COP26 highlights rising status of battery metals projects on the road to net zero

2021.11.04

One of the biggest fallouts we could expect from COP26 is a surge in demand for battery metals as nations and corporations make their ambitious clean energy goals known to the world.

In the latest energy outlook report prepared in advance of the climate change conference, Wood Mackenzie is projecting global demand for energy storage to rise to 1TWh by 2030.

Global lithium-ion battery capacity is also forecast to double over the next two years, the report added, with storage and EV application to drive battery demand to 2.3TWh by the end of the decade.

According to the Edinburgh-based consultancy group, increasing the supply of metals will be crucial in accelerating the entire decarbonization process and the fight against climate change.

“The energy transition starts and ends with metals,” it says.

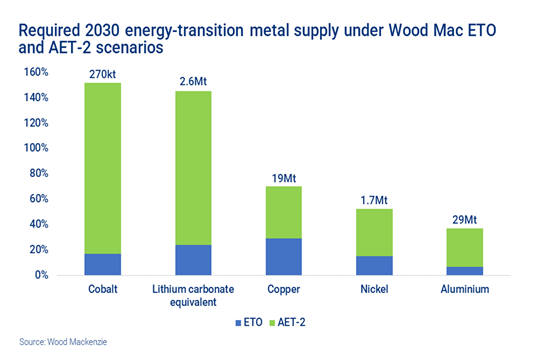

WoodMac’s report specifically points out that five metals — aluminum, cobalt, copper, lithium and nickel — are at critical volumes. The availability and reliability of their supply are in question as demand faces the prospect of a significant spike in demand.

Nickel, for instance, could see demand double from 2.4Mt today to 4.9Mt in 2040, WoodMac forecasts. Other metals too are confronted with demand forecasts that could leave a sizable supply gap in the market.

Just how much more metals are needed to achieve net zero by 2050, though, depends on the pathway on which the energy transition takes place.

WoodMac’s research shows a staggering difference between its base case energy transition outlook (ETO), which limits global warming to 2.5C on pre-industrial levels by the end of this century, and the 2C scenario (AET-2) that is aligned to Paris targets (see chart below).

Overall, WoodMac estimates that the capex for base metals mining projects alone needs to quadruple to about $2 trillion to achieve an accelerated energy transition.

According to Julian Kettle, senior vice president and vice chairman of metals & mining at WoodMac, the mining industry has been underinvesting even for a slower energy transition.

“The supply gap represented by the uncommitted proportion of the potential 2030 market represents a major opportunity for investment, with the associated tonnages being truly transformational when set in the context of current market size,” Kettle says.

As seen in the chart below, the metals highlighted by WoodMac have all enjoyed significant gains since the start of 2020.

As WoodMac puts it, “the huge challenge of meeting the demand for metals created by a 2050 net-zero carbon target is no secret in the mining community.”

We at AOTH have also been paying attention to the commodities closely linked to electrification and decarbonization, as well as the projects that have the potential to meet that challenge.

Below are four companies holding highly prospective projects which we believe could become an integral part of the global battery metal supply chain.

Surimeau District Property

The first project we are actively monitoring is located right here in Canada: the Surimeau polymetallic property held by Renforth Resources (CSE:RFR) (OTCQB:RFHRF) (FSE:9RR) in the province of Quebec.

This 260 sqkm brownfield property hosts several target areas for gold and industrial metals (nickel, copper, zinc, cobalt, silver) located south of the Cadillac Break, a major regional gold structure in Quebec.

Both the gold and battery metal targets on the property are supported by historic findings and Renforth’s follow-up exploration.

Exploration focus is currently placed on the sulphide nickel rich VMS targets, in particular the ~5km long Victoria West prospect (see map below), which was the site of recent drilling by the company over the past year.

The Victoria target was last explored in the 1990s by LAC Minerals looking for gold, though it was later determined by LAC and previous operators that nickel, zinc and copper, plus a few more minerals, are also present. This finding was later validated by Renforth’s initial fieldwork.

According to Renforth, information gleaned from drilling and trenching the Victoria West target, along with surface sampling, create an area of interest that includes about 5 km of strike on the western end of a 20 km magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

In fact, Renforth considers the style of mineralization to be an “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold.

About 50 million tonnes of ore averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined from three deposits between 1913-1988.

Renforth’s first drilling at Surimeau occurred in October 2020 with 2.5 short holes completed. A total of 15 holes for 3,456m were drilled during the 2021 program, drilling off 2.2 km of strike within the approximately 5 km long Victoria West target.

Another four holes totaling about 1,000m were drilled this summer; these delivered visible sulfides in the core. Assays are pending for the bulk of the 2021 drilling.

Victoria West is only one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization.

The latest to be prospected is the Huston area, located about 18 km northwest of the Victoria West area. This area is almost entirely unexplored with the exception of a limited drill program in the general area by Hecla in the 1980s, which focused on gold.

Results of this summer’s prospecting from the southwestern part of the area gave the first ever documented nickel occurrence at Huston. Follow-up work is planned by the Renforth geological team for the fall season.

Potentially, more drilling could occur during the last three months of the year at Victoria West, Huston and Malartic West, another important target that is prospective for copper and silver.

Palladium One Mining

Another Voisey-Style Project?

Meanwhile, the race to mine “decarbonization metals” is growing fierce next door in the province of Ontario.

This is where Palladium One (TSXV: PDM) (FSE: 7N11) (OTC: NKORF) is developing the Tyko project near Marathon, where previous work has indicated high potential for a Voisey-style nickel-copper-PGE mineralization.

The project covers approximately 24,500 hectares of land within the highly prospective Mid-Continent Rift nickel province, including over 7,000 hectares of the mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration.

The Archean-aged mafic-ultramafic intrusion is rich in nickel, containing twice as much the battery metal as copper, and equal amounts of platinum and palladium.

According to the company, the high tenor of the sulfide minerals suggests a valuable concentrate could be produced, and that even if the sulfides are disseminated, the deposit could still be economic.

Drilling in 2020 primarily focused on the Smoke Lake target, an EM anomaly identified through geophysical surveying. Magnetic survey undertaken shortly before drilling helped to refine the anomaly, resulting in the successful discovery of massive magmatic sulfides.

The first discovery of massive sulfide mineralization at Tyko was confirmed in January, when the company announced drill intercepts from massive magmatic sulfide of up to 9.9% nickel equivalent. Subsequent drill results reported from the 2020 program were a resounding success, confirming the high-grade nature of the deposit.

A second-phase, 2,000m drill program was initiated in April to follow up on these high-grade hits. The assays to date have been excellent, including massive magmatic sulfide intercepts grading up to 10.2% nickel equivalent, demonstrating a robust mineralization spread over a distance of at least 18 km.

In addition to the high-grade Smoke Lake zone, Palladium One believes there are new zones of nickel-copper mineralization yet to be discovered.

Preliminary results of the recently completed airborne EM survey have identified as many as four significant multi-line EM anomalies on the Tyko copper-nickel project, which further support this hypothesis.

Of particular interest are two anomalies in the Bulldozer Intrusion. These are the first EM anomalies identified in this large mafic-ultramafic intrusion and hint at potentially large tonnage targets.

Assay results from the Phase 2 drill program at Smoke Lake are still pending.

Potential Platreef-Type Deposit

Palladium One is simultaneously advancing the Läntinen Koillismaa (LK) PGE-Cu-Ni property in Finland.

The LK project area is covered by exploration permit renewals, new applications and exploration reservation applications.

The exploration permit applications — covering a grand total of 2,485.3 hectares — are divided into two groups: the Kaukua group consisting of the Kaukua and Murtolampi targets, and the Haukiaho group covering the Lipeävaara and Haukiaho targets as well as Salmivaara, which represents the eastern and western extension of Haukiaho.

This project draws comparison with the Platreef-type deposits of the Bushveld Igneous Complex in South Africa, the largest layered igneous intrusion within the Earth’s crust. It is also where most of the world’s platinum is produced.

Surface sampling and previous drilling have shown evidence of palladium, platinum, gold, copper, cobalt and nickel.

In 2019, Palladium One published the first NI 43-101 resource for the Kaukua deposit, showing 11 million tonnes of indicated resources grading 1.80 g/t PdEq (635,600 oz PdEq), plus another 11 million tonnes inferred grading 1.50 g/t PdEq (525,800 oz PdEq).

This resource endowment was recently doubled following months of drilling by the company at the Haukiaho zone, which successfully converted the area’s historical resources into the inferred category.

The project now boasts 11 million tonnes of indicated resources grading 1.60 g/t PdEq (600,000 oz PdEq) and 44 million tonnes of inferred resources grading 1.19 g/t PdEq (1.7 million oz PdEq). The resource upgrade further confirmed LK’s potential to host a large, bulk-tonnage deposit.

A maiden resource is also expected in the coming months for the Kaukua South zone, about 500 m south of the pit-constrained resource at Kaukua.

Lomiko Metals

Another company looking to develop a sustainable supply of minerals for the EV industry is Lomiko Metals Inc. (TSXV: LMR) (OTC: LMRMF) (FSE: DH8C). The company is simultaneously working on two exploration projects (graphite and lithium, respectively), both within the mineral-rich regions of Quebec, Canada.

Low-Cost Graphite Mine

Lomiko currently holds a 100% interest in its La Loutre graphite development project in southern Quebec, consisting of one large, continuous block of 42 mineral claims totalling 2,509 hectares.

The property is located approximately 117 km northwest of the city of Montréal and 53 km east of the Imerys Carbon and Graphite’s Lac des Iles mine. Farther out, Nouveau Monde Graphite and its high-purity mineral reserve at Matawinie are located 230 km to the north.

La Loutre was originally explored for base and precious metals in the late 1980s. However, historical reports have also pointed to graphite being present in different lithologies on the property.

Recent sampling by Lomiko has confirmed a graphite-bearing structure covering an area approximately 7 km by 1 km, with results of up to 22.04% graphite in multiple parallel zones of 30-50m wide.

Another area has also been identified covering approximately 2 km by 1 km in multiple parallel zones of 20-50m wide, which include results up to 18% graphite.

The two mineralized areas on the property were later named the Electric Vehicle (EV) zone and the Graphene-Battery zone respectively for the potential applications of the graphite material contained in each.

The project’s first resource estimate (2016) was obtained from only the Graphene-Battery zone, containing a pit-constrained 18.4 million tonnes of 3.19% graphitic carbon (Cg) indicated and 16.7 million tonnes at 3.75% Cg inferred.

Encouraged by the initial estimates, Lomiko pursued further exploration drilling at La Loutre, including the EV zone, to boost its resource base. The latest drill program in 2019 returned positive results, which had high-grade intercepts of 87.9 m of 7.14% Cg, including 21 m of 15.48% flake graphite; and 116.9 m of 4.80% Cg, including 15.2 m of 18.04% flake graphite.

These results allowed the company to expand the resource, as shown in a preliminary economic assessment (PEA) released in August, to an estimated 23.2 million tonnes indicated grading 4.51% Cg (for 1.04 million tonnes of contained graphite), plus 46.8 million tonnes inferred grading 4.01% Cg (for 1.9 million tonnes of graphite).

The PEA study highlighted a potential open-pit mine with total graphite production of 1.4 million tonnes spanning 14.7 years, for average annual production of 97,400 tonnes.

This comes at attractive cash costs of $386/tonne Cg and all-in sustaining costs (AISC) of $406/tonne Cg — both in the lower end of the industry spectrum. The project capex was estimated at C$236.1 million.

In preparation for the upcoming Prefeasibility Study (“PFS”), Lomiko is developing an infill drill program in order to increase confidence in its mineral resources and to confirm the tonnes and the grades within projected open pit shells. Also, the infill program will provide core for the next level of the metallurgical studies which would further derisk and provide input into the processing plant design.

“La Loutre has shown it has the potential to become a highly profitable graphite mine in one of the most prolific producing regions in Canada,” Lomiko’s chief executive Paul Gill commented on the PEA results.

Potential New Lithium Field

In addition, Lomiko has a joint venture option to earn 70% of the Bourier lithium project from Critical Elements Lithium Corp. by funding exploration activities and other considerations.

The Bourier property consists of 203 claims for a total ground position of 10,252 hectares, in a region of Quebec that boasts other lithium deposits and known lithium mineralization. Lomiko considers this project to be a potentially a new lithium field in an already established lithium district.

Bourier is located in the northeastern part of what is known as the Superior geological province, and more specifically, in the northeastern part of the Lac des Montagnes Formation. The Lac des Montagnes volcano-sedimentary belt is a sequence of aluminous metasediments and amphibolites containing basalts and ultramafic sills.

The lithium pegmatites in this area tend to occur in swarms in the volcano-sedimentary units. The Bourier property covers a large part of this regional volcano-sedimentary unit, which is also host to Nemaska Lithium’s Whabouchi deposit and Critical Elements’ Lemare showing.

Initial exploration at Lemare was undertaken in 2012 by Monarques Resources Inc., which resulted in the discovery of a “granite pegmatite dyke containing a considerable amount of spodumene.”

The Bourier property lies adjacent and northeast to the Lemare property, where drilling conducted between 2016-2018 yielded results that included 41.5m at 1.71% lithium oxide (Li2O), including 15m at 2.18% Li2O and 6m at 3.6% Li2O.

The pegmatite ranges in apparent thickness from 4.8-14.2m and was followed for close to 200m in length on surface. Further exploration will confirm whether similar mineralization exists at the Bourier property.

Although there has been little exploration for lithium undertaken at Bourier so far, based on other lithium deposits around the world, it is a common occurrence for pegmatites to exist in “swarms.”

Preliminary results of this summer’s field exploration by Critical Elements have revealed the discovery of five new sectors of spodumene-rich pegmatites, highlighting the potential of the Bourier lithium project. As compiled results have identified numerous targets, Lomiko is looking to prioritize those targets and follow-up with surface mapping, trenching and eventually drilling, once sufficient information is collected to warrant more detailed drill planning.

Victory Resources

Whilst on the topic of lithium, one place that is shaping up to be the next hunting ground for the battery metal is the Clayton Valley of Nevada.

The lithium deposits there contain favorable characteristics such as arid climate, closed basin containing a playa or salar, tectonically driven subsidence, associated igneous or geothermal activity, and suitable lithium source rocks.

The Clayton Valley is currently home to North America’s only lithium-producing site: Albemarle’s Silver Peak mine.

Leveraging Nevada’s favorable geology and rich mining history, several companies have begun exploring its claystones and brines over recent years, with the goal of developing the next lithium source for the EV battery supply chain.

Among those lithium explorers in Nevada, we are particularly intrigued by Victory Resources Corporation (CSE: VR) (FWB: VR61) (OTC: VRCFF), which is anticipating further advancement on its Smokey lithium project in the near term to benefit from the EV revolution.

Victory’s Smokey lithium project is located about 35 km west of Tonopah, Nevada, within the famous Big Smokey Valley that traverses three counties across the state.

Esmeralda County — where the project is situated — is one of the world’s most prolific regions for lithium clay deposits (Noram, Cypress, American Lithium, Spearmint, Enertopia, Jindalee). These deposits all have proven large tonnages with acceptable lithium grades in excess of 900 ppm.

The Smokey lithium property lies approximately 35 km north of Clayton Valley, adjacent to and possibly on trend with the Clayton North project (930 ppm Li) held by Australia’s Jindalee Resources Ltd.

Farther away, Noram’s Zeus lithium project (900 ppm Li) is about 25 km to the southeast, while 35 km to the northeast is American Lithium’s flagship Tonopah Lithium Claims property (1,000 ppm Li).

In this prolific lithium region hosting, Victory’s Smokey project covers a total of 350 claims covering 7,000 acres of land with excellent access and relatively flat ground.

The property shares similar geologic settings to the Clayton Valley and the many exploration projects nearby. It is located in the Walker Lane trans tensional corridor on the western margin of the Basin and Range province.

The property’s geology consists of Miocene – Pliocene tuff deposits, claystones and siliciclastic beds (Esmeralda Formation) with overlying younger alluvium deposits and desert pavement formation. The claystone, which can carry high lithium concentrations, is observed as highly weathered light grey to tan mounds of unconsolidated clay from 0.10-1.50m thick.

The flat-lying nature of the claystones, together with the frequent occurrence of transported cover, requires drilling to fully validate and assess the Smokey project’s lithium potential.

Based on strong results from this summer’s geological sampling, which indicated several areas of high lithium values (up to 1,500 ppm Li), Victory is now fast-racking a drill permit application for the Smokey lithium property.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks.

Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on Richards site aheadoftheherd.com

Richard does not own shares of Palladium One (TSX.V:PDM), Lomiko Metals Inc. (TSXV:LMR) or Victory Resources Corp. (CSE:VR). PDM, LMR, VR are paid advertisers on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.