Citi sees copper rising 10% on coming trade deal

2019.02.06

Citi Bank is bullish on copper and appears to be brimming with optimism that the United States and China can strike a trade deal soon.

The New York-based bank said in a report Monday that it expects the bellwether metal to rally 10% over the next three to six months, during which time the Chinese and US trade delegations should come to an agreement on the near-year-long trade dispute.

That would put copper at $6,700 a tonne this year due to 2% growth in Chinese demand “led by strong growth in late cycle construction completions and power infrastructure investment,” Citi said, adding that growth in electric cars will buttress copper needs.

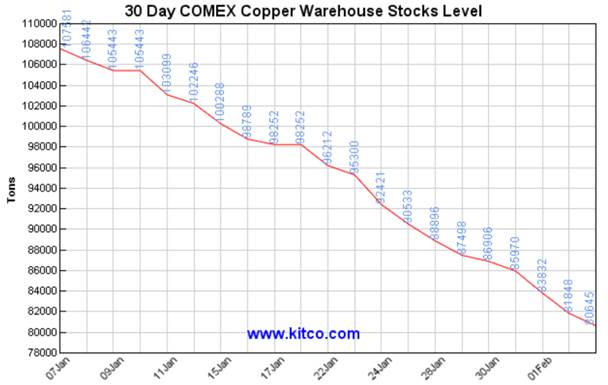

The banks also predicts copper inventories, which are at a 10-year low, will fall further in the second quarter and leave the copper market in a deficit of 200,000 tonnes this year and next.

While there are sticking points on intellectual property and technology transfers, US trade negotiators and President Trump appeared confident on a deal after two days of high-level talks. CBC reported:

[US trade representative Robert] Lighthizer said there was “substantial progress” on these issues, including verification mechanisms to “enforce” China’s follow-through on any reform commitments it makes.

“At this point, it’s impossible for me to predict success. But we’re in a place that if things work out, it could happen,” Lighthizer said at the Oval Office meeting.

Trump, speaking at the White House during a meeting with Chinese Vice Premier Liu He, said he was optimistic that the world’s two largest economies could reach “the biggest deal ever made.”

The Chinese trade delegation said in a statement that the two days of high-level talks made “important progress,” China’s official Xinhua news agency reported.

Although it must also be said that time is ticking. If no resolution is reached before March 1, tariffs on $200 billion worth of Chinese goods will increase from 10% to 25%.

Citi’s bullishness on copper is no surprise. While the price dropped last year, on Chinese growth concerns, it’s long-term supply and demand that copper miners and explorers look to, as far as planning expansions and development properties.

As we wrote in The coming copper crunch, by 2035, without major new mines up and running to replace the ore that is being depleted from existing copper mines, we are looking at a 15-million-tonne supply deficit by 2035. Four to six million tonnes of added capacity are needed by 2025.

Lower ore grades are also expected to be painted into the waning supply picture. Copper grades have declined about 25% in Chile in the last decade – highlighting the urgent need for grassroots exploration to arrest the trend.

Finally, some of the world’s largest copper mines are slashing production, thus feeding into the supply deficit thesis that is predicted to push the copper price back up over three dollars a pound.

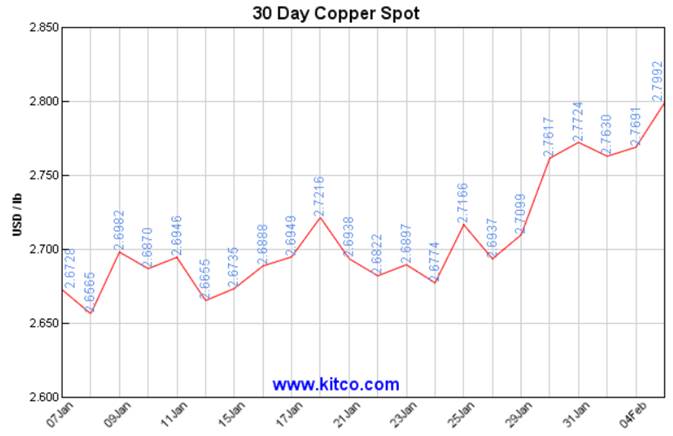

Since the start of the year, copper has risen nearly 7%. Let the copper bulls run.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.