Copper bulls ride on increased orders, mine disruptions

2020.06.12

Hit hard by the pandemic when it first struck China in February, then again in March when it spread to the Middle East, Europe and North America, over the past month copper prices have ticked up, as economies gradually reopen and growth prospects improve.

True to its “Dr. Copper” moniker, demand for the red metal is surging in expectation of a manufacturing resurgence in the second half of the year. At the same time, supply is tightening as copper warehouse stocks are drawn down and mine supply in Chile, the top producer, is threatened by reports of increasing covid-19 infections among mine workers.

In this article we are returning to one of our favorite metals, copper.

Price jump

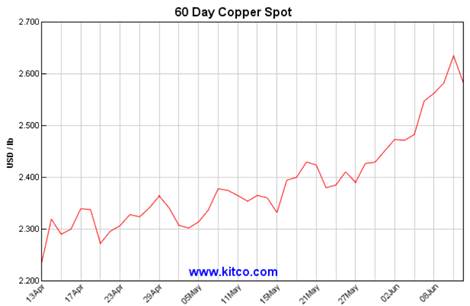

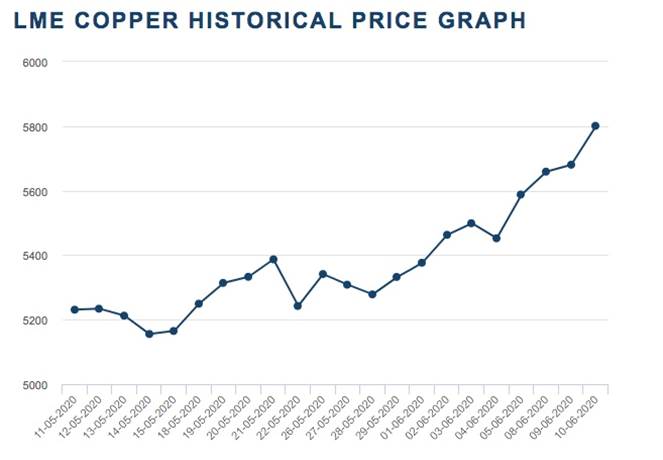

Copper prices, as of writing, are US$2.62 a pound, almost 30% better than copper’s mid-March low.

The big gain was due to news that Beijing has begun a widely anticipated $700 billion stimulus program focused on “new infrastructure” and “new urbanization”.

According to BMO, new urbanization refers to refurbishing old urban housing stock, railways, airports, and upgrades to power grids and local utilities while new infrastructure includes 5G networks, ultra-high voltage power grids, EV charging stations and data centers.

On Wednesday, June 10, prices rallied as much as 2.3% to $2.67 a pound, the highest in more than four months.

The news on copper is so good, Bank of America analysts increased their price forecast by 5.4% to $2.54 a pound. The analysts suggested that while Western economies may not completely mirror the rebound seen in China, the easing of lockdown measures would likely facilitate a rise in raw material purchases around the world.

They also made another interesting point about the current recession: it is more directed at services – think of restaurants, retail, any business requiring face to face interactions – than manufacturing. This means commodities are less affected than they might be in a full-blown recession that hits all sectors.

Demand heating up

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal.

A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand.

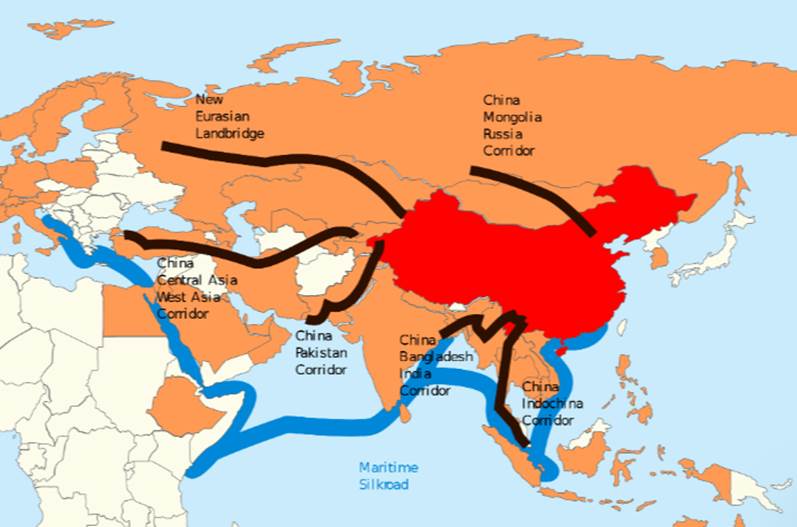

Research by the International Copper Association found that China’s Belt and Road Initiative (BRI) is likely to increase demand for copper in over 60 Eurasian countries to 6.5 million tonnes by 2027, a 22% increase from 2017 levels.

The country already consumes over half the world’s copper; its refineries are reportedly using copper concentrates at higher volumes than the record-setting 2019 total of 22 million tonnes (m/t). April copper concentrate imports topped 2 m/t for only the third time, shipments from South America rose 22% and the first 4 months of 2020 saw imports total 7.58 m/t, a pace that, if sustained, will surpass last years record breaking 22 m/t’s.

The global 5G buildout and the continued movement towards electric vehicles – including cars, trucks, vans, construction equipment and trains – are two big copper demand drivers.

Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

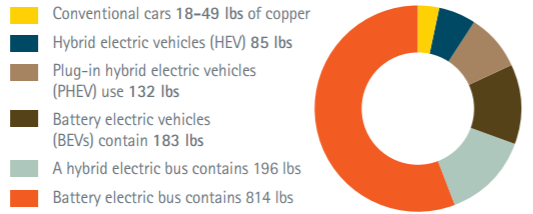

Electric vehicles and associated charging infrastructure may contribute between 3.1 and 4 million tonnes of net growth by 2035, according to Roskill. EVs contain about four times as much copper as regular vehicles. With each charging station using about 2 kg of copper, that’s 42 million tonnes, or double the current amount of copper mined in one year.

BMO cites the latest survey of copper wire and cable fabricators, showing operating rates in May hitting 101.7%, the highest level in the history of the survey – thanks mainly to purchases by China’s State Grid.

According to Trafigura Group, one of the world’s largest copper traders, there are signs that copper could emerge from the covid crisis even stronger than before.

Bloomberg quotes the company’s head of copper trading saying that demand is bouncing back in China, and stimulus packages unleashed by countries across the globe are notably focused on copper-intensive “green infrastructure” (like new solar and wind projects requiring kilometers of new transmissions lines). On top of that, The coronavirus has also disrupted mines and delayed new builds, throttling current and future supply.

“Copper is coming out of this crisis differently,” [Kostas] Bintas said by phone from Geneva. “When lockdowns were eased and people started to return to work, we were surprised to see our customers not only taking deliveries of volumes they’d already bought, but requesting more to cover themselves in case there were any further disruptions to supply.”

It’s interesting to see Trafigura taking a reading on the most direct barometer of supply and demand – customers that are buying the metal.

“Despite the noise of what the price is doing or the equity markets are doing, the most important thing is to isolate the signal that you’re getting from customers and suppliers,” Bintas told Bloomberg. “You can’t get more genuine feedback than that.”

Apart from customer feedback, the company’s bullishness is based on stimulus packages targeting renewable energy and electric vehicles; climate change fueling greater demand for heating and cooling systems (copper is the preferred material for heat exchangers, wiring and motors); and the fact that the pandemic has forced many copper mines to halt operations particularly in South America, where most of the red metal is mined, and delayed work on future projects.

Bloomberg reports demand is expected to rise 3.4% a year in the coming decade, which will push the market into a deep deficit unless new sources of supply are found.

Given the high costs of development, copper would need to trade above $7,600 a ton [$3.80/lb] to incentivize long-term investments in new mining projects.

We already know that over the next two years, copper supply is expected to be weak. The base metal is heading for a supply shortage by the early 2020s; something we at AOTH have covered extensively.

Copper refineries not only buy copper concentrate from mines, but scrap metal for melting down into saleable end-products. But the coronavirus has restricted the collection and processing of scrap around the world, including in China. Lockdowns have idled manufacturing activity and halted the generation of new scrap. The restricted supply has boosted scrap prices.

According to Bintas, the Trafigura head trader, scrap copper supply has dried up so drastically that buyers in China were paying higher prices than for brand-new metal.

Local sourcing

Another surprising result of the pandemic is that certain countries are diversifying their supply chains, aiming to become less dependent on foreign suppliers.

In particular China, which is dependent on imports of key minerals copper, iron ore and uranium, could look to source metal domestically, or increase investment in exploration overseas to ensure supplies. This may become more important if relations between China and developed countries like the United States continue to deteriorate. Beijing imports around 40% of its mined metal commodities from Australia.

“Post-covid-19 we believe China could move to re-invest in its mining industry to secure its resource base. The government could either increase exploration and development of minerals, or invest in technology to enable profitable mineral production from previously uneconomic, mineralised rock” Fitch Solutions wrote in a recent report.

Supply disruptions

Copper supply is frequently dented by poor weather, natural disasters like earthquakes and floods, and strikes.

This year we have seen either reductions in output, or temporary closures, due to government-imposed restrictions to restrict the spread of covid-19.

Up to now, big copper miners like Chile’s Codelco, have managed to continue operating through the outbreak, by adopting safety measures. Other mines that closed earlier this year are beginning to reopen. But Latin America is nowhere near coming out of the crisis; in fact it may be just beginning.

Brazil now has more new coronavirus cases and new deaths than the United States. The disease is apparently spreading most in northern states such as Para, which accounts for 8% of the world’s iron ore supply.

Regarding copper, Chile is the country to watch, since it is the largest producer of the red metal. The country last year saw a wave of social unrest and protests over rising inequality, and now, Chile is getting hammered by covid-19. BNN Bloomberg says Chile is reporting new cases on a per-capita basis at a pace comparable to that of Spain at the peak of the spread in March, pushing hospitals toward collapse and prompting authorities to tighten restrictions.

Not only that, the infections are starting to seep into Chile’s large population of mine workers. At the beginning of June, 15 staff members and 34 workers tested positive for coronavirus at Codelco’s Chuquicamata mine. Another 140 were quarantined. On June 10, the company’s unionized workers said they are weighing walking off the job at some sites, after one of their members died from the virus. They claim Codelco is not adequately protecting their health.

“If it is necessary to halt work in those areas … until sanitary conditions are adequate to protect mine workers, we are ready to do so,” the Federation of Copper Workers said in a statement.

Trafigura estimates the coronavirus crisis has so far reduced mined copper supply by 400,000 tonnes, which is 2% of annual global production of around 20 million tonnes.

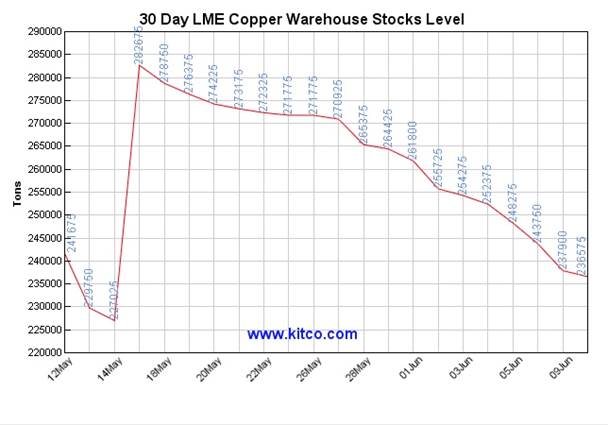

The best evidence of tightening supply can be seen in plummeting copper inventories. Indeed the recent surge in copper demand appears to be being met, to some extent, by stored copper.

Copper stocks at LME warehouses recently fell below 250,000 tonnes for the first time in seven years. Global inventories between March and June fell by 412,000 tonnes.

Conclusion

Combine shrinking inventories with probable labor disruptions in Chile, add in all the demand factors outlined above, and you have the perfect storm for copper. Many copper watchers were expecting the essential industrial metal to take a big hit from the coronavirus, but if current market fundamentals continue, we might even see copper posting a 2020 gain on economic recovery momentum.

That would be great for copper explorers, and their investors, who know the best leverage against a rising copper price is to own an early-stage junior with a sizeable and scalable deposit in a mining-friendly jurisdiction.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.