Copper Road intersects broad zones of visible copper mineralization at its namesake project in Ontario – Richard Mills

2023.09.23

Copper Road Resources Inc. (TSXV: CRD) is encountering promising geology at its Copper Road project in Batchewana Bay, Ontario.

The recently completed drill campaign, which totaled 1,224 meters in seven holes, was designed to demonstrate that the JR Zone hosts a shallow mineralized porphyry and high-grade breccia in the center of a district-scale land package that hosts two past-producing copper mines.

The drilling, according to Copper Road, is the first step in proving the JR Zone as a large-scale zone of economic copper mineralization at shallow depths.

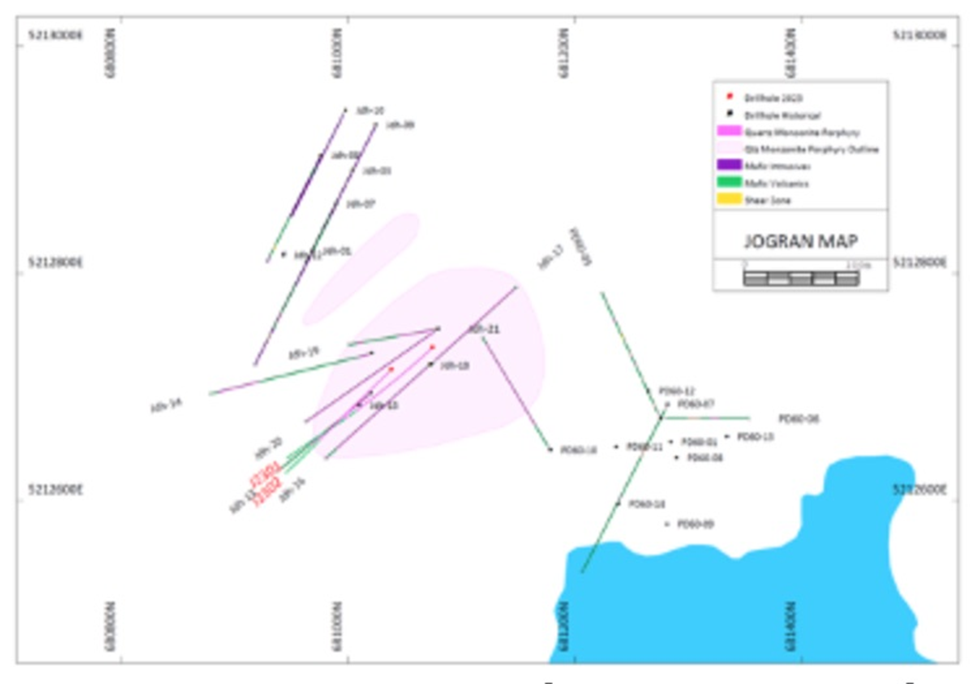

Jogran porphyry

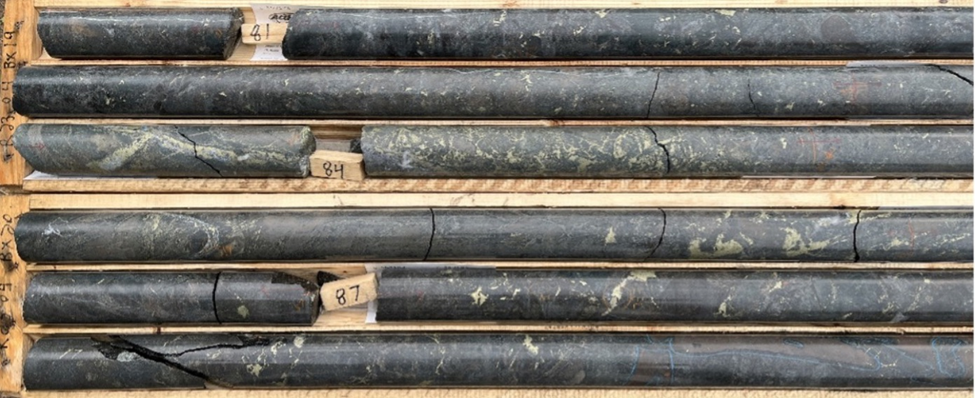

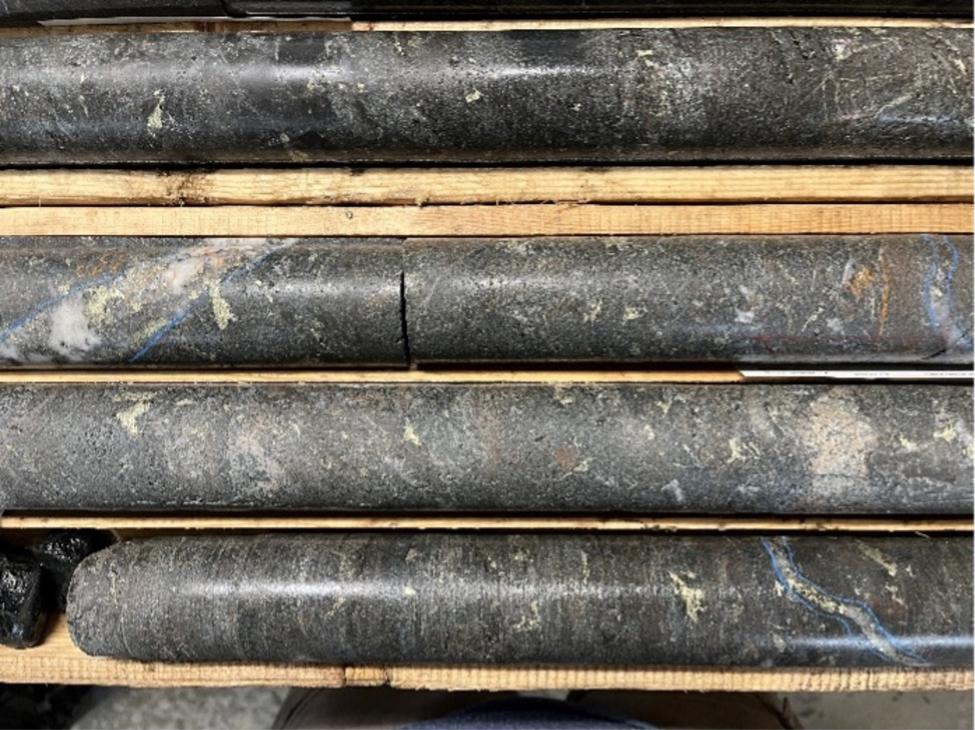

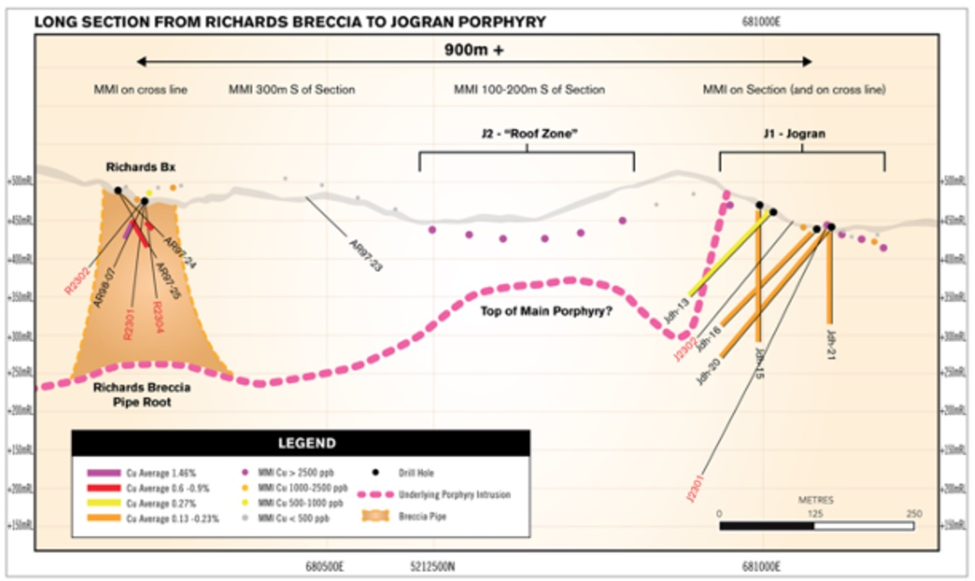

At the Jogran porphyry target, two holes intersected broad zones of copper mineralization — 194 meters and 137 meters, respectively. Mineralization is seen as chalcopyrite + molybdenite ± bornite + pyrite + pyrrhotite disseminations, and in quartz veinlets hosted in a quartz-sericite-pyrite (phyllic) altered quartz monzonite porphyry.

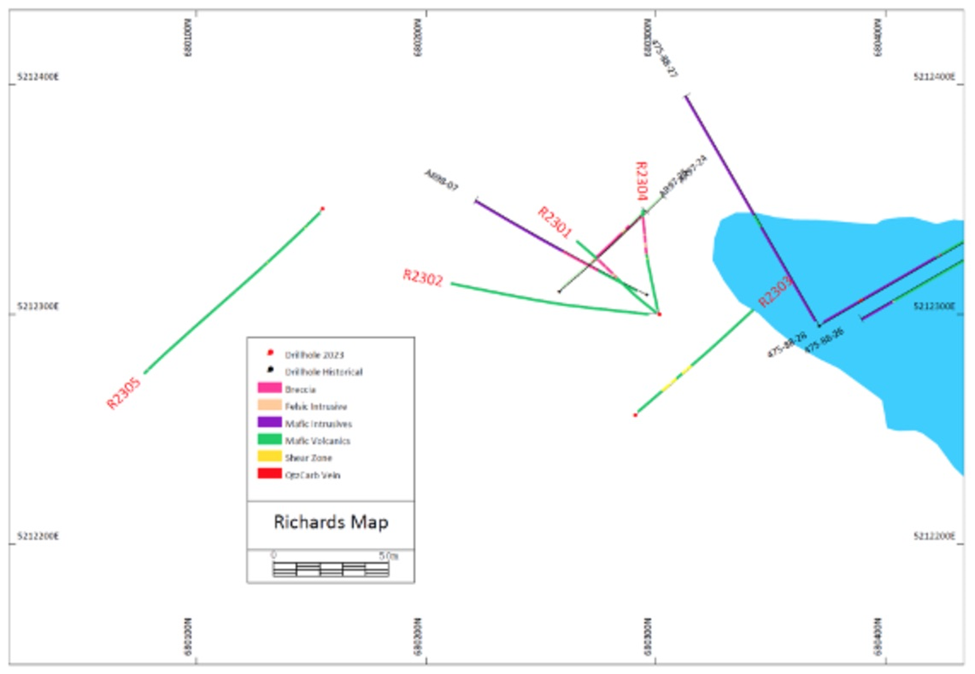

Richards breccia

At the Richards breccia target, two of four holes encountered wide intersections of copper mineralization of 37 meters and 49 meters, respectively. The mineralization at Richards consists of chalcopyrite + pyrite ± pyrrhotite ± chalcocite aggregates disseminations, and veinlets hosted in a chlorite-sericite-carbonate-pyrite altered breccia. The drilling successfully extended the breccia 50-60m vertically below known mineralization.

Assays from both targets are pending.

“We are eager to see the assays from the JR Zone, over the past year we completed 4,200 metres of diamond drilling and have established both the Tribag and JR Zones as large-scale, at-surface Cu-Mo-Au-Ag targets,” John Timmons, president & CEO of Copper Road, said in the Sept. 19 news release.

“The JR Zone is in the centre of 30 kilometres of mineralization with two past-producing high-grade copper mines, the Coppercorp to the southwest and the Tribag to the northeast,” he added.

“The Company believes this region has the potential to deliver several much larger copper-dominant polymetallic deposits based on the extensive Cu-Mo-Au-Ag mineralization throughout this contiguous 24,000-hectare project.”

Copper Road maintains that the JR Zone has a current copper mineralization footprint 1.5 kilometers long by 550m wide, based on reconnaissance soil surveys and historical data.

The zone is just one of several alkalic porphyry targets across the property, which also includes the former Tribag mine, Con-Negus and Gimlet Lake (see map below). The company compares these targets to well-known alkalic porphyry deposits and clusters in British Columbia, such as Galore Creek, Mt. Milligan, Mt. Polley, Afton-Ajax (Iron Mask) and Copper Mountain.

The JR Zone consists of the Jogran surface porphyry, which has been drilled to a depth of 200 meters, and the Richards breccia, a near-surface copper target. The two targets are located 900 meters apart.

The entire zone is located about 12 km from the former Tribag mine, which the company drilled in 2022 and returned significant intervals of near-surface mineralization (9 meters at 1.47% copper equivalent).

After it receives assays, Copper Road says it plans to develop more drill targets in the JR Zone, and to advance the JR and Tribag zones with geophysical and geochemical surveys.

Copper market

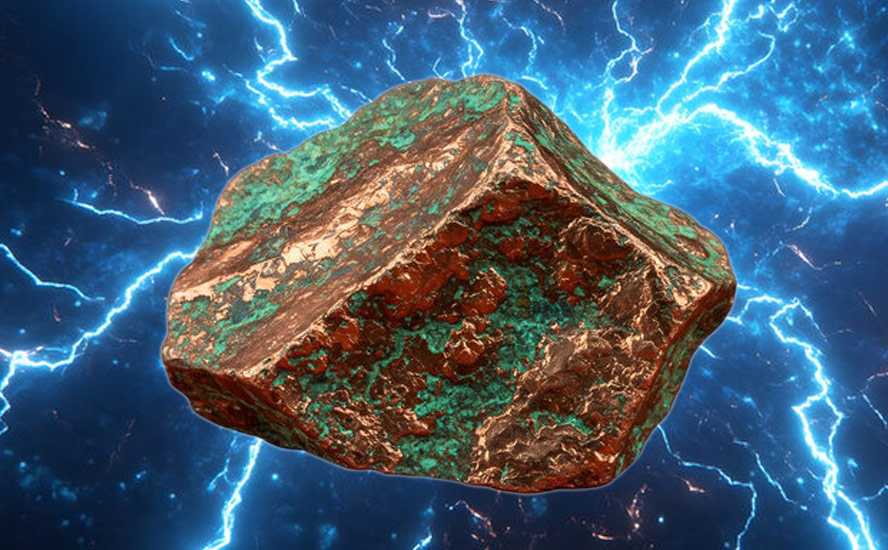

The importance of copper exploration projects cannot be understated. In an era dictated by continued global warming, the world requires more infrastructure to support electric vehicles and renewable energy applications, which use large amounts of the metal.

The bright forecasts for Chinese growth, despite current economic malaise, bode well for the copper market. Research by the International Copper Association found that Belt and Road projects in over 60 Eurasian countries will push the demand for copper to 6.5 million tonnes by 2027. And this was before Beijing’s most recent Five-Year Plan, that calls for developing high-speed rail, power infrastructure and new energy.

As infrastructure needs multiply, copper supply can’t keep up.

The European Union’s “Green Deal” aims to make the continent climate neutral by 2050, with funding mechanisms totaling over €1 trillion.

President Joe Biden is spending $2 trillion on remaking the American economy, hoping to “build it back better”.

According to S&P Global, Among the metals-intensive funding in the [Infrastructure Investment and Jobs Act] is $110 billion for roads, bridges, and major projects, $66 billion for passenger and freight rail, $39 billion for public transit, and $7.5 billion for electric vehicles.

I have to ask, where are we going to find the copper? Without a serious push to develop new mines, the supply deficit predicted by 2025 is going to arrive even sooner.

Canada’s Teck Resources is spinning off its steelmaking coal business to focus on base metals, particularly copper and zinc.

Experts correctly predicted that the split would make Teck, which owns four copper mines in South America and Canada, a takeover target.

A few weeks after the spin-off was announced, Switzerland’s Glencore, currently the world’s largest mining company, launched a $23.1 billion hostile takeover bid. The deal would have created two new companies combining their respective metals and coal businesses.

However, it was rejected by the Teck board and its controlling shareholder, Norman Keevil, despite Glencore sweetening its initial bid with an $8.2 billion cash component.

Even though the takeover bid failed, there are other suitors waiting in the wings. Such is the interest in companies with significant copper assets right now.

Mining.com reported that Teck has been approached by Vale, Anglo American and Freeport-McMoRan, on potential deals for its base metals business. In fact the trio are among six companies that have expressed interest in the Canadian miner, post-split, states Toronto-based newspaper The Globe and Mail.

With all that is going on with copper — record-low LME inventories, a flurry of M&A, low ore grades, more complicated metallurgy, mine depletion, a lack of new discoveries, resource nationalism, and of course, demand for the metal steadily increasing as electrification and decarbonization ramps up, it’s curious why the copper price is now under $4 a pound, after reaching its best-ever $5.02/lb in May, 2022.

Where are the world’s future copper mines?

All of the recent deal-making in the copper space has got me thinking, “Who’s next”? The majors are buzzing around Teck like bees on flowers and Vale is even looking to develop exploration-stage properties in Peru — activities typically done by juniors. It just shows that they are starting to work their way down the food chain.

I predict juniors will become targets right across the geographical and mine development spectrum, because they own the world’s next copper mines. Anybody with a copper deposit that has the grades and the scalability to interest a major will become the belle of the ball.

Gold miners are also looking at copper, reflecting the rising profile of the red metal. Indeed people ignore copper at their peril, because as I’ve said many times before, nothing happens without it. No electric vehicles, no charging stations, no renewable power, smart power grids, transmission lines, 5G, etc.

Problem is, the massive and increasing demand for copper is like a hammer blow to dwindling supplies. The mining industry simply must find more of it, to avoid this fatal flaw in the electrification and decarbonization thesis.

New supply is coming online, but little of it is coming to the West. The handful of new copper mines already have offtake agreements that guarantee a pre-determined amount of production is shipped to Asia.

We can hardly call this situation Western security of supply, when most of the raw copper material (cathodes or concentrate) is going to China, South Korea and Japan, who then turn around and sell more expensive copper end products to North America and Europe.

Three of the biggest copper producers — Chile, Peru and the DRC — are becoming less reliable due to resource nationalism. These countries have a lot of poverty, inequality is rampant, and governments face constant pressure to increase resource rents.

Why don’t we develop more copper mines in North America? Well the mining industry is trying, but there are many obstacles. The Biden administration has blocked copper mines in three states. It can take up to 20 years in North America to build a mine to production from scratch. Permitting delays are the rule not the exception.

Yet demand pressures continue to increase.

S&P Global Market Intelligence projects that annual global copper demand will nearly double to 50 million tonnes by 2035. Last year, global copper mine production sat at approximately 22 million tonnes, short of even current demand.

“Assuming mining output continues to grow at a rate of 2.69% annually (as it has done for the past decade), global output will reach a mere 31 million tonnes, a far cry from the 50 million figure that we’d need as previously mentioned,” S&P said.

“The market overall is pretty tight,” Robert Edwards, copper analyst at CRU, mentioned in a recent Wall Street Journal piece. “Longer term there’s a narrative around resource scarcity and the green transition with EVs and renewables as well as the build-out of electricity grids. On paper it’s quite a substantial supply gap opening up over the next 10 years.

All of this means one thing — that the global copper market is entering an age of deficits so large that it could derail our climate goals.

The solution is to build more copper mines, which begins by identifying exploration projects with production potential, preferably in well-established jurisdictions. It’s no coincidence that the biggest mining companies like Glencore, Vale and Anglo American are all actively looking for copper development assets, setting off a new wave of investments.

Copper Road Resources

TSXV:CRD

Cdn$0.09, 2023.09.21

Shares Outstanding 47.3m

Market cap Cdn$5.0m

CRD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does does not own shares of Copper Road Resources (TSXV:CRD). CRD is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of CRD

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.