Africa, Bolivia becoming important in race to lock up lithium supply – Richard Mills

2023.07.11

The race is on to score lithium, the crucial electric vehicle battery ingredient, as China pivots to sources from Africa, and Bolivia signs agreements with Russian state-owned nuclear firm Rosatom and China’s Citic Guoan Group, to develop its huge, untapped resources of the light-weight metal.

According to Benchmark Mineral Intelligence (BMI), to meet demand, the global lithium industry needs to invest up to $42 billion by the end of the decade. This works out to $7 billion each year from now until 2028, helping it to meet predicted demand of 2-4 million tonnes per annum by 2030, which is 15 times higher than the 130,000 tonnes of lithium produced in 2022.

Bloomberg notes the forecast, from a recent BMI report, comes as Europe and North America look to reduce their dependency on Chinese lithium imports and try to develop their own lithium production.

The Biden administration has earmarked billions to help process key battery metals including lithium.

Electric cars are expected to account for nearly 80% of EV market revenues and 83% of battery demand over the next two decades.

Annual spending on EVs reached $388 billion in 2022, up 53% from 2021, according to a report published by BloombergNEF. The total value of electric vehicles sold to date in the passenger vehicle segment has now crossed $1 trillion. 2023 sales are likely to top $500 billion.

Albemarle executives quoted by Reuters warned of the “potential for significant deficits” by the end of the decade without new mines and processing plants.

According to the US Geological Survey, six mines in Australia, one mineral tailings operation in Brazil, two brine mines each in Argentina and Chile, and three mineral and two brine operations in China, accounted for the majority of world lithium production in 2022.

While lithium prices have come off the boil compared to the record 600,000 yuan per tonne (USD$87,365) high set in November, the bull run is likely not over yet, with a deficit forecast for 2023.

Source: Trading Economics

New supply is ramping up but experts say it won’t be enough to catch up to demand.

Fastmarkets previously forecast a small surplus in 2023 but this has been revised to a deficit because of increased battery demand and some expected supply disruptions. The introduction, in the United States, of the Investment Reduction Act, has resulted in Fastmarkets upgrading its forecast for battery electric vehicle (BEV) sales by 80% in 2023 and 107% in 2024.

Mine supply could increase by 35%, year on year, to 984,000 tonnes, mostly fueled by Australia and China, but Fastmarkets is predicting a 2023 deficit of about 14,000 tonnes lithium carbonate equivalent (LCE).

Africa

China has previously turned to Africa for supplies of iron ore, copper and cobalt, to name just a few metals. Now, Chinese producers of lithium products are adding investments in raw materials supply from Africa. According to a Bloomberg story and graphic, planned mining and/or refining capacity is being sought in Mali, Ethiopia, Zimbabwe and the Democratic Republic of Congo (DRC).

Another graphic shows the growing significance of African supply, with all of the above nations except Ethiopia expected to join the ranks of top lithium producers through to the end of the decade.

“It is a sure thing that Africa will play an important role for China,” particularly as an alternative source of raw materials to Australia, currently the top supplier and where exports could be constrained as domestic refineries come online, said Peng Xu, a Beijing-based analyst for BloombergNEF.

According to S&P Global Commodity Insights, African mines are forecast to increase production of lithium more than 30-fold from last year’s volume by 2027, by which time the continent will account for 12% of global supply compared to just 1% in 2022.

Diversifying supply sources will boost China’s efforts to defend its dominance in EV metals processing, Bloomberg notes.

Chinese investments in African lithium are already bearing fruit, with a first shipment of lithium concentrate reaching Zhejiang Huayou Cobalt last month from a Zimbabawe project; Chengxin Lithium Group starting production at its Sabi Star lithium mine, also in Zimbabwe; Ganfeng Lithium investing in the Goulamina mine in Mali; a unit of CATL backing a project in the DRC; and Sichuan Yahua Industry Group holding a stake in a project in Ethiopia.

Bolivia

There is currently no lithium produced in Bolivia, despite hosting the Salar de Uyuni salt flats, estimated to contain over a quarter of the world’s known reserves.

That could be changing soon, thanks to recent agreements the Bolivian government signed with Rosatom, Russia’s state nuclear firm, and China’s Citic Guoan Group. Reuters reports the deals, which envisage a total investment of $1.4 billion, follow a similar agreement in January with Chinese battery maker CATL, another potential win for Beijing in its efforts to lock in supply of the metal used in electric vehicles.

Bolivia’s Minister of Hydrocarbons and Energy, Frank Molina, said the agreements mean the South American country will be able to produce 100,000 tonnes of lithium carbonate in 2025 from its iconic salt flats, which according to the US Geological Survey, host the largest lithium resources on the planet at 21 million tons.

Molina told Reuters the investments would allow the construction of two direct lithium extraction (DLE) processing plants in the towns of Pasto Grande and Uyuni Norte, where at least 45,000 tons of lithium carbonate would be produced per year…

Russia’s Rosatom, which bid via its Uranium One Group unit, confirmed the news, saying it would invest $600 million in the project, its first large-scale lithium venture overseas, with planned annual capacity of 25,000 tons of lithium carbonate…

Molina said Citic Guoan would invest $857 million and would also “look at investing in battery plants and the installation, possibly with technical studies, of a vehicle assembly plant…”

Meanwhile, the lithium nationalization bombshell dropped earlier this year by Chile is good news for North American lithium miners, that are likely to become more important as potential suppliers of the white metal needed for making lithium-ion batteries used in electric cars and trucks, as well as energy storage and an array of consumer electronics.

The development could also further pressure electric vehicle makers, who are scrambling to secure lithium supplies.

If Chile is unable to provide the needed lithium, and with China and Russia being the ones to develop Bolivia’s Salar de Uyuni, it could give fresh impetus to finding new sources of the metal.

Canada doesn’t currently produce lithium, but hosts about 2.5% of the world’s lithium deposits. According to Natural Resources Canada, the country has an estimated 2.9 million tonnes of lithium resources, in the measured and indicated category.

Similarly, the US mines and processes only 1% of the world’s lithium, according to the US Geological Survey. However, within its borders are 1 million tons of lithium reserves, ranking it among the top five countries in the world. In the less certain resources category, the US has 12 million tons, including continental, geothermal and oilfield brines, claystones and pegmatites.

While there is just one lithium mine in operation, Albemarle’s Silver Peak, a lithium brine operation located outside Tonopah, Nevada, many lithium juniors are exploring for the white metal in the Silver State.

Victory Battery Metals

One of my favorites is Victory Battery Metals (CSE:VR, FWB:VR61, OTC:VRCFF), exploring for lithium not only in Nevada, but Quebec and Ontario.

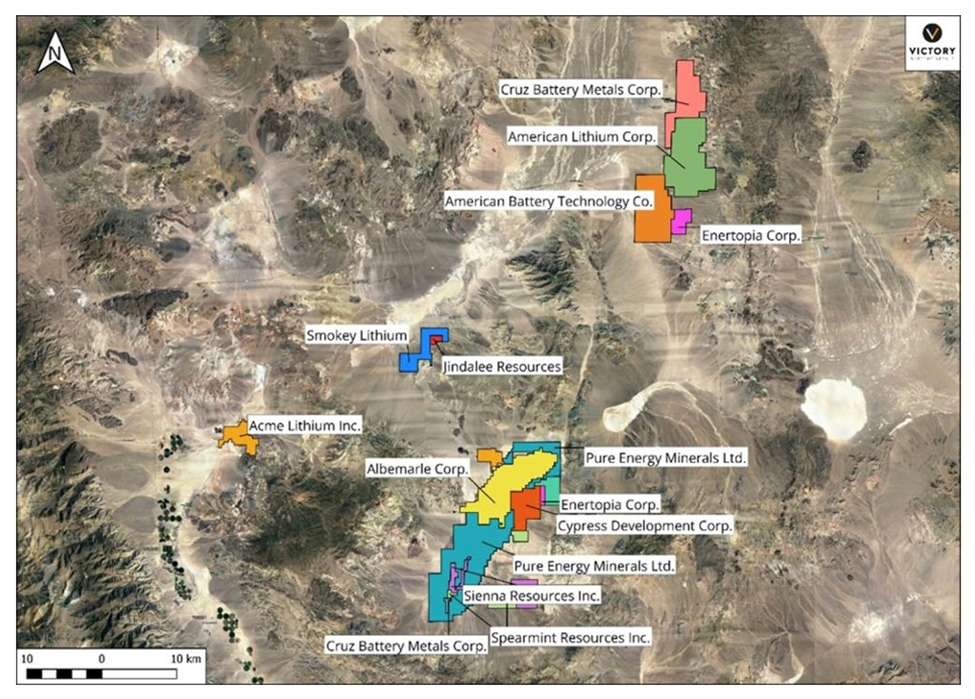

Its Smokey lithium property lies approximately 35 km north of Clayton Valley, and 32 km west of American Lithium’s TLC project, within the Big Smokey Valley, NV.

It is also in Esmeralda County, a prolific region for very large-tonnage lithium clay deposits with grades up to and exceeding 900 ppm. These include Noram Ventures (166Mt @ 900 ppm), Century Lithium (formerly Cypress Development, 593Mt @ 1,032 ppm), American Lithium (495Mt @ 1,000 ppm), Spearmint Resources, Enertopia and Jindalee Resources.

The project is in close proximity (35 km) to North America’s only producing lithium mine, Albemarle’s Silver Peak. Smokey also surrounds Jindalee’s Clayton North lithium prospect on three sides, with excellent access and relatively flat ground.

According to a June 26 news release, Victory’s Phase 2 drill program at Smokey, completed in May, demonstrated high-grade lithium claystone mineralization over significant widths, with diamond drill hole 23-01 comparing favorably to American Lithium’s high-grade in-fill drill results from its TLC claystone lithium deposit, back in 2019.

Remember, TLC is only 32 km east of Smokey.

Using a 600 ppm Li cutoff, Table 1 below shows a 33.8 meter interval grading 1,149 ppm Li, and a 25.8m interval @ 1,267 ppm Li.

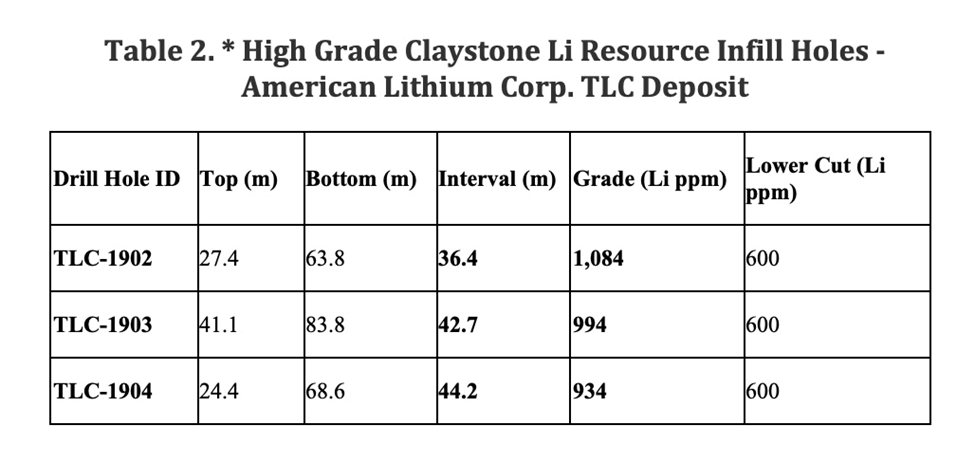

Three holes at American Lithium’s TLC project, located within the same Esmeralda formation as Smokey, returned 36.4m of 1,084 ppm Li, 42.7m @ 994 ppm Li, and 44.2m @ 934 ppm Li.

Victory is now planning to define the subsurface extensions of the thick claystone interval reported in drill hole 23-01. A geophysical approach will be taken to map basement faults and potentially conductive claystone units to outline the depth and continuity of favorable thick high-grade lithium claystone units present on the property prior to the next phase of drilling.

“Victory’s Geology team has is very encouraged by these preliminary results, noting that these types of deposits do not exist in isolation. As noted on June 12th, our team has expanded the Smokey Lithium ground in response to the drill program findings and analysis. Going forward our team is focused on defining the main body of this deposit,” Victory’s President and CEO Mark Ireton stated in the June 26 news.

In addition to Victory’s excellent drill results from Smokey, the company on June 29 said it also has work programs and analysis in full swing at its Georgia Lake and Tahlo Lake properties, and is preparing to launch an initial work program at its Stingray property array in Quebec, which is adjacent to Patriot Battery Metals’ Corvette lithium discovery.

At Stingray, an initial geological reconnaissance program is planned for this summer, the main focus to be on Victory’s claims underlain by a belt of greenstone belt which parallels the greenstone belt underlying the Corvette property to the north.

At its Georgia Lake lithium project in the Thunder Bay district of northern Ontario, Victory notes that much of the property appears to be underlain by relatively thin overburden that should be amenable to till/soil sampling.

A previously unmapped intrusive was encountered at the southeast corner, indicating that the property has not been thoroughly evaluated.

Regional mapping indicates the prospective intrusive rocks trend towards the property from both the east and the west. These rocks are often recessive or covered by diabase — an intrusive igneous rock with the same mineral composition as basalt — so they could easily have been missed during previous mapping.

The property is 1.8 km east of Rock Tech Resources’ advanced-stage lithium project within the Georgia Lake lithium district, which has a proven track record of economic lithium deposits dating back to the mid-1950s.

In the district, pegmatites bearing the lithium mineral spodumene occur almost entirely within metasediments, usually spatially associated with mica-bearing granitic rocks. Historical regional mapping indicates that Victory’s Georgia Lake property is largely underlain by metasediments.

Victory Battery Metals Corp.

CSE:VR, FWB:VR61, OTC:VRCFF

Cdn$0.04, 2023.07.07

Shares Outstanding 66m

Market cap Cdn$3.10m

VR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Victory Battery Metals Corp. (CSE:VR). VR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.