Cashed-up Norden Crown to continue exploring ‘Broken Hill Type’ silver-zinc-lead deposit in Sweden

2021.07.28

The largest miner in the world, BHP Billiton (in 2018 shortened to BHP) began in the mid-1800s as a merger between two small mining companies, BHP and Billiton.

Billiton’s roots go back to 1851 and a tin mine on the little-known Indonesian island of Belitung, while the first part of the name, BHP, is an acronym of the Broken Hill Proprietary Company, founded on July 16, 1885.

Broken Hill Proprietary’s rich history started at its namesake Broken Hill mining property in New South Wales, a large silver, lead and zinc deposit.

Broken Hill has an interesting history.

In 1875, men drilling on a sheep station struck a lode of silver. The discovery prompted other station hands to look for the shiny metal, and in September 1883, a boundary rider named Charles Rasp found what he thought was tin oxide on an unusually shaped formation known locally as Broken Hill.

Rasp wasn’t a geologist, but he had worked in the chemicals industry in his native Germany, giving him some knowledge of minerals. When Rasp sent samples to Adelaide for testing, the results were disappointing. They came back showing concentrations of lead and zinc but only trace amounts of silver.

Undeterred, Rasp maintained his belief and registered a 40-acre claim on the hill with two co-workers. He received the support of Mt. Gipps sheep station owner George McCullough, who initially was opposed to prospecting on his land, but softened his stance after a drought left the station in poor financial shape.

“At the start it was very bad. There was no accommodation, water and provisions were scarce and the weather was very trying. It was an awfully dusty place. For 12 months it was really doubtful whether we would make anything out of it; I had unlimited faith in it right through. Of course, I did not think it would turn out as big as it has done, but I always thought it would be a fairly good thing.”

- Charles Rasp, Argus, 19 August 1905

McCullough convinced Rasp to take on more partners and organized some of the station hands to peg off claims. Known as the Syndicate of Seven, the men later amalgamated their claims into the Broken Hill Mining Company, the predecessor of BHP Billiton.

As Professor Geoffrey Blaney discusses in a video of BHP’s founding, “They didn’t get all the good ore at Broken Hill, but they got a large part of the cream.”

The National Museum of Australia describes what happened next:

Mining on the Broken Hill was initially not a great success and shares in the enterprise changed hands many times between pegging the claim in 1883 and floating the company two years later. Lind, Poole and Urquhart sold out of the syndicate before the company made any significant finds.

However, in January 1885 the syndicate’s luck changed when Phillip Charley found the first substantial amount of silver on the claim. In the company’s first large-scale smelting in Melbourne an astonishing 35,600 ounces of silver was produced from 48 tons of Broken Hill ore.

Unemployed miners from around the country were attracted by the promise of Broken Hill. Most of the population of Silverton moved there, as did many Cornish miners from South Australia. The town of Broken Hill sprang up at the base of the hill, with Argent Street as its main road. In just six years the population neared 20,000.

The directors made fortunes splitting their shares and floating different companies, and profits flowed on to shareholders.

However, there were challenges: the sheer size of the lode (7.5 kilometres long and 250 metres wide) made the logistics of the operation complex and there were difficulties in finding senior staff qualified to manage the scale of the undertaking.

Despite these difficulties, Broken Hill went on to become the largest single source of silver, lead and zinc in the world. It would eventually generate more than $100 billion.

Fredriksson Gruva

Fast forward to the spring of 2021, when Scandinavia-focused junior Norden Crown Metals (TSXV:NOCR, OTC:NOCRF, Frankfurt:03E) announced the discovery of “Broken Hill Type” mineralization at a prospect within its Gumsberg volcanogenic massive sulfide (VMS) project in Sweden.

VMS deposits are sought after for mining because they usually contain a mix of base metals and sometimes precious metals including zinc, lead, copper, silver and gold. The minerals are often clustered together, making them relatively easy to extract.

The Fredriksson Gruva target is a past-producing Swedish mine originally discovered in 1976.

Based on historical drilling data and 3D modeling, the company projected that the mineralization does not end below historical mine workings, and instead continues, as suggested by regional drilling done by past explorers looking for iron deposits.

The evidence so far is proving this theory correct.

Having completed the first three drill holes, the company has successfully shown not only that the mineralization continues at depth, but that it has qualities consistent with a Broken Hill Type (BHT) deposit.

BHT comparison

BHT silver-zinc-lead deposits constitute some of the largest and highest-grade ore deposits in the world (see Table 4 below). The namesake deposit, Broken Hill in New South Wales, Australia, represents the largest accumulation of lead, zinc and silver on Earth.

Broken Hill Types constitute a distinctive type of stratiform, sediment hosted lead-zinc mineral deposit. They are distinguished from other silver-zinc-lead deposits by the chemistry of the sediment that hosts them, and they are usually associated spatially and temporally with volcanism.

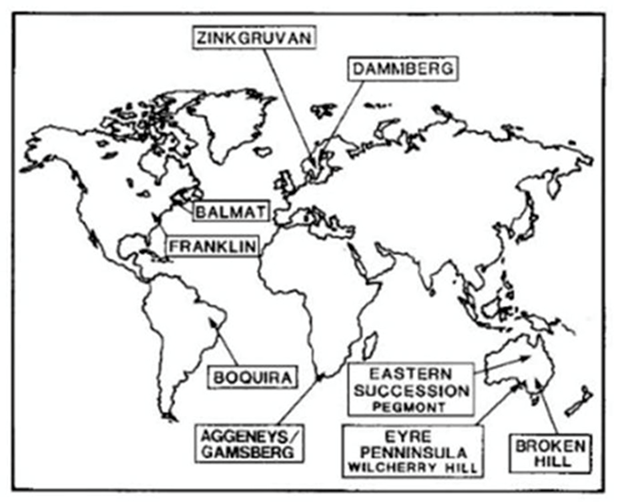

Most of the world’s BHT deposits are concentrated in Australia, Sweden and Africa. The map below shows the main ones.

According to a research paper on Broken Hill Type lead-zinc deposits authored by geologist Robert Beeson, PhD, “Broken Hill-type deposits are major resources and sources of lead, zinc and silver. The large size of some deposits of the type, plus their potential to contain high grades of Pb-Zn, makes them an attractive exploration target. In addition, the metamorphic overprint increases the grain size of minerals and improves processing amenability. In consequence, deposits of this type are currently being mined in five continents.”

There are two settings where mineralization in BHT deposits occurs: in calc-silicate rocks and in banded iron formations (BIF). (most Broken Hill Types contain both calc-silicates and BIF, but usually one is more prevalent than the other)

Examples of the calc-silicate type are the Broken Hill mine in Australia, Zinkgruvan in the Bergslagen mining district of Sweden, currently being mined by Lundin, and the Franklin zinc-iron-manganese deposit in New Jersey, USA.

Banded iron formations known to host Broken Hill Type mineralization include the Dammberg deposit in Sweden which is close to Norden Crown Metals’ Fredriksson target; Gamsberg and Aggeneys in South Africa, Pegmont at Mount Isa, Australia; and Boquira in Brazil.

Back to Norden Crown, the three discovery holes (569m), part of an 11-hole, 2,365-meter diamond drill program at its Gumsberg property, intersected significant (ie. wide, high-grade) mineralized widths ranging from 8.13 to 13.60 meters of precious and base metals massive and semi-massive sulfide mineralization, in a geological setting unique to the BHT clan of silver-rich zinc-lead ore deposits.

“We are delighted to present to our shareholders robust silver-zinc-lead intersections which are part of a bona fide Broken Hill Type mineralizing system at Fredriksson Gruva; the widths and grades intersected beneath the historical mine workings suggest that the Gumsberg Project has exceptional growth potential,” said Patricio Varas, Norden Crown’s chairman and CEO, in the March 1 news release.

“Massive sulphide deposits are special because it is possible to delineate large tonnages from comparatively small drill footprints due to the high density of the mineralization. To put these results into perspective, Norden Crown’s GUM-20-09 intercept is comparable in width to the height of a three-storey building.”

The drill program’s objective was to demonstrate that the mineralization continues below the Fredriksson mine workings, which extend to 91m depth, and to confirm historical silver-zinc-lead grades, thicknesses and continuity.

The findings from the first three holes confirm that Norden Crown is into a Broken Hill Type deposit such as those found in Australia, South Africa and parts of the Bergslagen mining district of southern Sweden where Gumsberg is located.

Reported grades from mined ore are remarkably consistent, and past drilling rarely missed mineralization, which Varas says is very encouraging for further resource expansion.

$2.5M financing

Current and future exploration at Fredriksson Gruva was made possible through a recently closed private placement. Last week Norden Crown announced that 8,625,617 units were issued at $0.30 per unit with gross proceeds of $2.59 million.

Net proceeds from the financing will be used to carry out an airborne magnetic survey, geological mapping, geochemical sampling and a phase 2 step out drilling program at the company’s Fredriksson Gruva discovery, according to the June 24 news release.

Conclusion

The presence of BHT mineralization hosted in banded iron formations could be an important characteristic at Fredriksson to trace and find deposits with the potential for scale — something a junior like Norden Crown Metals must be able to demonstrate to a prospective acquirer. It’s encouraging that another banded iron formation, the Dammberg Zn-Pb-Fe sulfide deposit, is in close proximity to Frederiksson.

CEO Pat Varas and Norden Crown have come across a potential Broken Hill Type deposit in their Fredriksson target, that is the company’s focus going forward. If Norden Crown does indeed have a BHT deposit that we know will be of interest to a major or mid-tier miner, it will be exciting to see them continue to characterize it and delineate it, hopefully to scale, as drilling there continues.

Norden Crown Metals

TSXV:NOCR, OTC:BORMF, Frankfurt:03E

Cdn$0.24 2021.07.27

Shares Outstanding 53,024,478

Market cap Cdn$12.7m

NOCR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown minerals (TSX.V:NOCR). NOCR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.