Commodity boom puts world’s copper supply to the test

2021.06.30

We’re witnessing one of the greatest commodity booms in decades.

Despite recent efforts by top consumer China to cool-off price spikes by releasing a portion of its stockpile of base metals — the first time it has done so in ages (last time was 2010) — this “supply shock” was rather short lived.

Copper Run Not Over

Copper, especially, recovered just days after China’s announcement.

After falling to a two-month low last week, copper prices appear to be back on an upward trajectory, trading well above $4.20/lb. Year-to-date, the industrial metal is still sitting on close to a 20% gain.

According to business leaders who participated in this week’s Qatar Economic Forum, commodities like copper are likely to become more expensive as the rally resumes.

Among the attendees of this virtual conference was Glencore CEO Ivan Glasenberg, who believes China’s efforts to cool surging metal prices can’t be sustained for long.

He describes China’s efforts as a “short-term phase”, and that the country will have to move to restock strategic supplies that it feeds into the market in order to cool prices.

“I think that’s a short-term game because the underlying fundamentals will keep it at these levels,” he said.

The Glencore boss also expects commodity prices to stay strong for a good while longer, as demand from China coincides with infrastructure spending in the US.

Analysts, too, are bullish on copper.

“We do not think the rally is over,” Citigroup analysts including Tracy Liao said in an emailed note on June 17. Beijing’s measures “target managing expectations and deterring speculators rather than solving supply/demand imbalances.”

With inventories low, it’s likely that investors will buy into price declines, reigniting the rally in coming months, the bank added.

“We’re at a point where a lot of the cyclical tailwinds, if they haven’t blown themselves out, are past their peak,” Colin Hamilton, MD for commodities research at BMO Capital Markets, recently told Bloomberg.

“That fear that things are just going to go higher and higher and higher – that has come out of the market now.”

Supply Needs to Double by 2050

A looming shortage of the metal should also be factored in.

Glencore’s Glasenberg said on Tuesday that a supply gap was growing in the metals necessary for the world to replace fossil fuels with renewable energy.

For copper, he estimated that supplies needed to increase by one million tonnes a year until 2050 to meet an expected demand of 60 million tonnes.

“Today, the world consumes 30 million tonnes of copper per year, and by the year 2050, following this trajectory, we’ve got to produce 60 million tonnes of copper per year,” Glasenberg said.

“If you look at the historical past 10 years, we’ve only added 500,000 tonnes per year … Do we have the projects? I don’t think so. I think it will be extremely difficult.”

Star Copper Project

Thankfully, the sustained rally in copper prices is paving the way for new projects to emerge around the mineral-rich regions of the world.

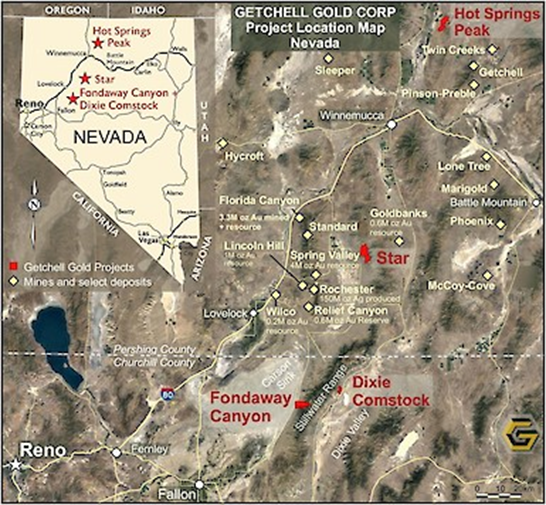

Over the past year, junior miner Getchell Gold (CSE:GTCH) (OTCQB:GGLDF) has been actively exploring for copper in the US state of Nevada. The company has acquired a large land package that had seen copper mining in the past, with significant exploration data to back it up.

Despite being known for its extraordinary levels of gold production over the past decades, Nevada is also a rich source of copper, much of which remains underexplored to this day.

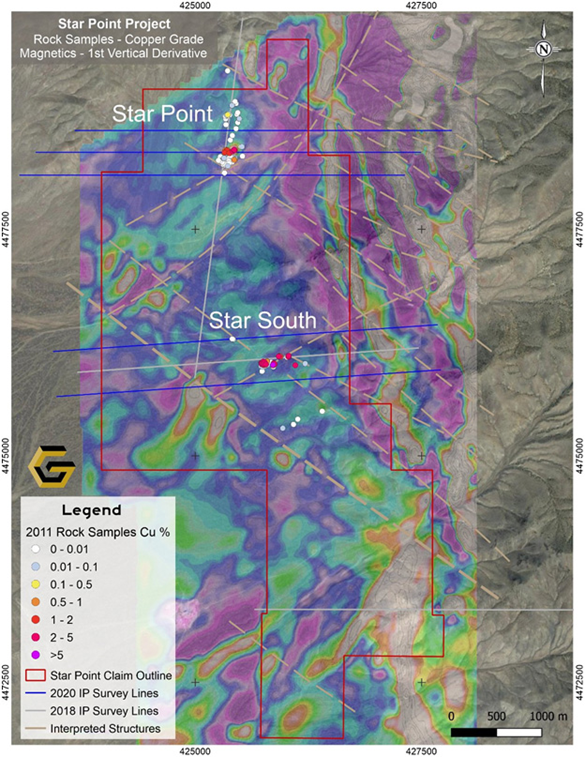

Getchell’s Star copper project consists of 199 lode mining claims in Pershing County, approximately 65 km southwest of Winnemucca on the east side of the Buena Vista Valley.

The property comprises two main mineralized occurrences: the formerly producing Star Point copper mine and the Star South Cu-Au-Ag prospect situated 2 km to the south.

A 2020 geophysical survey identified two high-priority targets (one at each occurrence) displaying classic characteristics of porphyry-style mineralization and alteration, which will be the focus of a drill program on the Star property this year.

Permits are pending for the upcoming drill program.

Historic Copper Mine

The Star Point target is the site of a high-grade, near-surface copper oxide (tenorite) mine that operated from the late 1940s through the mid-1950s. The ore produced there was shipped to a smelter in Utah for processing, but no record of shipped tonnage or grade was found.

Past development primarily focused on a 300 x 300 m area covered with various pits, portals, shafts, open cuts and associated dumps, while the underground development consists of several short shafts, winzes and tunnels of varying length leading to a series of stopes and drifts.

The high-grade copper mineralization is associated with quartz veins hosted within shear zones, and the dumps were seen to contain numerous strongly mineralized specimens of malachite and azurite.

Surface sampling first began in 2011, with the samples primarily sourced from the dumps and to a lesser extent from outcrop. Of the 79 grab samples collected, 13 of them returned a grade >0.5% Cu, with the highest grades reported at 4.25, 3.00 and 2.35% Cu.

A recent IP survey has defined a coincident low-resistivity, high-chargeability anomaly about 400 m to the southwest of the historic copper mine, in an area of high-angle structures similar to the ones observed at surface at the mineralized Star Point occurrence. This represents a high-priority target for this year’s drilling.

Copper-Gold-Silver Prospect

Located 2 km south of the past-producing mine is the Star South copper-gold-silver prospect, which comprises a series of pits, artisanal adits and associated dumps within a 300 x 150 m area.

These adits appear to follow high-grade copper-gold-silver mineralization hosted within quartz veins that are associated with shears trending in several different orientations.

A total of 89 samples were collected during the 2011 sampling campaign, with the vast majority sourced from the dumps in the area. As with Star Point, malachite and azurite mineralization is abundant and indicative of high copper content, though Star South is additionally rich in gold and silver.

Many of those reported high grades of copper, gold, and silver in combination, with 40 samples grading >1% Cu, 21 samples grading >1 g/t Au and 20 samples grading >30 g/t Ag. One sample returned a remarkable 2.45% Cu, 9.26 g/t Au and 310.0 g/t Ag.

The 2020 IP survey has defined a prominent low resistivity anomaly that directly underlies the main high-grade Cu-Au-Ag showing and is also considered a priority drill target.

Drilling Begins at Fondaway Canyon

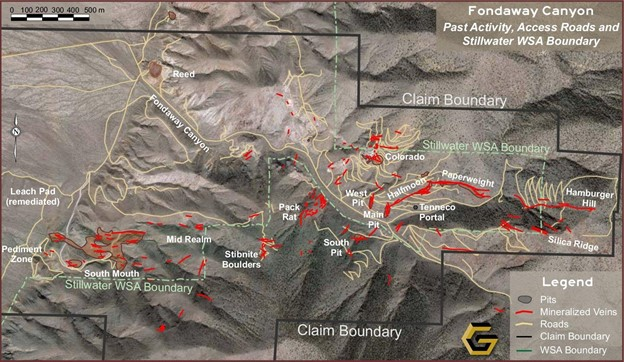

Elsewhere in Nevada, Getchell is ramping up exploration efforts at its flagship, advanced-stage Fondaway Canyon gold project situated in Churchill County.

The Fondaway Canyon property, comprising 170 unpatented lode claims, has a history of previous surface exploration and mining in the late 1980s through early 1990s.

Earlier this month, the company announced the start of its 2021 Phase 1 drill program on the Central Area of the property.

Up to 4,000 meters of infill and step-out drilling have been planned to further delineate and expand on the mineralization discovered during the highly successful 2020 drill program.

Initially, the drill plan will target the newly named Juniper high-grade structural gold zone, shallowly located down-dip of the Colorado Pit, reporting a 21.9 m interval grading 6.2 g/t Au from last year’s hole FCG20-02.

The Juniper gold zone was previously intersected by hole TF-114, drilled in 1989, that reported one of the highest gold grade-thickness intervals in the history of the Fondaway Canyon project, returning 17.6 g/t Au over 15.2 m.

The Central Area drill plan will also target the two thick zones (>100m) of mineralization, the Colorado SW extension and the North Fork zone, that were both newly identified in 2020 and remain open laterally and to depth.

“The stellar results from the 2020 drill program blew the potential of the Fondaway Canyon gold project wide open,” Getchell’s president Mike Sieb stated in the June 1 news release.

“The revised geological interpretation represents more than a doubling in the projected down-dip extent of the gold mineralization from previous geological models and has provided ample target areas for the 2021 drill program to further delineate and expand upon our recent discoveries.”

Conclusion

Strong performance of base metals has eradicated concerns of the commodity rally coming to an end, despite recent measures to contain prices. Against the backdrop of the biggest commodity boom in decades, there’s no better time for mining firms to shine.

Copper — being one of the key energy transition metals — has grabbed much of the spotlight. It’s estimated that supply would need to at least double within the next 30 years, and this requires many more new copper projects.

Past-producing mines are usually safe bets. By holding an extensive land package containing at least two main mineralized occurrences, including the historic Star Point copper mine, Getchell Gold looks to prove that this project is synonymous with “high-grade copper mineralization”.

Recent work has demonstrated resemblance to porphyry-style deposits, which are known globally for their copper production.

A maiden drill program on this promising project is set to begin soon, with the company awaiting permits.

Between an oversubscribed $2.71 million private placement and the exercise of warrants worth nearly $650,000, the company has a healthy budget to accomplish its exploration goals during what looks to be an extremely busy season.

A Phase 1 drill program totaling 4,000 meters is also underway at its advanced-stage Fondaway Canyon property, where the company looks to double up on last year’s successful drilling.

Getchell Gold

CSE:GTCH, OTC:GGLDF

Cdn$0.55, 2021.06.30

Shares Outstanding 83m

Market cap Cdn$45.6m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.