Fully-funded Core Assets eyeing next phase of exploration at Blue

2022.05.17

Flush from the exercise of warrants connected to a 2021 private placement, Core Assets Corp (CSE:CC, OTC.QB: CCOOF, Frankfurt: 5RJ) is in good shape to explore its flagship Blue project in the northwestern corner of British Columbia.

Under the March 17, 2021 financing, 12,177,767 share purchase warrants were issued, entitling unit holders (each unit consisting of one share plus one warrant) to purchase one CC “warrant share” at CAD$0.15 in the first year, and $0.25 in the second year.

As of the one-year anniversary (March 17, 2022), 86% of the warrants that were issued, were exercised, for cash proceeds of $1.566 million, bringing Core Assets’ balance sheet to $3.92 million, fully funding the company for its 2022 field program at Blue.

In January of this year, Core Assets completed a $1.597 million financing @ $0.24 per unit, exercisable for two years at $0.39. Crescat Portfolio Management LLC was responsible for the bulk of the non-brokered private placement, investing approximately $1.275 million.

With CC trading at $0.66/sh, as of this writing, existing warrant holders are well into the money.

The company is tightly structured with 73.86 million shares outstanding (94.81 million fully diluted), of which insiders own 26%.

Blue property

Core Assets’ Blue property commands 1,083 km² of district-scale land position in British Columbia’s prolific Atlin mining district. It is located 48 km southwest of Atlin at the bottom of Atlin Lake and Tagish Lake, providing cost-effective exploration mobilization and potential low-cost ore transportation.

The project geologically is in the Stikine Terrane, host to some of the province’s most significant projects such as Teck Resources’ Schaft Creek and Galore Creek, and Newmont’s Tatogga (see map below).

A significant feature of this region is the abundance of carbonate replacement deposits (CRD). These deposits are polymetallic, which implies that they have various metals in them such as copper, gold, silver, lead, manganese and zinc. The mineralogy depends on the distance from the intrusive rock.

CRDs are epigenetic, meaning they are produced on or near the Earth’s surface, usually through a “replacement process”, hence the name.

Many CRDs today are characterized by high grades (up to 1,500 g/t Ag, 25% Pb and Zn, and 5% Cu), bulk tonnage (up to 150Mt), low mining costs and minimal environmental footprint.

Evidently, the CRD geological model has been responsible for many of the world’s major discoveries, such as Newmont’s Peñasquito mine in Mexico and the Resolution Copper joint venture in Arizona held by Rio Tinto and BHP.

Preliminary results from the Blue property indicated that it follows the “hub & spoke” model similar to one of the largest CRD-porphyry deposits in the world: Bingham Canyon.

Exploration to date has indicated the presence of a large and well-endowed carbonate replacement system on the Blue property.

Rock sampling results (February 2022) from several carbonate replacement and skarn, massive to semi-massive sulfide occurrences at the Sulphide City and Grizzly targets contained values up to 406 g/t Ag, 11.8% Cu, >20% Pb and 15.45% Zn.

Backpack drilling results

Results from 2021 backpack drilling further strengthened the company’s belief that these occurrences exhibit grade consistency and continuity over shallow depths as well as along surface.

The drill campaign using handheld equipment was designed to test the extent of target mineralization at depth within the central part of Blue property. Six drill holes (25mm core diameter) were collared within zones of skarn (Sulphide City – Whaleback target) or carbonate replacement mineralization (Jackie target) that were originally tested by channel sampling during the Phase 2 exploration program.

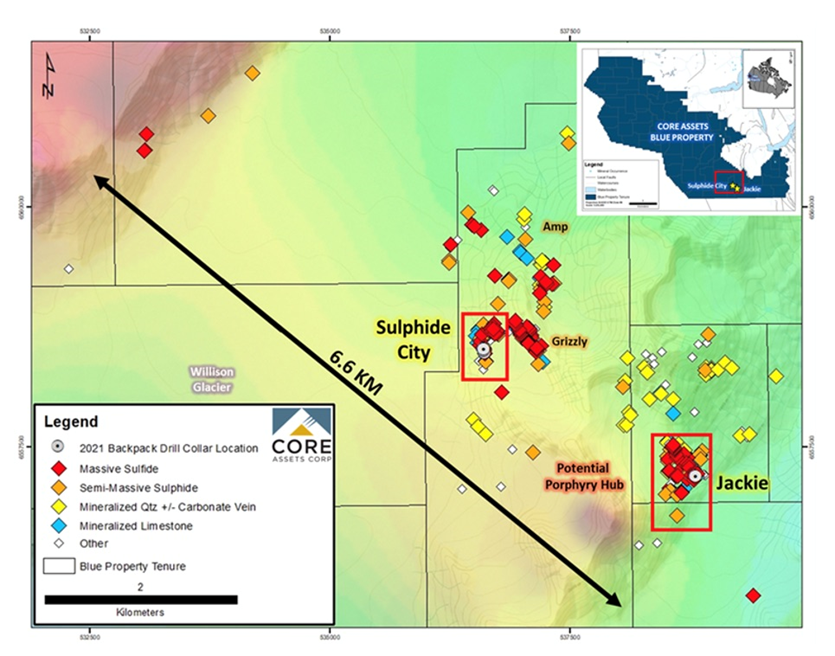

Location of the Sulphide City and Jackie targets, within the extensive 6.6 km mineralized corridor at the Blue property, are shown on the map below. All historical and recent surface samples, as well as the locations of the 2021 backpack drill collars, are plotted.

All five backpack drill holes completed at Sulphide City (Whaleback) intersected calc silicate skarn-hosted semi-massive sulphide over their full lengths ranging from 1-3m depth, and returned assays greater than 7 g/t Ag, 0.16% Cu and 7% Zn (see figure below).

It’s important to note that backpack drilling is limited in terms of where the drilling takes place and what is being drilled; usually no rocks can be taken out of the ground.

“Despite the backpack-style drilling depth limitations, the results from the low-hanging skarn and carbonate replacement occurrences at the 2021 Discovery zone demonstrate that grade is consistently elevated along surface and at shallow depths,” Core Assets’ President and CEO Nick Rodway commented in the March 14 news release.

Laverdiere copper-iron skarn-porphyry target

More good news came in April, when CC discovered a new copper occurrence exposed at surface, observed during a property accessibility assessment carried out in late March at the Laverdiere Project. Located on the eastern end of the Blue property, the historical copper-iron skarn-porphyry target is about a 45-minute snowmobile ride from the town of Atlin, BC.

Core Assets confirmed the existence of outcropping copper-iron mineralization between historical adits (entrances to old mines) during a visit to the Laverdiere Project in late March via snowmobile.

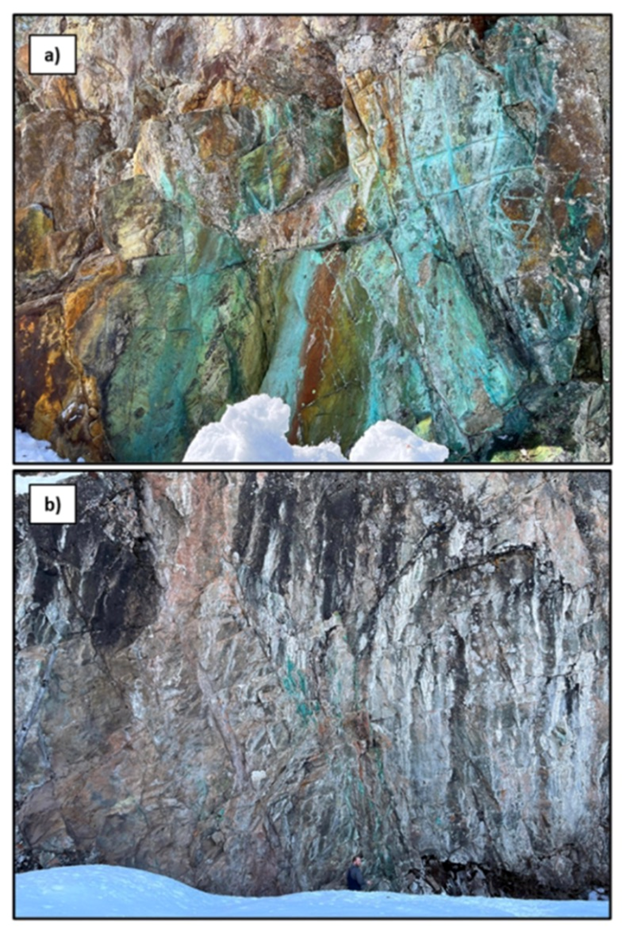

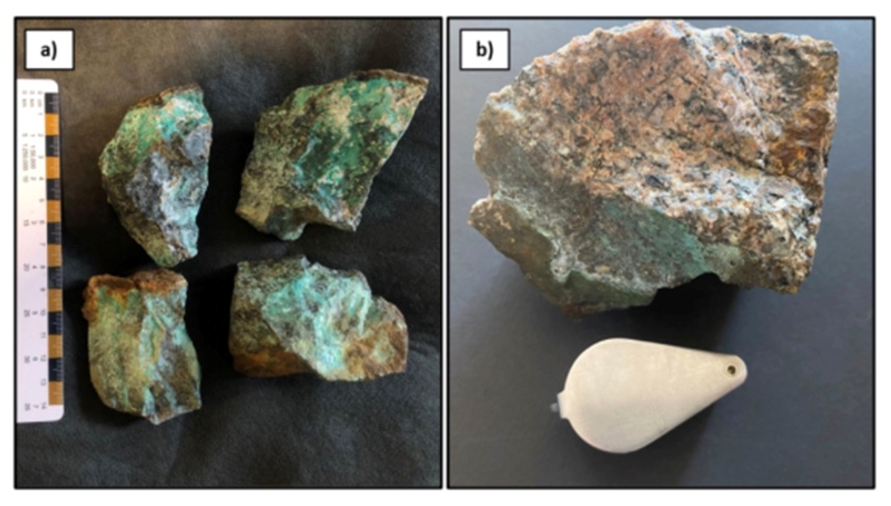

Multiple unsampled exposures of magnetic, copper-stained lithologies were identified along a 3.9-kilometer mineralized corridor coinciding with the Llewellyn Fault. The identified rock units consisted of medium-grained granodiorite and fine-grained Cu-Fe skarn mineralization hosted in marble, as shown in Figure 3 below.

Figure 1: a) Cu-Fe skarn mineralization in marble at the Laverdiere project, March 2022; b) Malachite staining along fractures in potassic altered granodiorite, geologist at bottom for scale.

“Visiting the Blue Property in late March was a game changer,” CEO Rodway stated in the April 6 news release. “We now have a better understanding of how easily accessible the Property is during winter months. The Laverdiere Project was reached effortlessly via a 45-minute snowmobile trip from Atlin, demonstrating how cost-effective mobilizing materials to the Blue Property will be during consecutive exploration programs.”

VTEM survey results

Most recently, Core Assets received results from a geophysical survey carried out last year on the property, which identified numerous large-scale anomalies that may well point the company towards a major discovery as soon as this year.

The newly detected anomalies are all located along the Llewellyn fault. These will be tested as part of the company’s aggressive drill campaign in the summer.

The survey of approximately 2,000 line km took place at 150-meter spacings across the Blue property. It led to the identification of several large-scale geophysical anomalies at the Laverdiere Project.

Below is a geological map and 3D model of the Fe-Cu-Au skarn mineralization and Cu grade at Laverdiere, highlighting the locations and orientations of historical drill holes and the current extent of the skarn body.

There was a large-scale, untested conductivity anomaly coincident with the Llewellyn Fault Zone (LFZ), traceable along the entire length of Hoboe Creek. The strongest conductivity highs residing along the LFZ persist to depths up to 500m.

The map on the left shows the total magnetic intensity (TMI) and distribution of magnetic and overlapping resistivity anomalies at the Laverdiere Project. The map on the right shows the distribution of conductive (hot colors) and resistive (cold colors) geological features in the subsurface.

“The Laverdiere Project is what initially attracted us to the Llewellyn fault area. We can see a clear correlation between geophysical data, historic drilling and surficial geochemical data indicating the right geological ingredients are present for a major discovery at Laverdiere,” Rodway commented in the April 22 news release. The next step, Rodway confirms, is to test these anomalies in the upcoming drill campaign.

Conclusion

The Blue property located in the Atlin mining district is considered to be the most northerly, district-scale porphyry asset in the province.

It is characterized by a major structural feature known as the Llewellyn Fault Zone, which is approximately 140 km in length and runs from the Tally-Ho shear zone in the Yukon, south through the property to the Alaskan Panhandle Juneau Ice Sheet in the United States.

Core Assets believes that the south Atlin Lake area and the LFZ have been neglected since the last major exploration campaigns in the 1980s.

The newly detected anomalies are all located along the Llewellyn fault. They will be tested as part of the company’s upcoming drill campaign.

Periods of stock market volatility are difficult even for the most battle-hardened resource investors, but the ones who usually come out on top are those holding quality companies with strong cash positions.

With nearly $4 million in the kitty, Core Assets is fully cashed up for at least the 2022 exploration season. It doesn’t have to go to the market to raise funds, and it will soon be putting out news, making CC one of only a few bright spots in a beaten-down junior resource sector.

Core Assets Corp.

CSE:CC, OTC.QB: CCOOF, Frankfurt: 5RJ

Cdn.$0.66, 2022.05.16

Shares Outstanding 73.86m

Market cap Cdn$38.4m

CC website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Core Assets Corp. (Core Assets Corp. CSE:CC). CC is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.