Five copper plays amid supply-driven price surge – Richard Mills

2024.03.27

For the first two weeks of March, copper rallied 4.1%, hitting its highest level since April 2023.

A couple of factors identified by us at AOTH indicate that 2024 will be a great year for copper. Most important is supply failing to keep up with demand. The second factor is a weakening of the US dollar if market expectations of monetary easing come to pass.

The US Federal Reserve just had its March meeting, where it maintained its pause on rate hikes (federal funds rate @ 5.25-5.5%), and telegraphed 3 x 0.25% rate cuts, for a total of 0.75%. Most economists believe the first cut will be in June.

If the Fed lowers rates, the dollar will weaken, as it has done in the past during monetary easing. Commodity prices have an inverse relationship with the dollar; a lower dollar typically means higher commodity prices.

Commodities to push higher

In February, analysts at Goldman Sachs said copper and gold would see the largest price boost among commodities from interest rate cuts.

“The immediate price boost from a Fed-driven 100 basis point decline in U.S. 2-year rates is the largest for metals, especially copper (6%), and then gold (3%), followed by oil (3%),” Goldman Sachs said in a Feb. 20 note.

The influential bank repeated its call on commodities this week. In a March 24 note, GS analysts said raw materials may return 15% over 2024 as borrowing costs come down, manufacturing recovers, and geopolitical risks persist. Again, copper and gold, followed by oil, were the commodities chosen by Goldman for the biggest gains.

Copper is forecasted at 10,000 a ton by year’s end, from the current $8,855, and gold is seen hitting a new record-high $2,300 an ounce.

Earlier this month, the bank’s former head of commodities research, Jeff Currie, also predicted gains when the Fed cuts rates, while Australia’s Macquarie Group (via Bloomberg) said Commodities are entering a fresh cyclical upswing aided by tighter supplies and an upturn in the global economy.

Wall Street commodities investment firm Goehring & Rozencwajg referenced the World Bureau of Metal Statistics, which confirms copper demand remains robust, particularly in non-OECD countries:

Despite all the talk of Chinese economic problems, their copper demand surged 13% year-on-year over the first ten months of 2023. Strong non-OECD copper demand growth was not limited to China. India’s copper demand grew 30% and, although seldom mentioned, Indonesian demand grew an astounding 40% over the same period.

Manufacturing rebound

Copper is used in a plethora of manufacturing processes, so commodity analysts keep a close eye on economic growth and manufacturing to get an idea in which direction copper prices are headed.

Global purchasing managers’ indices show that factory orders bottomed in January and are moving back up.

In early February, Mining.com ran three charts from Macquarie identifying “the first green shoots” for copper, nickel, zinc and aluminum prices after a rough 2023.

“January’s full set of PMIs (World manufacturing new orders up 1.2pp to 49.8) looks like a potential turning point for the global industrial cycle, with bullish implications for industrial commodities demand,” reads a trading desk note.

Frank Holmes, CEO of US Global Investors, wrote that the global economy appears to be on surer footing than many anticipated. With the rate of inflation on a downward trajectory, we’re likely to see a softening of interest rates by the Federal Reserve by midyear at the latest. This economic environment bodes well for industries reliant on copper, including automotive and consumer goods manufacturing.

The JPMorgan Global Manufacturing PMI was a neutral 50 in January — anything above 50 reflects an expansion — halting a 16-month streak of sub-50 readings, and ticked up to 50.3 in February.

The S&P Global US Manufacturing PMI was 52.2 in February, with US manufacturing conditions improving at the fastest pace since July, 2022, and bettering January’s 50.7. The March numbers were even better, rising to a 21-month high of 52.5.

The ISM Manufacturing PMI on the other hand was a disappointment. It registered 49.1 in January, up from 47.1 in December, but fell back to 47.8 in February, well below market expectations of 49.5. February was the 16th straight month of readings below 50. ISM blamed a decline in new orders, lower production levels, and more expensive transportation, chemicals, computer and electronic products for the contraction. A fresh downturn in consumer demand pressed the need for capacity and drove employment levels to decline for a fifth straight month.

Copper supply disruptions

A tightening copper market is raising prices and shining a spotlight on copper smelters in China, which have been expanding, leading to a glut in refining capacity that has dropped so-called treatment and refining charges (TC/RC) to record lows.

Smelters lower or raise the amounts they charge for smelting the metal brought to them by mines. Low TC/RCs are good for mining companies who pay less for smelting, but rock-bottom rates cut into the profitability of smelters, who may slash output if TC/RCs are too low.

China is the largest producer of refined copper, accounting for 47% of the global total last year. It is also the world’s biggest copper consumer.

In a nutshell, there are too many smelters and not enough imported raw copper ore to feed them.

With TC/RCs near zero, smelters have been forced to cut production, reducing refined copper supply — even though there is rising demand for copper. According to Oilprice.com, in early March, 19 companies agreed to cuts via maintenance outages, lower output rates, and delays in new operations.

Chinese smelter overcapacity is not the only reason for higher copper prices. In recent years, the mining sector has faced output constraints, plagued by protests, closures, water shortages and lower ore grades.

Nearly 600,000 tonnes of copper supply didn’t come to market last year due to the Panama government’s closure of Cobre Panama — a large copper mine that only recently came online — and a strike at the Las Bambas copper mine in Peru.

Though Las Bambas is back operating, Oilprice reports that

a possible expansion of operations has already drawn the ire of local organizations. This has the potential to trigger renewed protests that could impact the mine’s output.

On top of that, Anglo-American announced that its 2024 Chilean production would disappoint between 210,000 and 270,000 tonnes owing to head grade declines and logistical issues at its Los Bronces mine. (Goehring & Rozencwajg)

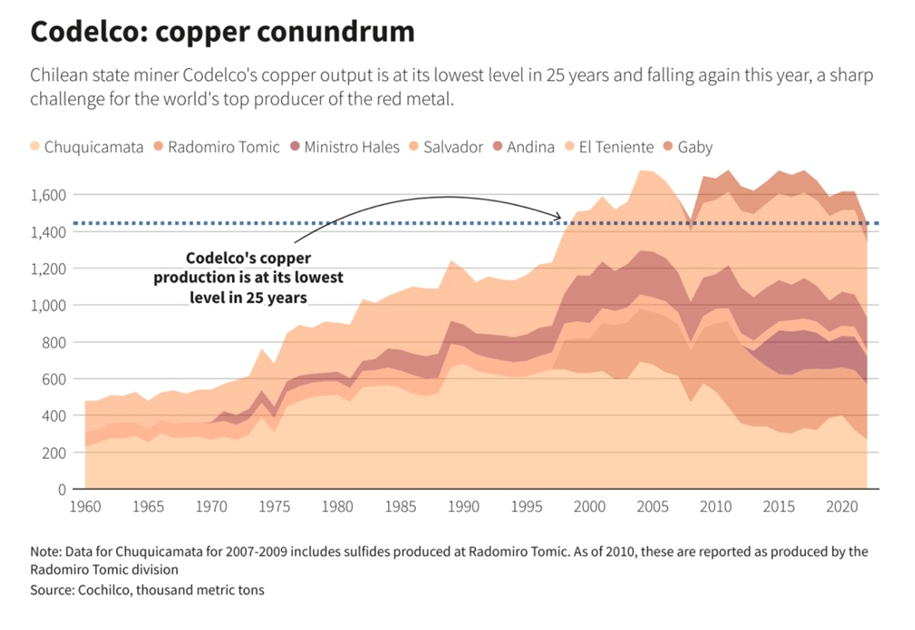

Chile’s copper output has been dented by a long-running drought in the country’s arid north. Codelco’s 2023 production was the lowest in 25 years.

To extend the life of its Chuquicamata mine, one of the world’s largest, the state-owned company is going underground in a project known as Chuquicamata Subterranea,or PMCHS. The $5 billion expansion, originally launched in 2008, was supposed to see construction finish in 2017; instead, completion is delayed until 2025.

A Reuters investigation into the troubled project found it has been beset by delays, collapses and construction difficulties. Some of the workers Reuters spoke to said when management from Codelco’s El Teniente mine took over the project in 2019, they failed to adjust for Chuqicamata’s different geology. The latter has sandier soil compared to the former’s rocky terrain.

A drop in ore grade, a drought then heavy floods, combined with accidents meant production fell to 1.325 million tonnes last year compared to 1.62Mt in 2021.

All four of Codelco’s megaprojects have been delayed by years, faced cost overruns totaling billions, and suffered accidents and operational problems while failing to deliver the promised boost in production, according to the company’s own projections, Reuters said, including an 8-km tunnel at El Teniente that was supposed to go live in 2017, but still had 500m to go last August.

Goldman Sachs, via Oilprice.com, has said it predicts a copper deficit of over half a million tonnes in 2024 due to mining disruptions. “The supply cuts reinforce our view that the copper market is entering a period of much clearer tightening,” analysts at the bank wrote.

Other credible sources agree with the supply conundrum.

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

According to the International Energy Agency (IEA), to keep the world on a path to net zero carbon emissions, copper must rise from 25 million tons to 35 million tons by 2030.

In 2023, mines only produced 22Mt globally.

Even though almost every copper mine was profitable over the past year, prices are not high enough to incite new mines to come onstream. Fitch Ratings via Bloomberg estimates that supply will fall 1.2Mt short of demand by 2029.

The US Geological Survey estimates that, while the world has produced 700 million tonnes of copper, there are 2.1 billion tonnes worth of discovered copper deposits yet to be tapped.

Two reasons we aren’t extracting more copper are costs (incentive pricing in the copper industry is considered to be anywhere from US$11,000/t to 15,000/t) and regulatory delays.

In North America, it can take up to 20 years for a mine to go from discovery to production.

Copper juniors

A junior resource company’s place in the mining food chain is to acquire projects, make discoveries and hopefully advance them to the point when a larger mining company takes it over. Discoveries won’t be made if juniors aren’t out in the bush looking at rocks.

Juniors help the majors to replace the ore that they are constantly depleting in their operating mines, thereby helping to overcome the supply shortfall that is coming for several metals, including copper.

The five copper juniors we are featuring are Abitibi Metals, Max Resource, Northwest Copper, Kodiak Copper and Dolly Varden Silver, which recently acquired the Big Bulk copper-gold porphyry project.

In mining, as in real estate, it’s all about location.

Abitibi Metals has a project within the famous Abitibi greenstone belt running through Quebec and Ontario; NorthWest Copper and Kodiak Copper are operating in British Columbia’s world class copper region known as the Quesnel Trough; Dolly Varden Silver is in the southern end of BC/ Yukon’s even more famous Golden Triangle; and Max Resource is advancing a potentially massive copper-silver sedimentary deposit in the northeastern copper/ silver, coal and O&G rich corner of Colombia.

Abitibi Metals Corp (CSE:AMQ)

Abitibi Metals’ B26 property is located 5 km south of the Selbaie mine and about 90 km west of Matagami, home to the Glencore mining complex. It is accessed by a 7-km gravel road that links the Selbaie mine to the former municipality of Joutel. A network of forestry trails provides access to the drill sites on the deposit. The nearest mining infrastructure is Hecla Mining’s Casa Berardi mine, about 60 km away.

The infrastructure of the former Selbaie mine has been dismantled, but the power line is still in operation near highway 810.

In 1997, SOQUEM drilled discovery hole B26-03, which intercepted 1.87 g/t Au and 2.89% Cu over 11.3 meters. Since that time, the project has been systematically explored by SOQUEM by drilling 254 holes over 115,311 meters.

Rushed assays from Drillholes 1274-24-293 and 294 released on February 29, 2024 included 4.0% CuEq over 22.7 metres, including 6.3% CuEq over 10.6 metres, and 4.1% CuEq over 34 metres, including 11.4% CuEq over 10.6 metres, respectively. Further assays from these holes are pending, including additional over-limit tests.

Abitibi Metals has a seven-year option to earn 80% from SOQUEM, whose mission is to promote the exploration and development of Quebec’s mineral resources (9.9% equity, $14.5M work commitment and $400,000 cash). A 2018 resource shows 6.97 million tonnes in the indicated category at 2.94% copper-equivalent, and 4.41Mt inferred.

Max Resource Corp (TSXV:MAX)

Vancouver-based Max was the first to recognize the potential for the Cesar Basin. Its land package now spans more than 1,150 km of geology prospective for sedimentary-hosted copper and silver deposits. Max’s 20 mining concessions total over 188 square km.

Field teams have so far identified 28 targets across three districts of the 120-km Cesar copper-silver belt: AM, Conejo and URU. The company is focused on expanding, refining, and prioritizing these targets in preparation for a drill program.

Most of the recent action has been at the AM District in the north, where seven outcrops have been discovered at the AM-14 target, which lies along a 15-km corridor of high-grade stratiform copper-silver mineralization. This corridor is parallel to the regional strike of the sedimentary rocks and has highlight grades of 24.8% copper and 230 grams per tonne silver.

In its March 24 news, Max reported high-grade assay results from rock chip channel sampling at AM-14, including 2.2% copper and 12.8 grams per tonne silver over 5.2 meters. The assays confirm copper-silver mineralization at CESAR is extensive and demonstrate significant thickness.

Kodiak Copper (TSXV:KDK)

Kodiak Copper’s MPD copper-gold porphyry project is a consolidation of four properties — Man, Prime, Dillard and Axe — that previously had never been explored as a single project with modern methods.

Just over 50,000 meters and 384 drill holes were completed historically. Kodiak Copper discovered the new Gate Zone in its 2019 maiden drill program. Since then, 123 holes or 74,805m have been completed.

In 2020, Kodiak found a copper-gold zone within the wider mineralized envelope at Gate, containing the highest grades in the property’s 70+-year history. The best intercept returned 535m of 0.49% copper and 0.29 g/t gold, including 45.7m of 1.41% Cu and 1.46 g/t Au.

Large drill programs in 2021 and 2022 extended the Gate Zone to 1 km x 350m, 900m depth and still open. Kodiak also discovered the Prime Zone parallel to Gate and the gold-silver Beyer Zone on surface from trenching.

Kodiak’s 2023 regional exploration program identified five new targets at MPD: Agie, Leeside, Celeste, Orbit and Comet. This brings the total number of prospective areas to 24, of which only eight have been drilled by Kodiak to date. (Feb. 21 news release)

NorthWest Copper Corp (TSXV:NWST)

NorthWest Copper’s project pipeline includes Kwanika/Stardust, Lorraine, and its 2021 discovery at East Niv, a new copper-gold porphyry system. The company has a land position over 150,000 hectares, bookended by the Kemess and Mt. Milligan mines, both owned by Centerra Gold.

The company consolidated the Stardust and Kwanika deposits into a single project. According to NorthWest, Kwanika is one of the largest copper-gold projects in British Columbia, and Stardust is one of the highest grade, sitting at nearly five times the average reserve grade of currently operating BC mines.

Drilling highlights from Kwanika include 235.5 meters at 2.65% copper-equivalent, and 399.8m @ 1.01% CuEq.

The idea is to combine multiple high-grade mining centers to feed a central processing facility.

A 2022 PEA presented a 12-year mine producing 90 million pounds of CuEq annually from Kwanika/Stardust alone, from a capex of $568M.

Forty kilometers north of Kwanika, NortWest consolidated the Lorraine and Top Cat properties. Lorraine is a high-grade alkalic porphyry mineralized system with a historical non-NI 43-101 compliant resource. Alkalic deposits typically form in clusters (e.g., Galore Creek, Mt. Polley), giving significant opportunity for new discoveries.

Dolly Varden Silver Corp (TSXV:DV)

In December, Dolly Varden acquired a 100% undivided interest in the southern portion of the Big Bulk project from Libero Copper & Gold.

“The Big Bulk porphyry was discovered in the early 1900s,” stated VP Exploration Rob van Egmond, in explaining the consolidation strategy. “It’s above treeline, the rocks are exposed so it got prospected first, revealing some high-grade silver and gold veins, peripheral to the porphyry system.”

“A porphyry means it has larger crystals in it,” van Egmond continued. “The mineralized fluids are often lower grade, copper, gold, silver and molybdenum. The deposits tend to be homogeneous. They are amenable to low-cost open pit mines. It’s a bulk tonnage scenario.”

Similar copper-gold porphyry deposits in the region include Red Mountain, KSM and Red Chris.

The southern portion of the Big Bulk property, that Dolly Varden is acquiring 100% ownership rights to, contains seven mineral claims of 3,025 hectares. When combined with the northern portion, this doubles the Big Bulk project to approximately 6,000 hectares.

The option will give DV a new consolidated copper-gold porphyry project in the Golden Triangle region of northwestern British Columbia.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of MAX. Both MAX & DV are paid advertisers on his site aheadoftheherd.com

This article is issued on behalf of MAX & DV

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.