Bernie Sanders, new Budget Committee Chair, vows to ram spending bills through Senate with simple majority

2021.01.26

The Democrats have turned the tables on the Republicans in the Senate, vowing to use their razor-thin majority to pass legislation, including trillions in new spending, favoring the party’s “progressive-left” agenda.

On Sunday Bernie Sanders, the hard left-leaning Vermont Senator and Democratic presidential candidate who lost to Joe Biden in the primaries, said the Senate Democrats would use a tactic known as budget reconciliation, to pass key parts of Biden’s agenda, if Republicans refuse to support his plans.

That is a very real possibility.

For months, Democrats in the Republican-controlled Senate saw their efforts to pass a second coronavirus stimulus package stymied by the GOP. The Trump administration had proposed a $1.8 trillion package in October but that was rejected as insufficient by Democrats led by Speaker of the House Nancy Pelosi. After much back and forth, the considerably watered-down legislation, worth $900 billion, was passed at the end of December.

Now, Democrats refuse to let the Republicans in the Senate, led by obstructionist Senate Majority Leader Mitch McConnell, turned Minority Leader on Jan. 21 following President Biden’s inauguration, call the shots.

The 78-year-old veteran senator from Kentucky has long decried the “big government” programs Biden highlighted during his campaign, including a jobs plan tied to climate-friendly infrastructure. As Majority Leader, McConnell was able to stop bills from even coming up for a vote.

The political matrix, of course, has changed.

Results from the hotly contested Nov. 3 election have Democrats retaining control of the House of Representatives, albeit with a slimmer majority, winning the White House, and dominating the Senate. Results from two run-offs in Georgia earlier this month saw both Republican candidates losing to Democrats, effectively giving the Dems control of the upper chamber — votes tied at 50-50 will be broken by Vice President Kamala Harris.

With majorities in the House and Senate, Democratic leaders now have the opportunity, just as the Republicans did before them, under Trump, to use the special legislative process known as reconciliation, to quickly advance high-priority fiscal legislation. In effect, that means making such legislation exempt from “the filibuster”, a political tactic whereby members of Congress engage in lengthy debate over a proposed bill to delay or prevent a decision.

It would also mean less Republican support (ie. normally 10 more votes) would be required to pass some of their big priority bills.

In the Senate, reconciliation bills aren’t subject to filibuster (debate is limited to 20 hours) and there is limited scope for amendments, compared to bills that fall under general Senate rules. Moreover, the upper chamber only needs a simple majority (ie. 51 votes) to pass a reconciliation bill, versus the 60 votes needed for most types of legislation. According to the Center on Budget and Policy Priorities, “The Congressional Budget Act permits using reconciliation for legislation that changes spending, revenues, and the federal debt limit. On the spending side, reconciliation can be used to address “mandatory” or entitlement spending.”

The decades-old Senate rule has been used to overcome the legislation-stalling filibuster, including key provisions of Obamacare health reform, and Trump’s 2017 tax cuts. As the CBC points out, even when the Democrats had a six-seat Senate majority, they were unable to pass relatively popular gun-control reform, due to Republicans’ use of reconciliation.

The Dems will have the chance to use the tactic in a few weeks, when Congress considers President Biden’s nearly $2 trillion covid-19 stimulus package. The proposed legislation is favored by both Sanders, who will chair the Senate Budget Committee, and Patrick Leahy, another Vermont senator, who will head the Senate Committee on Appropriations, which controls spending for government agencies and departments.

Biden’s American Rescue Plan is centered on robust spending to attack the coronavirus pandemic.

Among the key elements of the $1.9 trillion proposal are larger stimulus checks; more aid for the unemployed, hungry and those facing evictions; additional supports for small businesses, states and local government; and more funding for vaccinations and covid testing.

Republican fears realized

As far back as 2016, high-profile Republicans such as Sen. Lindsey Graham and Congressman Paul Ryan warned their party of what would happen if the Democrats won the Senate.

“If we lose the Senate, do you know who becomes chair of the Senate Budget Committee? A guy named Bernie Sanders. You ever heard of him?” the now-retired Ryan, then speaker of the GOP-controlled House, quipped at the time.

The committee is one of the most powerful in Congress because it controls the money. Fox News reports that Sanders has been creating a new stimulus package that could include an emergency universal health care program, so that anyone can get medical treatment during the pandemic, whether they currently have insurance or not. Sanders advocates strongly for a $15 minimum wage, something that is included in Biden’s $1.9 trillion plan soon to be considered by Congress.

“We are proposing to raise the minimum wage so that people can earn a living wage. The American people are hurting very badly, what do the American people want Lindsey? They want us to create jobs, they want us to repair a crumbling infrastructure and create millions of jobs,” Sanders said in 2013 on CNN Crossfire.

He now says that he will use the budget reconciliation process to “boldly address the needs of working families.” Speaking on CNN’s State of the Union, Sanders warned the GOP had set a precedent by using this tactic to side-step the 60-vote threshold needed for most legislation, while Trump was in office.

“Now, as you know, reconciliation, which is a Senate rule, was used by the Republicans under Trump to pass massive tax breaks for the rich and corporations. It was used as an attempt to repeal the Affordable Care Act. And what we’re saying is ‘You used for that. That’s fine. We are going to use reconciliation… You did it. We’re going to do it to protect ordinary people, not the rich and the powerful,’” said the Vermont senator, who often evokes powerful emotions from supporters and detractors alike.

“The American people are hurting, and they want us to act,” he continued, adding,

“We have got to restore the faith of the American people in government that we can respond to their pain.”

Sanders and Sen. Elizabeth Warren, another left-wing Dem, who also campaigned to be the Democratic presidential nominee, have both warned Republican lawmakers not to stall the next stimulus relief package, and that they will use their majority “aggressively.”

“I think we should reach out to Republicans. But if they choose not to come on board, which I suspect will probably be the case, we have the majority. We should use that majority in a very aggressive way,” Sanders said on Late Night with Seth Meyers,via Newsweek:

“I’m going to be chairman of the [Senate] Budget Committee, which handles what we call ‘reconciliation.’ That is a Senate process by which you can pass not all kinds of legislation, but a whole lot of very important legislation with a majority vote and not 60 votes. And it is my view, we should make sure that we address the needs of the American people in that reconciliation bill — and if we pass it with 51 votes, we’ll pass it with 51 votes.”

Meanwhile, in a story published Saturday, Warren told The Washington Post: “It’s important that Democrats deliver for America. If the best path to that is to do it in a way that can bring Republicans along, I’m all in favor of that. But if Republicans want to cut back to the point that we’re not delivering what needs to be done, then we need to be prepared to fight them. Our job is to deliver for the American people.”

Republicans, naturally, are reacting to this rhetoric with alarm. Nikki Haley, Trump’s former ambassador to the UN, tweeted, “Time to face the harsh reality, socialist Bernie Sanders will become the chairman of the Senate Budget Committee. He has vowed to use his position to enact his progressive agenda on healthcare, climate, infrastructure spending, and cutting defense spending.”

Guarding their majority

Reconciliation isn’t only a strategy used by Democrats to pass expensive social programs and by Republicans to block them.

Biden may be the oldest US President to take office, and look it, but he is also a wily Washington insider who spent decades in the Senate. He better than anyone knowns how to get and maintain control of Congress; reconciliation is part of a bigger plan by Democrats to retain power, by guarding their majority.

Although the Dems retained controlled of the House and won the Senate, their majority in both is thin. Down-ballot, the GOP actually did quite well. In the House, the Republicans trail the Democrats by 11, but their majority is less than during Trump’s term. The GOP gained 13 seats to the Democrats’ gain of three, and lost only three seats while the Dems lost 12. To pass legislation in the Senate, every single Democrat must vote ‘yay’, and Vice President Kamala Harris has to show up to cast the winning majority vote. (of course she will — suggestions she will be too busy fulfilling her VP duties are hogwash)

Biden’s problem, is if he lets an obstructionist Senate get in the way of what he needs to do, in terms of spending his way out of the pandemic, firstly, and secondly, fulfilling the lengthy wish list of demands from the party’s left wing, he will get tossed out on his ear, just like President Clinton was. Obama managed to get back to back terms but he was blocked practically every step of the way by a Republican-controlled Congress.

Biden only has two years to ensure his majority holds firm; that’s when the next election cycle takes place. During the 2022 mid-term election year, all 435 seats in the House of Representatives, and 34 of the 100 Senate seats will be contested.

There’s no way around it — if the 46th President wants to have any control over the legislative agenda during his term, and have a shot at a second mandate, he is pretty much forced into engaging in the kind of off-the-charts spending we described in our last article.

MMT Adventure

With Sanders, Leahy and Warren in charge of the Senate, and Congresswoman “AOC” in the background, Democratic lawmakers will have little to no concern regarding the already out of control $28 billion national debt, courtesy of Modern Monetary Theory, or MMT.

MMT is a new way of approaching the US federal budget that is both unconventional and absurd. It posits that rather than obsessing about how large the debt has grown and the ongoing annual deficits that fuel debt, we should focus on spending, specifically, how the government can target certain spending programs that will cause minimal inflation. Fiscal policy on steroids is, according to its proponents, to be the new engine of US growth and prosperity.

Government is therefore given a free pass on spending, because the only thing that we have to worry about with the national debt is inflation. Curb inflation and the debt can keep growing, with no consequences. This is because the US government can never run out of money. It just keeps printing it, because dollars are always in demand (with the dollar being the reserve currency, and commodities are traded in dollars).

MMT and the ideas of the Democratic Party’s far left fit like hand and glove. Pleas for universal medical coverage, free college tuition and a minimum $15 per hour wage can all be paid for by setting the money presses free.

When Biden’s $1.9 trillion is bolted onto the $3.5 trillion in coronavirus spending already spent, it brings the total to $5.4 trillion — an amount greater than the entire federal budget for fiscal year 2020, set at $4.79 trillion. Also worth comparing is the $1.8 trillion of fiscal stimulus spent in 2008 during the Great Recession, equivalent to 2.4% of GDP, compared to 2020’s relief legislation, which is estimated to cost about 3% of GDP over the next four years.

In tallying up the amount of stimulus thus far, we should also mention the trillions in tax breaks given by the Trump administration to the richest 1% of Americans and multinationals. The genesis of this giveaway was the 2017 Tax Cuts and Jobs Act, under which corporate taxes were lowered from 35% to 21%. The controversial legislation took trillions in profits held offshore, and gave the ultra-rich and multinationals a tax holiday to bring the profits home. According to Forbes, in 2018 the 400 wealthiest Americans made history by paying less tax than any other group. That same year, at least 60 companies reported their federal tax rates amounted to effectively zero, or less than zero, on income earned on US operations. Among the tax laggards, enabled by Trump’s $1.5 trillion tax cut, were Amazon, Netflix, Chevron, Eli Lily and John Deere.

This loss of income to the federal government has to be made up for somewhere. For Joe Biden, the answer is to create new money, that will never be paid back. Why even bother raising taxes? Just crank up the printing presses.

Completely separate from government spending to cushion the economic blow from the pandemic, is money printed by the US Federal Reserve. All of the emergency actions taken so far by the Fed amount to $7.3 trillion. According to the Committee for a Responsible Federal Budget (CRFB), that includes central bank purchases of securities, municipal and corporate bonds, new loans to banks, and emergency facilities like the Main Street Lending program.

If we include this new money, we get $12.7 trillion, which works out to around three years worth of US government spending. It should be stated that Janet Yellen, a former Fed Chair who is President-elect Biden’s nominee to run the Treasury Department, fully supports the new government’s spending priorities.

“Neither the president-elect, nor I, propose this relief package without an appreciation for the country’s debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big,” Yellen said in a prepared opening statement for her recent hearing before the Senate Finance Committee.

Beyond the United States, similarly huge checks are being written by governments intent on containing the economic damage wrought by covid-19.

In China, where the virus originated, the central bank last March reduced the mandatory reserve ratio among Chinese banks, freeing up 50 billion yuan, or about USD$7.7 billion, to support the economy. This was followed in May by a stimulus package worth $0.675 trillion. Another half-trillion was issued in local government bonds, plus a combined $280.5 billion anti-virus special government bond, to be transferred directly to prefecture and county governments.

In Europe, among the countries worst affected by covid-19 were Spain and Italy. Last July, EU leaders agreed on a €750 billion recovery effort, called Next Generation EU, to help the EU tackle the crisis. Combined with €540 billion of funds already in place for the three safety nets (workers, businesses and member states), the EU’s initial recovery package amounted to €2,364.3 billion, or USD$2.8 trillion. In December, the trading block which now excludes Great Britain, agreed to deploy another €1.8 trillion (USD$2.1 trillion) in funding, including €1.1 trillion for the EU’s normal seven-year budget and the rest for stimulus spending in economies cratered by the pandemic.

Across the English Channel, the British government has had to dig deep into its coffers to find the money for covid relief. According to the BBC, the government in 2020 budgeted £280 billion (USD$381B) on measures to fight covid-19 and its impact on the economy, including £73 billion for paying the wages of furloughed government workers. To fund the huge stimulus package, the government of Prime Minister Boris Johnson will have to borrow £394 billion, which is the highest figure ever seen outside of wartime. Before covid, the British government only expected to borrow about £55 billion for the year.

Rounding out the global stimulus totals — obviously not an extensive list — are Australia, Canada and Japan. According to KPMG, the Australian government provided AUD$257 billion in direct economic supports, with the 2020-21 budget committing a further $98 billion. This includes $25 billion in direct covid-19 response measures and $74 billion in new measures to create jobs, bringing the government’s overall support to $507 billion, or USD$389.9 billion.

In Canada, the CBC reports the Trudeau Liberal government spent CAD$240 billion fighting covid in the first eight months of the year, an average of $952 million per day. In November, total government spending on the pandemic was pegged at $322 billion (USD$252.6B) for the fiscal year ending March 31, 2021, including newly pledged funds and budgeted amounts yet to be spent.

The Japanese government has so far committed about $3 trillion to help the economy recover from its pandemic-induced slump. Reuters reports the country is considering a fresh round of economic stimulus, as a state of emergency in Tokyo is expanded to seven more prefectures, amid a surge in infections.

From this brief analysis, we see the global spending on covid — about $23 trillion thus far — is getting stupid, which is why, we believe, you should own silver and/or gold.

Conclusion: got gold?

Gold may have come off the boil after rising above $1,900 an ounce in the aftermath of the US election — in our view, $1,860 is still pretty hot, historically — but the precious metal, and its sister silver, will do very well under a Biden presidency, an Ahead of the Herd analysis has found.

The main factors are drastically increased government spending, leading to even more unsustainable US debt levels than currently, along with rising inflation; dovish monetary policy as the Federal Reserve continues to advocate near 0% interest rates; and a sinking US dollar. Gold prices and the USD generally move in opposite directions.

The Democrats winning the White House and both Houses of Congress is bound to be good for both metals because of Biden’s propensity to add to the debt.

If you think the nearly $28 trillion national debt is too high now, it will go even higher under a Biden administration (with all the forecast spending, the debt will most certainly reach $30 trillion over the next few months).

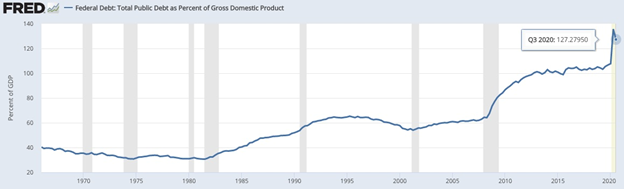

In an earlier article we showed the close relationship between debt-to-GDP ratios and gold. The lower the GDP and the higher the debt, the better it is for gold.

Beyond covid-19 expenditures, we know that Biden is putting clean energy at the center of a US$2 trillion plan to decarbonize American electricity in 15 years, and create a net zero-emissions economy by 2050.

Biden has signaled he will embrace central concepts of the “Green New Deal” — a program first espoused by New York Congresswoman, and Democratic wing-nut, imo, Alexandria Ocasio-Cortez. (“AOC” will reportedly serve on a panel helping Biden to develop climate policy.)

Dubbed “Clean Energy Revolution”, Biden’s plan calls for installation of 500,000 electric vehicle charging stations by 2030, and would provide $400 billion for R&D in clean technology.

Republican critics contend that his clean energy and climate strategy, stripped down from its AOC-inspired origins to be more palatable to voters on Nov. 3, could end up costing as much as $93 trillion.

The President has promised nearly $5.4 trillion in other new spending over the next decade, according to the University of Pennsylvania’s Penn Wharton Budget Model, including $1.9 trillion on education and $1.6 trillion on new infrastructure — roads, bridges, highways and other public structures.

The Biden administration will allow the International Monetary Fund (IMF) to provide a new allocation of Special Drawing Rights to all its member countries; US$2 trillion is the number being considered.

Biden is also going to rejoin the Paris climate agreement. This entails two huge commitments, reducing US greenhouse gas emissions, and to provide financial assistance to vulnerable developing countries.

As the chart below shows, the federal debt to GDP ratio as of Dec. 22, 2020, was 127.2%. The amount borrowed by the federal government has now exceeded the size of the economy.

With overseas investors like China and Japan continuing to gobble up US Treasuries, and zero interest rates likely to remain in place for the foreseeable future, allowing the federal government to keep borrowing to pay for more stimulus, the debt to GDP ratio will almost certainly go higher.

In fact, it’s likely the ratio will spike to $150%, or 200%, meaning for every dollar the US economy produces, it has to borrow $1.50, or $2.00. That’s insane. Of course, the profligate spending promised by Biden will only exacerbate the debt problem, which extends beyond the United States. The current global debt level is a whopping 320% of world GDP.

But there is a more immediate challenge facing Biden, the Fed and other central banks, that continue to shovel money into their moribund economies: inflation.

The idea among some gold bears, that the Federal Reserve is going to raise interest rates anytime soon, to combat inflation, is absurd. Fed Chair Jerome Powell has already said that the Fed is prepared to let inflation run above its normal 2% target “for some time”, which also means that interest rates are likely to remain low for the foreseeable future.

We know that negative real interest rates, when the 10-year Treasury yield minus the inflation rate “goes negative”, are always good for gold. Clearly, investors prefer to hold bullion when they are getting a negative return from government bonds. With the 10-year last quoted at 1.05%, and inflation running at 1.4%, we already have negative real rates.

Though inflation in the US is still subdued, there are signs it is creeping up. Consumer prices rose solidly in December, Reuters reported on Jan. 14, and import/export prices recently jumped 1% in a month.

Food prices are rising, so are the prices of several mined commodities, including zinc and copper, in part due to output restrictions and mine closures owing to covid-19. Upstream, a lot of manufacturing capacity has been lost, meaning higher finished good prices.

We already see commodity prices hitting five-year highs across the board, whether it’s industrial metals or agricultural commodities. Economist Peter Schiff thinks “by the end of 2021 we could see prices of commodities hit record highs.”

As our previous analysis has mentioned, gold prices and the US dollar generally move in opposite directions.

It looks as though the only direction that the greenback is headed is down thanks to the US Federal Reserve’s policy changes to accommodate lower interest rates and slightly higher inflation.

Many believe that the dollar, which fell to a 2.5-year low last year, will continue to face downward pressure in 2021 regardless of how the covid situation unfolds.

Alex Kimani, writing for Safe Haven, goes further than that, stating that the buck could stay low for years, based on three factors: a strong euro, a dovish Fed, and more government stimulus.

A cheaper dollar, naturally, will be welcomed by many US companies because it makes their goods more competitive abroad. CNBC adds that the dollar is also likely to fall due to the market viewing geopolitical risks to be lower with a Biden win, and the fact that US trade policy will probably become more predictable, without escalating tariff threats. (investors tend to move their funds into US dollars, or USD-denominated assets like Treasuries, in the event of destabilizing events like trade wars, civil unrest or military confrontations)

Put it all together, and we come to the inevitable conclusion that cash is trash in the hands of the Democrats. The only way for Biden to save his presidency and for the Dems to retain control over both Houses of Congress is for them to print and spend money hand over fist. Tens of trillions (the US has already spent nearly $13 trillion including Fed interventions on covid) will be thrown at the pandemic, “green” and regular “blacktop” infrastructure, Green New Deal investments in electrification and carbon reduction, upping the minimum wage, universal health care, massive give-aways to address poverty, you name it, it’s coming.

Prices are going to go up as the dollar loses purchasing power due to all the new money that the Fed prints to monetize all the debt the Treasury sells to finance the spending. The only way to protect yourself from the money-printing mayhem and further currency debasement that is about to ensure? Buy gold and silver, or even better, shares in junior resource stocks that historically, offer the best leverage against rising precious metals prices.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.