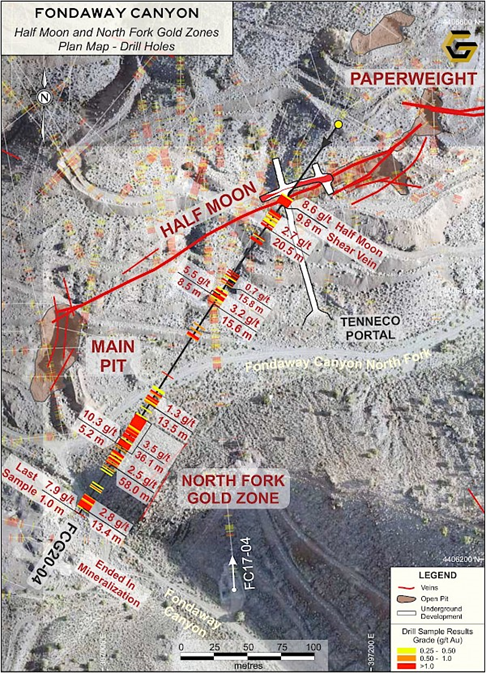

Drill hole FCG20-04 successfully encountered high-grade gold intercepts as it pierced the main Half Moon shear vein 54 meters below surface. Two notable gold intercepts were encountered further down the hole, which are interpreted to be splays of the main Half Moon gold shear vein.

The three gold intercepts are: 8.6 g/t Au over 9.8 m (main Half Moon shear vein); 2.7 g/t Au over 20.5 m; and 6.3 g/t Au over 3.3 m.

FCG20-04 was designed to serve two purposes: to pierce the Half Moon vein to characterize the mineralization; and to extend the gold mineralization intersected in hole FC17-04, drilled in 2017 by a previous operator, downdip to the southwest.

In addition, the drill hole encountered a broad 144-metre intercept of gold mineralization, newly identified as the North Fork gold zone, extending to the bottom of the hole with the final sample returning 7.9 g/t Au over 1.0 m. This indicates that the lower extent of the North Fork zone was not reached.

Within the North Fork broad zone of mineralization, the following notable gold intercepts are highlighted: 2.5 g/t Au over 58 m including 3.5 g/t Au over 36.1 m; 2.8 g/t Au over 13.4 m; and the last sample grade of 7.9 g/t Au over 1.0 m.

The newly identified North Fork zone is geologically modelled as a 100-meter thick shallowly dipping to the southwest zone of gold mineralization, and the results observed in FCG20-04 support this model.

Moreover, it represents a 200m step out to the southwest from hole FC17-04 and is open laterally and downdip. As seen in the plan map above, there are no adjacent holes that have targeted the North Fork gold zone’s depth horizon.

It is interesting to note that hole FC17-05, which was drilled by a previous operator, encountered significant gold mineralization at the bottom of the hole. It is 300 meters distant from the end of hole FCG20-04, and is within and on plunge with the projected window of the downdip extension of the North Fork zone, indicating a significant further potential extension to North Fork.

Colorado SW Extension

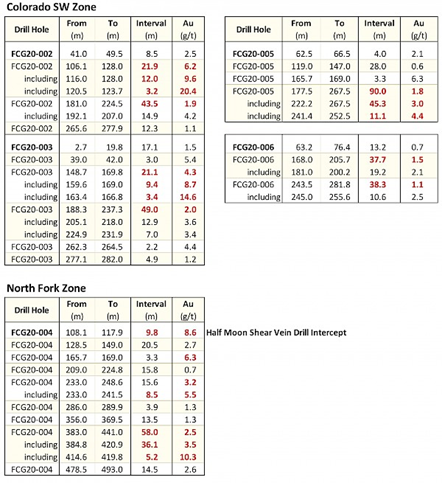

The remaining two holes, FCG20-05 and FCG20-06, successfully extended the mineralized Colorado structural zone, initially intersected by earlier drill holes FCG20-02 and FCG20-03.

FCG20-05 and FCG20-06 were collared on the same pad near the canyon floor and drilled to the northeast along a plane connecting the Colorado Pit to Pack Rat zone, and on plane with hole FCG20-02. They were designed to test the downdip extension of the mineralization observed at surface at the historic Colorado Pit and the mineralization encountered in holes FGC20-02 and 03.

Both holes, FCG20-05 and 06, encountered broad 100m thick zones of gold mineralization within the Colorado SW Extension target zone. FCG20-05 encountered the zone between 175 and 270 meters downhole, while FCG20-06 encountered the zone between 165 and 285 meters downhole.

Notable intercepts include 1.8 g/t Au over 90.0 m, including 3.0 g/t Au over 45.3 m and 4.4 g/t Au over 11.1 m (FGC20-05); and 1.5 g/t Au over 37.7 m and 1.1 g/t Au over 38.3 m (FCG20-06).

The strongly mineralized interval encountered in FCG20-05 represents a 150 to 200 m step-out to the southwest from the mineralization intersected in hole FC20-02 and is open laterally and downdip.

Of note is hole FC17-01, another drill hole from 2017 that encountered significant gold mineralization at the bottom. It is 250 metres away from hole FCG20-05 and is also within and on plunge with the projection of Colorado SW’s downdip extension, again indicating significant potential for further extensions.

A summary of the 2021 drill intervals is as follows:

2021 Drill Program

Drilling at Fondaway Canyon in late 2020 has demonstrated the identification of thick zones of gold mineralization, interpreted as a downdip continuation of surface mineralization: and high-grade mineralized structures with notable widths within the overall mineralizing system.

To follow up on these promising results, Getchell is planning an even bigger drill program this year at the Fondaway Canyon project. This week, the company announced it has secured a drill rig for early May to commence a Phase One 4,000-metre drill program.

“We are extremely eager to return to Fondaway Canyon with the intention of expanding our new, near-surface gold zones discovered during the 2020 drill program,” Getchell president Mike Sieb stated in the March 18 news release.

Additional details of the 2021 drill program will be released by the company later.

In preparation for this year’s drilling, Getchell recently expanded its technical team with the appointment of Scott Frostad as Vice President of Exploration. According to the company, Frostad was instrumental in the assimilation of the voluminous historical dataset, development of the geological model, and management of the 2020 drill program at the Fondaway Canyon project.

Frostad’s experience in the mining industry spans over three decades, having held positions at renowned gold mining companies such as Lac Minerals, Teck and Placer Dome.

Conclusion

2021 looks to be an exciting year of exploration for Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) as it looks to advance its flagship Fondaway Canyon project, a past gold producer with a significant in-the-ground historic resource estimate.

Last year’s drilling has already shown that the gold mineralization at Fondaway Canyon is thick and broad, with high-grade intervals that were not accounted for in the company’s geological model. The mineralization remains open, and every indication shows that it could continue.

The significant potential for extensions is likely to be investigated further in this year’s exploration program, as Getchell continues its path towards building ounces at what it believes could be another Carlin-style gold system.

Elsewhere in Nevada, another drill program is being planned for the company’s Star copper-gold-silver project, located 60 km north of Fondaway Canyon. This property contains two main mineralized occurrences, including a past-producing copper mine, with multiple priority drill targets identified. A geophysical survey last year delineated four additional anomalies exhibiting characteristics of porphyry-style mineralization on the property that will be included in this year’s drill testing.

It will be interesting to see what Getchell has planned for these two upcoming drill programs.

Getchell Gold

CSE:GTCH, OTC:GGLDF

Cdn$0.50, 2021.03.20

Shares Outstanding 73.6m

Market cap Cdn$36.8m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.