Electrification’s demands on copper and graphite are off the charts – Richard Mills

2023.06.27

The three most critical inputs in the race to electrify and decarbonize are copper, lithium and graphite.

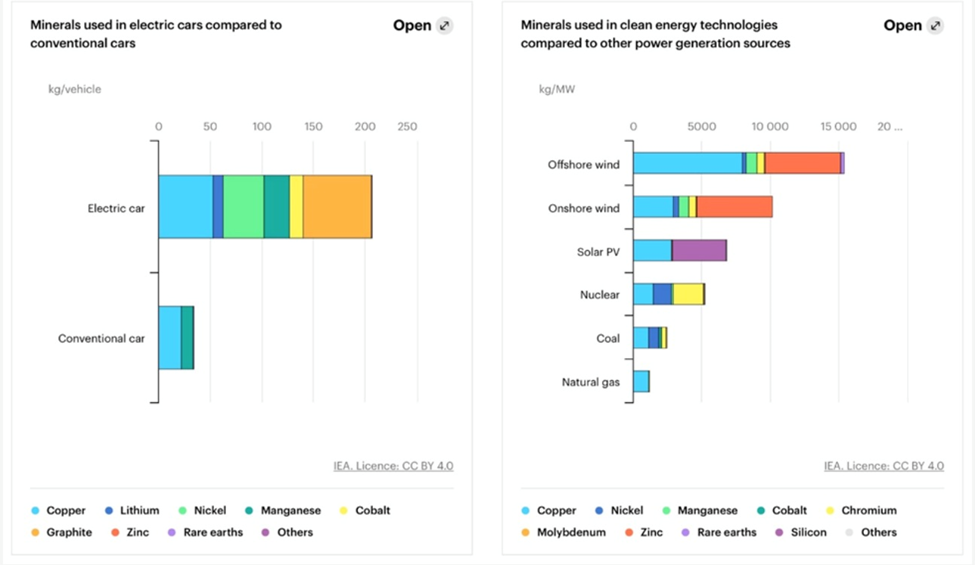

The continued movement towards electric vehicles is a huge copper driver. EVs use about four times as much copper as regular internal combustion engine vehicles.

Copper, too, is needed for charging stations and renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines.

An average plug-in EV has 70 kg of graphite. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced in 2020.

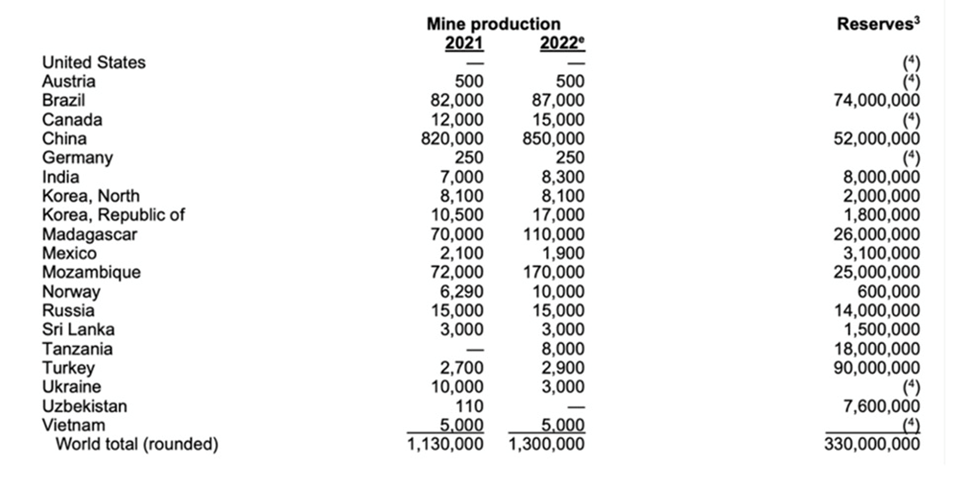

It’s thought that battery demand could gobble up well over 1.6 million tonnes of flake graphite per year (out of 2022 mine supply of 1.3Mt). Remember, the mining industry still needs to supply other graphite end-users. Currently, the automotive and steel industries are the largest consumers of graphite with demand across both rising at 5% per annum.

Electric vehicles

Of course the main reason for the supply deficits expected in all three of the main electrification metals — copper, lithium and graphite — is increasing EV popularity, and sales.

According to the latest edition of the International Energy Agency’s ‘Global Electric Vehicle Outlook’, more than 10 million electric cars were sold in 2022, with sales expected to reach 14 million in 2023, a 35% increase. Based on IEA projections, electric cars’ share of the overall vehicle market rose from 4% in 2020 to 14% in 2022. Market penetration is projected to hit 18% this year.

Demand for EV batteries surged a massive 65% in 2022, the annual report stated.

The IEA says market penetration needs to reach around 60% by 2030 if the industry is to meet “net-zero” CO2 emissions by 2050. That would mean the number of electric vehicles on global roads jumps from 16.5 million in 2021 to 350 million in 2030, a 21-fold increase.

Charging stations

One of the biggest obstacles to higher sales of electric vehicles is limited public charging infrastructure, something governments around the world are spending billions to fix.

While the number of charging stations for EVs continues to grow, there’s only about one EV charging station for every gas station in the U.S., with each gas station averaging 4-8 pumps. This means only 1 EV charging station exists for every 4-8 gas pumps, which is a 1:4 ratio, at best. (Oilprice.com, June 16, 2023).

To accommodate the demand for electric cars, experts project that more than a million new public EV charging stations will be required in the U.S. by 2030. According to a recent S&P Global Mobility assessment, the U.S. must triple its charging infrastructure by 2025, an 8x increase over the country’s current charging capacities. (Business Insider, Jan. 9, 2023)

In the United States, the firm says there are currently 126,500 Level 2 charging stations, which take about five hours to fully charge an EV, and 20,431 Level 3 stations, which will charge an electric vehicle to 80% capacity in 15-20 minutes. There are also 16,822 Tesla Superchargers and Tesla destination chargers.

President Biden has set a goal of 500,000 public charging stations by 2030, a five-fold increase from the 100,000 in place already.

But this objective may already be out of date. S&P Global Mobility says that, assuming there are 7.8 million EVs on American roads in 2025, they will require 700,000 Level 2s and 70,000 Levels 3s.

By 2030, if the number of electric vehicles rises to 28.3 million — a realistic assumption given that EV sales are projected to grow 35% in one year, between 2022 and 2023 — they will require 2.13 million Level 2 and 172,000 Level 3 public chargers, S&P Global Mobility forecasts. This does not include home charging stations drivers will install.

Copper

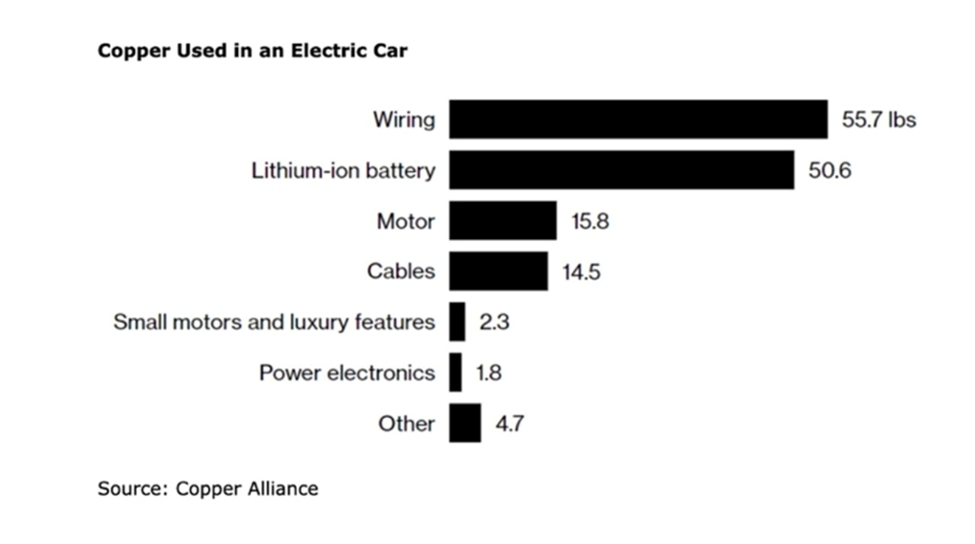

All of this charging infrastructure will require a lot more copper. An average EV contains about 85 kg of the red metal. Charging stations take 0.7 kg (for a 3.3 kW slow charger) or 8 kg (for a 200 kW fast charger), according to the Copper Alliance.

Most of Biden’s new chargers are “Level 2” powered at 6 to 8 kW, so if we assume a copper content of roughly 1.5 kg per charger, an additional 400,000 chargers would need 600,000 kg of copper or 600 tonnes (1 tonne = 1,000 kg).

Now let’s consider how much copper the 1 million charging stations forecasted by S&P Global Mobility in the US by 2030 would entail:

1,000,000 charging stations = 1,000,000 x 1.5 kg for Level 2 chargers = 1,500,000 kg/1,000= 1,500 tonnes of copper.

By 2030, though, S&P expects 28.3 million EVs on US roads, requiring 2.13 million Level 2 and 172,000 Level 3 chargers.

2,130,000 x 1.5 kg = 3,195,000 kg/1000 = 3,195 tonnes.

172,000 x 8 kg = 1,376,000 kg/1000 = 1,376 tonnes. Total 4,571 tonnes.

Remember this is only for the United States, and it doesn’t include charging stations homeowners might install in their homes, also requiring copper. It also excludes the copper wiring needed to connect all these new charging stations to renewable energy, and the copper in the renewable energy plants themselves (see below).

According to The Faist Group, in 2021 there were about 375,000 public charging stations in Europe, but according to calculations made by McKinsey, a consulting firm, at least 3.4 million will be needed by 2030.

These numbers check out with another source that said Europe will require 1.3 million chargers by 2025 and 2.9 million by 2030.

3.4 million charging stations x 1.5 kg copper for Level 2 chargers = 5,100,000 kg/1,000 = 5,100 tonnes.

5,100 tonnes (Europe) + 4,571 tonnes (US) = 9,671 tonnes.

So far the amount of copper required is quite do-able — 10,000 tonnes is 130 times less than the amount of copper produced by the US in 2022 and 520x less than the copper mined by top producer Chile.

However, if Europe meets its goal of 30 million cars by 2030, the amount of copper required @ 85 kg per EV, is 2,550,000,000 kg, or 2,550,000 tonnes. This is nearly double US copper production in 2022 of 1,300,000 tonnes, or almost half of Chile’s annual production.

Remember, S&P Global Mobility forecasts 28.3 million EVs in the US by 2030. 28,300,000 x 85 kg per EV = 2,405,500,000 kg/1,000 = 2,405,500 tonnes .

To meet this demand, and remember we are only talking about copper demand for electric vehicles sold in the US and Europe — we aren’t counting higher EV sales in other countries, along with millions more public and private charging stations to service them, all needing copper, plus supplying all the other copper markets, for construction, power transmission, telecommunications, etc. — would require 2,550,000 + 2,405,500 tonnes = 4,955,500 tonnes.

This equates to nearly five Escondida mines (the largest in the world), with each producing 1 million tonnes per year. Just to provide enough copper for EVs in the United States and Europe. And not including charging stations, which add another nearly 10,000 tonnes combined.

According to the Copper Development Association, a 3-megawatt onshore wind turbine takes up to 4.7 tons of copper, with offshore wind turbines requiring even more. Visual Capitalist states that wind farms use approximately 7,766 pounds of copper per megawatt, while an offshore wind installation uses 21,068 pounds per MW.

More copper tonnage is required for solar power systems, approximately 5.5 tons per megawatt, states the CDA, with the red metal used in heat exchangers, wiring and cabling. An estimated 1.9 billion pounds or 861,826 tonnes (861,826,527 kg/1,000) of copper will be needed to power 262 gigawatts of new solar installations between 2018 and 2027 in North America. This is just over the 830,000 tonnes of copper mined by Australia in 2022.

Copper is also used in energy storage made necessary by the intermittent nature of solar and wind power. According to Visual Capitalist, a lithium-ion battery contains 440 pounds of copper per megawatt, with a flow battery needing 540 lbs/MW.

As of 2019, a total of 5,752 MW of energy capacity had been announced and commissioned — 5,752 MW x 440 pounds copper or 200 kg = 1,150 tonnes.

Graphite

The electrification of the global transportation system doesn’t happen without graphite. That’s because lithium-ion batteries that go into electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

As previously stated, an average plug-in EV has 70 kg of graphite.

According to Benchmark Mineral Intelligence (BMI), the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. The amount of mined graphite for all uses in 2022 was just 1.3Mt. (USGS)

Furthermore, the London-based price reporting agency forecasts demand for graphite from the battery anode segment could increase by seven times in the next decade as the growth in EV sales continues to drive construction of lithium-ion megafactories.

BloombergNEF expects graphite demand by 2030 to quadruple.

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in demand for selected minerals from clean energy technologies by scenario, 2020 relative to 2040, will see: increases of lithium 13x to 42x, graphite 8x to 25x, cobalt 6x to 21x, nickel 7x to 19x, manganese 3x to 8x, rare earths 3x to 7x, and copper 2x to 3x.

If we use the earlier-mentioned IEA forecast, that by the end of this year, 14 million electric vehicles will be sold worldwide, that equates to:

14,000,000 x 70 kg graphite per EV = 980,000,000 kg/1,000 = 980,000 tonnes of graphite. Mined graphite production in 2022 was 1,300,000 tonnes, so 980,000 tonnes = 75% of 2022 production.

Remember, the IEA says market penetration needs to reach around 60% by 2030 if the industry is to meet “net-zero” CO2 emissions by 2050. That would mean the number of electric vehicles on global roads jumps from 16.5 million in 2021 to 350 million in 2030, a 21-fold increase.

To calculate how much graphite this entails, we subtract 16.5 million from 350 million. Then divide this number by nine to give us how much graphite per year is required for meeting net-zero emissions:

350,000,000 – 16,500,000 = 333,500,000/9 = 37,055,555. 37 million tonnes of graphite is 28x the amount of mined graphite in 2022, giving credibility to the IEA’s 25x forecast stated five paragraphs above.

Except that it’s needed 10 year earlier than the IEA’s 2040 forecast. Note also that 37Mt needs to be added every year for nine years, meaning the mining industry would have to mine 28 times more graphite than currently, and then sustain this level of production to the end of the decade.

Let’s be conservative and say that EV penetration is only 30%, not 60%, by 2030, given the obstacles to EV ownership such as sticker shock and range anxiety. And that the net-zero target is woefully unrealistic and gets missed. That’s still a lot more graphite than currently available:

175,000,000 – 16,500,000 = 158,500,000/9 = 17,611,111 tonnes. 17.6Mt of graphite is 13.5x the amount of mined graphite in 2022.

Conclusion

Where are we going to find the metals?

A green infrastructure and transportation spending push will mean a lot more metals will need to be mined, including lithium, nickel and graphite for EV batteries; copper for electric vehicle wiring, charging stations and renewable energy projects; and silver for solar panels.

In fact, battery/ energy metals demand is moving at such a break-neck speed, that supply will be extremely challenged to keep up. Without a major push by producers and junior miners to find and develop new mineral deposits, glaring supply deficits are going to beset the industry for some time, putting in jeopardy the global shift from fossil-fueled energy production and transportation to the new electrified economy.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.