Currency

February 20, 2026

By Michael Pento, President Pento Portfolio Strategies The Federal Reserve is a most […]

February 2, 2026

by Noah Smith – Asia Times Gold’s volatility and limited supply might not stop […]

February 2, 2026

From Crescat Capital We think the gold panic on Friday on the announcement […]

January 3, 2026

December 29, 2025

By Wolf Richter – Wolf Street The share of USD-denominated assets held by […]

December 2, 2025

By Marcus Lu – Visual Capitalist The U.S. dollar has steadily lost value over […]

November 16, 2025

By Dorothy Neufeld – Visual Capitalist While global public debt is lower than pandemic […]

October 27, 2025

By John Walter – JohnWalter25.substack The fall of the Western Roman Empire in […]

October 26, 2025

By Adam Clark – Barron’s The boom in companies holding large stocks of cryptos […]

October 23, 2025

By Jamie McGeever – Reuters Even though the $4 trillion global crypto market […]

October 7, 2025

By Nouriel Roubini – interest.co.nz What does the future hold for money and […]

October 4, 2025

By Wolf Richter for WOLF STREET The dollar’s status as dominant global reserve currency just took […]

October 4, 2025

By William Pesek – Asia Times TOKYO — Depending on your vantage point, the […]

August 28, 2025

By Ken Fisher – New York Post President Trump recently said, “Well, you know, […]

July 16, 2025

From YouTube U.S. debt is sitting at more than $36 trillion US — […]

July 14, 2025

By Wolf Richter – WOLF STREET The dollar’s status as dominant foreign exchange-reserve currency has […]

June 30, 2025

From Yahoo!finance A measure of demand in the $7.5-trillion-a-day foreign-exchange market is catching […]

May 30, 2025

From Interchange Financial The Canadian dollar has been quietly gathering momentum—and on Friday, […]

May 27, 2025

By MN Gordon – Economic Prisim The Federal Reserve is up to its old […]

May 19, 2025

2025.05.14 Donald Trump has boldly imposed a new era of US economic policy […]

April 28, 2025

From The Speculative Investor Think back to how bullish almost everyone was about […]

April 23, 2025

From Kitco The U.S. dollar has entered a period of sustained longer-term decline, […]

April 7, 2025

By Wolf Richter for WOLF STREET The status of the US dollar as the dominant global […]

January 25, 2025

From Ancient Origins Theories about the origins of money, one of the most […]

January 23, 2025

By Katharina Buchholz – Statista Looking at trade and transaction data for the […]

December 28, 2024

From Yahoo Finance The dollar is headed for its best year in almost […]

November 24, 2024

By Wolf Richter for WOLF STREET The Dollar Index [DXY] which tracks the USD against a […]

November 22, 2024

By Bruno Venditti – Visual Capitalist The Canadian dollar has fallen to its […]

November 21, 2024

By FXStreet “That said, given two main drivers we outline below, we now […]

November 17, 2024

By Joshua Gibson – FXStreet The Canadian Dollar (CAD) found fresh lows on Friday […]

November 12, 2024

From The Economist In 1971 John Connally, then the American treasury secretary, told his European counterparts […]

November 2, 2024

By Adam Button – Forexlive The US dollar rose 15 pips against the […]

October 9, 2024

October 8, 2024

2024.10.02 US stocks ripped higher on Monday, with all three indexes closing at […]

September 30, 2024

By Wolf Richter for WOLF STREET The US dollar, still the #1 reserve currency held by […]

September 2, 2024

By Alun John and Karin Strohecker – Reuters The dollar fell more than 2% against other […]

August 7, 2024

By MN Gordon – Econimic Prisim If there’s one thing to understand about […]

July 28, 2024

By Marc Chandler – Barrons The dollar’s long-anticipated downturn has begun, but don’t confuse […]

July 27, 2024

By Julia Wendling – Visual Capitalist Monetary policy, geopolitical events, and economic conditions—among […]

May 27, 2024

By Charles Hugh Smith – of two minds Money in all its forms […]

March 14, 2024

By Marcus Lu – Visual Capitalist Have you ever wondered how much U.S. […]

December 20, 2023

By Wolf Richter – WOLF STREET Foreign holders have not kept up buying the the incredibly […]

December 19, 2023

By Niccolo Conte – Visual Capitalist Global government debt is projected to hit $97.1 […]

December 19, 2023

By Daniel Lacalle Although the Federal Reserve and the European Central Bank’s message regarding interest rate cuts […]

December 19, 2023

By Yahoo Finance (Bloomberg) — OPEC’s one-time nemesis — US shale — is […]

December 13, 2023

By Marcus Lu According to the IMF, the most indebted poor countries in […]

December 12, 2023

By Willem H. Buiter – Project Syndicate While proponents of central bank digital […]

December 6, 2023

By James Eagle As the world’s reserve currency, the U.S. dollar made up 58.4% of […]

December 4, 2023

By James K. Galbraith – Project Syndicate Once again, larger deficits and higher […]

November 30, 2023

November 29, 2023

By Gary Wagner – Kitco A major component of today’s strong upside move […]

November 3, 2023

By Alasdair Macleod The day of reckoning for unproductive credit is in sight. […]

November 3, 2023

By Daniel Lacalle According to the U.S. Treasury, year-end data from September 2023 […]

September 15, 2023

By Katharina Buchholz The de-dollarization of the world economy has been thrust back into […]

September 15, 2023

Russia and the Saudis are driving up oil and diesel prices. But these […]

September 12, 2023

By Barry Eichengreen Whether the dollar retains its global role will depend not […]

August 30, 2023

2023.08.30 The US officially has a debt problem, in the present and in […]

August 30, 2023

2023.08.30 美国目前以及未来都正式存在债务问题。截止到目前,美国的国债总额略低于 33 万亿美元,占国内生产总值(GDP)的 122%!然而,更大的问题在于其增长速度,导致利息支付不断膨胀。 根据国会预算办公室(CBO)的预测,未来 30 年的利息支付将达到约 71 万亿美元,并在 2053 年占据所有联邦收入的 35%。 […]

August 28, 2023

By Daniel Lacalle The summit of the so-called BRICS (Brazil, Russia, India, China, and […]

August 27, 2023

By JIM O’NEILL Now that the BRICS (Brazil, Russia, India, China, and South […]

August 16, 2023

2023.08.16 Faced with the grim prospect of falling short of our climate targets, […]

August 16, 2023

2023.08.16 面对达不到气候目标的严峻前景,寻找更多实现电气化和脱碳所需的矿物的竞赛变得越来越重要。 提供整个全球能源行业分析和数据的国际能源署 (IEA) 预测,到 2040 年,用于电动汽车和电池存储的矿物需求将增长至少 30 倍。 锂的增长应该是最快的,在可持续发展情景中,需求增长超过 40 倍,其次是石墨、钴和镍(约 20-25 […]

July 24, 2023

By Goehring & Rozencwajg Incredibly, by 2016 commodity prices had sold off to […]

July 20, 2023

By Egon von Greyerz In spite of unprecedented risks in investment markets, for the […]

July 9, 2023

2023.07.09 We are moving into a multipolar reserve-currency world where the dollar will […]

May 25, 2023

By Naomi Rovnick and Libby George Rivalry with China, fallout from Russia’s war in Ukraine and […]

May 24, 2023

2023.05.24 The US national debt is again in the spotlight, as congressional leaders […]

April 22, 2023

By Julie R. Peasley Can you picture what $31.4 trillion looks like? The […]

April 18, 2023

2023.04.18 The days of paying for something with cold, hard cash may be […]

April 18, 2023

用现金支付的时代即将结束了。疫情加速了我们向无现金经济的过渡,如今消费者更喜欢手机银行或数字钱包的便利性。 皮尤研究中心的一项新调查显示,如今,大约 41% 的美国人表示他们在一周内的购物都不是用现金支付的,高于 2018 年的 29% 和 2015 年的 24%。 据加拿大领先的信用卡和借记卡处理公司 Moneris […]

April 13, 2023

By Alasdair Macleod Increasing numbers of national governments are abandoning the US sphere […]

April 10, 2023

By Patrick Barron The American empire is not enforced by walls with armed […]

April 7, 2023

By Wolf Richter The share of the US-dollar as global reserve currency dropped […]

April 6, 2023

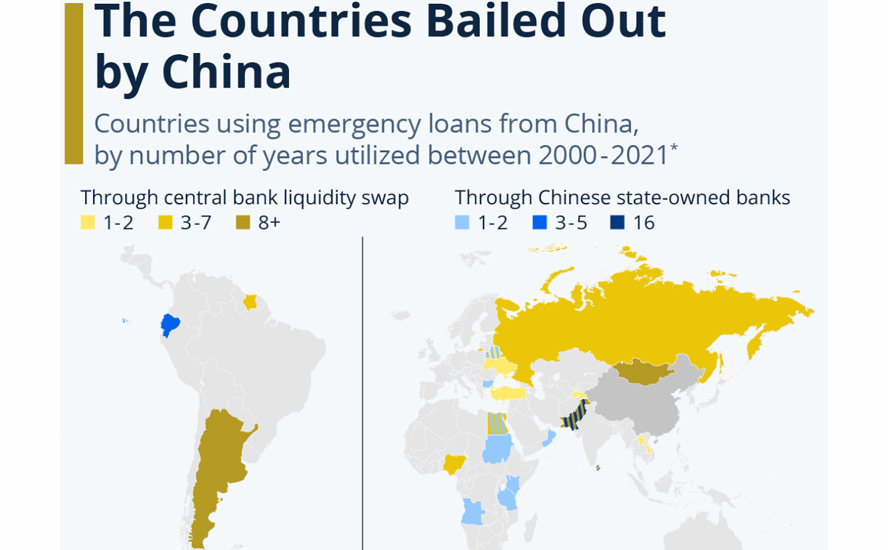

By Katharina Buchholz Bailout amounts provided by China remained quite low in the 2000s […]

April 5, 2023

By Michael Snyder For decades, the U.S. dollar was the undisputed king of […]

March 31, 2023

By Anna Golubova Former Goldman Sachs chief economist Jim O’Neill is calling on […]

March 28, 2023

By Bruno Venditti The U.S. dollar has dominated global trade and capital flows […]

March 26, 2023

By DAVID P. GOLDMAN The US banking system is broken. That doesn’t portend more […]

February 21, 2023

By The Economist After a calm 2010s, in which interest rates hardly budged, inflation is putting […]

February 7, 2023

By Daniel Lacalle 2023.02.07 The monster inflation we’ve endured these past years first […]

January 28, 2023

By Egon von Greyerz 2023.01.28 “The risk of over-tightening by the European Central Bank […]

December 31, 2022

It seems fitting that the year we are expecting to see an unprecedented rise in US government spending and money-printing to spur an economic recovery, marks the 50th anniversary of the end of the gold standard.

Done at the time to fight an economic crisis, we are still feeling the effects of this disastrous decision, five decades on.

In this article, we explain why President Nixon did what he did, and why every promise that unshackling the US government from the requirement of maintaining the dollar's value in terms of gold would mean for the United States, has been broken.

Done at the time to fight an economic crisis, we are still feeling the effects of this disastrous decision, five decades on.

In this article, we explain why President Nixon did what he did, and why every promise that unshackling the US government from the requirement of maintaining the dollar's value in terms of gold would mean for the United States, has been broken.

October 19, 2022

2022.10.19 For more than a year, the US dollar has been gaining strength […]

September 2, 2022

2022.09.02 Russia’s invasion of Ukraine may have the unforeseen consequence of weakening the […]

August 8, 2022

2022.08.08 The US dollar is the most important unit of account for international […]

June 18, 2022

2022.06.18 The dollar is the most important unit of account for international trade, […]

April 29, 2022

2022.04.29 In our last article, we discussed a proposed new economic model for […]

April 27, 2022

2022.04.27 Modern Monetary Theory, or MMT, posits that rather than obsessing about how […]

February 7, 2022

2022.02.07 The United States reached a new milestone this week, but it’s nothing […]

October 15, 2021

2021.10.15 The balance of trade is an important barometer of a country’s economic […]

September 8, 2021

2021.09.08 Lower interest rates and massive asset purchases by central banks are the […]