Copper: the most important metal we’re running short of – Richard Mills

- Home

- Articles

- Markets Commodities

- Copper: the most important metal we’re running short of – Richard Mills

2022.10.27

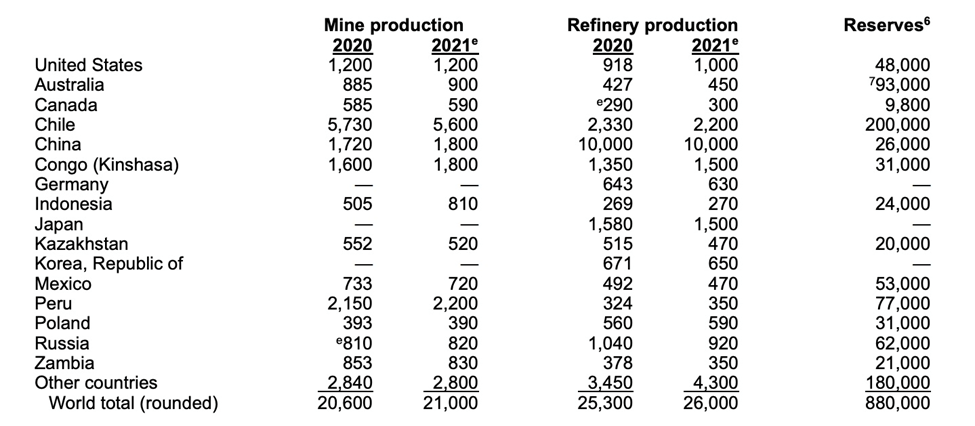

Copper is one of the most important metals with more than 20 million tonnes consumed each year across a variety of industries, including building construction (wiring & piping,) power generation/ transmission, and electronic product manufacturing.

In recent years, the global transition towards clean energy has stretched the need for the tawny-colored metal even further. More copper will be required to feed our renewable energy infrastructure, such as photovoltaic cells used for solar power, and wind turbines.

The metal is also a key component in transportation, and with increasing emphasis on electrification, demand is only going to increase.

A major rise in copper demand from new “blacktop” infrastructure (think roads, bridges, airports, etc.), combined with high demand for copper from large-scale efforts on behalf of governments to decarbonize and electrify, is not being met with an adequate supply of the industrial metal. Trillions worth of new projects are thus in danger of falling by the wayside unless much more copper is discovered — more than is currently possible, in my opinion.

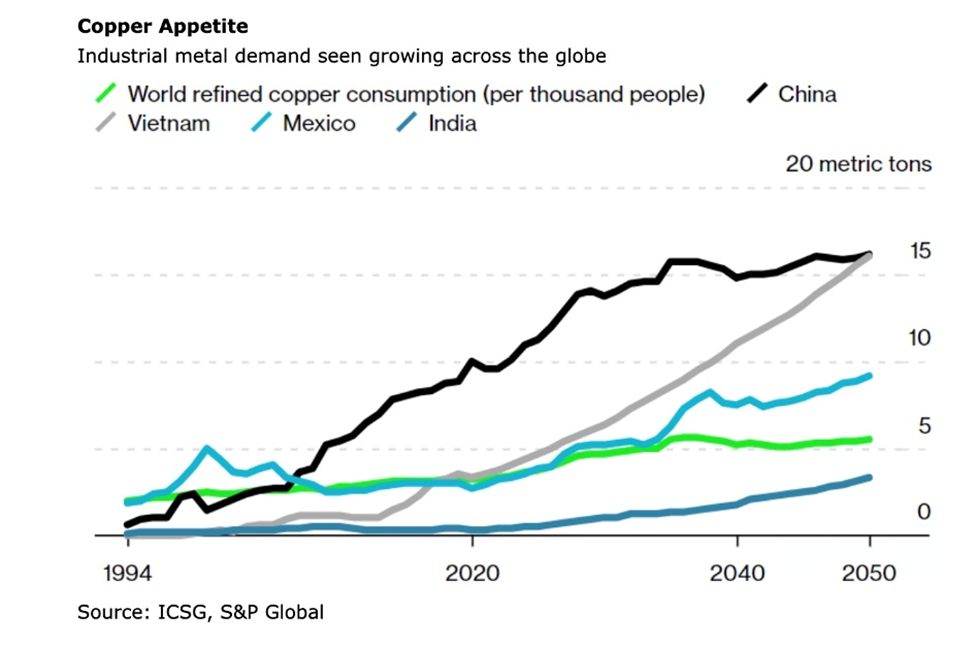

My position is supported by a recent report from S&P Global, which predicts the world’s appetite for copper will reach 53 million tonnes, on an annual basis, by mid-century. This is more than double current global mine production of 21Mt, according to the US Geological Survey.

How are we going to find the copper?

The green economy

According to S&P Global’s report, via Reuters, Efforts to reach carbon neutrality by 2050 are likely to remain out of reach as copper supply fails to match demand amid the growing use of solar panels, electric vehicles, and other renewable technologies.

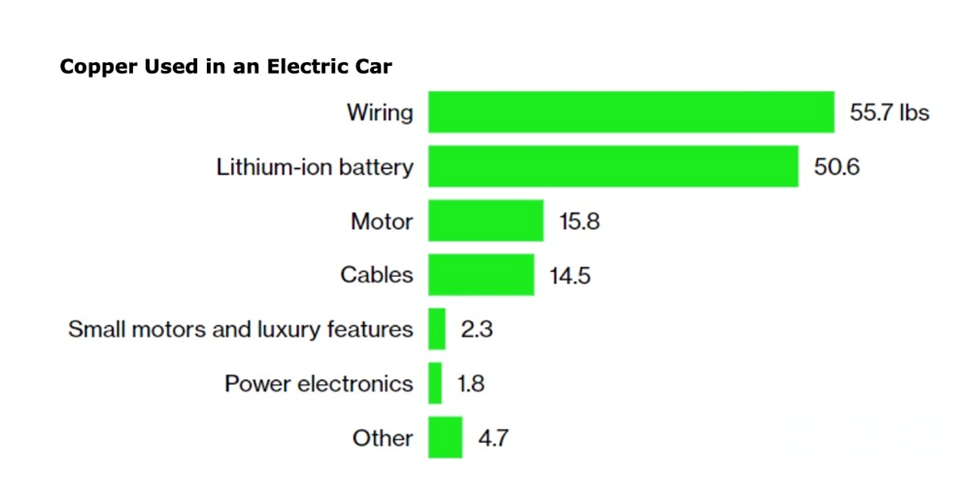

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. An average electric vehicle contains about 4X as much copper as regular vehicles.

Compared with traditional energy systems, renewables contain 12 times more copper. Wind farms use anywhere between 4 to 15 million pounds, while solar photovoltaic farms require 9,000 pounds per megawatt.

The big question is, will there be enough copper for future electrification needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses. The short answer is no, not without a massive acceleration of copper production worldwide.

According to a joint report from Ernst & Young (EY) and Eurelectric, Europe will have 130 million EVs by 2025. Each takes about 85 kg (187 pounds) of copper.

The report’s projections, cited by Bloomberg, show Europe’s EV fleet growing from its current <5 million to 65 million by 2030, then doubling over the following five years. This number of EVS will require 65 million chargers. Charging stations take 0.7 kg (for a 3.3 kW slow charger) or 8 kg (for a 200 kW fast charger), according to the Copper Alliance.

An EY leader notes it took 10 years to install 400,000 chargers, now we will need about 500,000 per year until 2030, and 1 million every year between 2030 and 2035.

We already know that we don’t have enough copper for more than a 30% market penetration by electric vehicles.

That would mean an extra million tonnes a year, over and above what we mine now, every year for the next 20 years! The world’s copper miners need to discover the equivalent of one Escondida, the largest copper mine on the planet, each and every year, while keeping current production at ~20Mt.

There is also no shift from fossil fuels to green energy without copper, which has no substitutes for its uses in EVs (electric motors and wiring, batteries, inverters, charging stations) wind and solar energy.

Copper, the most critical metal

Infrastructure push

Many countries need to reduce their so-called “infrastructure deficits”. Basic infrastructure such as roads, bridges, water & sewer systems, has been poorly maintained, and requires hefty investments, measured in trillions of dollars, to repair or replace.

China, the world’s biggest commodities consumer, has committed to spending at least US$2.3 trillion this year on major infrastructure projects. They are part of Beijing’s most recent Five-Year Plan that calls for developing “core technologies” including high-speed rail, power infrastructure and new energy. More money will be aside in years two to five.

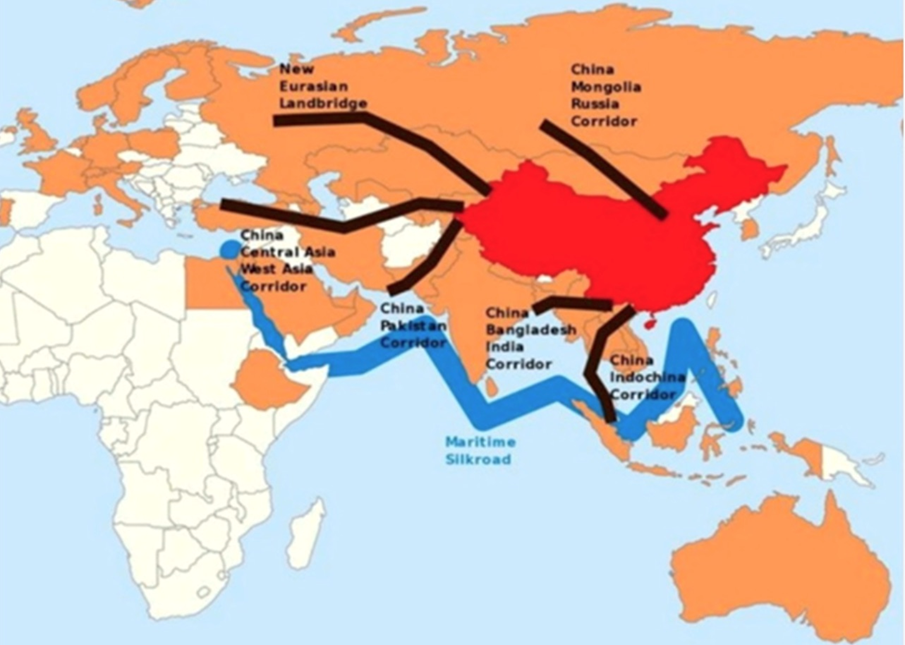

There is also the Made in China 2025 initiative, which seeks to end Chinese reliance on foreign technology by investing in a number of key sectors, including IT and robotics, and China’s $900 billion “Belt and Road Initiative”, designed to open channels between China and its neighbors, mostly through infrastructure investments. Dozens of countries have signed up to it, including Russia.

Research commissioned by the International Copper Association, quoted by Mining Technology, found that Belt and Road projects in over 60 Eurasian countries will push the demand for copper to 6.5 million tonnes by 2027.

That much copper equates to nearly a third of the 21Mt of copper produced in 2021 — new copper supply that would need to be either mined from existing operations or discovered.

The US is pursuing its own $1.2 trillion infrastructure package, to be spent on roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways, among many other items. According to S&P Global, Among the metals-intensive funding in the legislation is $110 billion for roads, bridges, and major projects, $66 billion for passenger and freight rail, $39 billion for public transit, and $7.5 billion for electric vehicles.

As infrastructure needs multiply, copper supply can’t keep up

Depletion

Some of the largest copper mines are seeing their reserves dwindle; they are having to slow production due to major capital-intensive projects to move operations from open pit to underground. Examples include the world’s two largest copper mines, Escondida in Chile and Grasberg in Indonesia, along with Chuquicamata, the biggest open-pit mine on Earth.

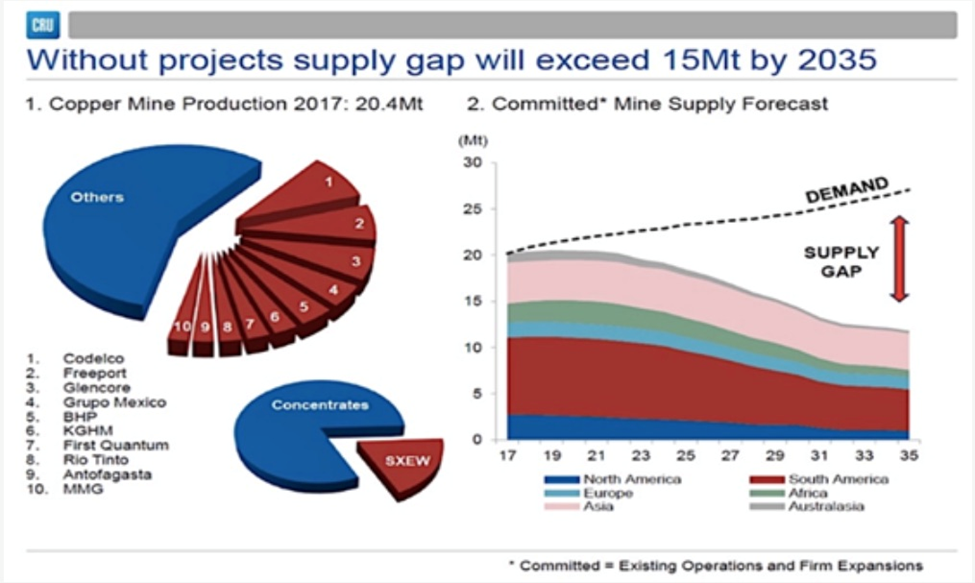

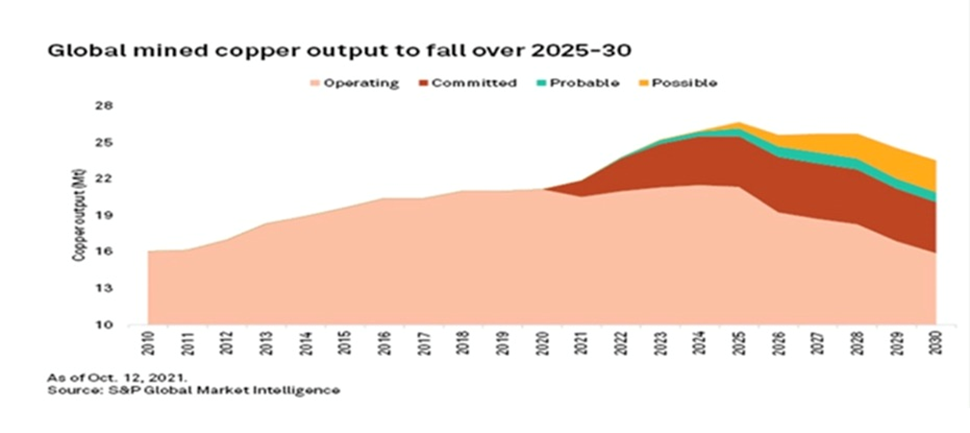

Without new capital investments, Commodities Research Unit (CRU) predicts global copper mined production will drop from the current 21Mt to below 12Mt, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Bank of America in a recent report predicts the copper market will flip into a deficit as early as 2025 following the completion of the current wave of project buildouts, the latest being Ivanhoe Mines’ massive Kamoa-Kakula project in the Democratic Republic of the Congo.

Five years later, analysts at Rystad Energy project that copper demand will outstrip supply by more than 6 million tonnes. That equates to nearly the entire annual production of Chile, the world’s top producer.

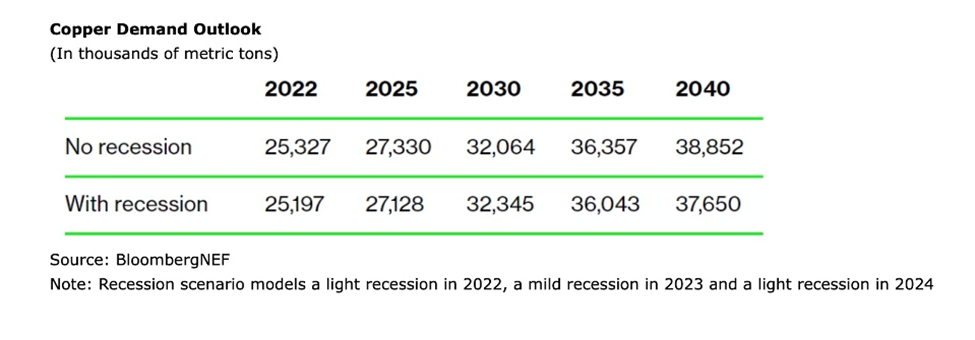

By 2040, the supply shortfall grows to 14Mt, according to a BloombergNEF August report, with a “best-case scenario” shortage of >5 million short tons possible by 2040.

Copper fundamentals strong despite price weakness

Production snafus

In fact we don’t have to wait, to see signs of an emerging copper crisis. Some of the world’s largest copper miners this year have proven unable to produce as much as they said they would. BHP, Rio Tinto, Anglo American, First Quantum Minerals and Glencore have all pared back production forecasts, blaming higher costs for their lower output figures. (see ‘Cost creep’ below)

Following a 14% drop in copper production in Q1, Glencore cut its 2022 guidance by 3% or 40,000 tonnes.

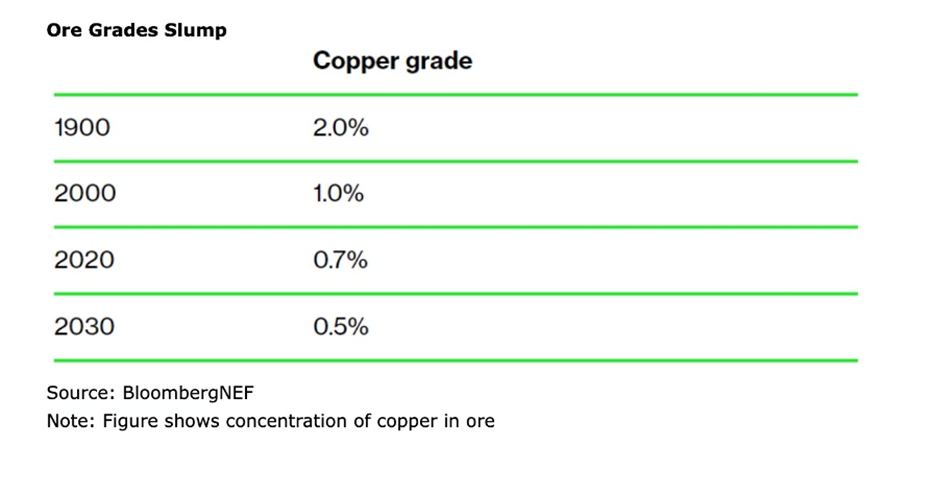

Some of this has to do with deposits getting mined out. As grades decline, higher amounts of ore need to be processed, to yield an equivalent amount of copper.

New deposits are getting trickier and pricier to find and develop. In Canada and the United States, there is a lot of anti-mining sentiment and politicians are beholden to these pressure groups. It can take up to 20 years to build a mine, after all the stakeholders have been consulted and the many permitting requirements have been satisfied. Overall it is getting harder, and taking longer, for new projects to be green-lit.

Lack of new mines

According to Goehring & Rozencwajg Associates, the number of new world-class copper discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

According to the Wall Street firm’s model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions are no longer a viable solution.

“If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all,” the report concluded.

It also shines a light on the importance of making new discoveries in establishing a sustainable copper supply chain.

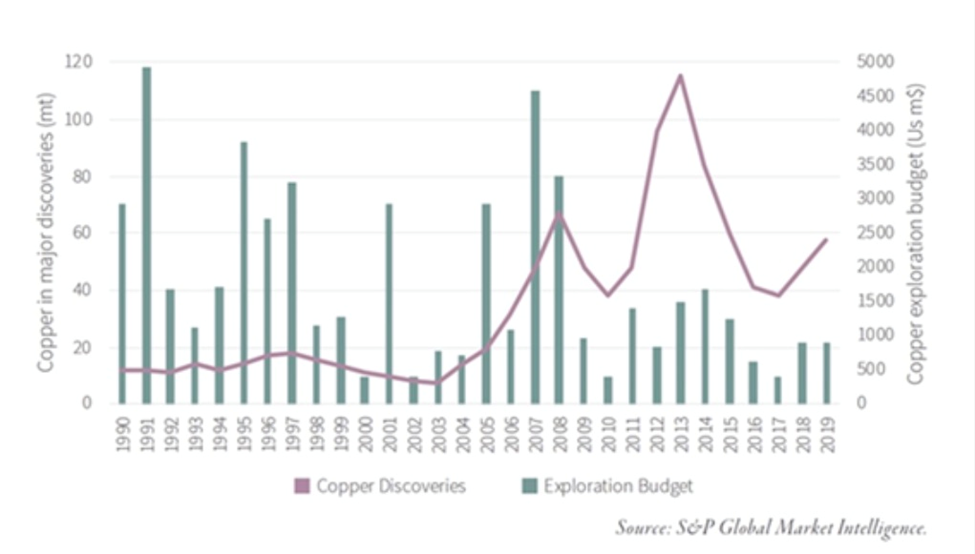

Over the past 10 years, greenfield additions to copper reserves have slowed dramatically. S&P Global estimates that new discoveries averaged nearly 50Mt annually between 1990 and 2010. Since then, new discoveries have fallen by 80% to only 8Mt per year.

In fact, new copper supply is concentrated in just five mines — Chile’s Escondida, Spence and Quebrada Blanca, Cobre Panama and the Kamoa-Kakula project in the DRC. Our analysis shows that in four of the five mines where new copper supply is concentrated, there are offtake agreements either in place or implied, with non-Western buyers.

In the case of Kamoa-Kaukula, 100% of initial production will be split between two Chinese companies, one of which owns 39.6% of the joint venture project. Nearly half of Cobre Panama’s annual production goes to a Korean smelter under a 2017 offtake agreement. Escondida and Quebrada Blanca are both partially owned by Japanese companies — one can make the assumption that a corresponding percentage of production will be going there.

Who owns the world’s future copper supply?

Gold miners want copper

One game plan for adding to supply, is for mining companies to diversify from gold, to copper and other so-called green-economy metals.

Diversification is the new mining buzzword

Companies that diversity into copper now, would be well-positioned to benefit from the coming copper shortfall, that should result in a much higher realized copper price. Barrick Gold and Agnico-Eagle are two recent examples. Agnico Eagle paid USD$580 million for a 50% share in Teck’s San Nicolas copper-zinc mine in Zacatecas, Mexico. About 20% of Barrick Gold’s production now comes from copper.

Cost creep

Copper mining has become an especially capital-intensive industry – the average capital intensity for a new copper mine in 2000 was US$4,000-5,000 to build the capacity to produce a tonne of copper; in 2012 capital intensity was $10,000/t, on average, for new projects. Today, building a new copper mine can cost up to $44,000 per tonne of production, an AOTH analysis has found.

Capex costs are escalating because:

- Declining copper ore grades means a much larger relative scale of required mining and milling operations.

- A growing proportion of mining projects are in remote areas of developing economies where there’s little to no existing infrastructure.

- Many inputs necessary for mine-building are getting more expensive, as cross-the-board inflation, the highest in 40 years, infiltrates the industry. This includes two of the largest costs, wages and diesel fuel, used to run mining equipment.

The bottom line? It is becoming increasingly costly to bring new copper mines online and run them. According to Goldman Sachs, the incentive price to make mining attractive is now 30% higher than 2018, at roughly $9,000 a ton (as I write this copper is US$7060.00t).

Copper mines becoming more capital-intensive and costly to run

Resource nationalism

Along with technical issues such as falling grades/ deteriorating ore quality, there is also supply pressure from growing resource nationalism.

There is a need to go further afield and dig deeper to find copper at the grades needed to economically produce copper products. This usually means riskier jurisdictions that are often ruled by shaky governments.

Peru and Chile, which together account for more than a third of global copper output, are both seeing a wave of resource nationalism, where governments try to exact a greater share of resource revenues through various means, such as higher royalties and export bans of raw ores.

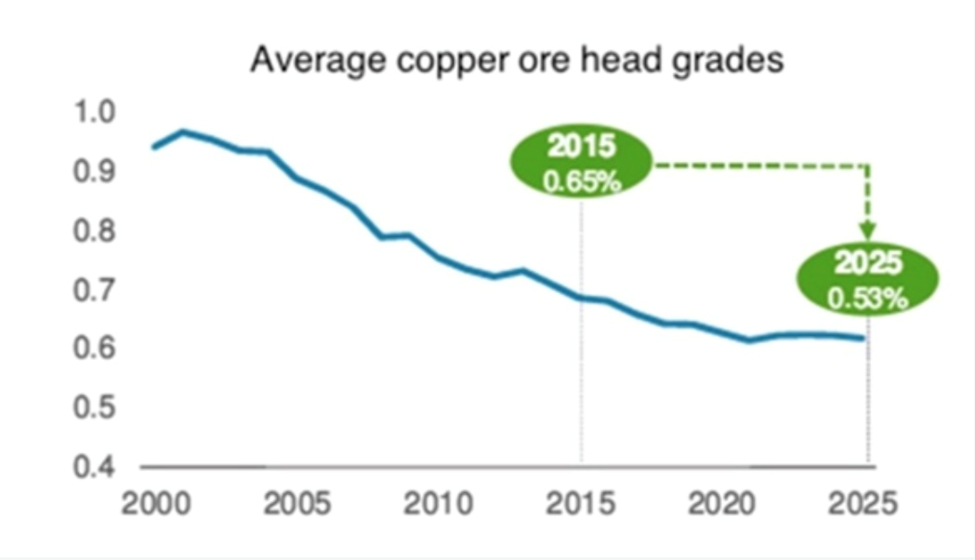

Chile has attracted substantial mining investment in recent years, including from leading copper producers like BHP and Teck. But long-term, Chile’s declining ore grades present a key downside risk to production forecasts.

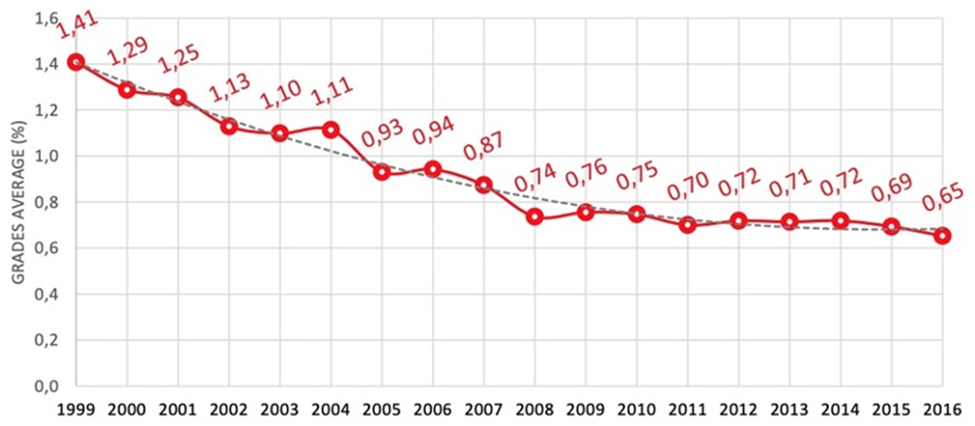

The chart below shows Chile’s average copper grades more than cut in half between 1999 and 2016.

Chile is also producing less copper. According to Cochilco, the country’s state copper commission, in 2000 Chile produced 34.7% of the world’s copper; by 2017, the percentage had fallen to 26.7% (the USGS’s latest figures show Chilean mine production at 26% of the global total).

State-owned copper miner Codelco, which is the largest copper company in the world, is facing challenges linked to the redevelopment of its copper mines, meaning it will produce 1.5 million tonnes of copper this year and next, compared with 1.7 million tonnes in 2021, Reuters said this week.

Making matters worse, after more than a decade of drought, freshwater supplies are becoming a big problem in Chile. Copper mines there require lots of water to process sulfide ores, and the lower the grade, the more water must be used.

The country’s left-ward shift is another mark against the top copper producer as far as attracting mining investment. Although Chile’s constitutional assembly has rejected plans to nationalize parts of the mining sector, the government is now weighing how much to increase royalties; a decision is expected soon.

Like Chile, the world’s second largest copper miner has underperformed. Copper production in July totaled 195,234 tonnes, following a respective 9.1% and 14.5% drop in output at the Antamina and Southern Copper mines. The result was a 6.6% year-on-year loss.

While copper production at China-owned Las Bambas recovered in June, following a truce with indigenous communities who oppose the mine, the agreement ended in July and renewed protests could risk copper supplies, Reuters said.

Peru’s President Pedro Castillo has proposed to raise taxes on the mining sector by at least 3%, which the country’s mining chamber says could cost USD$50 billion in future investments.

In the Democratic Republic of Congo (DRC), weak infrastructure, including a lack of power, is limiting growth potential for major copper deposits. This past summer, the Congolese government suspended metal exports from Tenke Fungurume, a large copper-cobalt mine owned by China’s CMOC.

The DRC is the world’s top producer of cobalt and Africa’s leading copper-mining country. Tenke Fugurume accounted for more than 10% of global cobalt output in 2021.

Dwindling inventories

In February, Goldman Sachs predicted a “scarcity episode” by the end of 2022, as global stocks of copper fell to dangerously low levels. That never happened due to the abrupt fall in the copper price, owing to the Federal Reserve’s interest rate increases, the high US dollar, a slowdown in China, and talk of a global recession. Still, Goldman’s warning about of a “stock-out” remains well supported.

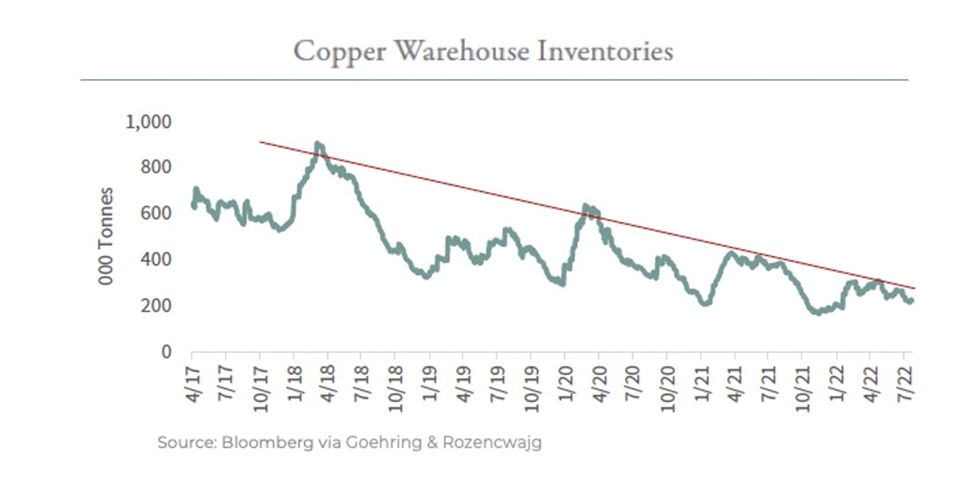

Goehring & Rozencwajg, the Wall Street firm, published a chart of copper warehouse inventories showing a four-year down-trend from around April, 2018 to present.

These days, there is a puzzling disconnect between the copper price, which has dropped to a five-week low, of $3.54 a pound (@ time of writing), and market tightness.

The latter is aptly demonstrated by what is happening in Shanghai, China, where for the past 15 years, a huge copper stockpile, larger even than the London Metal Exchange, has been used by Chinese companies as collateral for cheap financing.

Now, according to Bloomberg, China’s bonded warehouses are all but empty. The once-frenetic flow of metal into the stockpile has come to a juddering halt as two dominant financiers of Chinese metals, JPMorgan Chase & Co. and ICBC Standard Bank Plc, have halted new business there. Numerous traders and bankers interviewed by Bloomberg said they believe the trade is dead for now, and some predicted the bonded stocks could drop to zero, or close to it.

The implications are being felt across the market, as the world’s largest copper consumer becomes more reliant on imports to meet its near-term needs at a time when global stocks are already at historically low levels. The Chinese copper market is at its tightest in more than a decade as traders pay massive premiums for immediate supplies.

At their peak in 2011-12, China’s bonded stocks held about a million tons of copper. This month they totaled just 30,000 tons — down nearly 300,000t from earlier this year, the lowest level in decades.

Bloomberg explains that the decline began several years ago, with a massive warehousing fraud in 2014 that soured many banks and traders on the Chinese metals industry. This year, the country’s economic slump, rising interest rates and several high-profile losses caused more participants to stay away.

The key point is, without the Shanghai buffer of bonded stocks, any pickup in Chinese demand could send copper prices soaring.

It’s not only in China that copper stockpiles are getting depleted. As of this week, CRU Group estimates global stocks are down to just 1.6 weeks of consumption. That’s the lowest ever in the copper consultancy’s data going back to 2001, Bloomberg said.

On Oct. 19, Reuters reported the available copper in London Metal Exchange warehouses halved within eight days.

A squeeze on the Shanghai Futures Exchange (ShFE) has generated a scramble for metal, metals columnist Andy Home explained, adding that, As bonded stocks rapidly deplete to fill on-shore ShFE warehouses, physical premiums are in turn rising to attract more metal from the international market.

The Yangshan copper premium , a useful proxy for China’s spot import demand, has soared to $147.50 per tonne over LME cash, its highest trading level since 2013.

Western sanctions on Russian companies due to the war in Ukraine are also factoring into low copper inventories. The LME is reportedly talking about suspending deliveries of Russian metal (aluminum, copper and nickel), which at the end of September comprised over 60% of the exchange’s copper stocks.

Locking in

Some copper buyers are so worried about future availability of metal, they are looking to secure longer-term deals than normal. For example, Codelco recently signed contracts with customers in Europe for three to five years, versus the traditional annual deals, Bloomberg said.

“We are prepared to continue to strengthen our long-term relations with customers, because we can understand that in their risk matrix, their concern about copper supply is one of their priorities,” Codelco’s Chairman Maximo Pacheco said in an interview. Pointing to forecasts for strong copper demand growth, he said: “Obviously they have a question: ‘Where are we going to get this copper from?’”

Supply-demand gap

It’s a good question, we find ourselves asking it repeatedly.

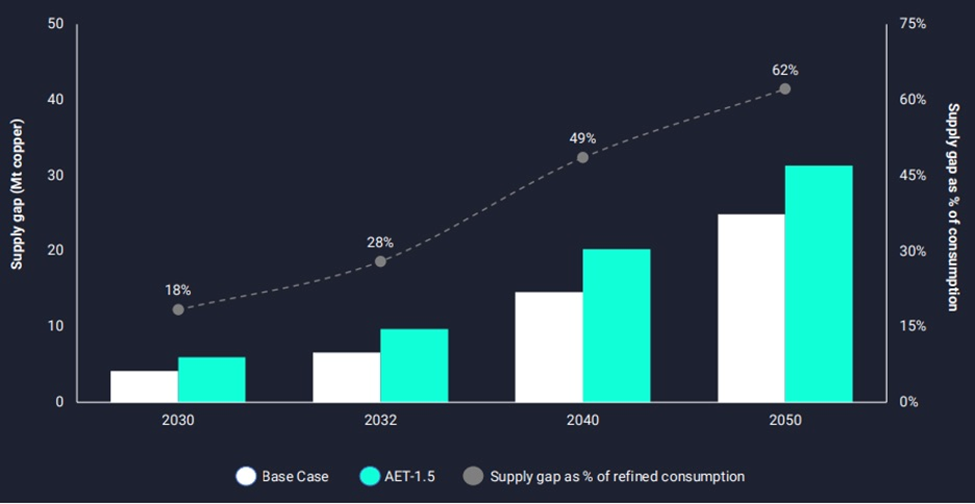

A new report from Wood Mackenzie estimates that 9.7 million tonnes of new copper supply is needed over 10 years, to meet the targets set out in the Paris Climate Agreement. As stated earlier, this is the equivalent of putting a new Escondida Mine into production every year.

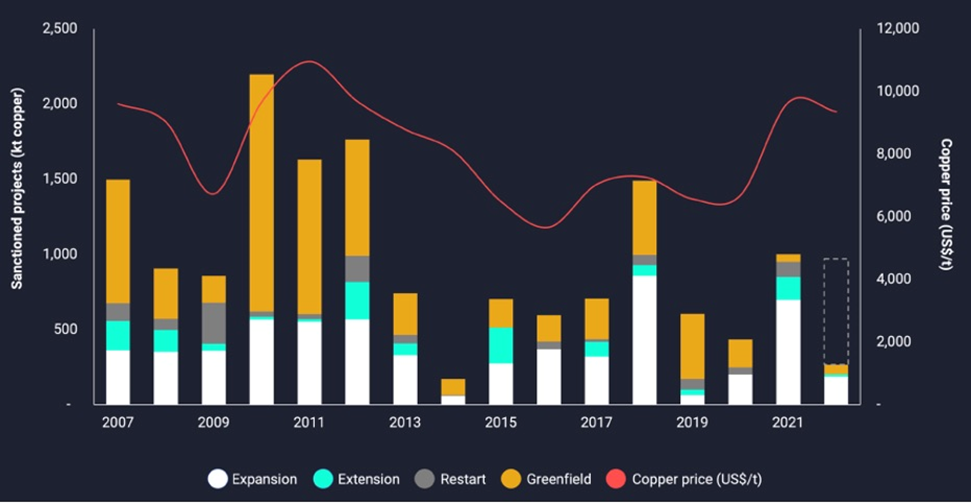

Figures from the commodities consultancy show that despite historically high copper prices (in Q1), mining project approval rates have stalled. During the first half of 2022, the volume of committed projects totaled just 260,000 tonnes of production per year (against total annual mine production of around 21 million tonnes).

“To successfully meet zero-carbon targets, the mining industry needs to deliver new projects at a frequency and consistent level of financing never previously accomplished,” said Nick Pickens, research director of copper markets at Wood Mackenzie.

In short, says Woodmac, “the global energy transition presents an almost unattainable mine supply challenge, with significant investment and price incentives required.”

The firm estimates over $23 billion a year will be needed over 30 years to deliver new projects under the 1.5 degrees Celsius Paris scenario — a level of investment previously seen only for a limited period from 2012 to 2016, following the China-induced commodity super-cycle.

The copper price needed to meet demand under this scenario is $4.25 a pound, about 25% higher than currently.

In an article titled ‘A Great Copper Squeeze Is Coming for the Global Economy’, Bloomberg reported in September that the recent downturn in copper prices stands to worsen the coming deficit, because the slump discourages new copper investments. As an example, Newmont just shelved plans for its $2 billion gold-copper project in Peru.

A massive copper shortfall that could be visited upon the industry in as short as two years’ time, could, says Bloomberg, hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course…

And the latest market downturn stands to exacerbate future supply problems — by offering a false sense of security, choking off cash flow and chilling investments. It takes at least 10 years to develop a new mine and get it running, which means that the decisions producers are making today will help determine supplies for at least a decade. [in North America the time frame is more like 20 years — Rick]

The coming supply squeeze will be truly breathtaking and deserves more of a numerical explanation.

According to a study from S&P Global, emissions goals commensurate with decarbonization & electrification, will double copper demand to 50 million tonnes by 2035. Bloomberg New Energy Finance estimates demand will increase by over 50% from 2022 to 2040.

Supply growth is expected to peak around 2024, the result of very few new projects in the works, and as existing mines are depleted. According to S&P’s research, this is setting up a supply deficit of 10 million tons in 2035 — the equivalent of 10 Escondidas.

Goldman Sachs thinks mining companies need to spend about $150 billion over the next decade to solve an 8Mt deficit. BloombergNEF predicts that by 2040 the mined output gap could reach 14Mt.

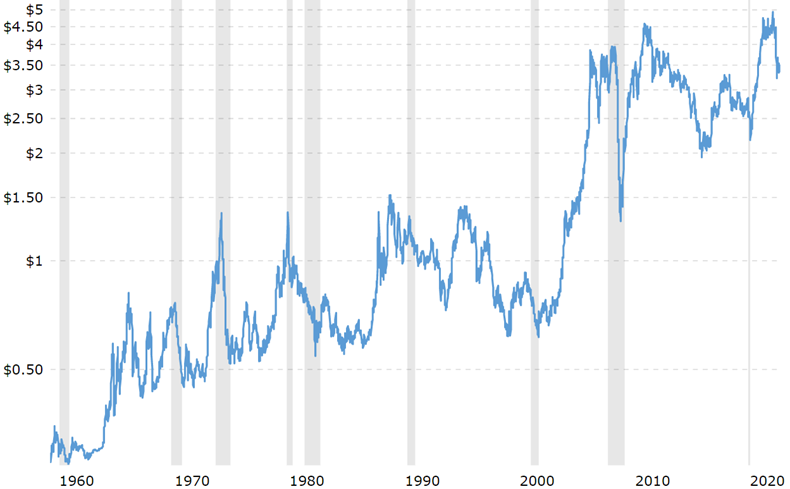

Copper prices

The next question is what this means for copper prices going forward. In 2021, when the copper deficit was 441,000 tons, copper prices jumped about 25%. 441,000t is less than 2% of demand but in S&P Global’s worst-case scenario, 2035’s shortfall will be the equivalent of about 20% of consumption.

Goldman Sachs is forecasting the LME copper price to more than double from its current level, to $15,000 a ton in 2025. Let’s step back here and remember the incentive price to make mining copper attractive is US$9,000.00 a ton – copper is trading currently at US$7,000.00t.

Copper will have to rise from its current price of US$3.54 to a minimum US$4.50lb to incentivize miners to build mines.

Of course one of the biggest wildcards in all of this is China, the world’s largest metals consumer accounting for about half of global copper demand. If the country’s property sector contracts significantly, it would obviously mean less copper demanded for construction.

Another unknown is the potential for a global recession. Citigroup, via CNBC, sees copper prices in the short-term falling due to an economic slowdown driven by Europe. The bank forecast copper at $6,600 a ton in the first quarter of 2023.

Other forecasters, and that includes us at AOTH, believe a recession will only delay demand, which is inevitable due to the trillions of dollars being planned for electrification and infrastructure investments. An Aug. 31 presentation from BloombergNEF states that a recession will not “significantly dent” consumption projections going into 2040.

Bloomberg points out there is already very little wiggle room on the supply side: The physical copper market is already so tight that despite the slump in futures prices, the premiums paid for immediate delivery of the metal have been moving higher.

Richard Adkerson, the CEO of Freeport McMoRan, recently weighed in on the disconnect between supply tightness and the lower copper price, saying during a conference call with analysts, “It’s striking how negative financial markets feel about this market and yet the physical market is so tight.”

“We’re not seeing customers scaling back orders. Customers are really fighting to get products,” Adkerson said. He added that such a pricing environment will defer new copper projects and mine expansions just when the world’s epic shift to electrification requires a massive amount of the metal.

The copper price rose on Wednesday, Oct. 26 to $3.54 a pound, the highest since Sept. 16, buoyed by a weaker US dollar. Hope for a rebound has also been strengthened due to recent news out of China.

The country is considering lessening its quarantine period for inbound visitors from 10 to seven days, an indication it is winning its war against the coronavirus pandemic that has resulted in nation-wide lockdowns.

Conclusion

The demand pressure about to be exerted on copper producers in the coming years all but guarantees a market imbalance, resulting in copper becoming scarcer, and dearer, with each infrastructure initiative and with each ambitious green initiative rolled out by governments.

The problem is existing copper mines are running out of ore, and the capital being invested in new mines is far below the level needed.

According to research by S&P Global Market Intelligence, of 224 sizable copper deposits discovered in the past 30 years, only 16 have been found in the last decade.

It takes seven to 10 years, at minimum, to move a copper mine from discovery to production. In regulation-happy jurisdictions like Canada and the US, the time frame is more like 20 years.

The pipeline of copper development projects is the lowest it’s been in decades.

Why can’t we just mine more copper? Over the past two decades, the big mining companies have approached the problem of dwindling reserves by doing exactly that.

Between 2001 and 2014, 80% of new reserves came from re-classifying what was once waste rock into mineable ore, i.e., lowering the cut-off grade.

The problem is that between lowering their cut-off grades and high-grading (removing all the best ore and leaving the rest) the grade of new reserves each year has steadily declined.

In 2001, the new reserves grade was 0.80% copper but by 2012, it had fallen to 0.26%. The copper industry was still able to replace all the ore used in production with new reserves, but the quality of those reserves, ie., the grade, had dropped by nearly two-thirds.

The authors of a recent report contend that even with prices above $10,000 per tonne, reserves cannot keep growing, specifically at porphyry deposits, where most copper is mined.

Their analysis also suggests that we are quickly approaching the lower limits of cut-off grades, concluding that we are rapidly approaching the point where reserves cannot be grown at all. In other words, peak copper.

The industry can no longer re-classify itself out of its problem. Billions and billions of dollars need to be invested in the exploration for, and development of new copper mines.

In sum, the copper industry is in the grips of a structural supply deficit that, combined with inflationary cost pressures and a creeping resource nationalism in some of the world’s largest copper producers, is only expected to get worse.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.