Aben’s three new discoveries at Forrest Kerr opens up the possibility of a stacked north-south mineralized corridor

2018.11.03

Aben Resources (TSX-V:ABN) continues to rock their 2018 drill program with a new discovery announced Thursday morning at the Forrest Kerr property in “The Golden Triangle” of northwestern British Columbia.

Aben investors and those who have been following the story know that earlier this month, the first hole of the program was a darling, featuring jewelry-box style mineralization (ie. exceptionally high-grade gold) at the North Boundary Zone.

Hole FK-10, the first of eight holes drilled during the first batch of the current 5,000m program, intercepted four separate high-grade zones all within 190 meters downhole. The hole was drilled 35 meters northwest of discovery holes FK17-04, 05 and 06 from last summer, containing high-grade copper and decent gold grades – which Aben minted the North Boundary Zone.

Hole 10 significantly increased the North Boundary Zone of precious and base metal mineralization, according to ABN’s Aug. 9 press release. The highest-grade zone assayed at a whopping 331 grams per tonne (g/t), or 9.65 ounces per tonne, over 1.0m, within a broader zone of 38.7 g/t over 10m. The results from other high-grade zones in the discovery hole included 22.0 g/t gold and 22.4 g/t silver over 4.0m, 4.0 g/t silver over 13.0m, and 8.2 g/t gold with 1.4 g/t silver over 6.0m. The hole was drilled 230m north of a high-grade historic hole drilled by Noranda in 1991, which hit 326 g/t gold.

Now, enter Thursday’s press release announcing the South Boundary Zone. But first, a little background. When Aben started this year’s drill program, the aim was to expand the mineralization at North Boundary.

According to Aben, this part of the Forrest Kerr property hosts gold-silver-copper in rock and soil anomalies that span over 2 km by 4 km. The zone’s mineralization remains open in multiple directions with numerous soil geochemical anomalies and geophysical targets currently being drill-tested.

In July, Aben announced the first five holes hit mineralization. While assays at that point had not yet been released, Aben hinted that it looked similar to what they found last year in the three discovery holes at North Boundary:

These holes have transected rock that has been strongly altered with quartz-sericitepyrite with variable chlorite and strong calcite and hematite throughout. The pervasive nature of the alteration is evidence toward the strength of the hydrothermal system that operated through time in this part of the Property. Several fault and shear zones have been encountered in each hole, which have been interpreted and observed as the likely host to Au-Ag-Cu mineralization.

However the mystery closely guarded by Mother Nature at Forrest Kerr is hidden within the drill core. It’s not visible to the naked eye. So while last year’s three hits at North Boundary showed clear evidence of chalcopyrite – the copper mineral – it wasn’t until the assays came back that Aben knew it also had relatively high-grade gold intersections. Hole 4 averaged 0.26 grams per tonne (g/t) over 387m (the best hit was 18.9 g/t over 3.0m) and hole 5, drilled slightly deeper, showed 21 g/t over 6.0m.

The same goes for the drill program this year. While the core from hole 10 – the bonanza-grade hole announced on Aug. 9 – contained fault and shear zones likely to host copper, gold and silver, it wasn’t until the assays from the first hole came back that Aben knew it had hit pay dirt (ie. multiple high-grade zones).

“The high-grade gold and base metal values in the first hole of the 2018 drill program have far exceeded our expectations and confirm the presence of a robust and strong mineralizing system at the recently discovered North Boundary Zone,” said Jim Pettit, President and CEO of Aben Resources, in the Aug. 9 press release. “We are now looking at an area that extends 230m south to the historic high-grade Noranda drill hole from 1991 and although the geology is complex we believe more drilling will delineate additional high-grade mineralization. The target areas in and around the Boundary Zone are relatively shallow and continue to provide strong discovery potential as we look to value-add the project using a systematic exploration methodology.”

The theory

Earlier this year Aben’s VP Exploration Cornell McDowell told Ahead of the Herd that there is a large hydrothermal system with alterations of quartz, sericite and pyrite spread over several kilometers. The gold and silver mineralization is often associated with high-grade copper over the tested intervals but has not had a distinctly epithermal (near-surface) nor mesothermal (deeper) geochemical signature, nor does it display typical porphyry deposit characteristics.

“I call it intrusion-related because there is widespread hydrothermal alteration with both volcanic and plutonic rocks present that likely acted as drivers to the system. We know that what we’ve seen so far is likely fault controlled or structural controlled because it looks like a breccia zone in a shear system,” McDowell said prior to this year’s drill program.

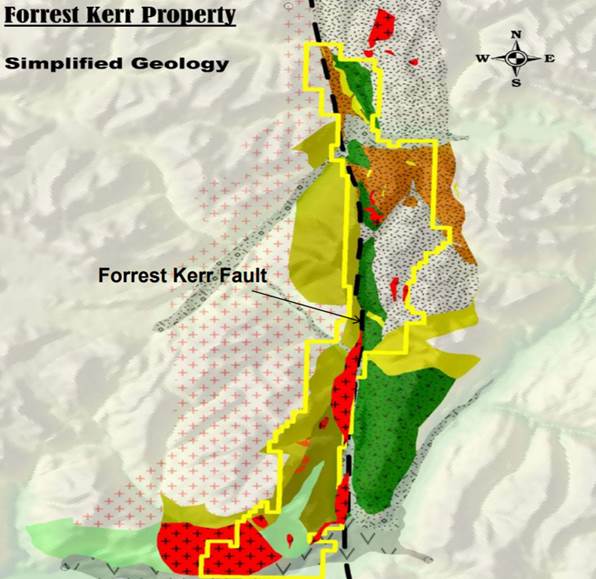

When McDowell says “fault controlled”, he’s referring to the Forrest Kerr fault. Aben was originally interested in the Forrest Kerr project because of the fault – a large structural feature that the company theorizes may be a significant gold source for the Golden Triangle. Aben’s 50-kilometer-long property runs along the fault, which acts as a major geological “engine” for the whole region, giving Aben tremendous discovery upside due to the amount of geological activity in the area.

Forest Kerr property outline in yellow

Click here for an on-site video interview with VP Exploration Cornell McDowell re Forrest Kerr fault system.

For more on the geology of Forrest Kerr, read our Aben’s boots, hammers, smoke and fire

South Boundary

So what exactly has Aben found south of the North Boundary Zone? According to the press release, while the majority of drilling so far this summer has taken place at North Boundary, the most recent holes were punched into an area one and a half kilometers south of that area.

Visualize the property as a steep valley, with the Forrest Kerr fault running on the west side of the valley and the Red Line on the east side. At the very top of the drainage is the North Boundary Zone, and moving down the drainage, you encounter what Aben is calling the South Boundary Zone, an area that up to now, had never been drilled.

Three of the holes have been completed in this new zone. It’s important to note that this target was identified from soil geochemical anomalies, discussed in greater detail below. The three collared holes (ie. drilled from the same pad in different directions) hit quartz-sulfide veins at various depths, and while Aben doesn’t yet have the assays, we do know that they contain “ abundant pyrite and copper (chalcopyrite) mineralization,” Aben states in its release. The South Boundary target is also prospective “due to the elevated gold in rock and soil values that are coincident with an historic electromagnetic (“EM”) conductive geophysical anomaly.”

North-south mineralized corridor?

Here is where an expert summary of the Forrest Kerr property and Aben’s drilling so far reveals an extremely tantalizing scenario – one that could put Aben in the lead as the most successful junior operating in the Golden Triangle this season.

The market has taken notice as has revered resource investor Eric Sprott. On the morning of the North Boundary Zone discovery hole announcement, the shares spiked 70% in the first 20 minutes of trading. By 10:17 am in Toronto, 6.4 million shares were changing hands, and by the end of the day, volume was at 22.5 million shares traded.

A month ago Aben could be had for 21 cents. Since then it’s doubled, closing Wednesday at 41.5 cents a share on the TSX Venture. On Aug. 21 Aben closed a $4.28 million private placement at 30 cents a share led by Eric Sprott, who bought 6.6 million shares and the same number of warrants. Sprott now owns 6.6% of Aben’s issued and outstanding shares (non-diluted). The financing puts Aben in a good position to complete its expanded 2018 drill program, with $6 million in the treasury.

This is where it gets interesting. 2017’s discovery holes had exactly the same kind of mineralization as the 2018 holes they describe in Thursday’s news. Except of course these new holes are 1.5 km away from 2017’s and the use of the word “abundant” referring to the pyrite and chalcopyrite mineralization. From the release:

Of the sixteen holes, three holes (1,150 metres) have been completed on the southwest side of the valley at the South Boundary target, located 1.5 km south of the strong gold and copper mineralization intersected at the North Boundary zone. Drilling in this area targeted a prominent soil geochemical anomaly (gold, copper) that trends southward over two km. These three holes represent the first-ever drill holes collared in this target and have intersected numerous broad horizons of quartz-sulphide veins containing abundant pyrite and copper (chalcopyrite) mineralization.

In the 2017 discovery, gold values were directly associated with the presence of chalcopyrite (chalco). Seems to me we have the possibility of even better than 2017 grades a kilometer and a half away from last year’s discovery. Are they connected? Time, and more drilling, will tell. Page 17 of the August corporate presentation shows the further south you go from the North Boundary Zone, the higher the grades of soil geochem results. The red dots represent high-grade gold, over .02 parts per million.

Three discoveries

2018’s first drill hole, with the long intersections of ultra-high grade gold, drilled below 2017’s discovery holes, has to be considered a separate second gold/silver discovery; it’s a complete turnaround and a bit of a surprise to your author as there is no chalco.

And then of course, again looking at the August presentation, I see what they are saying in Thursday’s news release regarding the previously unknown southward extent of the South Boundary Zone.

Stacked north-south mineralized corridor

Look closely at the middle and right heat maps of the geochemical anomalies. The high-grade dots extend quite a ways south of the area Aben is current drilling, indicating the possibility of more mineralization as drilling continues down the drainage. The white area is overburden. Compare the red dots to the washed-out, orange-colored dots in the North Boundary Zone. That makes sense because more chalco than gold mineralization was found there, near surface.

But this year, when the drill was sunk deeper (within 190m) in hole 10, it encountered multiple high-grade zones, but no chalco. What does this mean? Well, it appears that there are really, at least, two separate mineralized horizons at Forest Kerr, one at surface and the other a bit deeper. The shallow mineralization encountered in the first three holes of the North Boundary Zone last year is exactly the same type of mineralization as that found near-surface in the South Boundary Zone (ie. abundant pyrite and chalcopyrite).

The really intriguing question is whether these two “surface copper zones” for lack of a better description, are connected, with the mineralization running all the way down the drainage. This is what the geochemical anomalies shown in the slide above appear to indicate.

And what if the jewelry-box style, bonanza-grade gold contained in the first assayed hole of the 2018 drill program is repeated underneath the three holes drilled thus far in the South Boundary Zone? That could mean a widely mineralized copper system at surface, AND a high-grade gold system consisting of multiple zones, at depth. Aben’s management is excited about this possibility and so are we. Here’s Jim Pettit, President and CEO:

“This new discovery of mineralization 1.5km south of the North Boundary Zone is a major development for the Company and further highlights the robust discovery potential at the Forrest Kerr Project. The mineralizing system at the property is apparently widespread and well-developed with high-grade mineralization being discovered at shallow depths over a large area. We believe we have only just scratched the surface at the newly discovered North and South Boundary Zones and an expanded drill program is currently underway with assays pending for most of the holes drilled to date.”

Conclusion

I’m waiting to see how the assays come in from the South Boundary Zone, and how close they are to the North Boundary Zone shallow mineralization. I would also love to see Aben try to repeat the impressive discovery hole we saw earlier in August, at South Boundary. The existence of two mineralized, interconnected corridors at surface and depth would be very exciting for the junior gold market at a time when it really needs a shot in the arm.

Opportunities like this to get into an undervalued resource stock, just $33 million market cap with huge upside potential, are rare. Keep in mind too that we still have assays to come from the other seven holes drilled at North Boundary. If those come in anything close to hole 10, or 2017’s discovery holes it’s your author’s opinion Aben will run faster and longer then a dog that has had its butt sandpapered and dipped in turpentine. And there’s still so much more to come from Aben this drilling season – they are beefing up their on-site crew and sourcing another drill for up to another 5,000m of drilling; work will continue right into freeze-up, likely late October. All of this is why Aben is my only gold stock pick in 2018 and why I own shares.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Aben Resources (TSX-V:ABN).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.