Arcology publishes source code on GitHub to gain feedback from blockchain community

2021.02.20

2021 could be the year that cryptocurrency finally hits the big leagues in the global financial landscape.

Earlier this month, Tesla announced it bought $1.5 billion worth of bitcoin for “more flexibility to further diversify and maximize returns on our cash,” according to CEO Elon Musk. The electric vehicle maker also said it will start accepting payments in bitcoin in exchange for its products, making it the first major automaker to do so.

Many believe this move by Tesla could open the floodgates for other big firms to join the foray into the crypto market. One analyst from RBC specifically mentioned Apple, stating that it would be a “no-brainer” for the iPhone maker to develop its Apple Wallet into an exchange similar to Coinbase.

With digital currencies led by bitcoin en route to mainstream adoption, market interest from both retail and institutional investors has skyrocketed, driving the total value of cryptocurrencies past the trillion-dollar mark.

Bitcoin, which has taken the finance industry by storm, saw an 80% gain since the new year. Its rival Ethereum enjoyed an even bigger gain, up nearly 160% year-to-date.

The long-term viability of bitcoin et al., however, is largely connected with the technology behind the crypto mania: blockchain.

Blockchain Revolution

The rise of cryptocurrencies has made blockchain a household name.

By definition, a blockchain is defined as “a decentralized, distributed, and oftentimes public, digital ledger consisting of records called blocks used to record transactions across many computers.”

This means a blockchain is resistant to modification of its data, because the data in any given block cannot be altered retroactively without modifying all subsequent blocks. Simply put, blockchain offers enhanced security and greater transparency, making it the ideal network for financial transactions; hence, the birth of cryptocurrency.

In theory, by changing how we view and handle “money”, blockchain technology could revolutionize the global economy in many ways. Over recent years, there has been enormous interest in the technology and its potential to upend countless industries, from fintech and real estate to gaming and social networking.

Corporations like IBM are already making big bets on blockchain, placing confidence in the technology’s potential value in areas such as financial services, shipping and healthcare.

New analysis from PwC showed that blockchain technologies could boost the global economy by US$1.76 trillion over the next decade through raising levels of tracking, tracing and trust.

Gartner estimates that blockchain will generate as much as US$3.1 trillion in new business value by 2030, but the technology is already set for more mainstream adoption as early as 2023.

Arcology Ecosystem

While the idea of using a blockchain-powered network for business transactions excites industry participants, offering a glimpse into the “economy of the future,” the technology itself remains unproven in the real world.

Even with years of development and billions in funding, the current market leaders are still unable to compete with yesterday’s technology.

For blockchain to fulfill its many promises, we must solve some of the key problems faced with decentralized platforms such as speed, scalability and security.

Recognizing these problems are what make blockchain systems such as Ethereum inefficient and costly to deploy, a team of developers has invented a radically new way of looking at blockchain with the Arcology ecosystem.

Codebase Ventures Inc. (CSE:CODE) (FSE:C5B) (OTCQB:BKLLF), prized investment holding – Arcology.

Arcology is the first systemic solution in the world to address all the common challenges faced by blockchain technologies today.

As a revolutionary blockchain system, Arcology is designed to compete with market leaders like Ethereum that employ smart contracts to host decentralized apps for finance, gaming and other commercial sectors. At the moment, these other platforms are facing serious performance issues and high costs, both are major barriers to any type of mainstream adoption.

“We haven’t seen a lot of exciting applications on other blockchain networks to date,” Arcology founder and CEO Laurent Zhang said, adding that:

“The primary reason is because the benefits of blockchain have not outweighed the weaknesses of the technology as it presently exists. Arcology has been designed with the belief that once it does, it will change how the world works.”

Moving Beyond Ethereum

According to the Arcology team, for widespread applications ultimately, blockchain technology must be measured in transactions per second.

“Financial institutions require a standard of approximately 250,000 transactions per second; we see that as a key figure, measuring system power and representing a real-world target for our new blockchain technology,” CEO Laurent Zhang stated back in 2019.

The team at Arcology advanced the technology to move beyond sequential ordering for the processing of transactions.

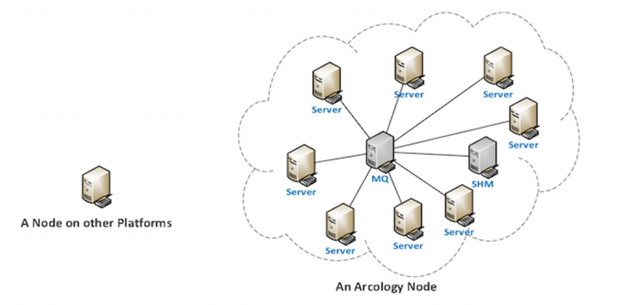

While other blockchain technologies process individual transactions one by one, Arcology is designed to use parallel processing, meaning that thousands of transactions are processed in batches at a time in a distributed, network-wide system to achieve the system power required to deliver the rate of transactions per second for real world applications.

“For servers having multiple cores, serial processing means only one core can work at a time, other processing cores simply stay idle, it is a huge waste of computation power,” Zhang explained,

“The problem is understood throughout the blockchain industry and it is recognized that parallel processing is the only answer to the problem. However, the biggest obstacle hindering parallel processing is avoiding potential conflicts among these transactions. This becomes even more complicated when dealing with smart contracts, whose internal processing logic is pretty much unpredictable before execution,” he said.

According to Zhang, the Arcology team has developed an effective solution to solve this critical problem. When transactions are processed in fully parallel mode on the Arcology network, any conflicts will be detected and caught in real time.

After three years in development, Arcology has achieved several of its internal targets along the way.

Results of the first testnet — Testnet 1.0 — released last fall demonstrated Arcology’s compatibility with market-leading blockchain ecosystems including Ethereum, and supported management’s claim that Arcology can outperform Ethereum et al. for both speed and scale.

This was followed up by January’s announcement that Testnet 2.0 was successfully deployed. As expected, Testnet 2.0 confirmed Arcology’s ability to provide stable throughput and improved user experience and verification.

The launch of Testnet 2.0 marked an important step toward the planned public release of Arcology’s Mainnet, which is tentatively scheduled for summer 2021.

Public Code Debut

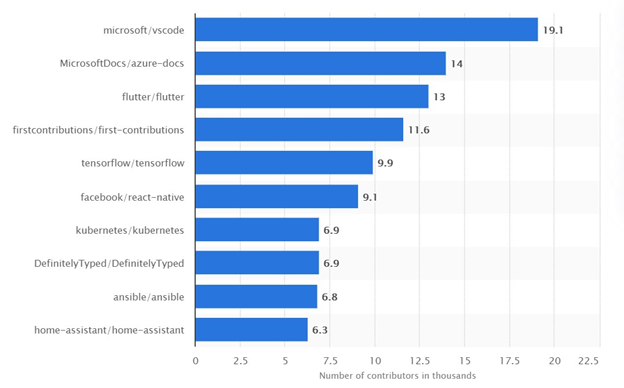

Building on the successful results from tests to date, Codebase Ventures announced this week that Arcology has published a portion of its source code on GitHub.

GitHub is currently the largest Internet hosting provider for software developers with a contributor base of over 56 million worldwide. It provides access control and several collaboration features such as bug tracking, feature requests, task management and continuous integration for every project.

For years, the GitHub service has been used by Microsoft to host many of its open-source projects and development tools.

The public release of this code demonstrates the team’s confidence and commitment to openness, and broadcasts that they welcome feedback by third-party developers and other experts in the blockchain community.

“With trust and transparency so important to the blockchain community, it’s critical that Arcology operate fully in the open,” Arcology founder Laurent Zhang stated in the Feb. 15 press release. “That’s why this is such an important step. We look forward to creating a community of active developers who will build their applications with us.”

In addition to portions of Arcology’s source code, the GitHub repository includes the benchmark suite that was featured in earlier tests. As a live production repository, Arcology’s code will be revised and updated frequently as the team releases new features.

The debut of its source code on GitHub moves Arcology further along its 2021 roadmap, which includes a full-scale testnet and the launch of the mainnet. A potential coin offering is also in the work.

Conclusion

The latest development from Codebase Ventures’ (CSE:CODE) (FSE:C5B) (OTCQB:BKLLF) prized investment holding has caught the attention of investors.

Following the Feb. 15 announcement, shares of Codebase Ventures exploded to an all-time high, with the stock price more than doubling. This shows the level of optimism investors have for this new blockchain technology.

The team at Arcology is building an industrial-grade platform that will scale at unprecedented speed by reducing costs and increasing enterprise capabilities.

Having officially announced itself to the global Internet community via GitHub, Arcology is now in pole position to take the blockchain community by storm.

Codebase Ventures Inc.

CSE:CODE, FSE: C5B, OTCQB:BKLLF

Cdn$0.70, 2020.02.19

Shares Outstanding 46,123,011m

Market cap Cdn$32.2m

CODE website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard does not own shares of Codebase Ventures Inc. (CSE:CODE). CODE is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.