Exploding Demand for Lithium-ion EV Batteries Puts Cypress Development Corp. In The Driver’s Seat

2018.11.10

In the last 25 years, Lithium-ion batteries have become essential to modern-day electronics.

They are used in everything from mobile phones and laptops to power tools, electric vehicles, large stationary storage batteries, and military applications such as missile guidance systems.

By far the most important future application for lithium-ion batteries is in electric vehicles (EVs).

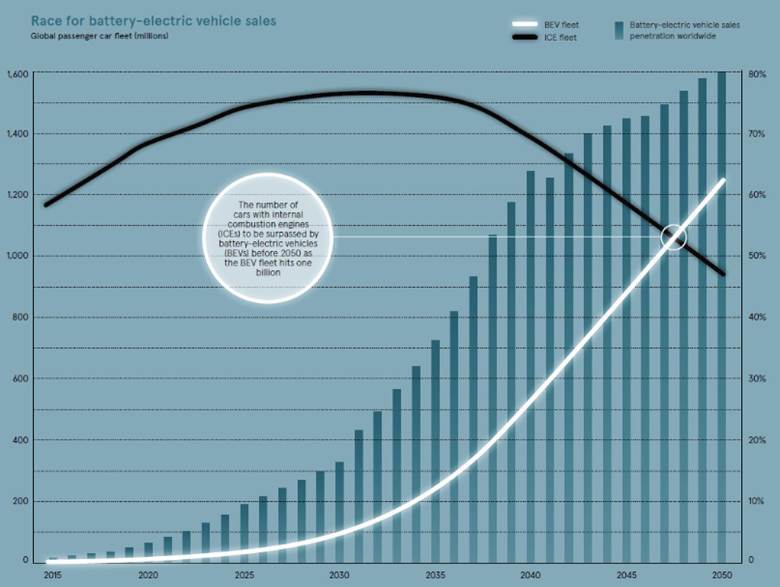

Today EVs are a small part of the auto industry. But by 2047, there are expected to be upwards of 1 billion electric cars on the road. All these EVs will need lithium-ion batteries.

weforum.org/visualcapitalist.com using statistics from Morgan Stanley

Currently a Tesla 3 battery pack uses 63 kg of lithium carbonate. If there are going to be upwards of 1 billion EVs manufactured by 2047, that could mean up to 28.6 million tonnes of lithium carbonate is needed over the next 29 years.

The lithium market is small, currently only about 230,000 tonnes a year. So that’s well over 120 times current production.

Demand for lithium is going off the charts. Miners, battery makers, EV manufacturers and defense contractors and are all going to be scrambling for supply.

Lithium-ion battery technology is now the mainstay technology in consumer electronics and because of the first mover adoption benefit is going to stay the number one technology for a very long time. Prices have come down so far, billions have been invested in making the technology work so it’s going to be impossible for any competing technology to gain the economic foothold to successfully compete.

Demand Can’t Possibly Keep Up With Supply. That Means the Lithium Price Must Go Up – Major Lithium Producers Are Currently Selling LCE For $16,500/tonne And Lithium Carbonate Prices Will Likely Go Much Higher

“Quite simply, there’s not enough supply to meet the demand, and the demand is increasing quicker than the supply is. Much, much quicker. Therefore, lithium’s price will remain strong.” Simon Moores, Managing Director at Benchmark Mineral Intelligence

Trump’s America-First Minerals Policy

Lithium already has the wind at its back from the surging demand for consumer electronics and EVs but there’s even more to lithium’s story.

A year ago US President Donald Trump included lithium in a list of 23 minerals he deemed critical to the defense of the United States. President Trump issued an executive order to reduce America’s reliance on imports of lithium, rare earths and other critical minerals – by exploring and mining, in the US. This was after the United States Geological Survey reported that the United States relies on China for sourcing 20 out of the 23 minerals deemed critical for US national security and the economy.

“USGS experts prepared an analysis of which critical minerals would be components of a Navy SEAL’s combat equipment. It concluded that the outfit would include five critical mineral elements in night-vision goggles, 13 for communications gear and a Global Positioning System and three for an M4 rifle.

As a former Navy SEAL, I didn’t realize that when I was entering combat, much of it was made in China…”

Interior Secretary Ryan Zinke

“The United States must not remain reliant on foreign competitors like Russia and China for the critical minerals needed to keep our economy and our country safe.” President Donald Trump

At Ahead of the Herd we have been invested in, and featuring the lithium space in our newsletter since 2009, when President Obama made reducing the US carbon footprint through the electrification of the transportation system a major plank in his election platform.

Our track record for our newsletter subscribers is excellent:

- Salares Lithium (TSX.V:LIT) – $0.39 to a buyout by Talison @ $1.29

- Rodinia Minerals (TSX.V:RM) – $0.05 to $0.85

- Lithium X Energy Corp (TSX:LIT) – $0.15 to a $2.61 buyout by a Chinese company, NextView

- Cypress Development Corp (TSX.V:CYP) – $0.10

Cypress Development Corp. (TSXV:CYP, OTCQB:CYDVF). Building the Most Critical Metals Mine in America

A company that is uniquely positioned to benefit from, 1. Having what appears to be an extremely long-lived profitable lithium mine and 2. Trump’s America-first policy of mining lithium and other critical metals at home, is Cypress Development Corp. (TSXV:CYP, OTCQB:CYDVF).

Cashed-Up Cypress Development Corp. (TSXV:CYP, OTCQB:CYDVF) Has a World-Class Lithium Project In Nevada’s Clayton Valley

Cypress is a publicly traded lithium exploration company currently advancing their Clayton Valley Lithium Project in Nevada. The property is located just east of Albemarle’s Silver Peak Mine, North America’s only lithium brine operation.

- Exploration by Cypress has uncovered an extensive deposit of lithium-bearing claystone just below surface. A 23-hole drill program returned high-grade lithium (up to 1,144 parts per million) with plenty of room for expanding the deposit at depth – 21 of the 23 holes ended in lithium mineralization.

- Cypress’ Clayton Valley Lithium Project hosts an Indicated Resource of 3.835 million tonnes LCE and an Inferred Resource of 5.126 million tonnes LCE. This ranks the Clayton Valley Lithium Project among the largest in the world.

- A preliminary economic assessment (PEA) published in October showed an outstanding net present value of $1.45 billion at an 8% discount rate, yielding an internal rate of return (after tax) of 32.7%. Payback is just under three years.

- The proposed mine would produce about 24,000 tonnes of lithium carbonate per year for 40 years.

- The initial pit shell contains about 500 million tonnes of claystone, more than enough to last Cypress 40 years of mining, before tapping into the rest of this massive deposit.

- Rare earth and other by-product credits. Rare earth elements were detected in leach solutions – including scandium, dysprosium and neodymium. Cypress has determined there is the potential to recover these elements, along with potassium and magnesium.

Location is key:

- Cypress is operating in an established lithium-mining district in Nevada. Nevada, in 2017, was the third top jurisdiction in the world for mining investment based on the Fraser Institutes Investment Attractiveness Index.

- Infrastructure – Roads, power and water are all close by.

- Permitting is not expected to be a problem.

- Unlike a lot of lithium projects – for example those in Chile and Argentina – the US government is unlikely to arbitrarily impose a tax on miners, change the rules, or expropriate the mine.

- Speed – Cypress has advanced this project very quickly – moving from exploration, building an immense resource to a PEA in under two years. That’s unusual for an exploration company. It usually takes 3 to 5 years just to put out a resource estimate, let alone a PEA. Not only that, Cypress only had to spend about a million dollars on exploration to do it.

Cypress Is Financed Through To The Next Step, A Prefeasibility Study

A resource estimate, PEA and now Cypress has raised $2m and has already started on the next step on the development path to building a mine, a pre-feasibility study (PFS) expected in Q1 2019.

What should Cypress investors expect from a PFS?

- More certainty than the PEA, giving more confidence to the metallurgy and the economics, thus de-risking the project, which should further interest institutional investors and financiers.

- Strategic partner. The greater confidence to come from the PFS is also likely to attract a strategic partner that could help Cypress to advance to the next step, a bankable feasibility study.

- A partner could emerge from the following interested parties: mining companies, battery manufacturers, end users like automakers or electronics companies, or defense contractors eager to lock in a reliable North American lithium supply.

- Defense contractors are finding lithium-ion batteries more and more important. Examples include lithium-ion batteries that are being installed in military vehicles for “silent watches” without the need for frequent engine starts to charge the battery; night-vision goggles; portable computing; and missile guidance systems.

Cypress Is Extremely Undervalued Compared to Its Peers

Cypress Development Corp. (TSXV:CYP, OTCQB:CYDVF):

- Net Present Value $C1.45 billion

- Currently trading at C$0.22 a share

- Market cap C$14.7 million.

Stage of Clayton Valley Lithium Project: PEA completed, PFS started, compared to:

- Lithium Americas: C$5.46 a share, market cap C$483.7 million. Stage of Thacker Pass project: PFS

- Bacanora Lithium: 45.50GBX (C$0.78) a share, market cap £67.2 million (C$114.2 million). Stage of Sonora project: Bankable feasibility study (BFS)

- Global Geoscience: A$0.26 a share (C$0.94), market cap A$382.0 million (C$360.5 million). Stage of Rhyolite Ridge lithium-boron project: PFS

According to Haywood Securities, most precious metals juniors trade at a share price to net asset value (NAV) ratio of 0.3X. Using this as a basis of comparison, Cypress is trading at 0.007X, or 1/37th the value of an early-stage precious metals junior.

10 Reasons Why Cypress Development Corp. (TSXV:CYP, OTCQB:CYDVF)

Should Be On Your Radar Screen

- Size. The company has unearthed one of the largest lithium deposits in North America. Cypress’ Clayton Valley Lithium Project hosts an Indicated Resource of 3.835 million tonnes LCE and an Inferred Resource of 5.126 million tonnes LCE. The vast majority of drill holes used for the resource calculation ended in mineralization.

- Timing. Cypress Development Corp (TSXV:CYP, OTCQB:CYDVF) is developing its Clayton Valley Lithium Project at the perfect time. There is a perfect storm of a supply deficit meeting increasingly higher demand as the world moves away from the internal combustion engine.

- Location. Clayton Valley, Nevada. Roads, power and an experienced mining workforce.

- Economics. PEA report says pre-tax revenue of $260 million expected every year, for at least 40 years.

- Low-Cost Producer. Cypress Development Corp (TSXV:CYP, OTCQB:CYDVF) has a rare opportunity to significantly cut its production costs of $4,000/tonne due to: By-product credits including potassium, magnesium and rare earth oxides.

- Technical Expertise. CEO Bill Willoughby is a mining engineer with nearly 40 years of industry experience, with a Doctorate in Mining Engineering and Metallurgy.

- Made in the USA. The need for an American supply of lithium cannot be underestimated. Even President Trump has called for an America-first minerals policy. Cypress is there at the perfect time to benefit from government policies favoring explorers of lithium and other metals – thus reducing US import dependence of greater than 80% for its lithium needs.

- Competitive Edge – South American brine operations are having problems with water supply and the major producers are fighting amongst themselves over dwindling resources and production quotas.

- Cash. Cypress Development Corp. (TSXV:CYP, OTCQB:CYDVF) is not looking for any help from the market as it moves to the next stage, a prefeasibility study. The company has just raised $2m through an oversubscribed private placement.

- High Upside Potential. The stock is inexpensive compared to its peers.

“Cypress is pleased to enter into this Definitive Agreement and have the opportunity to work with Dajin. Besides exploring for lithium in Alkali Spring Valley, the JV presents potential synergies with Cypress’ Clayton Valley Lithium Project, particularly with respect to water supply. Cypress recently completed an oversubscribed private placement, which will enable us to complete upcoming milestones for Clayton Valley, including further drilling, metallurgical study, and a pre-feasibility study, as well as pursue exploration and a water rights application for Alkali Spring Valley with Dajin.”

The ‘Holy Grail’ Of Junior Resource Company Investing

When was the last time you heard of a major mining company making a discovery? The majors’ business is to produce, whereas the juniors’ place on the food chain is to explore, find and develop its deposit to a given point. Major mining companies have to look at juniors as opportunities to replace their reserves and grow their resources. That happens not because the majors want to, but because they need to.

As investors our ‘Holy Grail’s’ come few and far between. If, as they say, only one in 1,000 projects, or is it one in 2,000 projects ever become a mine, then ‘Holy Grails’ are rare indeed.

What could trigger a major miner’s attention, or for that matter a battery maker, defense contractor or EV manufacturer’s attention (all looking to lock up supply)?

Here at Ahead of the Herd we believe it is the confirmation of the all-in- production cost of $4,000/tonne lithium carbonate in the Preliminary Economic Assessment (PEA).

Advanced metallurgical studies are ongoing. They are a major part of any pre-feasibility study. Met studies, as they are called, provide definitive recovery numbers which leads to confirming a hard cost-of-production number. In Cypress’ case the PEA showed a ‘soft’ all in-production number of $4,000/tonne LCE. Confirm that number, ‘harden’ it with the results from the much more in-depth met studies done at a pre-feas level, and in our opinion potential partners will have the confidence necessary to move forward. A PFS attracts these kinds of partners, meaning validation of Cypress’ project and a market cap revision.

Expect met results to be released before the full pre-feasibility study is posted on SEDAR.

Investors are always looking for share price appreciation catalysts – hopefully an upward revision of a company’s market cap WITHOUT further share dilution. Cypress could be at this point – after all, the company did just raise $2m and is fully funded through the PFS. If an all-in production cost of $4,000/tonne LCE is realized then investors should have a very strong wind behind them.

Richard (Rick) Mills

aheadoftheherd.com

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Cypress Development (TSX.V:CYP). CYP is an advertiser on his site aheadoftheherd.com. Richard Mills is not a registered investment advisor or financial planner. Nothing on aheadoftheherd.com is to be taken as investment advice or the recommendation to purchase or sell any security.

NONE OF AHEAD OF THE HERD SITE CONTENT OR THIS ARTICLE CONSTITUTES AN: • OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY BY AHEADOFTHEHERD.COM AND/OR ITS REPRESENTATIVES ANY SECURITY OR OTHER INVESTMENT; • OFFER BY AHEADOFTHEHERD.COM AND/OR ITS REPRESENTATIVES TO PROVIDE INVESTMENT SERVICES OF ANY KIND; AND/OR • INVITATION, INDUCEMENT OR ENCOURAGEMENT BY AHEADOFTHEHERD.COM AND/OR ITS REPRESENTATIVES TO ANY PERSON TO MAKE ANY KIND OF INVESTMENT DECISION.

SECURITIES OR OTHER INVESTMENTS REFERRED TO IN ANY SITE CONTENT MAY NOT BE SUITABLE FOR YOU AND YOU SHOULD NOT MAKE ANY KIND OF INVESTMENT DECISION IN RELATION TO THEM WITHOUT FIRST OBTAINING INDEPENDENT INVESTMENT ADVICE FROM A PERSON AUTHORISED TO GIVE IT. FROM TIME TO TIME, AHEADOFTHEHERD.COM AND ITS REPRESENTATIVES, INCLUDING WITHOUT LIMITATION PERSONS INVOLVED IN THE PREPARATION OF CERTAIN AHEADOFTHEHERD.COM SITE CONTENT, MAY HAVE LONG OR SHORT POSITIONS IN, AND BUY AND SELL THE SECURITIES OR DERIVATIVES (INCLUDING OPTIONS) OF COMPANIES MENTIONED IN SITE CONTENT.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.