Cypress Development: a potential low-cost lithium producer in Nevada to look out for in 2022

2021.01.08

In 2022, renewable energy and electrification of the global transport system stand to keep its place as one of the biggest investment themes, as the global race towards net-zero emissions continues.

But for vehicle electrification to happen, the world would need more minerals to build car batteries, with one of the key ingredients being lithium. The white-colored metal is used as cathode material in almost every EV battery; a typical EV battery contains about 8 kg of lithium.

Benchmark Mineral Intelligence, a UK-based consultancy specializing in EV battery supply chains, forecasts that demand for lithium is set to triple by 2025, rising to 1 million tonnes and outpacing supply by 200,000 tonnes.

Another market analysis firm, CRU Group, estimates a lithium demand of about 450,000 tonnes in 2021, thus exceeding last year’s supply by around 10,000 tonnes.

A December 2020 Forbes article quotes investment bank UBS, stating that at today’s prices, lithium “might run out by 2025.” By then, UBS predicts, EVs will reach cost parity with gas-powered cars, meaning that more people will opt for electric cars once they become affordable.

For this reason, UBS projects that EVs will make up nearly half of all new car sales by 2030 (see below).

This prediction is also in line with US President Joe Biden’s executive order that half of all US new vehicle sales will need to be electric by 2030.

Studies point to EV sales reaching 55% of total vehicle sales as early as 2030. That represents 65 million units, and 3 million tonnes of lithium in just eight years, compared to the 400,000 tonnes annual mine production right now.

Even if you combine all existing operations with future projects, that’s only 1 million tonnes of future lithium supply, compared to the 3 million tonnes we would need by 2030.

With the climate goals set by the US and others around the globe, and major automakers scaling up production, a lot more lithium will be needed to satisfy the EV battery supply chain.

US Lithium

It’s no secret that the US wants to challenge China’s dominance in the global EV market.

Ironically, its EV battery market relies heavily on China, which processes the majority of the world’s lithium and makes nearly two-thirds of all lithium-ion batteries.

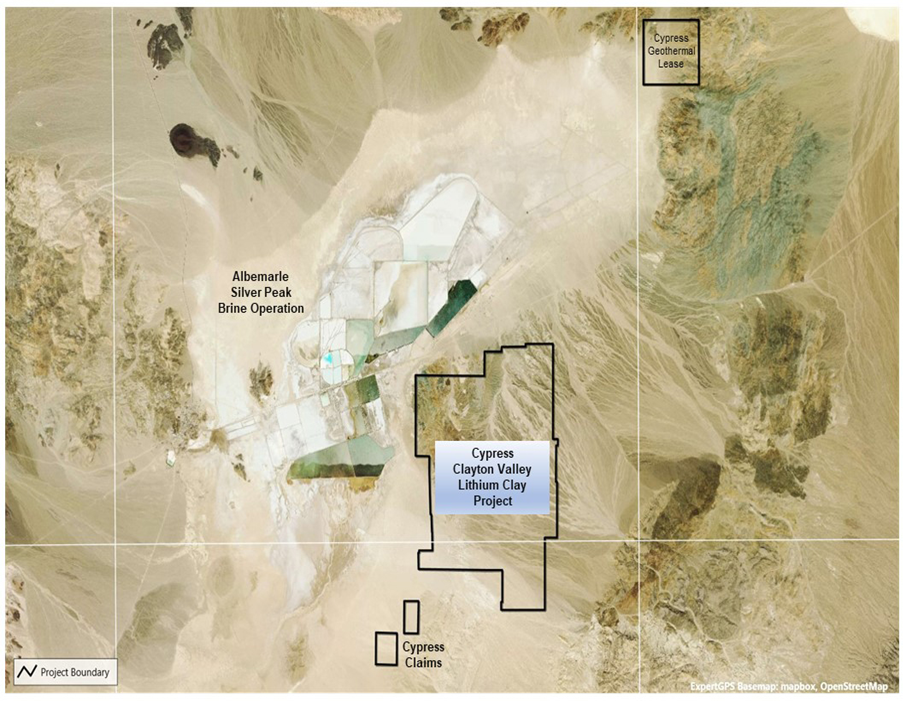

At the moment, the US has only one lithium mine, Albemarle’s Silver Peak, which extracts lithium from brine outside of Tonopah, Nevada, outputting merely 5,000 tonnes of lithium carbonate a year. That mine has been in continuous operation since 1966.

Another close to operation is the Thacker Pass lithium project in Humboldt County, held by Lithium Americas. Thacker Pass is considered the largest known lithium resource in the country, and the open-pit mine could produce as much as 60,000 tonnes of lithium carbonate annually.

This goes to show that the US, specifically Nevada, is capable of producing its own lithium, and with the right amount of investment, a burgeoning domestic “mine to battery to EV” supply chain could be created there.

Given Tesla’s $5 billion Gigafactory, the world’s biggest EV battery plant by volume, is also conveniently located in Nevada, with Elon Musk’s company even looking to mine lithium near its site, it feels almost inevitable that Nevada would someday become a hotbed for lithium miners.

Considered to be the top mining jurisdiction in the world, the state is mostly known for its gold and silver. However, its abundance of lithium resources – conveniently scattered around Tesla’s Gigafactory – has piqued industry interest in recent years.

Some even consider Nevada’s Clayton Valley, which is endowed with both lithium-rich brines and clays, to be the next hotspot for lithium mining after Chile’s Atacama Desert.

Cypress Development Corp.

One company that has a sizable lithium deposit in this prolific part of Nevada is Cypress Development Corp. (TSXV: CYP) (OTCQB: CYDVF) (Frankfurt: C1Z1), whose 100% owned Clayton Valley project covers 5,430 acres and is located immediately east of Albemarle’s Silver Peak mine.

The company sees itself profiting from a lithium market segment that is expected to see high demand and potential shortfalls in coming years, especially in North America as the production of battery cells and electric vehicles ramps up.

In the long run, Cypress is looking to replicate the success Albemarle had at Silver Peak with sustainable and economic production of lithium hydroxide, the preferred lithium product for EV batteries.

The company is currently working towards a feasibility study, and the permitting of a mine and metallurgical facility for its large lithium-bearing claystone deposit at Clayton Valley.

Project Background

Exploration and development by Cypress have led to the discovery of a world-class resource of lithium-bearing claystone adjacent to the brine field to the east and south of Angel Island, an outcrop of Paleozoic carbonates protruding up through the lakebed sediments.

The lithium mineralization occurs within montmorillonite clays throughout the sediments to a depth of at least 150 meters. Metallurgical testing indicates low-cost processing can be achieved by leaching with low acid consumption (126 kg/t) and high lithium recovery over 85% Li.

These high extractions prove the dominant lithium-bearing minerals present are not hectorite, a refractory clay mineral that requires roasting and/or high acid consumption to liberate the lithium.

Instead, lithium in the deposit is associated with illite and smectite clays, thus is amenable to leaching with dilute sulfuric acid leach followed by filtration, solution purification, concentration, and electrolysis to produce high-purity lithium.

Testwork by engineering consultancies NORAM and Continental Metallurgical Services (CMS) in 2020 was successful in yielding a purified concentrated lithium solution suitable for the production of high-purity lithium hydroxide (LiOH).

Another key feature of the Clayton Valley project is the large flat-lying nature of the lithium claystone deposit, which allows for mining with a low strip ratio (0.29:1) due to minimal overburden and no interbedded waste, and no drilling or blasting in excavation.

Clayton Valley PFS

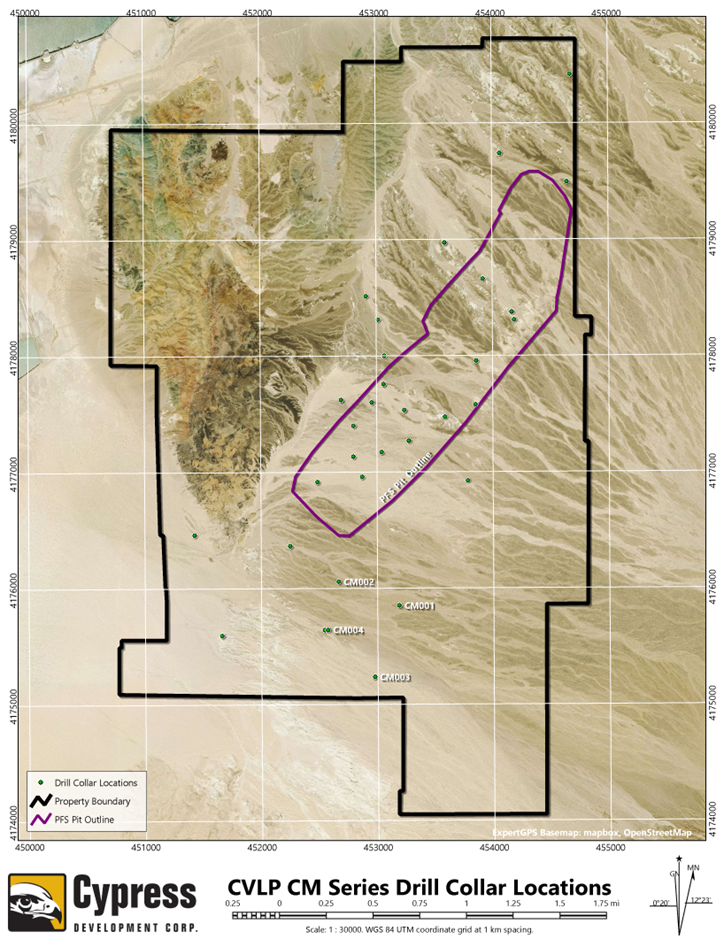

A positive Pre-Feasibility Study (PFS) was released in the summer of 2020 (later amended in March 2021), showing an average production rate of 15,000 tonnes per day for 27,400 tonnes of lithium carbonate equivalent (LCE) annually over a 40-year mine life.

The production figures are based on a probable mineral reserve of 213 million tonnes averaging 1,129 ppm Li (1.28 Mt LCE), using a cut-off grade of 900 ppm Li.

Reserves and production plan are derived from an indicated mineral resource of 1,304 million tonnes averaging 905 ppm Li (6.28 Mt LCE), using a cut-off grade of 400 ppm Li.

Capital cost for the project is estimated at $493 million, with pre-production and operating cost averaging $3,387 per tonne LCE.

At $9,500 per tonne LCE, the Clayton Valley project would have an after-tax net present value (NPV) of $1.03 billion at an 8% discount rate, with a 25.8% internal rate of return (IRR). The capex payback period is 4.4 years.

The PFS demonstrates that Cypress’ land position and resources provide the opportunity for a long-life project with low operating costs and the potential to be a significant source of lithium for the US electric vehicle market.

The numbers also stack up extremely well against any of the big lithium deposits in the world (see list for top 10).

The project’s large resource size allows the mineral resources/reserves for the PFS to be derived from only a portion of the property (the initial pit), showing a mine life of +40 years. All resources and reserves are pit-constrained by property and geologic boundaries.

2021 Recap

Pilot Plant Program

The PFS supported further work on the lithium deposit, including a pilot plant study to advance the project towards Feasibility Study (FS) and permitting.

Following this recommendation, Cypress commenced in March 2021 development of a lithium extraction pilot plant at a metallurgical facility south of Beatty, Nevada.

The facility, located approximately 160 km south of the project, is operated by del Sol Refining, a company permitted under state laws for chemicals use with permits in place with the US Environmental Protection Agency (EPA).

The purpose of the program is to ensure all the processes work together as a single unit, and to identify and resolve any scale-up or potential operational issues, in accordance with the recommendations outlined in the PFS.

The initial operation of the pilot plant will focus on chloride-based leaching to confirm the results of the company’s scoping study on lithium extraction.

The pilot plant is planned to operate at a rate of one tonne/day and will be designed for correct interaction and testing of the major components within the extraction process and assessment of the resulting lithium products.

According to Cypress, the program would provide essential data for a planned feasibility study and enable the company to produce marketing samples to support negotiations with potential offtake and strategic partners.

Assembly of the pilot plant in Amargosa Valley, Nevada, was completed in October. Shortly after, Cypress announced the start of testing of the lithium-bearing claystone, utilizing chloride-based leaching combined with the Chemionex—Lionex process for direct lithium extraction (DLE).

The first full test was completed with 72 hours of continuous operation, during which sampling was conducted at six-hour intervals. Analyses of solution samples at various points throughout the plant were conducted using the ICP unit on-site.

Leaching performed as expected, yielding solution grades of 350 to 700 ppm lithium. The Lionex DLE process also appears to be functioning well, yielding a return solution back to leach of less than 10 ppm lithium.

These preliminary results are encouraging, according to the company, with expected to better-than-expected values.

Cypress’ latest update shows the successful completion of a 7-day continuous run at the pilot plant, operating at its designed feed rate of one tonne per day of lithium claystone.

“From an operating perspective, we are very pleased with how the pilot plant has performed to date”, President and CEO Bill Willoughby stated in the Dec. 22 news release.

“Most plant components ran throughout the seven days with only minor operating issues, achieving expected targets in materials handling, reagents and water balance. Over 400 samples of leach solutions and solids were collected and shipped to ALS Global for analysis during the testing period. We look forward to seeing the analytical results and to resume testing in the new year.”

In addition, the lease agreement with del Sol Refining was extended through 2025, allowing Cypress the option to expand its use of the facility, including all of the 12,000 sqft processing building at the site.

“The amended lease gives us the time and room to expand beyond our requirements for our feasibility study. This is important given the likelihood we will want to continue testing,” Willoughby added.

Water Rights

Another key development in 2021 was the purchase of permits for water rights in Clayton Valley from Nevada Sunrise Gold Corp.

The permit is considered as an essential piece of Cypress’ strategy to develop its Clayton Valley lithium project, given that water is a vital resource to the project.

The permit allows for the appropriation of the public waters of the state of Nevada in the amount of 1,770 acre-feet of groundwater per year. This amount represents the largest single volume of permitted water available in the Clayton Valley, which is a fully appropriated hydrogeographic basin.

Mining Claims Purchase

Cypress also expanded its landholding in Nevada’s Clayton Valley last year with the acquisition of 24 unpatented mining claims that have exploration potential for lithium-bearing claystone and brine.

These claims, which total 480 contiguous acres, are proximal to the company’s Clayton Valley lithium project, bringing its land position to 6,558 acres in total.

The claims have no retained or underlying royalties.

Financings

Over the past year, Cypress has closed a total of C$17 million in financings to fund ongoing work on its Clayton Valley lithium project in Nevada.

On top of that, the company also received in December a total of C$6.9 Million from the exercise of warrants, adding to the C$19.8 million cash that it held as of September 30, 2021.

“These cash injections significantly increase the company’s reported cash position without any dilution to the current shareholding structure,” commented Willoughby.

With a strong treasury, Cypress is in an excellent position to execute upon its plans for the coming year, he added.

Conclusion

We believe the future of US lithium supply is neither South American lithium brines, nor spodumene deposits Down Under, but lithium hydroxide produced right in Nevada.

Ranked the #1 global mining jurisdiction according to the latest Fraser Institute Survey, the state hosts a plethora of claystone deposits that are proving to be extremely amenable to low-cost leaching processes.

If Cypress is able to prove, at its pilot plant, that it can make lithium hydroxide at a reasonable cost, and can scale it up, it will be a huge coup for the company. It would also shift the goalposts for the lithium industry at a time when global powers such as the United States are in dire need of finding a way to add significantly more supply for battery metals.

Cypress’ very successful year, in terms of news and goal completion, has been noticed by the market. CYP shares hit a 52-week high of $2.61 on Nov. 15. Though the stock has slipped back in recent weeks, we expect continued progress at the pilot plant and other milestone completions will return CYP to its previous heights.

Industry interest has been strong, as exemplified by last year’s upsized financing, and we fully expect to see a buyout before the end of 2022.

Cypress Development Corp.

TSXV:CYP, OTCQB:CYDVF, Frankfurt:C1Z1

Cdn$2.19, 2022.01.06

Shares Outstanding 126.0m

Market cap Cdn$275.8m

CYP website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Cypress Development Corp. (TSXV:CYP)

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.