Boreal Metals advancing Scandinavian Projects

2020.10.14

Before the famous Broken Hill ore deposit was first discovered in Australia during the 1880s, few could imagine that such lead-zinc deposits could even exist on Earth.

Since then, it has almost become a “gold standard” in base metals mining, with explorers rushing to every corner of the world to replicate that kind of geological triumph.

One region that has been renowned for its lead and zinc production is Sweden, where companies like Boliden and Canada’s Lundin Mining have enjoyed success for decades.

A junior resource company that recently joined the fold is Boreal Metals Corp. (TSXV:BMX), which set foot in the Scandinavian nation after acquiring the silver-zinc-lead-gold Gumsberg project, along with the Burfjord copper project in Norway, from Eurasian Minerals Inc. (now EMX Royalty Corp.) back in 2017.

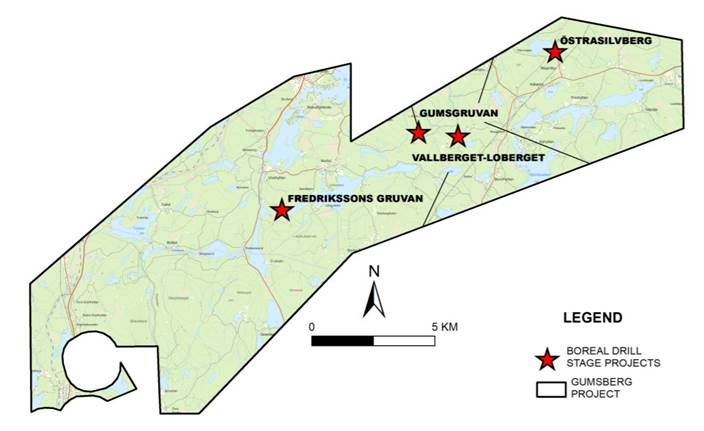

Boreal recently began a soil survey on the past-producing Fredriksson mine (Fredriksson Gruva in Swedish), one of the four drill-stage prospects at Gumsberg (see map below).

With a private placement and debt financings both secured back in August, the company is now fully locked in and accelerating exploration activities on the Gumsberg property, beginning with the Fredriksson prospect.

A major part of Fredriksson’s appeal lies in its resemblance to Broken Hill-type lead-zinc-silver deposits, remarks Boreal chairman and CEO Patricio Varas.

Aiming to deliver on the potential of another Broken Hill-type discovery, Varas says his company is committed to advancing the project to the drill-testing stage, along with two other past-producing areas in Östra Silvberg and Vallberget-Loberget.

Thus far, a total of 112 soil samples have been collected at Fredriksson. These were collected at 15-25 cm below the organic horizon across three test lines with an average sample station spacing of 15 m and average line spacing of 100 m, with analysis and results on the way.

Another area that should see increased activity is the Östra Silvberg prospect, where Boreal plans to expand the Östra Silvberg South discovery.

Drilling at Östra Silvberg by the company between 2017 and 2019 returned significant high-grade intercepts, including: 10.94 m of 656.7 g/t Ag, 16.97% Zn, 8.52% Pb and 0.76 g/t Au, as well as 11.01 m of 275 g/t Ag, 7.45% Zn, 2.65% Pb and 0.77 g/t Au.

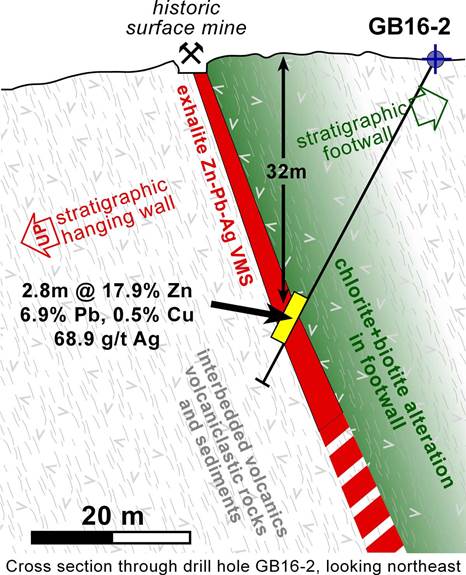

The four holes drilled along the 2 km long Vallberget-Loberget trend in 2016 also intersected significant intervals of mineralization (2.8 m of 17.9% Zn, 6.9% Pb, 0.5% Cu and 68.9 g/t A; and 3.0 m of 9.2% Zn, 3.0% Pb and 12.8 g/t Ag), demonstrating that multiple horizons of exhalative VMS style mineralization are present in the stratigraphy and contain interbedded zones of replacement style mineralization.

The Gumsberg Project

Located in the Bergslagen province of southern Sweden, Boreal’s Gumsberg project consists of five exploration licenses covering over 18,300 hectares, over which multiple zones of volcanogenic massive sulfide (VMS) style mineralization occur.

The project is situated in the renowned Bergslagen mining district, which has had a rich mining history with activity dating back to as far as the 13th century through to the 1900s.

In fact, the region has hosted over 30 mines throughout the course of history, the most notable of which was the Östra Silvberg mine: the largest silver mine in Europe between 1300 and 1590. However, despite the long-lived production history within the district, relatively little modern exploration has taken place on the Gumsberg property.

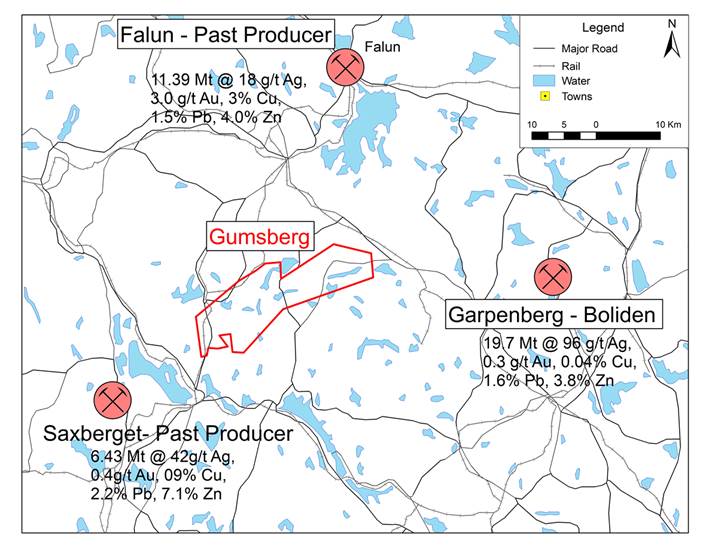

The project is also in good company, enveloped between the past-producing Falun and Saxberget mines and what is currently considered the world’s most productive underground zinc mine in Garpenberg, owned by Swedish mining giant Boliden (see figure below).

Furthermore, Gumsberg is in close proximity to Lundin’s Zincgruvan mine, which has been in continuous production since 1857.

New geologic interpretations, geophysical surveys and reconnaissance drilling by Boreal and partner Eurasian Minerals have led to the identification of multiple exploration targets, near the historic workings.

Fredriksson Mine

More often than not, the future prospects of an exploration project are dictated by its past success.

Boreal’s current focus at Gumsberg is the Fredriksson target, a past-producing mine originally discovered in 1976, when surface trenching, sampling and nine diamond drill holes identified precious metal enriched base metal mineralization.

Test mining conducted by the previous owner produced 21,000 tonnes grading 53 g/t Ag, 5.13% Zn and 1.7% Pb from an open pit, and subsequently 45,000 tonnes grading 49 g/t Ag, 5.77% Zn and 1.84% Pb from underground workings.

Boreal later staked the Fredriksson prospect as part of a larger staking acquisition in March 2017. This licence is referred to as “Gumsberg West“ and forms the western half of its Gumsberg project.

Burfjord Copper Project

As diversification is key to any mining portfolio, the Gumsberg project is not the only project that Boreal is working feverishly to advance.

Exploration is also underway at the company’s Burfjord copper-gold project in Norway, comprising a total of six exploration licenses covering 5,500 hectares. The project is located 32 km west of the Kåfjord copper mines, the first major industrial enterprise north of the Arctic Circle.

Mineralization at Burfjord belongs to the Iron Oxide Copper Gold (IOCG) deposit clan; this portion of northern Fennoscandia is a key IOCG province globally. IOGC deposits are among the most valuable concentrations of copper, gold and uranium ores in the industry. The orebodies can range from around 10 million tonnes of contained ore to 4 billion tonnes or more, with grades of 0.2 to 5% Cu and 0.1 to > 3 g/t Au.

High-profile examples include BHP’s Olympic Dam complex in Australia and the Candelaria undeveloped copper-gold deposit in Chile.

Copper was mined in the Burfjord area during the 19th century, with over 30 historic mines and prospects developed along the flanks of a prominent 4 by 6 km anticline. Boreal believes that many of the rocks in the anticline are intensely hydrothermally altered and contain sulphide mineralization.

However, only limited exploration has taken place at Burfjord in the modern era. Previous drilling confined to the vicinity of Cedarsgruve mine produced intercepts including 7 m at 3.6% Cu.

In the spring of 2019, Boreal released more compelling drill results from Burfjord, including an intercept of 32 m averaging 0.56% Cu and 0.26 g/t Au (including 3.46 m of 4.31% Cu and 2.22 g/t Au) at shallow depths below a group of historic mine workings.

“The fact that it was over 30 metres wide gives you a sense there is bulk tonnage potential for a larger deposit,” said Boreal chief Varas when explaining the significance of these results.

“The occurrences you see are expressions of a larger system. The deposit for all I know could be buried and so the idea here is to go and find perhaps one large deposit within all of these areas,” he added.

Boliden JV

Though exploration is still at an early stage, Burfjord’s geological and economic potential has not gone unnoticed.

Boreal recently joined forces with Boliden to develop this project together, with the latter agreeing to fund the entirety of the ongoing exploration program with a planned spending of US$6 million over the next four years.

This joint venture would allow Boreal to unlock the potential of its Burfjord project with the technical input and financial backing of one of Europe’s top mining firms. Meanwhile, Boliden would be able to earn up to a majority stake in the project should all pieces fall into place, a win-win situation for all parties involved.

The current exploration program at Burfjord consists of geological mapping focused on the widespread hydrothermal alteration, lithology and structural controls on gold and copper mineralization. It will also entail detailed geochemical sampling, as well as geophysics including EM and a property-wide airborne magnetic survey.

Conclusion

As we enter the fall season, more news will surely be released from Boreal’s exploration programs in the Scandinavian Peninsula, a region no stranger to producing base metals in the past.

The fact that the company has not one but two promising projects in the region warrants the attention of established players in the industry, as seen with the recent Boliden option deal.

More work is yet to be done, but the vote of confidence from an US$8 billion market cap company is certainly a good start.

Boreal Metals

TSX-V:BMX

Cdn$0.10 2020.10.12

Shares Outstanding 133,075,785m

Market cap Cdn$13.3m

BMX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Boreal Metals (TSX.V:BMX). BMX is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.