G1, graphite and anodes: all overlooked pieces of the EV battery supply chain – Richard Mills

2022.11.25

The electrification of the global transportation system doesn’t happen without graphite.

Graphite is included on a list of 35 critical minerals the US Geological Survey has deemed critical to the national economy and national security.

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced in 2020.

However, the concentration of mined and synthetic graphite production in one producing country, casts doubt on the ability of the mining industry to supply the needed battery raw material.

“Over the last decades, China has cornered the supply chain for batteries from critical mineral mining and processing to cathode anode belt manufacturing for critical minerals. For the critical minerals lithium, cobalt, graphite, nickel and manganese that are crucial to advanced batteries, China controls nearly all global processing capacity,” a White House official said recently.

This, however, is beginning to change, as funding from the US government is being offered to companies with the technology and know-how to build battery plants that can compete with Asian battery and electric-vehicle manufacturers. In fact the formation of a “mine-to-battery” domestic supply chain is well underway.

Lithium-ion battery chemistry

A lithium-ion battery is a type of rechargeable battery technology found throughout portable electronics and electric vehicles. It is also growing in popularity for military and aerospace applications. This kind of battery uses lithium ions as a key component of its electrochemistry, hence its name.

For starters, a battery consists of an anode, cathode, separator, electrolyte and two current collectors (positive and negative). The anode and cathode are used to store the lithium, while the electrolyte carries ionized lithium atoms from the anode to the cathode, and vice versa.

The separator, located between the anode and the cathode, allows the lithium ions to pass through due to their small size.

It is the movement of lithium ions that creates free electrons in the anode, producing a charge at the positive current collector. The electrical current then flows from the positive current collector through the device being powered (cell phone, computer, etc.) to the negative current collector. The separator blocks the flow of electrons inside the battery.

During a discharge cycle, the anode releases lithium ions to the cathode, generating a flow of electrons from one side to the other. When plugging in the device, the opposite happens: lithium ions are released by the cathode and received by the anode.

Graphite as anode material

The lithium-ion battery used to power electric vehicles is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

This is due to the fact that, with natural strength and stiffness, graphite is an excellent conductor of heat and electricity. Being the only other natural form of carbon besides diamonds, it is also stable over a wide range of temperatures, with a temperature resistance that goes above 3,500 degrees Celsius — same as the outer atmosphere of the sun!

The cathode is where metals like lithium, nickel, manganese and cobalt are being used, and depending on the battery chemistry, there are different options available to battery makers.

Hence, graphite is considered indispensable to the global shift towards electric vehicles. It is also the largest component in batteries by weight, constituting 45% or more of the cell. It may surprise some readers to learn that there is nearly four times more graphite feedstock consumed in each lithium-ion cell than lithium and nine times more than cobalt.

Battery growth forecasts

It’s thought that battery demand could gobble up well over 1.6 million tonnes of flake graphite per year (out of a 2021 market, all uses, of 1 million tonnes). Remember, the mining industry still needs to supply other graphite end-users. Currently, the automotive and steel industries are the largest consumers of graphite, with demand across both rising at 5% per annum.

INN quoted Benchmark Mineral Intelligence data showing demand for natural graphite from the battery segment amounted to 400,000 tonnes in 2021, with that number expected to scale up to 3Mt by 2030. Demand for synthetic graphite came to about 300,000 tonnes in 2021, and is expected to increase to 1.5Mt by 2030.

According to the US Geological Survey, output has increased in response to strong demand from the lithium battery market and increased prices. Just to supply Tesla’s expected 100 million EVs, by 2032, would require 6X the amount of lithium currently being mined.

Where are the EV makers going to find the graphite?

According to Fastmarkets, a UK-based commodity price reporting agency, the current rate of EV production indicates demand for battery-grade graphite could rise by a jaw-dropping 36% this year.

“Such large growth will allow room for significant rises in both natural and synthetic graphite,” analysts at consultancy Wood Mackenzie said.

An average plug-in EV has 70 kg of graphite. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

By estimates, at least 125 million EVs are expected to be mobile by 2030. That’s more than 8 million tonnes of additional battery-ready graphite needed this decade; remember, the mining industry is currently only able to supply 1 million tonnes.

According to Benchmark Mineral Intelligence (BMI), another UK-based price reporting agency, the flake graphite feedstock required to satisfy the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. At this rate, demand could easily outstrip supply in a few years.

China’s dominance

Almost all lithium-ion battery manufacturing currently takes place in China because of the ready availability of graphite, weak environmental standards and low costs.

There are no producing graphite mines in the United States, and only 10,000 tonnes a year is being mined from two facilities in Canada. The fact is, for the United States to develop a “mine to battery” supply chain at home, it currently has no choice but to import its raw materials from foreign countries.

For battery-grade graphite, that means China, which is growing increasingly adversarial, economically, politically and militarily.

(The United States is 100% import reliant according to the US Geological Survey. In 2021 the US imported 53,000 tons of natural graphite, of which 57% was high-purity flake, 42% was amorphous and 1% was lump and chip. 33% came from China, Mexico 21%, Canada 17%, India 9% and Other, 20%).

A 2020 article by BMI aptly demonstrates China’s battery-metals strength. BMI’s chart below shows China’s share of global battery production, broken down by each stage of the battery supply chain — upstream (mining), midstream (refining, cathode/anode production), and downstream (lithium-ion battery cells).

The chart clears up the misconception that China mines most of the world’s battery metals. In fact its mine production represents less than a quarter of global supply. Compare this to China’s dominance in chemical production of battery-grade raw materials, at 80% of total global production.

Still, China has around 30 of the 45 graphite mines in operation globally. According to Benchmark, the country supply nearly two-thirds (64%) of the world’s natural graphite and just over half (55%) of its needle coke, a derivative of crude oil and coal tar that is the feedstock for making synthetic graphite anodes.

China’s synthetic graphite output is 68%, the country supplies 90% of the world’s anodes, and according to BMI, for uncoated spherical graphite (99.5% purity), China is in charge of 100% of production, with the majority coming from Heilongjiang province.

Much has been made of the number of battery “gigafactories” being built worldwide, but again, China is top of the heap. BMI found that, of the 136 lithium-ion battery plants in the pipeline to 2029, 101 (74%) are in China.

Benchmark says China’s dominance of the graphite market could pose problems for Western automakers, as demand for anode material is set to rise by over seven times this decade.

These companies will need to diversify their sources of graphite to reduce the risks of relying on one country for a critical battery material.

Indeed with most graphite coming from China, and all anodes in the lithium-ion battery currently requiring graphite, all countries making these batteries need to source this material.

Consider: No matter where a battery is made, much of the graphite originates in China, and from there it either gets processed in China, or it moves to South Korea or Japan, for manufacturing by LG or Panasonic, for example.

Most battery manufacturers are Asian. According to data from SNE Research, via Visual Capitalist, the top three battery makers — CATL, LG and, Panasonic — combine for nearly 70% of the EV battery manufacturing market.

Government incentives

Fortunately, the US government has begun taking a stand on US critical minerals vulnerability, including graphite.

On February 24, 2021, President Joe Biden signed an executive order aimed at strengthening critical US supply chains. Graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy and economy.”

This year, the United States government invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now gain access to $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies. The decision could also cover the recycling of these materials, according to Bloomberg sources.

The Biden administration has also allocated $6 billion as part of the $1 trillion infrastructure bill — towards developing a reliable battery supply chain and weaning the auto industry off its reliance on China, the biggest EV market and leading producer of lithium-ion cells.

All of this is in addition to the funding announcement on Oct. 19. The Department of Energy will award $2.8 billion in grants to 20 manufacturing and processing companies for projects across 12 states.

The funding will come from the bipartisan infrastructure law passed last year and will include components affecting both the electric grid and electric vehicles.

The Biden administration’s plan is to have 50% of US auto production be electric and hybrid by 2030.

$2.8 billion for US battery supply chain announced

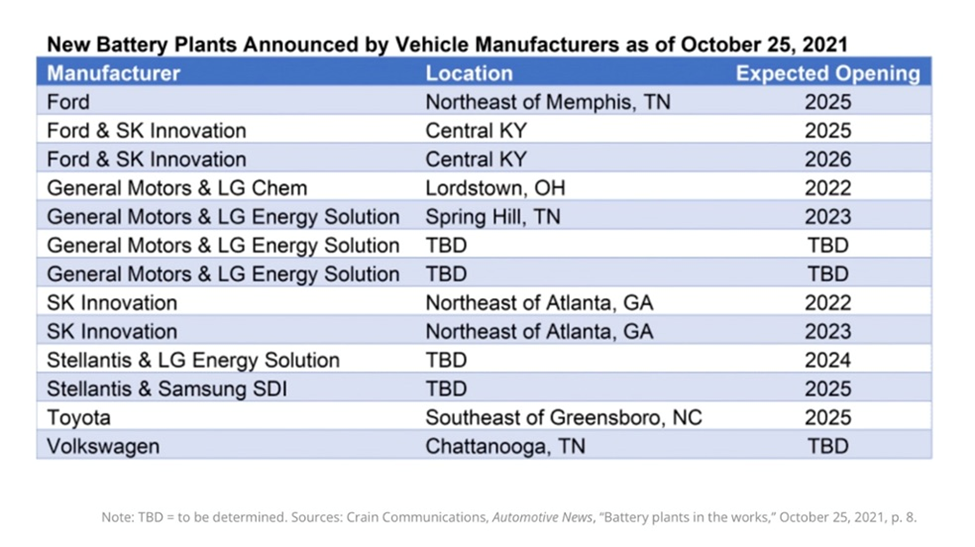

Battery plants galore

According to data collected by The Book of Deals, via cargroup.org, in 2021 automakers announced $36 billion of investments to build facilities dedicated to manufacturing EVs and batteries. In the first five months of 2022, automakers announced $24 billion in EV-related investments, almost double the investments announced by the same time last year. Recent automaker announcements on EV and battery manufacturing investments demonstrate an acceleration of growth in the EV market driven by new government EV targets and increasing consumer demand.

Source: Center for Automotive Research

State-directed funding for vehicle electrification has been made available through President Biden’s American Rescue Plan, a $1.9 trillion funding package to help US states, territories, cities and tribal governments replace tax revenue lost during the pandemic. According to a recent Bloomberg piece, hundreds of billions in federal aid was made available to states but never spent.

Michigan took advantage by announcing a $6.6 billion electric-truck factory and battery plant from General Motors, along with a billion in corporate subsidies. The announcement came soon after rival Ford made public that it had chosen two southern states, Tennessee and Kentucky, as sites for an $11 billion electric-vehicle project.

The Bloomberg article quotes an expert saying that, while states have long competed against one another to lure companies, the scale and the ferocity of it now — for EV plants, semiconductor factories and other megaprojects — are unprecedented:

“I have never seen the same kind of surge in subsidies all across the US all happening at the same time,” said Michael Farren, a senior researcher at the Mercatus Center at George Mason University and a critic of corporate incentives. “It’s pretty clear that there’s an external motivating factor, and that is the American Rescue Plan relief funds.”…

The $350 billion that Congress set aside for states and municipalities in May 2021 is coinciding with a once-in-a-century transformation of the auto industry, as carmakers prepare to retire the combustion engine in favor of battery power…

What is known is that global carmakers and established battery manufacturers have announced plans to invest at least $50 billion into at least 10 states to build EV assembly and battery plants since the start of 2021, and states have made commitments totaling at least $10.8 billion to lure those investments, according to a tally of publicly disclosed incentives by Bloomberg and Good Jobs First. That figure almost certainly underestimates the actual number.

Arun Kumar, a managing director at consulting firm AlixPartners, forecasts a 54% EV market share globally by 2035, and suggests that at such volumes, more EV plants will be coming to the United States.

US battery and EV plants galore

US anode facilities

Of the above-mentioned $2.8 billion awarded by the DOE, $1.16 billion will go to nine projects in the component-manufacturing segment of the supply chain.

Green Car Congress divides the projects into the anode, cathode and separator components of the lithium-ion battery. Three anode manufacturers are mentioned, four cathode companies are cited, and two companies that make separators are described.

Of the anode makers,

- Applied Materials, Inc. was awarded $100 million to set up an advanced prelithiation and lithium anode manufacturing facility. The proposed facility will support industrial-scale production of advanced lithiated anodes for multiple battery call makers and automobile manufacturers. Nameplate production capacity would exceed 5 gigawatt-hours (GWh).

- Group 14 Technologies will receive $100 million for making a silicon-carbon composite to displace graphite in lithium-ion battery anodes. Called SCC55, the composite is made of amorphous silicon within a porous carbon scaffold. The company plans to build two 2,000 tonnes per year commercial manufacturing modules in Washington State.

Major countries in silicon production worldwide in 2021

- Sila Nanotechnologies will get 100 million dollars to support a 600,000 square-foot facility, also in Washington, expected to start producing Sila’s proprietary silicon anode material in the second half of 2024. According to Sila, via Charged magazine, “the Moses Lake site has the potential for further expansion and investment by 15X to reach production volumes to power 150 GWh of cells when used as a full graphite replacement or 750 GWh as a partial replacement — enough to power 2 to 10 million electric vehicles per year.” The company has partnerships with BMW and Mercedes-Benz, Bloomberg reports.

Note: Group 14 and Sila’s technologies are next-gen and have yet to be manufactured on a commercial scale. Both are using silicon and/or carbon in the anode, in place of graphite. It’s unclear from its website whether Applied Materials is using graphite. The silicon battery market is expected to grow from USD 38 million in 2020 to USD 177 million by 2025.

In October, Anovion Battery Materials announced it was getting a $117 million grant under the Bipartisan Infrastructure Law, to build a 35,000 tpa synthetic graphite manufacturing facility — an expansion of its existing plant near Niagara Falls, New York, which opened in early 2021.

The country’s second anode manufacturing facility opened in Chatttanooga, Tennessee, in November, 2021. NOVONIX’s Riverside Recharged plant will produce synthetic graphite at a rate of 10,000 tonnes per year by 2023 and 40,000 tpa by 2025.

Natural vs synthetic graphite

Natural graphite exists in three forms: flake, amorphous, and vein or lump. Only flake graphite, upgraded to 99.95% purity, can be used in batteries.

Flake graphite is made up of layers of graphene, which is the mineral’s base structural element, and is preferred by most manufacturers of refractories, batteries, crucibles, pencils, powder metallurgy, on top of lithium-ion batteries. About 40% of the world’s production is flake graphite.

The anode material — called spherical graphite — can also be manufactured from synthetic/artificial graphite, which is produced from heating petroleum coke feedstock in a special furnace, but this method is costly and super energy-intensive, as explained below.

It’s important to understand that both natural and synthetic graphite are processed to yield a purified, milled, spheroidized, and coated product. Natural graphite has been mined, whereas synthetic graphite must be “graphitized” (baked) at 3,000 degrees C.

Battery Power Online notes, The environmental footprint of graphite is thus highly dependent on the ore grade, processing efficiency, and energy source of the manufacturing facility.

However what is clear, is the higher carbon dioxide emissions from the graphitizing process. The linked article states the graphite anode is responsible for 50% of the CO2 emissions from battery production, and that synthetic graphite is often processed with coal power in Mongolia.

Earlier this year, Fastmarkets wrote that Producing spherical graphite out of natural mined flake material requires less energy than the Acheson furnace process employed in synthetic graphitization.

The latter is obviously reflected in a significant cost savings for natural graphite, which is priced around half that of synthetic.

Moreover, natural flake graphite exhibits a much higher crystalline structure than synthetic, and is therefore more electrically and thermally conducive. According to Canada Carbon, natural graphite’s ability to be exfoliated and then pressed into sheets make it the preferred structure for heat sinks, fuel cells and gaskets.

The rising costs associated with the production of synthetic graphite in China are pushing local battery manufacturers to turn increasingly toward the use of natural graphite, Fastmarkets reported in January.

While the current graphite mix in China is about 80% synthetic and 20% natural (most anode technologies employ a blend of both), the surging costs related to graphitization of synthetic, have Chinese battery manufacturers considering a shift to using more natural graphite.

Fastmarkets notes that graphitization capacity is mainly located in Inner Mongolia, and while the region is known for its low energy costs, it was the first in the firing line when the 2021 energy crisis unfolded.

After dual controls were put in place on the amount and intensity of energy consumption from the end of 2020, coal prices in China soared over the following year due to reduced imports from Australia, as well as high internal demand when the country’s post-Covid economy began to fire on all cylinders once more.

This played out for the whole of 2021, but in the third and fourth quarters the energy crunch spread to most of the country and could not be contained to remote areas. Energy costs rocketed, while availability tumbled. Local governments imposed rolling blackouts for energy-intensive industries.

For synthetic graphite, this led to reduced output and sudden, unpredictable cost increases…

“Energy consumption in synthetic graphite production far outpaces energy demands for spherical graphite production, leaving synthetic graphite producers more vulnerable to soaring costs, reduced energy availability, and forced closures,”according to Amy Bennett, principal consultant on graphite for Fastmarkets Metal Bulletin Research…

“The synthetic market is much more exposed to shutdowns in China than [the market for] natural [material],” one North America-based graphite supplier source said. “It is an obvious target for power-rationing. It also has much greater emissions issues. Most Chinese power is coal-based, so it’s a double whammy for western buyers concerned with ESG [environmental, social, governance] issues.”

Besides, it would be difficult for new synthetic operations to be added in China. The country’s latest policy changes have set a cap on energy usage imposed by local authorities, and require additional approval for any extra energy needs, a source with an anode manufacturer in China said…

All this may prompt battery makers to increase the share of natural-based material in their graphite anode products, at the expense of synthetic material.

Other technical reasons may support this change. The development of silicon as a component in anodes would also favor natural graphite, because this performs better with silicon in the anode than its synthetic counterpart.

Graphite One

A global graphite shortage is a matter of when, not if, without new sources of supply. For the US, which is 100% dependent on foreign imports of the material, it’s a ticking time bomb that could derail the nation’s vehicle electrification and decarbonization ambitions.

This goes back to the importance of establishing a reliable, secure and sustainable “mine to battery” EV supply chain, beginning with a domestic graphite source and integrating it with processing, manufacturing and recycling to create a full circular economy.

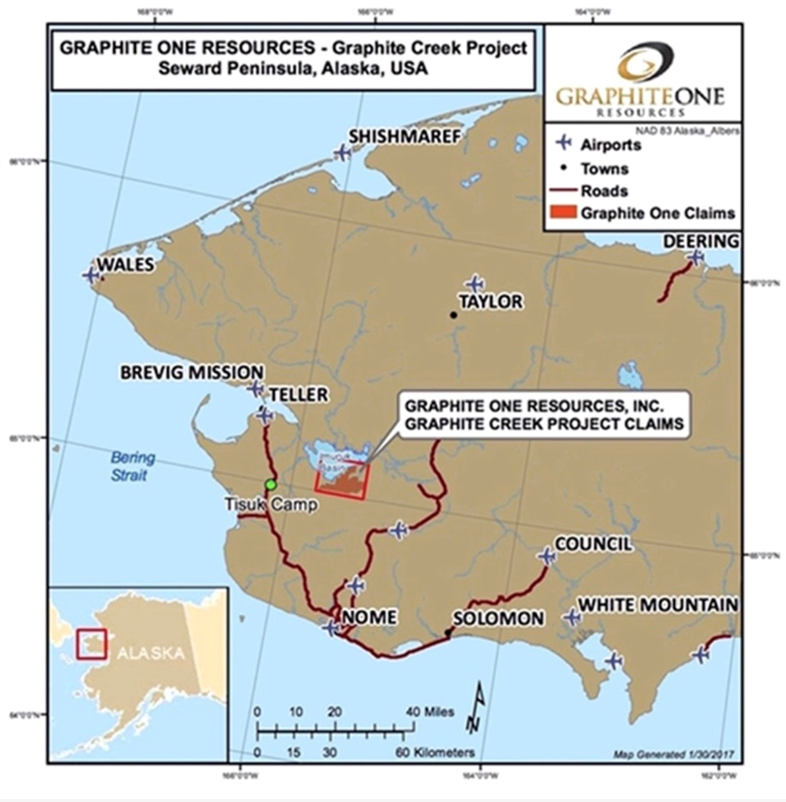

The US Geological Survey has cited the Graphite Creek resource near Nome, Alaska, as the largest known graphite deposit in the country. It is part of an integrated project proposed by Graphite One (GPH:TSXV; GPHOF:OTCQX), which aims to mine and process the graphite and build an advanced materials and battery anode manufacturing plant in Washington State. Graphite One was granted “High-Priority Infrastructure Project” status in January by the Federal Permitting Improvement Steering Committee (FPISC), which would allow the company’s approval process to be streamlined.

Over the summer Graphite One underwent a major de-risking event with the release of the prefeasibility study (PFS) for its Graphite One Project. 2021 drilling has successfully upgraded the 2019 resource estimate, delivering nearly a 200% increase in measured and indicated resources. The PFS also portrays the Graphite One Project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite product price of $7,301 per tonne.

“With the growing demand for graphite in electric vehicle batteries and other energy storage applications – and recent actions by the Biden administration to secure U.S. supply chains for critical minerals – we see Graphite One’s aim to produce a U.S.-based supply chain solution becoming increasingly significant as a new potential source of advanced graphite products for decades to come,” says Anthony Huston, Graphite One’s President & CEO.

The company is well-financed, having just completed a private placement. A total of 9,322,987 units were issued over two closings for gross proceeds of $10,721,434.

Conclusion

Trading at a fraction of the price of nickel, cobalt and manganese, graphite is an overlooked part of the EV supply chain.

At BenchmarkWeek2022 in Los Angeles, BMI’s COO Andy Miller said during a presentation that batteries became more than 50% of the cobalt market in 2016 and the same thing happened to lithium in 2018. Next year, the company sees lithium-ion batteries overtaking the steel industry and becoming the top demand source for graphite.

According to Benchmark’s Natural Flake Graphite Forecast, refractories and foundries this year still dominate demand, but by 2025, the battery industry is set to consume two-thirds of the world’s flake graphite, increasing to 79% in 2030.

Demand is expected to grow at a CAGR of 10.5% over the next decade, versus supply, which will only add 5.7% annually, despite new mines coming online in Africa, Mining.com said.

To meet 2035 graphite demand, the industry needs 97 new graphite mines, @ an average production rate of 56,000 tonnes per day, and 52 new synthetic graphite plants, averaging 57,000 tpa. Compare this to the 59 new lithium mines, 62 cobalt mines and 72 nickel mines needed.

As for which type of graphite will be more in demand, natural or synthetic, Benchmark is squarely in the natural camp. The Mining.com article states:

While synthetic anodes are currently more sought after by carmakers because they improve charging times and battery life, natural graphite-heavy anodes will find favour in future, boosted also by the increasing addition of silicon to anode chemistries.

Benchmark forecasts natural graphite anode demand to grow by more than 400% by the end of the decade versus 170% for synthetic. Alternative anodes including silicon, lithium titanate (LTO) and mesocarbon microbeads (MCMB) will gain market share but graphite will still make up more than 80% of the market by 2040, according to Benchmark.

Demand for natural graphite is set to overtake synthetic before the end of the decade because of carmakers’ worries about the environmental impact of the latter, the need to cut costs and to diversify the supply base away from China.

On a CO2 per kilogram of graphite anode basis, natural graphite production in China is half that of synthetic production across the country. And when compared to synthetic graphite production in Inner Mongolia, which relies almost exclusively on coal fired power plants, the emissions rise to more than three times as much as natural graphite.

Underinvestment by the oil industry also means no new needle coke plants have been built for decades in the US.

When looking for an investment our method involves a thematic approach, studying global, long-term trends. We then study the different sectors to select the one that is going to match up well with what we think is the overriding theme. This is top-down investing.

The second part of our search for dominant long-term investments is a bottom-up approach. This is where we find individual companies in the specific sector we have chosen to invest in.

The electrification of the global transportation system is one of the most important, and enduring, themes to emerge following the turn of the millennium. Governments are spending billions of dollars to encourage consumers and businesses to switch their driving and car-buying habits from fossil-fueled to electric models. Automakers are also investing heavily in electrification, with just about every major carmaker offering new electric models. 2021 automakers announced $36 billion of investments to build facilities dedicated to manufacturing EVs and batteries. In the first five months of 2022, automakers announced $24 billion in EV-related investments.

Graphite is essential to electrification. Graphite is needed in the anode part of the battery and there are currently no substitutes. While the US government has promised $100 million each to three companies building anode plants, at least two of them rely on silicon based technologies.

Natural and synthetic graphite are currently used to make anodes, and while some EV makers prefer synthetic, citing its fast-charge turnaround and battery longevity, it is twice and expensive as natural graphite and far more polluting. Remember, synthetic graphite needs to be heated to 3,000 degrees C and the feedstock is petroleum coke and coal tar pitch. The process emits twice as much CO2 as natural graphite. Kinda defeats the purpose of going green, doesn’t it?

The rising power costs associated with the production of synthetic graphite in China are pushing local battery manufacturers to turn increasingly toward the use of natural graphite.

To meet 2035 graphite demand, the industry needs 97 new graphite mines, @ an average production rate of 56,000 tonnes per year.

The biggest graphite deposit in the US, which currently has no producing graphite mines, is Graphite Creek in Alaska, being developed by Graphite One.

According to the recently completed prefeasibility study, the mine would produce, on average, 51,813 tonnes per year of graphite concentrate for its projected 23-year mine life.

Note that the prefeas is based on exploration of only one square kilometer of the 16-km deposit, meaning GPH could easily crank up production by a factor several times the current (proposed) run rate of 2,860 tonnes per day.

Scale is important to Graphite One’s future customers, they will not want a fragmented supply chain.

The company says it intends to make a production decision on the project upon the completion of a feasibility study. It’s my opinion that the feasibility study will incorporate much more of the deposit and will therefore envision a ramp-up of production, to the point where Graphite One could be, not just a US supplier but a global supplier of anode material.

That would completely change the paradigm for Graphite One and catapult Graphite Creek into the top tier of graphite deposits worldwide.

Alaska Governor Nominates Graphite One Project as High-Priority Infrastructure Project

U.S. GOVERNMENT DESIGNATES GRAPHITE ONE PROJECT AS “HIGH‐PRIORITY INFRASTRUCTURE PROJECT”

Graphite Added to the U.S. National Defense Stockpile List

“I’m proud of the fact that our efforts to develop our project so it aligns with key goals of public policy, have helped generate strong support from Alaska’s Governor Mike Dunleavy, who has made Alaska’s responsible development of critical minerals a key policy objective, and who frequently mentions Graphite One as a project of importance for Alaska. We’ve had strong support from Senator Lisa Murkowski, who has elevated the critical minerals issue in the Senate from her position on the Senate Energy & Natural Resources Committee. Also from Senator Dan Sullivan, who sits on the Senate’s Committee for Armed Services, and is the driving force behind a comprehensive US Arctic Strategy, which requires sustainable economic development in northern Alaska of the kind Graphite One — with North America’s largest graphite deposit — can provide.” Graphite One CEO Anthony Huston

A global graphite shortage is a matter of when, not if, without new sources of supply. For the US, which is 100% dependent on foreign imports of the material, it’s a ticking time bomb that could derail the nation’s vehicle electrification and decarbonization ambitions.

Top-down, bottom-up investing, thoroughly researching macro, global, long-term trends is how we invest at Ahead of the Herd. The information in this article is why I bought, and continue to hold, Graphite One shares (Two GPH private placements, including the most recent @ Cdn$1.15).

Graphite One (G1) is my top pick among the graphite juniors seeking to bring new natural graphite to market.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.24, 2022.11.24

Shares Outstanding 83.3m

Market cap Cdn$131.2m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.