Drilling at Palladium One’s Tyko Returns High-Grade Ni-Cu-PGE Assays

2021.02.12

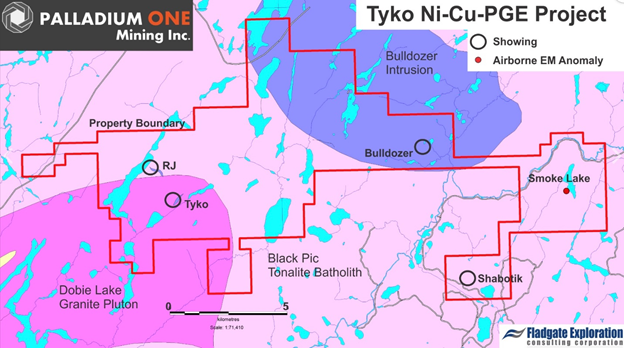

Palladium One’s (TSXV:PDM, FRA:7N11, OTC:NKORF) Tyko is an early-stage project with high nickel tenor potential located in Ontario’s highly prospective Mid-Continent Rift province.

The Archean-aged mafic-ultramafic intrusion at Tyko, formed during the Mesoproterozoic era, is rich in nickel; Tykos ore contains twice as much nickel as copper, and equal amounts of platinum and palladium.

The property is close to existing mining operations, with road and trail access and power and rail infrastructure close by. It is located 25 km north of the world-famous Hemlo mining complex, and 55 km from the Marathon deposit, which hosts a measured and indicated resource of 3 million ounces palladium and 618 million pounds of copper.

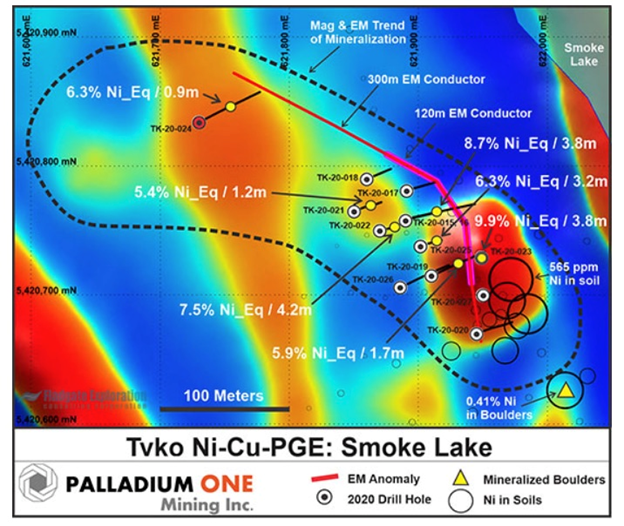

On Jan. 5 PDM announced assay results from the first two holes of a maiden drill program at the Smoke Lake target, completed last year. Of 14 drill holes totaling 1,123 meters, 13 were drilled into the Smoke Lake electromagnetic (EM) anomaly, that was identified by geophysics.

Previous EM surveys showed two near-surface, closely spaced conductors, the largest of which has a strike length of over 300 meters.

A drone-based magnetic survey also identified a strong bullseye associated with soil anomalies (up to 565 parts per million (ppm) nickel and greater than 40 times background levels), representing the surface expression of the EM anomaly.

Mineralized boulders with high nickel (up to 0.41% Ni) and copper values were recently discovered, indicating potential for high-grade massive sulfide mineralization.

According to Palladium One, the lithologies at Smoke Lake closely resemble those found at both the Tyko and RJ showings located 17 km to the west, where 2016 drilling returned up to 1.06% Ni and 0.35% Cu over 6.22m including 4.71% Ni and 0.82% Cu over 0.87m. Drilling so far indicates a mineralized ultramafic body at surface, transitioning to massive sulfides which dip shallowly (about 32 degrees) to the southwest. The mineralization occurs as a consistent sheet with a possible fault near its base. All 13 holes at Smoke Lake intersected magmatic sulfides.

Drilling has identified a strike length of 270m, that is mostly shallow, with the deepest intercept to date only 100m. Mineralization remains open to the northwest and down dip.

High lights included hole TK-20-016, which intersected massive magmatic sulfides grading 8.7% nickel equivalent (Ni Eq) over 3.8 meters at less than 30 meters true depth. Within this intersection, a higher-grade 10.1% Ni Eq was identified over half a meter.

These results were followed a week later by the results from six more holes, which contained several massive sulfide intercepts. Highlights included hole TK-20-22, which returned 7.5% Ni Eq over 4.2 metersfrom 46.8 meters down hole; and hole TK-20-019, which cut 5.9% Ni Eq over 1.7m, from a depth of 28.7m. Higher-grade sections featured 8.8% Ni Eq over 2.1m and 8.7% Ni Eq over 0.8m.

The final set of drill results from Tyko came in on Jan. 19, highlighted by magmatic sulfides in hole TK-20-023 grading 9.9% Ni Eq over 3.8m. This result from the Smoke Lake target, starting at less than 9 meters true depth, was within a broader interval of 6.1% Ni Eq over 7.5m from 5.3 meters down hole. Hole TK-20-025 returned 6.3% Ni Eq over 3.2m, including 11.8% Ni Eq over 0.6m.

“Smoke Lake continues to deliver extraordinarily high-grade intercepts. The highest to date being 9.9% Ni Eq over 3.8 meters, within a broader intercept of 6.1% Ni Eq over 7.5 meters! An extremely high-value, near surface resource appears within our grasp at Smoke Lake,” says Derrick Weyrauch, Palladium One’s President and CEO.

He added: “The massive sulfide mineralization discoveries, combined with historic high-grade drill results 17 km to the west, provide significant encouragement for additional discoveries, especially given Tyko is incredibly underexplored. The Tyko project covers over 20,000 hectares, which includes the 7,000-hectare mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration.”

Disraeli PGE Project, Ontario Tyko isn’t the only project that Palladium One is looking to advance in Ontario’s Mid-Continent Rift province. The Disraeli PGE project is located 40 km north of Clean Air Metals’ Thunder Bay North (TBN) project and 50 km east of Impala Platinum Holdings’ Lac Des Iles palladium mine.

According to Palladium One, the magnetic target at Disraeli is high-grade PGE-rich nickel-copper mineralization located within magma conduits similar to Clean Air Metals’ TBN and Escape Lake deposits. Recent drilling at TBN returned 83.3m of 1.91 g/t Pd, 1.47g/t Pt, 0.73% Cu and 0.41% Ni.

LK Palladium Project, Finland

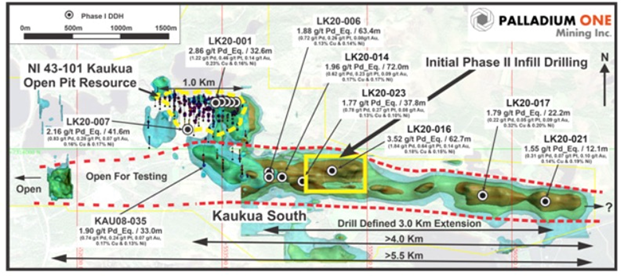

At Palladium One’s other active project, Läntinen Koillismaa (LK) in north-central Finland, recent phase 2 drilling at the Murtolampi Zone intersected high-grade mineralization of 13m at 3.4 g/t palladium equivalent (Pd Eq) within 79m at 2.0 g/t Pd Eq (hole LK20-026), the best grade drilled in the area. This intersection is located 50m southwest of hole LK20-012, which returned 20m at 2.3 g/t Pd Eq within 87m at 1.4 g/t Pd Eq during last summer’s drilling. It is also located 550m northeast of hole LK20-024, which returned a core interval of 3m at 1.4 g/t Pd Eq within 21m at 0.85 g/t Pd Eq.

The geology at LK dates back to the early Palaeoproterozoic era, 2.4 billion years ago, during which rift-related igneous activity produced mafic-ultramafic rocks containing palladium-rich copper-nickel-platinum group elements (Cu-Ni-PGE) sulfide minerals, chromium, as well as iron-titanium-vanadium.

The property is part of an intrusive belt that runs east-west across Finland and into neighboring Russia.

Exploration permits covering a total of 3,845 hectares are divided into two groups: the Kaukua Group consisting of the Kaukua and Murtolampi targets; and the Haukiaho Group covering the Lipeävaara and Haukiaho targets, as well as Salmivaara, which represents the eastern and western extension of Haukiaho.

The project is comparable to the Platreef type deposits of the Bushveld Igneous Complex in South Africa, the largest layered igneous intrusion within the Earth’s crust. It is also where most of the world’s platinum is produced.

The latest drill results suggest there is potential for a low-cost satellite open pit at Murtolampi, close to the Kaukua deposit located 2 km to the south.

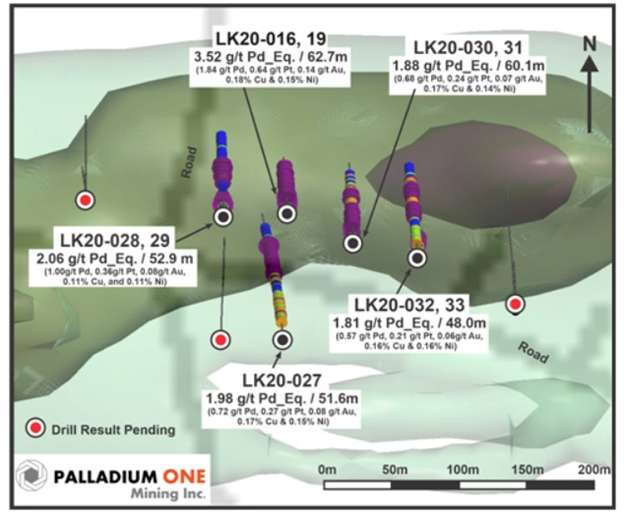

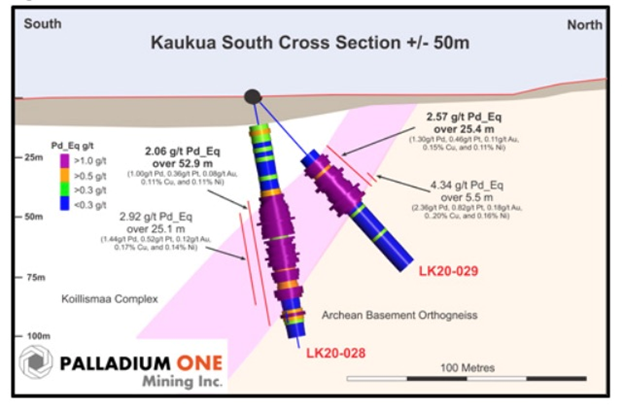

The current 17,500m diamond drill program also targets the Kaukua South Zone. It is designed to support a future inferred resource estimate at Kaukua South, which possesses a drill-defined, greater than 4 km mineralized strike length.

On Jan. 18 Palladium One released the results of initial in-fill drilling. The first seven holes show excellent grades and continuity of widths, with mineralization between 1.8 and 2.6 g/t Pd Eq, in sections between 25 and 60 meters wide.

“Initial Phase II infill drill results at Kaukua South demonstrate shallow disseminated sulfide mineralization the same as the Kaukua Deposit and support the belief that LK hosts a very large-scale mineralized system. With a greater than 4-kilometer, drilling proven, mineralized strike length at Kaukua South, plus up to an additional 2-kilometer strike length potential east of our existing Induced Polarization (IP) survey, we are on track to potentially define a multi-million ounce resource at Kaukua South. said Weyrauch

There is also the opportunity for expansion at mafic/ultramafic host rocks to the east of the Kaukua South IP survey grid. Plans are underway for a high-resolution drone magnetic and IP survey over this extended area.

Market Update

The company is exploring for palladium and nickel at an opportune time for both metals. In 2020 palladium gained 26%, bettering its sister PGE, platinum, which only saw an 11% increase. Palladium prices continue to trade much higher than gold, on Friday hitting $2,256.00 per ounce to gold’s $1,812.05, at time of writing.

According to Metals Focus, a UK-based consultancy, 2021 should see strong demand from the auto sector, particularly China, which together with tighter emissions legislation from the Biden administration, could push Pd prices back near record highs.

Higher EV sales are helping to boost the price of nickel, an essential component of an electric car battery. Adamas Intelligence, which tracks demand for EV batteries in over 90 countries, found that nickel used in newly sold electric vehicles was up 85% in November compared to the same month in 2019. The price of nickel has risen by over a third, from $6.00 a pound a year ago to its current $8.20/lb.

Conclusion

At Ahead of the Herd, we think that Palladium One’s LK PGE-Ni-Cu project is among the best palladium plays in the world, and that Tyko is one of the better early-stage nickel plays. Having reported on the company for over a year now, it is gratifying to see how far they’ve come.

Palladium One recently secured a $12.5 million cash injection from Sprott Capital Partners. The bought deal financing (upsized to $15M due to being over- subscribed) ensures a healthy treasury that PDM can draw from, as it continues to explore its projects in Canada and Finland. Once the ongoing financing is completed, we are eager to continue following the story and reporting on new developments at Palladium One, one of the premier palladium- and nickel-focused companies in the sector.

Palladium One

TSXV:PDM, OTC:NKORF, Frankfurt:7N11

Cdn$0.33, 2021.02.11

Shares Outstanding 179.3m

Market cap Cdn$59.5m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of PDM. PDM is a paid advertiser on Richards site Ahead of the Herd

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.