Essential graphite and G1’s Soon-to-be-Released Feasibility Study – Richard Mills

2025.01.24

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

(China mines about two-thirds of the world’s natural graphite, controls about 60% of synthetic graphite, and almost 100% of coated spherical graphite used in EV batteries. China also accounts for 98% of announced anode manufacturing capacity expansions through 2030, according to the International Energy Agency.)

The United States currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

Washington has finally begun to recognize this vulnerability.

In 2022, President Biden issued a Presidential Determination under the 1950 Defense Production Act (DPA), declaring graphite and four other key battery minerals at risk of supply disruptions, as “essential to the national defense.”

The aim of the Defense Production Act is to wrest control of “clean technology” (e.g. EVs, renewables) supply chains from China, which has been building and controlling them for decades.

Graphite One (TSXV:GPH, OTCQX:GPHOF) could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite anode manufacturing plant in Voltage Valley, Ohio. Initially, G1 will produce synthetic graphite and other graphite products from purchased graphite.

Automakers and defense companies have been raising alarm bells over the fact that the United States hasn’t mined any graphite since the 1950s, and even if it had, it would need to be shipped to China for processing. G1 intends to play a large part in correcting this.

Properties

A mineral found in metamorphic and igneous rocks, graphite is formed when carbon is subjected to high temperature and pressure in the Earth’s crust. Graphite is also one of the naturally occurring forms of crystalline carbon. It has a black or sometimes greyish color.

Graphite is soft and cleaves easily with light pressure. It is greasy and features low specific gravity.

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Graphite is chemically inert, meaning it is not affected by a majority of reagents and acids.

Graphite is found all over the world in its natural form and in high quantities. It is usually classified into three forms — flake, crystalline, and amorphous — depending on the source of the mineral. (BYJU’S)

Civilian uses

Graphite is found in a wide range of consumer devices, including smartphones, laptops, tablets and other wireless devices, earbuds and headsets.

The electrification of the global transportation system doesn’t happen without graphite.

That’s because the lithium-ion batteries in electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

Graphite is the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

Needless to say, graphite is indispensable to the EV supply chain.

Besides being integral to electric car batteries, e-bikes and scooters, graphite is used in pencil lead, lubricants and repellants, paints and refractories.

Graphite can absorb fast-moving neutrons, making it useful in nuclear reactors to stabilize nuclear reactions.

Crystalline flake graphite is used in the manufacturing of carbon electrodes, brushes, and plates needed in dry cell batteries and the electrical industry.

Graphite can be used to make graphene sheets, said to be 100 times stronger and 10 times lighter than steel. This derivative of graphite is used in making lightweight yet strong sports equipment. (BYJU’S)

Four ways graphite has transformed aerospace engineering to make it more efficient, are increasing the service life of airplanes; improving fuel economy; having the ability to run hotter engines; and reducing the weight of airplanes.

Fun fact: when an industry giant replaces a single leaded bronze part with a graphite equivalent, it saw a weight decrease of 1.5 lbs. In aerospace, every pound saved equates to $5,000 a year in fuel costs.

Military uses

The energy transition and digitalization have made critical minerals top of mind for policymakers and investors alike. However, little is said about the role that these minerals play in the defense sector, and the impact of supply chain disruptions on the world’s militaries.

The danger of running out of minerals needed to build weapons and defend territories is a heightened risk now, during a period of intensified global conflict. With wars raging on two fronts — Eastern Europe and the Middle East —and numerous smaller wars like the conflicts in Yemen and the DRC, nations are girding for war and re-arming their militaries, pushing up demand for critical and non-critical minerals including graphite, aluminum, steel, iron, rare earths, nickel and titanium.

Despite this re-arming trend, the US military and its NATO allies face dwindling stockpiles of minerals for military use. The problem is especially grave considering that China, now America’s strongest foe militarily, controls the market for most critical minerals and the United States is dependent on China (and Russia) for the materials required for building its military equipment and weaponry.

In 2023 China imposed export restrictions on gallium, germanium and graphite, disrupting supplies to the United States.

Graphite is ideal for defense purposes thanks to its unique ability to withstand high temperatures. It can be found in aircraft, helicopters, ships, submarines, tanks, infantry fighter vehicles, artillery and missiles. Graphite is also used in electric-vehicle batteries.

A report from the Hague Centre for Strategic Studies found that natural graphite and aluminium are the materials most commonly used across military applications and are also subject to considerable supply security risks that stem from the lack of suppliers’ diversification and the instability associated with supplying countries.

The report says aluminum and natural graphite are the two most used materials in the defence industry and can be found in aircrafts (fighter, transport, maritime patrol, and unmanned), helicopters (combat and multi-role), aircraft and helicopter carriers, amphibious assault ships, corvettes, offshore patrol vessels, frigates, submarines, tanks, infantry fighter vehicles, artillery, and missiles. These materials are used in components such as airframe and propulsion systems of helicopters and aircrafts as well as onboard electronics of aircraft carriers, corvettes, submarines, tanks, and infantry fighter vehicles. The impact of supply disruption would be very significant, given the multiplicity of aluminum and natural graphite applications.

Graphite market

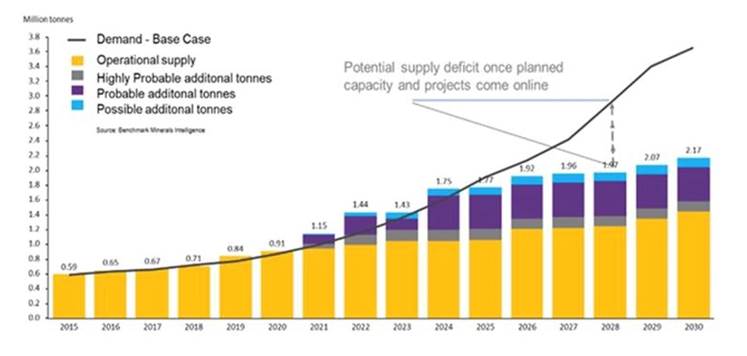

BloombergNEF expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector.

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in graphite demand could see an 8- to 25-fold increase between 2020 and 2040, trailing only lithium in terms of demand growth upside.

Given that demand for graphite is accelerating at a rate never seen before, and the EV industry is now gradually shifting towards natural graphite, the impending supply crunch could get serious.

Analysis by Benchmark Mineral Intelligence projects that natural graphite will have the largest supply shortfalls of all battery materials by 2030 — even more than that of lithium — with demand outstripping expected supplies by about 1.2 million tonnes.

And this is just counting EV battery use only; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI previously stated that flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. For reference, the amount of mined graphite for all uses in 2023 was 1.6 million tonnes.

The lithium price reporting agency has said up to 97 average-sized graphite mines need to come online by 2035 to meet global demand.

While graphite prices have been down lately due to oversupply in China, the expectation of a market recovery in 2025 is likely to re-ignite interest in graphite projects, writes GraphiteHub founder Harry Minnis.

BMI warns that shortages could persist for up to 20 years unless production diversifies especially outside of China. Fastmarkets also forecasts a deficit in the natural graphite market, driven by soaring EV demand and delayed capacity expansions. Rising power costs and environmental controls are expected to contribute to increasing prices, making the market more dynamic in the coming years, says Minnis.

US dependence

In the event of a mineral shortage, the US could not depend on its closest allies for critical raw materials. NATO has limited mineral production. The European Union imports between 75% and 100% of most metals it consumes, and neither the EU nor its member countries have stockpiles. Nor do Canada or Great Britain. The United States does not produce any graphite; most of it is imported from China.

Graphite is:

- One of 14 listed minerals for which the US is 100% import dependent.

- One of nine listed minerals meeting all six of the industrial/defense sector indicators identified by the US government report.

- One of four listed minerals for which the US is 100% import-dependent while meeting all six industrial/defense sector indicators.

- One of three listed minerals which meet all industrial/defense sector indicators — and for which China is the leading global producer and leading US supplier.

We have clearly reached a point where much more graphite needs to be discovered and mined.

Graphite One could supply a significant portion of the graphite demanded by the United States.

Consider: In 2023, the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity.

Based on G1’s Prefeasibility Study (PFS), not the Feasibility Study which is expected in the first quarter of 2025, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

Graphite One Inc. (TSXV:GPH, OTCQX:GPHOF)

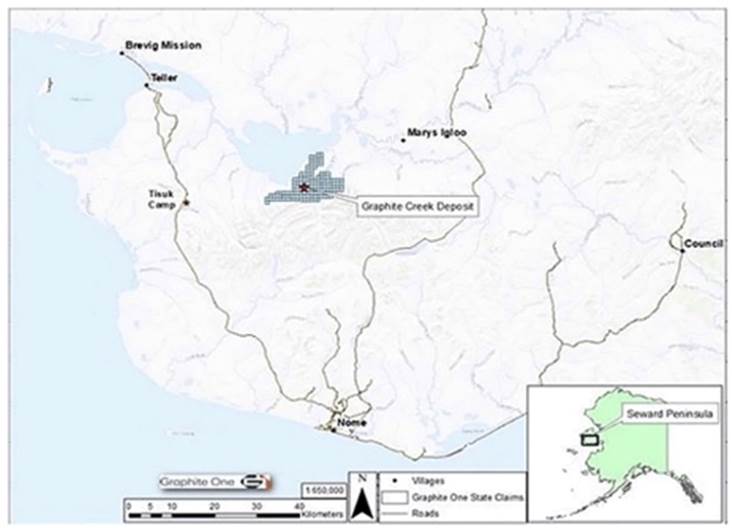

Graphite One (TSXV:GPH, OTCQX:GPHOF) has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek in Alaska, the largest graphite deposit in the country and one of the biggest in the world.

Two Department of Defense grants have been awarded, one for $37.5 million, the other for $4.7 million.

On Jan. 16, Graphite One announced that the Defense Logistics Agency has released a video on Graphite One and Vorbeck Materials Corp. of Maryland and North Dakota’s congressionally-funded project to develop an alternative to the current firefighting foam used by the US military and civilian firefighting agencies, using graphite sourced from G1’s Graphite Creek deposit.

G1’s Feasibility Study is now 75% funded by the DoD.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

Graphite Creek in 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

Graphite One plans to develop a “circular economy” for graphite. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically — a US first.

President Donald Trump issue’s Executive Orders

On January 20, 2025 President Donald Trump issued Executive Orders (“EOs”) on energy, Critical Minerals and the importance of Alaska to U.S. Critical Mineral development and American energy independence.

Three EOs in particular impact G1’s Critical Mineral project:

The Energy Emergency EO aims to facilitate “the energy and critical minerals (“energy”) identification, leasing, development, production, transportation, refining, and generation capacity of the United States,” to support development of the “…energy supply needed for manufacturing, transportation, agriculture, and defense industries, and to sustain the basics of modern life and military preparedness.”

This EO addresses a range of federal policies with a focus on streamlining permitting processes to bolster U.S. energy dominance, eliminating or reducing current burdens in developing domestic energy resources, specifically on Critical Minerals.

UNLEASHING ALASKA’S EXTRAORDINARY RESOURCE POTENTIAL

This new EO recognizes the essential importance of Alaska – home of G1’s Graphite Creek project, recognized by the USGS as the nation’s largest graphite deposit and “among the largest in the world” – to U.S. Critical Mineral development and energy independence.

“These Presidential actions confirm our 100% U.S.-based supply chain strategy. So much depends on the U.S. having a robust, reliable source of advanced graphite materials, and Graphite One intends to meet that need. These Presidential actions confirm our 100% U.S.-based supply chain strategy. So much depends on the U.S. having a robust, reliable source of advanced graphite materials, and Graphite One intends to meet that need.” said Anthony Huston, CEO of G1.

Graphite One plans to invest $435 million to build a graphite anode manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh.

As Graphite One builds its anode active materials (AAM) production plant, first to accommodate synthetic graphite, then natural graphite from the Graphite Creek mine, the company has the opportunity to make other graphite products. Two possibilities are silicon-blend graphite, where silicon is embedded within a graphite matrix in the anode; and hard carbon, which improves ionic flow and provides higher power densities in batteries.

Through its wholly-owned subsidiary, Graphite One Alaska, the Vancouver-based company chose Ohio’s Voltage Valley, entering into a 50-year land-lease agreement on 85 acres.

The Ohio facility represents the second link in Graphite One’s graphite materials supply chain; the first link is Graphite One’s Graphite Creek mine in Alaska, currently working toward completion of its Feasibility Study, funded by a $37.5 million Defense Production Act grant from the Department of Defense in July 2023.

Subject to financing, the plant will manufacture synthetic graphite until natural graphite anode active material becomes available from the company’s Graphite Creek mine.

The plan also includes a recycling facility to reclaim graphite and other battery materials, to be co-located at the Ohio site, which is the third link in Graphite One’s circular economy strategy.

The new 25% tariff on Chinese graphite imports will help G1 to develop a home-grown graphite supply chain. US graphite miners have asked Washington to increase the tariff to 920%.

China, meanwhile, has imposed restrictions on Chinese graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Increased usage of natural graphite is expected from non-Chinese sources, who are seeking to establish ex-China supply chains.

The mine

Graphite One is at the forefront of this trend. The company has significant financial backing from the Department of Defense, the Export-Import Bank of the United States (EXIM), and political support from the highest levels of government, including the White House, Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation.

The project isn’t near a salmon fishery and it has the backing of local communities. Nome has a long history of resource extraction.

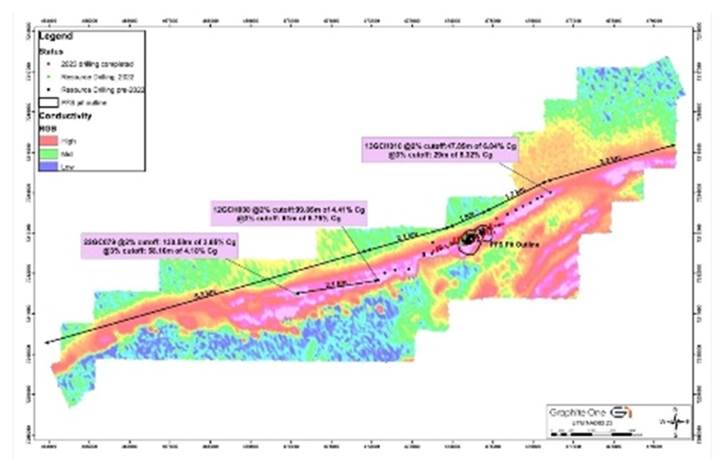

On March 13, 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

2022 Drilling Program Results Increase Graphite One Measured and Indicated Resource by 15.5%

The site hosts 32.5 million tonnes of graphite (measured and indicated) grading 5.25% Cg for 1.7 million tonnes, and 254 million tonnes inferred at 5.11 Cg for 13 million tonnes. In total, 14.7Mt contained graphite. The estimate used a cutoff grade of 2% Cg.

A 2022 Prefeasibility Study (PFS) portrays the project as highly profitable. The initial capex is $1.1 billion, with production costs of $3,590 per tonne and an after-tax present value, discounted 8%, of $1.4 billion. The internal rate of return is 22%.

Once running, the mine would produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

The PFS was based on the exploration of only one square kilometer of the 16-km deposit, meaning that G1 could potentially increase production by a factor several times the proposed run rate of 2,860 tonnes per day.

“The continued expansion of our Graphite Creek resource will support our plan to quadruple the annual production from our PFS study,” said Graphite One Senior Vice President of Mining Mike Schaffner.

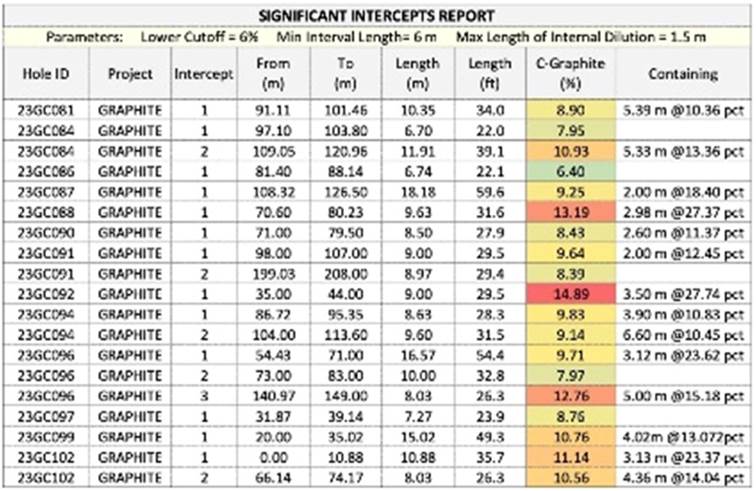

In 2023, an 8,736-meter drill program focused on upgrading and expanding the deposit, and collecting data for the Feasibility Study, saw 52 holes drilled. Highlights included:

• 9.63 meters averaging 13.19% graphitic carbon in hole 23GC088

• 9.0 meters averaging 14.89% graphitic carbon in hole 23GC092

• 15.02 meters averaging 10.75% graphitic carbon in hole 23GC099

• 10.88 meters averaging 11.14% graphitic carbon in hole 23GC102

The company said the results demonstrated exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

“The results — 52 graphite intercepts over 52 holes — confirm our confidence that Graphite Creek is truly a generational resource of strategic value to the United States, and we wish to thank the Alaskan Government, our funding partners, local stakeholders, and communities for their continued support in advancing this critical asset,” Huston said in the Oct. 23, 2023 news release.

The 2024 field program was developed to gather the remaining data required to complete the company’s Feasibility Study. Three drill rigs were used to gather the geotechnical information needed to engineer the pit walls and foundations for the processing facility, tailings/waste rock facility, and other infrastructure.

The Feasibility Study detailing a larger mine at Graphite Creek and a processing plant in Ohio is expected to be out in the first quarter of 2025.

Only about 10% of the mineralized trend has been drilled so far.

Summary of 2023 drill results

Conclusion

Graphite is ubiquitous in modern society with a plethora of civilian and military uses. We simply cannot live without graphite, an understated mineral that has no substitutes.

Graphite is ideal for defense purposes thanks to its unique ability to withstand high temperatures. It is found in aircraft, helicopters, ships, submarines, tanks, infantry fighter vehicles, artillery and missiles.

Graphite is also used in electric-vehicle batteries.

A report from the Hague Centre for Strategic Studies found that natural graphite and aluminium are the materials most commonly used across military applications and are also subject to considerable supply security risks that stem from the lack of suppliers’ diversification and the instability associated with supplying countries.

Citing a study it commissioned by Oxford Economics Group Ltd the North American Graphite Alliance said, in 2023 China produced 79 per cent of the natural graphite supply and 97 per cent of the synthetic graphite used in anode material.

“China’s complete dominance of the battery-grade graphite supply chain allows it to maliciously influence the global graphite market.”

In 2023 China imposed export restrictions on gallium, germanium and graphite, disrupting supplies to the US, and impressing upon the industry and government the need for a domestic source of graphite.

Graphite is found in a wide range of consumer devices, including smartphones and laptops. The electrification of the global transportation system doesn’t happen without graphite.

Graphite One’s Graphite Creek mine in Alaska has all the ingredients for success, including funding from the Department of Defense, the support of high-level Alaska politicians, and the backing of the Bering Straits Native Corporation.

In March 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

2022 Drilling Program Results Increase Graphite One Measured and Indicated Resource by 15.5%

A 2022 Prefeasibility Study (PFS) portrays the project as highly profitable. The initial capex is $1.1 billion, with production costs of $3,590 per tonne and an after-tax present value, discounted 8%, of $1.4 billion. The internal rate of return is 22%.

The site hosts 32.5 million tonnes of graphite (measured and indicated) grading 5.25% Cg for 1.7 million tonnes, and 254 million tonnes inferred at 5.11 Cg for 13 million tonnes. In total, 14.7Mt contained graphite. The estimate used a cutoff grade of 2% Cg.

The PFS was based on the exploration of only one square kilometer of the 16-km deposit, meaning that G1 could potentially increase production by a factor several times the proposed run rate of 2,860 tonnes per day.

“The continued expansion of our Graphite Creek resource will support our plan to quadruple the annual production from our PFS study,” said Graphite One Senior Vice President of Mining Mike Schaffner.

That tells me the mine is looking at a massive increase in high-grade graphite and that the Feasibility Study, when it comes out, will likely be a major catalyst for Graphite One.

Remember in 2023 the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity, suitable for electric vehicles.

Based on G1’s Prefeasibility Study (PFS), not the Feasibility Study which is expected this year, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

That’s nearly two-thirds (62%) of US graphite needs, and according to the VP of Mining, annual production is expected to quadruple.

With all that Graphite Creek has going for it, we firmly believe the mine is going to move forward if it doesn’t get bought, which leaves enough for US friends.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2025.01.22 share price: Cdn$0.81

Shares Outstanding: 137.8m

Market cap: Cdn$112.5M

GPH website

Richard (Rick) Mills

aheadoftheherd.com

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of GPR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

2 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

$GPH #GraphiteOne #Graphite

As it is curious.. 🙂