Cashed-up Dolly Varden Silver gearing up to explore consolidated Kitsault Valley project

2022.05.13

Periods of stock market volatility are difficult even for the most battle-hardened resource investors, but the ones who usually come out on top are those holding quality companies with strong cash positions.

Indeed a soft market is often the best time to buy into a worthy junior – buy low sell high.

Nothing has changed with this investment thesis, the company still has a great property, or properties, with the right metals in the right locations, and an experienced management/ technical team.

The only thing that’s different is the stock price has fallen below the last financing price, having been swept up in the general market correction, making it a screaming bargain for savvy investors.

One of the best examples of a resource stock with staying power, even in the worst of markets, imo is Dolly Varden Silver (TSXV:DV, OTC:DOLLF).

$13M financing

A financing that closed on March 31 saw the company issue 11.274 million flow-through shares, @ $1.02 per share. The brokered private placement netted Dolly Varden approximately $13 million, including $1.5 million from Hecla Canada and $2.5 million from Eric Sprott.

The billionaire resource investor purchased 3,488,200 shares for $2,499,945, increasing his stake in the company from 10.2 to 11.1%.

Proceeds of the financing are expected to be put towards exploration of the Kitsault Valley project, located at the southern tip of the highly prospective Golden Triangle region of northwestern British Columbia.

“By consolidating seven high-grade silver and gold deposits and historic mines with potential development synergies as well as excellent exploration upside, we are on track to be the next pre-development Company, located within an accessible and stable region of B.C.’s prolific Golden Triangle,” said Dolly Varden’s CEO Shawn Khunkhun, in the March 31 news release. “With $26 million in the treasury, we are grateful to existing and new strategic shareholders, including Hecla Mining and Eric Sprott that have supported Dolly Varden’s effort to advance one of the largest undeveloped silver-gold projects in Western Canada. We will announce upcoming drilling strategy and mobilization plans shortly.”

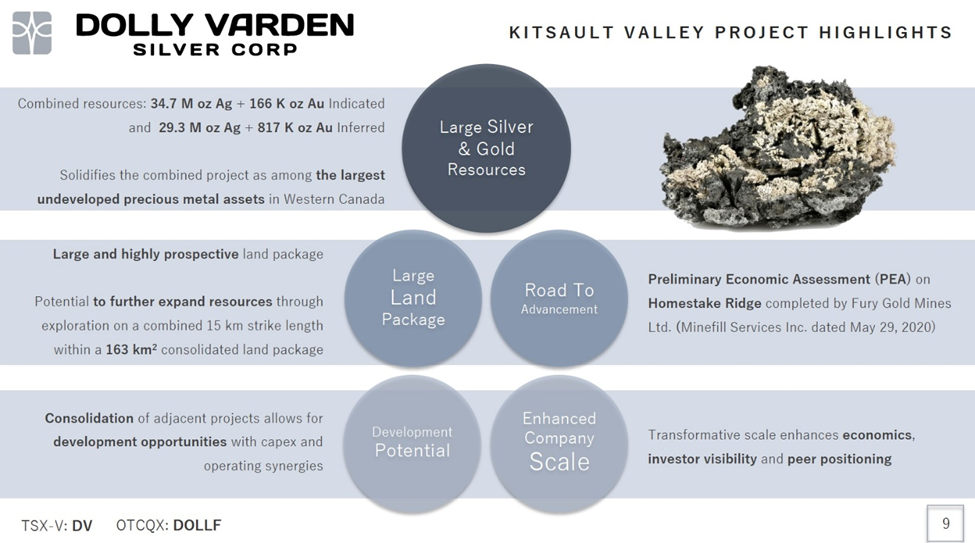

One only has to review the slide below, in DV’s corporate presentation, to understand how undervalued Dolly Varden is right now. Six weeks ago they closed a $13 million financing at just over a dollar per share.

Along with Hecla and Eric Sprott, some of the most experienced mining financiers, including US Global Investors, Delbrook Capital Advisors, Crescat Capital, and Dundee Capital Markets, had the confidence in Dolly to buy shares at a buck. Since then, DV’s stock price has been cut in half, not by anything Dolly has done, but simply being caught up in market palpitations.

Only 8% of DV’s stock is owned by retail investors, the rest is held by Sprott (11%), Fury Gold Mines (33%), Hecla (10%) and institutional investors (38%). These are long-term investors that likely will not sell just because we have entered a market downturn almost 100% caused by the Federal Reserve’s plan to raise interest rates to fight inflation.

They, like us at AOTH, know that all downturns eventually come to an end. When the Fed realizes it can no longer keep raising interest rates and that rates are high enough to deal with inflation (the latest CPI numbers already show a decline), the markets will bounce back and many beaten-down junior resource stocks will make gains.

If ever there was an opportunity for retail investors to take a position in Dolly Varden Silver, that time is now, when the shares are worth half of what some of the greatest minds in the business were willing to pay.

A junior doesn’t want to go to the markets during a downturn to raise funds, and Dolly Varden shouldn’t have to. The company is sitting on CAD$26 million in cash, which should easily cover this year’s exploration expenditures and next year’s too.

These factors make Dolly Varden one of only a few bright spots in an otherwise dim junior resource market. This argument is bolstered by the company’s recent consolidation of the high-grade Homestake Ridge gold-silver project, located next to Dolly Varden’s namesake project in the Golden Triangle, through the acquisition of Homestake Resource Corporation, a subsidiary of Fury Gold Mines (TSX:FURY).

Kitsault Valley project

Following the $50 million transaction, the Homestake Ridge and Dolly Varden projects were amalgamated into one single project known as Kitsault Valley, with a combined mineral resource base of 34.7Moz silver and 166,000 oz gold indicated, and 29.3Moz silver and 817,000 oz gold inferred.

This combination makes Kitsault Valley one of the largest high-grade, undeveloped precious metal assets in all of Western Canada.

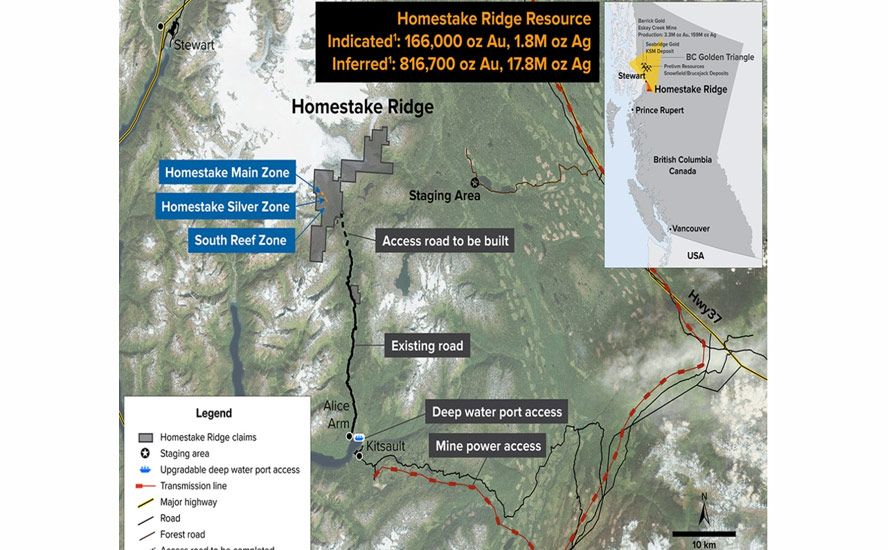

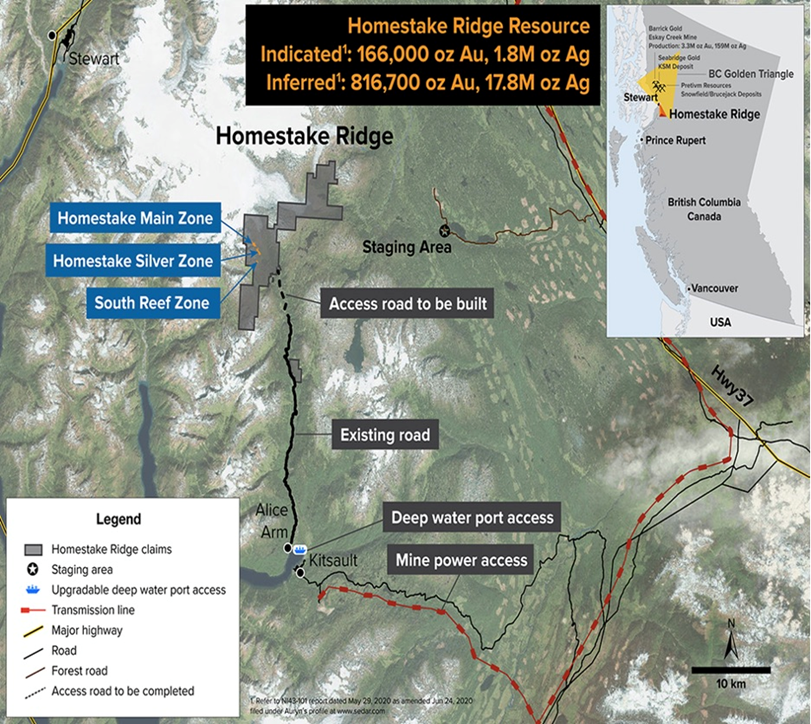

Homestake Ridge covers a 7,500-hectare land package contiguous to and northwest of the Dolly Varden property, which comprises 8,800 hectares (88 sq km) in the Stewart Complex of northwestern BC, known to host base and precious metals deposits.

An updated NI 43-101 resource estimate completed by the company in 2019 revealed 32.9Moz silver in indicated resources and 11.477Moz inferred, for a total of 44Moz Ag, all adjacent to four historical deposits — Dolly Varden, Torbrit, North Star and Wolf.

Homestake Ridge hosts an estimated resource of 165,993 oz gold and 1.8 million oz silver in the indicated category, plus 816,719 oz gold and 17.8 million oz silver in the inferred category.

Conclusion

Dolly Varden Silver continues to return high-grade silver results from the southern end of the highly mineralized Golden Triangle — one of only a few pure-play silver districts in the world, and the largest such project in all of Canada.

The first batch of drill assays from 2021 saw silver grades exceeding 1,500 grams per tonne; the latest assays, the first of 21 drill holes left to report, returned assays up to 1,220 g/t.

In the summer, when DV returns to the property, we expect to see continued investigation of the Dolly Varden project targets, including the Wolf Vein extension and Western Gold-Copper belt.

Also likely to be a priority is the connection between the Dolly Varden and the Homestake Ridge properties.

With a share price cut in half from the March 31 buy-in price of $1.02, Dolly Varden Silver imo is extremely undervalued. The company is fully cashed up for at least the next two exploration seasons, it doesn’t have to go to the market to raise funds, and it will soon be putting out news, making DV one of only a few bright spots in a beaten-down junior resource sector.

We know the market is soft but there are always 5 to 10% of companies that will stand out from the others; we believe DV is one of those. With $26 million in cash, a share structure 92% held by mining companies, Eric Sprott and institutional investors, and the recent consolidation of seven high-grade silver & gold deposits and historical mines, we continue to regard Dolly Varden as among the best exploration companies in the sector, one whose shares just happen to be on sale.

Dolly Varden Silver Corp.

TSX.V:DV, OTC:DOLLF

Cdn$0.50, 2022.05.11

Shares Outstanding 230m

Market cap Cdn$115.2m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSX.V:DV). DV is a paid advertiser on his siteaheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.