China copper nudges 3-year high as supply cuts bite – Richard Mills

2024.03.16

A tightening copper market is raising prices and shining a spotlight on copper smelters in China, which have been expanding at breakneck speed leading to a glut in refining capacity that has dropped so-called treatment and refining charges (TC/RC) to record lows.

Smelters lower or raise the amounts they charge for smelting the metal brought to them by mines. Low TC/RCs are good for mining companies who pay less for smelting, but rock-bottom rates can really cut into the profitability of smelters, who may slash output if TC/RCs are too low.

China is the largest producer of refined copper, accounting for 47% of the global total last year. It is also the world’s biggest copper consumer.

Price spike

On Wednesday there was a meeting of China’s major copper smelters on how to cope with a sharp drop in processing fees following disruptions to supplies of mined ore. They stopped short of cutting output, instead agreeing to lower operation rates, adjust maintenance plans and postpone new projects.

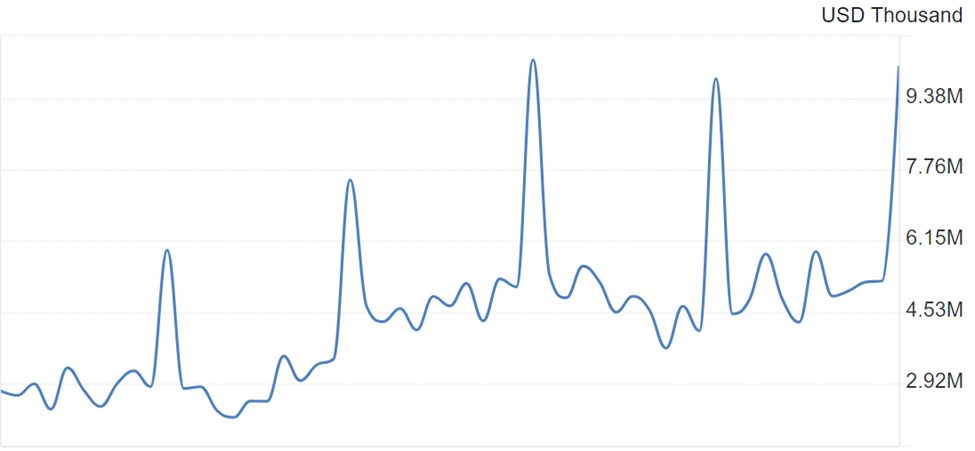

Copper rallied on the decision, and on Friday, the price surge continued, with Shanghai copper hitting a near three-year high, while prices in London touched a 10-month peak. Three-month copper futures on the LME advanced 1.2% to $8,998 per tonne, having hit the highest since April 2023 earlier in the session, Nasdaq reported.

Source: Trading Economics

Supply cuts

Copper gained 5% this week, ending a months-long spell of inertia, as investors hone in on risks to supply at mines and smelters. (Bloomberg, March 15, 2024)

The main catalyst fueling copper’s rally is the expected tightening in mine supplies, driven mostly by last year’s closure of First Quantum Minerals’ Cobre Panama mine. A lot of that supply was bound for Chinese smelters. There are also concerns about output in Zambia, Africa’s second largest copper producer, which is facing a power crisis due to low dam levels.

In Chile, operational challenges (like low ore grades) and water supply issues are affecting mine production, while in Peru, anti-mining community actions are expected to affect mining investments and output negatively. (Economic Times, Jan. 8, 2024)

Demand strong

China is expected to amplify its stimulus efforts, potentially boosting demand for metals, with copper consumption forecast to rise, the Indian newspaper quoted a 2024 commodity outlook report.

Demand from China’s green energy sector, i.e., electric vehicles and power infrastructure, is expected to underpin copper prices.

A November article in Japan Times is bullish on copper, noting that,

Although copper analysts broadly expect a slightly slower expansion in Chinese demand [this] year, China is still likely to outpace the rest of the world as Beijing continues to bolster the economy…

Despite the financial toll of the pandemic and China’s property crisis, the nation’s metals consumption has been relatively strong in 2023. That has probably helped copper stave off an even deeper market slump, with prices only slightly lower than this time [in 2022].

CRU sees copper demand in China growing 5% [in 2023], while Goldman Sachs Group named copper as one of its top commodities picks for [2024] on a “robust green demand environment” — especially in the Asian powerhouse.

China’s smelter expansions

China has been expanding its copper smelting capacity at a torrid pace, as it seeks to shore up security of copper supply amid robust demand due to electrification and decarbonization, and shrinking supply from some of the biggest copper producers including Chile, Peru, Panama and Zambia.

The expansion echoes the history of China’s other metals, such as steel. Until 2006, China was a net importer of steel, but a wave of new capacity eventually led to a flood of exports.

Bloomberg notes the expectation that China’s government will have to curb copper capacity in the future to meets its emissions targets, has accelerated the building of new plants. Local governments are encouraging the construction of new smelters to raise taxes, promote employment and meet Beijing’s growth targets.

According to Wood Mackenzie, smelter capacity last year expanded by 868,000 tons to 12.6 million tons and will rise another 457,000 tons in 2024. This compares with an average addition of 658,000 tons over the previous five years.

In 2023, China’s refined copper output rose 13.5% to a record-high 13 million tonnes.

China will still import growing amounts of copper, but more raw ore than refined metal will cross its docks. The country is the fourth largest copper miner, behind Chile, Peru and the DRC.

Imports of copper ore and concentrate were 9% higher than a year earlier at 27.5 million tons, also a record high, according to official data. (Reuters, March 11, 2024)

According to the International Copper Study Group, China’s copper smelting capacity will increase by another 45% by 2027.

But the expansion of copper refining capacity in China has led to a race for (imported) copper concentrate. When concentrate is scarce, the treatment charges that miners pay smelters to process ore drops.

In February, treatment and refining fees plunged to a record low of $21.90 a ton, following global curtailments at mines, most consequentially the shutdown of Cobre Panama. (Bloomberg, Feb. 5, 2024)

Earlier this month they dropped to the lowest level since 2013, evoking memories of single-digit levels seen in 2010 after the financial crisis.

Stockpiles losing importance

If you needed a lot of copper, and had very little production of your own, what would you do?

I’m thinking you would manipulate the market like crazy trying to get everyone to believe there is a huge surplus instead of a major deficit.

How would you do it? Well, we can look at the last time the Chinese manipulated the copper market. In March 2015 they found every analyst they could and invited them to China. The group was shown a few warehouses stacked with copper to the rooftops. There was so much copper the ground was compacting, said one analyst. Another said the stacks were falling over like dominos. The world bought the surplus story, swallowed it hook line and sinker. Headlines screamed ‘China has enough copper!’

Of course it wasn’t true. China needed 5mt copper, and what they had, all of 2 million tonnes, was tied up in financing deals.

The world continues to get conned. Every year so-called “experts” predict a surplus; instead what happens? Deficit after supply deficit.

We see the copper con on display in a Bloomberg article on Friday. The author dutifully reports:

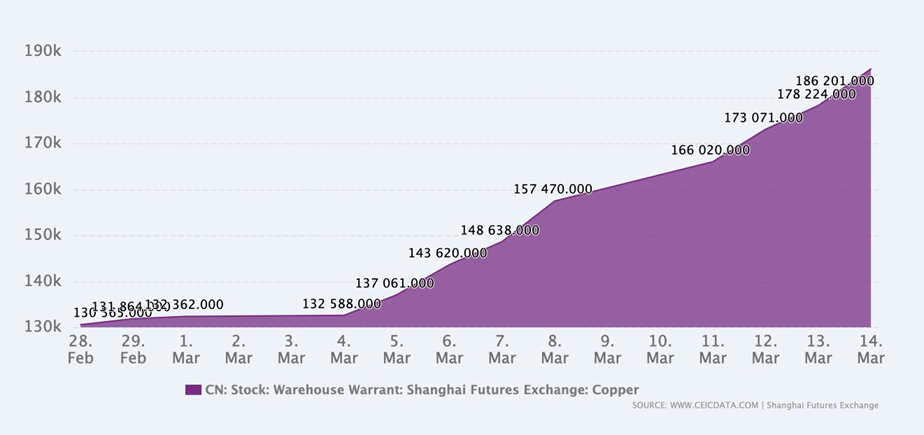

On Friday there were fresh signs that weakness in China’s industrial economy is hitting the copper market too, with stockpiles tracked by the Shanghai Futures Exchange surging to the highest level since the early days of the pandemic.

Indeed the chart below shows China’s copper warehouse stocks on the Shanghai Future Exchange were 186,201 tonnes on March 14, compared to 178,224t on March 13. The all-time high was 246,870t on March 17, 2020 and the record low was 753t on Nov. 7, 2023.

But what do these numbers really mean? In an August, 2023 Reuters article, it states that the combined copper inventory in the Shanghai Futures Exchange and bonded warehouses was 110,314 tonnes on Aug. 11 — equivalent to just under three days of consumption!

So, when Bloomberg reported on Friday that Shanghai copper stockpiles were “surging to the highest level since the pandemic,” all of 186,201 tonnes, in reality this equates to five days consumption! (36,711t = one day’s consumption. 186,201/36,711=5)

More importantly, the trade in copper from warehouses in Shanghai’s free trade zone is no longer the center of gravity of the global copper market it once was.

Copper warehouses were important because Chinese traders used metal as collateral for cheap financing. But in 2022 the flow of metal practically came to a halt when the two dominant financiers of Chinese metals, JPMorgan Chase & Co. and ICBC Standard Bank Plc, halted new business there. An Oct. 23, 2022 Bloomberg article states:

The implications are being felt across the market, as the world’s largest copper consumer becomes more reliant on imports to meet its near-term needs at a time when global stocks are already at historically low levels. The Chinese copper market is at its tightest in more than a decade as traders pay massive premiums for immediate supplies.

Another article written the same month states that:

China’s bonded copper stockpile (so called because metal there is held “in bond,” before import duties have been paid) first came to the world’s attention in the wake of the global financial crisis. When copper prices slumped, Chinese traders bought up all the metal they could find — thanks to Beijing’s massive stimulus plan — making copper the leading indicator of the global economic recovery.

But China wasn’t actually consuming all that copper — at least, not right away. Instead, the traders directed it into the bonded stockpile, using the metal to raise financing…

The money they raised could then be reinvested in other areas, such as the red-hot property market…

At the peak in around 2011-12, China’s bonded stocks held about a million tons of copper, worth some $10 billion. This month, they totaled just 30,000 tons, according to industry consultancy Shanghai Metals Market. That’s down nearly 300,000 tons from earlier this year and the lowest level in decades, according to several Chinese physical traders who have been in the market for over 15 years.

The decline began several years ago, with the massive [above-mentioned — Rick] warehousing fraud at Qingdao in 2014 that caused many banks and traders to reassess their appetite for the Chinese metals industry as a whole.

But it accelerated this year, as China’s economic slump, rising interest rates and several high-profile losses caused more participants to step away…

To be sure, China’s copper imports and production have remained at high levels despite the economic slowdown: the metal just hasn’t been going into bonded warehouses.

Conclusion

Don’t buy the argument that global copper supply is increasing because Chinese bonded warehouses are filling up with it. First, this amount of metal is inconsequential to China’s supply — we’re talking about less than a week’s consumption.

The copper price is driven by the convergence of supply and demand, with lack of new supply being of primary concern.

Reuters reported recently that China’s property sector is showing signs of recovery, including new home prices rising and government land sales turning positive after nearly two years. Nikkei Asia said China’s move to pump about a trillion yuan (USD$140 billion) will act as a further catalyst, boosting copper demand.

Goldman Sachs reported the shutdown of Cobre Panama last year, which canceled an annual 400,000 tonnes of production, combined with lower grades in Chile, has left the copper market prematurely tight. The influential bank is calling for $9,000 a tonne this year, and we’ve already reached it. Truth is, today’s copper price is too low for new mines to be economical. Incentive pricing in the copper industry is considered to be US$11,000 a tonne — much higher than the current ~$9,000/t. Ivanhoe Mines founder, and billionaire Friedland says even $11,000 is too low to incentivize new mines. For that, the market needs $15,000, he said.

A couple of factors identified by us at AOTH indicate that 2024 will be much better for copper. Most important is supply failing to keep up with demand. The second factor is a weakening of the US dollar if market expectations of monetary easing come to pass.

If the Fed cuts rates, the dollar will weaken, as it has done in the past, and will do so again.

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

Yet, the US Geological Survey reports supply from copper mines in 2023 amounted to only 22 million tonnes.

Goldman Sachs, via Oilprice.com, has said it predicts a deficit of over half a million tonnes in 2024 due to mining disruptions. “The supply cuts reinforce our view that the copper market is entering a period of much clearer tightening,” analysts at the bank wrote.

Some of the world’s largest mining companies, market analysis firms and banks are warning that by 2025, a massive shortfall will emerge for copper, which is now the world’s most critical metal due to its essential role in the green economy.

The deficit will be so large, The Financial Post stated, that it could hold back global growth, stoke inflation by raising manufacturing costs, and throw global climate goals off course.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.