China’s near-complete dominance of ‘green economy’ metals – Richard Mills

2022.11.08

The “green economy” rejects dirty sources of energy and transportation, namely coal, oil, and natural gas. Instead, it relies on carbon-friendly modes of transport and energy production, including electric vehicles, renewable power, and energy storage, as well as mobile technology (5G) and rapid adoption of artificial intelligence (AI) technologies needing increased computing power.

Transportation makes up 29% of global emissions, so transitioning from gas-powered cars and trucks to plug-in vehicles, as well as high-speed rail, is an important part of the plan to wean ourselves off fossil fuels.

However, to accomplish all of the above will require a colossal boost in the production of mined materials, including copper, silver, zinc, nickel, lithium, graphite and palladium.

The move away from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks. Large automakers like Volkswagen, Mercedes Benz, GM and Ford are coming out with new EV models, and are planning new EV manufacturing/ assembly plants in North America and Europe.

US battery and EV plants galore

The metals required include copper for EV motors, wiring and charging stations, permanent magnets that use rare earths like neodymium and dysprosium, and battery metals such as lithium, graphite, cobalt, sulfide nickel and manganese.

Not only do we need to figure out a way to transition from gas and diesel-powered vehicles, but there is also the question of how to fill the batteries demanded by electrification. Creating that energy — mostly solar and wind but also hydroelectric power — involves a massive use of metals to build batteries, battery storage systems, transmission lines and smart grids.

The manufacturing imperative

Despite keeping a lower profile when it comes to commodities consumption than during the last super-cycle, from 2003-11, arguably China will continue to need more commodities than the rest, for traditional infrastructure (roads, bridges, airports, etc.), green projects needing a broad range of electrification/ decarbonization metals, and to feed an expanding, and evolving, manufacturing base.

Some say China isn’t driving the next commodity super-cycle. We beg to differ

Building more highways, railways and airports, the traditional “blacktop infrastructure” are seen as a way to stabilize the economy.

But Beijing is also advocating for so-called “new infrastructure”, including 5G, ultra-high-voltage power transmission, big data centers, industrial internet and artificial intelligence.

Not only has China outspent the United States and led the world on infrastructure investments, it has also worked relentlessly over the past decade to lock up the world’s metals with off-take agreements, creating import dependencies for a number of key minerals in the US and other Western countries.

Think of an important mineral and chances are China controls the mining and/or refining. The list includes rare earth elements, copper, magnesium, lithium, graphite, cobalt and sulfide nickel.

See Bloomberg’s graphic below, based on US Geological Survey data and the Periodic Table of the Elements.

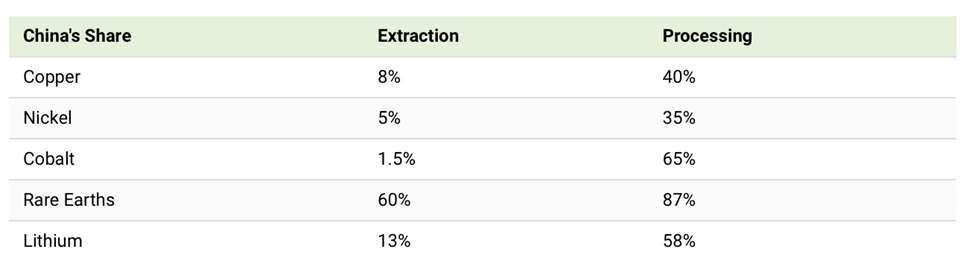

Another graphic by Visual Capitalist used data from the International Energy Agency (IEA) to show that China is the largest producer of most of the world’s critical metals needed for the green revolution.

A mistake is often made in presuming that China mines a lot of these materials. In fact the country has relatively little and instead, has developed sophisticated technology to process them. The country’s share of refining is around 35% for nickel, 58% for lithium, 65% for cobalt and 85% for rare earths.

Conclusion

We weren’t paying attention when China cornered the rare earths market back in 2010, and were also blind to the Chinese locking up global supplies & processing capabilities for nickel, cobalt, graphite and lithium.

Canada’s weak politicians preferred to export raw materials, mostly to China, meanwhile the US and EU went all “NIMBY.” Donald Trump’s solution was to slap China with hundreds of billions worth of tariffs, which did nothing to end China’s metal monopolies, and then along came “sleepy Joe” Biden who claimed Americans need to invest more in infrastructure, sourcing the raw materials from Canada, and a whole host of other much less friendly places, to avoid China “eating our lunch”. Well Joe, the Chinese long ago ate your breakfast, your lunch and your dinner too.

East eats West’s breakfast, lunch and supper

China has already locked up most of the world’s metals, either through the purchase of mines by sovereign wealth funds, taking stakes in existing mines, or signing offtake agreements.

China long ago monopolized rare earths and is the main player in a number of critical minerals markets including lithium, cobalt, graphite, manganese and vanadium.

China has not only run circles around US mining, effectively drawing end-users into a precarious web of import dependence, Beijing has outspent the United States by a long shot and leads the world on infrastructure investments.

US in a competition with China for resources, global influence

China understands that mining is the lynchpin, that enables an economy to move from low-tech producer of inexpensive goods for export, to high-tech manufacturer of goods and services the future world economy needs. Because they have the raw materials.

It won’t be long before westerners wake up to the fundamental truth that he who controls the resources, controls the world. When the realization sets in, that we’ve been snookered, the mad rush to secure what’s left will surely ignite a fire under metal prices.

At Ahead of the Herd we understand what has happened, we know we live in a finite resource world with insatiable demand. We know who owns the world’s resources and that we’re two decades behind trying to play catch up.

And we also know that historically the best leverage to higher metal prices – whether it be gold, copper, silver, nickel or graphite – is to own the shares of junior resource companies who are exploring for, finding and developing the worlds future mines.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.