The Debt Trap Part Three: A Debt Jubilee

2021.09.08

Lower interest rates and massive asset purchases by central banks are the monetary tools of choice when it comes to restoring shocked financial systems. The idea being that making the cost of borrowing cheap for individuals and businesses will entice them to spend, spend, spend.

The downside of “quantitative easing”, QE for short, is a major accumulation of global debt, of which there are three kinds: government, corporate and household.

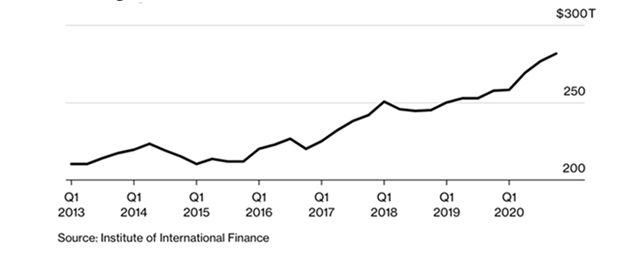

The Institute of International Finance (IIF) found that governments, companies and households borrowed $24 trillion last year to offset the pandemic’s economic toll, bringing total global debt to an all-time high, at the end of 2020, of $281 trillion.

Government debt

Even with vaccine rollouts, low interest rates worldwide are keeping debt above pre-pandemic levels. The Federal Reserve continues to purchase $120 billion per month in government bonds and mortgage-backed securities as part of its quantitative easing policy. The Bank of Canada’s QE program was scaled back in July but is still being maintained at $2 billion per week, despite over 75% of the country (12 and older) fully vaccinated against the coronavirus.

Global debt more than doubled from US$116 trillion in 2007 to $244 trillion in 2019.

The IIF estimates that governments with large budget deficits are expected to add another $10 trillion in 2021.

Last year, South Africa and India had the biggest increases in government debt ratios, with China seeing the biggest jump in emerging markets, followed by Turkey, Korea and the United Arab Emirates.

Among mature economies, France and Spain had the sharpest increases in non-financial industry debt to GDP ratios, IIF data showed.

Another set of figures, via the World Economic Forum (WEF), found that falling revenues combined with costly pandemic relief measures increased global debt by $20 trillion between the third quarter of 2019 and the end of 2020. Excluding the financial sector, Canada’s debt to GDP ratio climbed by nearly 80% last year, the highest of any developed country.

In a December 2020 report, RBC Wealth Management contributed more illuminating statistics that paint a grim picture of a growing global debt burden powered by pandemic-related borrowing.

The Canadian bank quoted the IMF in stating that the public debt of advanced economies has climbed nearly 27% since January 2020, and now sits beyond the greater than 120% of GDP reached after World War II. The United States and Japan are the two most indebted economies accounting for half of total global government debt (see the pie chart below).

Global debt is a tamer 102% of GDP because many of the largest emerging economies have lower debt burdens, however it’s still a record, noted RBC.

The United States is the obvious poster child of excessive debt accumulation.

According to usdebtclock.org, the current national debt sits at $28.7 trillion, and it is increasing with each tick of the clock.

The next round of government spending involves President Joe Biden’s $1 trillion infrastructure bill, just passed by the Senate but not yet approved by the House; and a $3.5 trillion anti-poverty and climate plan Senate Democrats hope to get passed this fall.

Debt is clearly a major limitation on a growing economy.

According to the World Bank, if the debt to GDP ratio exceeds 77% for an extended period of time, every percentage point of debt above this level costs a country 0.017 percentage points in economic growth. The US is currently at 125.7%, so that is 48.7 basis points multiplied by 0.017 = 0.82, nearly a full percentage point of economic growth!

The Balance notes that a combination of recessions, defense budget growth and tax cuts has raised the debt to GDP ratio to record levels. Throughout the years, US military spending has been a major contributor to the debt. During the First Iraq War in 1991, the debt to GDP ratio hit 54%. Between 2001 and 2020, America’s War on Terror consumed $6.4 trillion, helping to elevate the debt to GDP ratio from 55% in the year of 9/11, to 127% in 2020.

The current national debt of $28.7 trillion, and the current debt to GDP ratio of 125.7%, doesn’t include the $1 trillion infrastructure bill before the House; nor the $3.5T anti-poverty and climate plan.

We also have to add the federal budget numbers. President Biden’s budget for full year (FY) 2022 totals $6.011 trillion, more than any other previous budget. The US government estimates that for FY 2022, revenues will again fall short of expenditures, leaving a $1.8 trillion deficit. Better than the projected $3 trillion deficit for 2021 — almost the same as last year’s $3T — but it still means nearly $2 trillion will be added to the national debt. (CNBC notes the budgetary shortfall this year is equivalent to 13.4% of GDP, the second-largest level since 1945 and exceeded only by 2020 spending)

Adding it all up, you get $28.7T (national debt) + $1 trillion (infrastructure bill) + $3.5T (anti-poverty and climate plan) + $6T (FY 2022 budget spending) + $3T (2021 deficit) + $1.8T (2022 deficit) = $44T. By 2022 the national debt, presuming all of the spending commitments use borrowed (or printed) money, will be approaching $44 trillion!

The Fed is severely constrained in how much it can raise interest rates, to quell rising inflation, due to ballooning debt. Following $4.5 trillion spent on pandemic relief, and trillions more to come, through Biden administration spending, along with the continuation of quantitative easing (what I like to call “quantifornication”) to the tune of $120 billion in asset purchases per month, the Fed has in one year doubled its balance sheet to around $8.3 trillion.

According to the Committee for a Responsible Federal Budget, the federal government this year will spend $300 billion on interest on the national debt. This is the equivalent of 9% of all federal revenues collected or more than $2,400 per household.

A today’s debt levels, each 1% rise in the interest rate would increase interest expenditures by roughly $225 billion. On a per-household basis, a 1% interest rate hike would increase interest costs by $1,805, to $4,210.

Quantitative easing is a technique used by the US Federal Reserve and other central banks to stimulate the economy in times of crisis. The Fed buys up securities from its member banks, thereby adding new money to the economy (this is where the expression, the Fed is “printing money” comes from). It’s a way of funding new expenditures, without actually dipping into the federal budget.

The idea is to free up more money for banks to make loans to individuals and businesses, thus growing the economy. The money is not cash, but credit that is added to banks’ deposits. When it wants to print money, the Fed lowers the benchmark federal funds rate, and banks in turn lower their interest rates, making capital more affordable so that businesses and investors are more likely to borrow.

The Fed used quantitative easing in the wake of the 2008-09 financial crisis and it did so again in 2020 to deal with the coronavirus pandemic. (QE continues although the Fed has stated it wants to start “tapering” its monthly asset purchases) QE was successful in preventing a financial meltdown during 2008 and 2020, but the effect has been a reliance on cheap credit that has fueled both a stock market bubble and a real estate bubble that many observers believe is in danger of popping. Bond investors have also become addicted to Fed stimulus.

Excessive money-printing not only in the United States, but Britain and the EU, is continuing to devalue currencies at an alarming rate (this, by definition, is inflation, because it takes more units of currency to buy the same amount of goods as before) — for which precious metals, namely gold and silver, are the best defence.

Inflation erodes the purchasing power of fiat currencies and eventually they become worthless.

The dollar has lost 90% of its purchasing power since 1950.

By contrast, since 1972 gold has gone from $35/oz to $1,800.

Corporate debt

According to the IIF, global debt in the financial sector hit 86% of GDP in 2020, the largest increase since 2007 and the first annual rise since 2016.

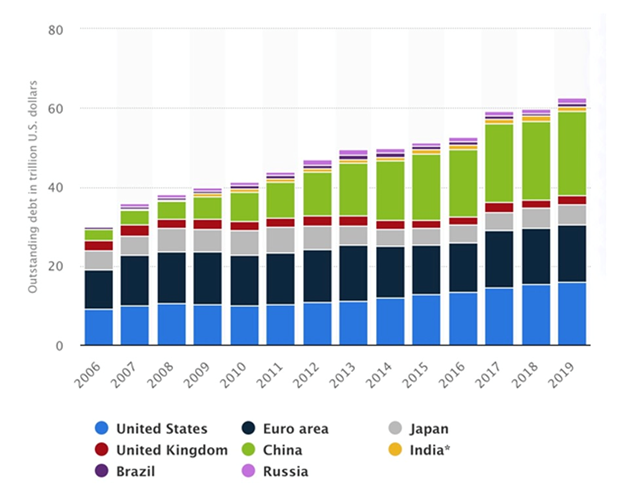

The debt of non-financial corporations has also grown significantly, nearly doubling from $46.6 trillion in the second quarter of 2009 to $81T in the third quarter of 2020, says Statista. Chinese corporations had the most debt in 2019, at $21.2T, exceeding US corporate debt of $16T the same year. In the third quarter of 2020, the coronavirus pandemic pushed the debt of nonfinancial corporations worldwide to 101% of global GDP.

Statista shows US-based telecom firm AT&T carrying the largest long-term debt in 2020, at more than $147 billion, followed by Ford Motor Company whose debt exceeded $114B.

In the United States, companies in need of cash issue bonds in the corporate bond market. Buyers of these bonds are essentially lending companies money, and picking up a coupon (interest) as long as they continue to hold that company’s debt.

According to the Federal Reserve and the Securities Industry and Financial Markets Association (SIFA), US companies now face the highest debt levels on record, at more than $10.5 trillion. In 40 years the amount of corporate bonds outstanding has grown by over 2,000%, from 16% of US GDP in 1980, to 50% of GDP in 2020.

Forbes notes the level of corporate debt is actually much higher because the above-mentioned figures only include fixed income debt, not loans and lines of credit.

These debt levels were massive even before the coronavirus (about $9 trillion), with rock-bottom interest rates left over from the financial crisis making it very easy for corporations to borrow money.

According to accounting firm Deloitte, the corporate debt surge in 2020 was likely due to at least one of three factors: 1/ some businesses were forced to borrow to keep operations running as large swaths of the economy shut down; 2/ some had to invest in technology to support remote work; and 3/ not all businesses were worse off due to covid-19, consequently some of them needed to borrow to grow their enterprises.

Whatever the reason for rising leverage, Deloitte found that non-financial business debt at the end of 2020 was 82% of GDP, higher than the (pre-pandemic) third-quarter 2019 ratio of 75%.

There has been talk of a “corporate bond bubble” triggering the next financial crisis, after the Fed took extraordinary measures at the beginning of the pandemic to buy corporate bonds — part of a $250 billion program funded by the CARES Act.

Questions emerged about why the Fed was purchasing the bonds of companies that really didn’t need their help, including such economic stalwarts as Microsoft, Visa and Home Depot. Moreover, several of them had “junk bond” as opposed to “investment-grade” status, such as Heinz, Ford and Macy’s. “The corporate bond market is hanging on right now by a very precarious string. How long can we continue to live on red ink?” asks a March 12 CNBC video on the subject.

Most of the $10.6T in US corporate debt is made up of bonds (the other part is loans), which as mentioned, are divided into investment-grade and high-yield/ junk bonds. Independent ratings agencies decide on the classification, based on a company’s ability to make their debt payments to bondholders.

The danger is if the bond market crashes, which could happen if enough companies are unable to pay their debts (ie. redeem bonds upon maturity plus interest). The bond market is several times larger than the stock market, amplifying the risk of a crash. “When the bond market blows a gasket, the damage is much worse for the economy,” states the CNBC video.

Right now the corporate bond picture looks good because interest rates are so low. Again, it’s very easy for companies to issue bonds and to get investors to purchase them. They much prefer to do this rather than dip into their own cash piles, or issue stock which dilutes the share float.

But problems occur when companies get reckless with their debt, resulting in a status downgrade. Currently there are a number of companies teetering on the edge of investment-grade status. When they are downgraded to junk bond status, a lot of bond investors sell these “fallen angels”. In 2020 50 companies worth $200 billion in debt were downgraded, including Macy’s, Ford and Occidental, compared to $40-50B in a normal year.

Companies unable to find enough investors to buy their corporate bonds may go bankrupt. Equally bad, if a company is unable to pay back the principal plus interest on bonds when they reach maturity, the firm could default on its loans.

The number of bankruptcies during all of last year and the first quarter of 2021 were above average. According to Forbes, in March 2021 there were 61 corporate bankruptcies, double the amount in February, with consumer discretionary companies and industrials comprising the largest number of business failures.

As the CBNC video notes, defaults last year would have been higher if not for the Fed buying corporate debt for the first time. “The amount of bonds that the Fed actually purchased was very small versus what they could. Just the Fed announcing it, setting it up, doing a little bit, was more validating to the market, than the actual need, desire to buy everything.”

The huge amount of corporate debt is benign for now, but what happens if the Fed hikes interest rates to deal with rising inflation? This is a very real possibility if inflation stays above the Fed’s 2% target for much longer (it currently sits at 5.4%).

“Even a 100, 150-basis point interest rate could spell doom for a company that’s living on the edge,” says the CBNC video, referring to so-called zombie companies that are drowning in debt, to the point where they could default on their loans. These companies are only making interest payments, they’re not investing in their businesses or employees, meaning they ultimately are dragging down national economic growth.

Yet poorly managed companies are still qualifying for loans and issuing debt. An analysis earlier this year by S&P Global Market Intelligence found that “a record-high $67.4 billion was issued in the first quarter from borrowers with a B- corporate rating on at least one side. That represents 40% of total issuance during the quarter. Note that for any full year the share of comparable B- issuance has never been above 36%.”

If ability to repay debt is the main concern, the above-mentioned Deloitte report makes some interesting observations.

First, analysis of the data by cohorts reveals that the top 50 companies by market value are leading the debt surge, with only 5% of 1,000 companies accounting for 30.7% of the group’s total long-term debt.

Second, ability to repay debt has deteriorated for all companies except the largest ones. For example during the pandemic, the ratio of net debt to earnings before interest, taxes, depreciation and amortization (EBITDA) fell by 18.2% for the 501-1,000 and by 16.7% for the 101-500 cohort. The top-10 cohort was better placed than others in its net debt to EBITDA ratio.

Third, the pandemic affected most companies’ ability to pay interest on their debt, again with the exception of the top-10 cohort. The interest coverage ratio — a ratio of earnings before interest and taxes (EBIT) — fell for all cohorts except the top-10 in 2020, with EBIT dropping by 40.3% for the 501–1,000 cohort and by 28.5% for the 101–500 one.

Deloitte’s analysis suggests there is inequality with respect to corporate debt and companies’ ability to pay it off. Only 5% of 1,000 companies account for 30.7% of this group’s debt, and these companies are least likely to default on their debts or fail to pay the interest on their debts. This means 95% of the other 1,000 companies in Deloitte’s study group hold 70% of the rest of the debt, with the pandemic impacting most’s ability to repay.

How many of these 950 companies are zombies on the edge of bankruptcy or are close to being downgraded to junk bond status? The $10.6 trillion in corporate debt is certainly something we as investors need to be aware of and keep tracking, so as to stay ahead of a potential meltdown if many companies begin defaulting on their loans.

Household debt

In the United States, consumer spending makes up nearly 70% of GDP, meaning the ability of households to spend, and to handle debt burdens, is of utmost importance. Globally the figure is similar.

Household debt is defined by Stats Canada as mortgage debt on all residences and real estate, and consumer debt (including debt outstanding on credit cards, personal and home equity lines of credit, secured and unsecured loans from banks and other institutions, and unpaid bills).

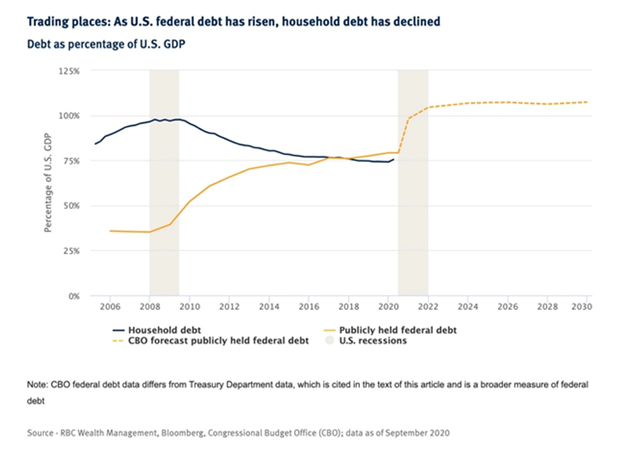

In its recent report, RBC notes that in some countries, household debt is of greater concern than government debt. In other countries the reverse is true. For example in the decade following the financial crisis, Canada’s household debt rose from 93% of GDP to 106%, compared to federal debt falling from 47% to 40%; whereas in the US, government debt has surpassed household debt and continues to swell.

In the OECD bar graph below, countries are ranked according to their total household debt as a percentage of net income. Denmark leads the pack with household debt greater than 250% of income, followed by five other European countries, then Korea. Canada is ninth at 175%, with the US 19th at 105%.

Getting more granular, CNBC reports that US consumer debt rose to nearly $14.6 trillion at the end of 2020, driven by a record-breaking increase in mortgages, which in February totaled over $10 trillion, as home buyers took advantage of low mortgage rates. Mortgage debt in Q4 2020 increased 1.4%, or $206 billion, making it the fastest fourth-quarter rise since 2006.

Student loan debt last year increased marginally to $1.37 trillion as a result of low interest rates and student loan forgiveness (the Biden administration announced it will cancel another $5.8B of student loan debt by the end of this year), while credit card debt fell by $108B to $820B. Many Americans, holed up at home either unemployed or working remotely, elected to save money during the pandemic or pay down loans with help from direct stimulus checks. The “serious delinquency rate” or 90 days past due for all debt, fell from 2.36% to 1.25% during the fourth quarter 2020.

However it appears that Americans’ parsimony was shortlived.

A more recent CNBC story states that household debt jumped the most in 14 years in the second quarter of 2021. Though mostly driven by the housing market, credit card debt is reportedly back on the rise.

Despite significant paying down card balances, the average balance is above $5,000 and there are signs that fiscal prudence may be waning, including the fact that government stimulus checks are slowing, and that consumers are in the mood for spending, with around $2 trillion in forced savings ready to be unleashed.

A Creditcards.com survey quoted by CNBC found 44% of people saying they are willing to take on debt in the second half of 2021 for non-essential purchases, such as dining out.

A May report from the Federal Reserve found that credit card balances rose 11% from April to May, the largest increase in five years. On Aug. 4, the Fed reported the highest second-quarter jump in household debt in 14 years, to nearly $15 trillion.

This can’t go on forever. It’s not a stretch to envision a scenario whereby the world’s reserve currency, the US dollar, collapses under the weight of unmanageable debt, triggered say, by a mass offloading of US Treasuries by foreign countries, that currently own about $7 trillion of US debt. This would cause the dollar to crash, and interest rates would go through the roof, choking consumer and business borrowing. Import prices would skyrocket too, the result of a low dollar, hitting consumers in the pocketbook for everything not made in the USA. Business confidence would plummet, mass layoffs would occur, growth would stop, and the US would enter a recession.

All the countries that sold their Treasuries would then face a major slump in demand for their products from American consumers, their largest market. Eventually companies in these countries would begin to suffer, plus all other nations that trade with the US, like Canada and Mexico. Before long the recession in the US would spread like a cancer, to the rest of the world.

Apocalyptic visions like these have pundits offering outside-the-box solutions. According to economist David Rosenberg, and others, the only policy prescription is debt default.

Debt default? Yes, you read that right.

Debt Jubilee

The global debt overhang which as stated, has more than doubled since 2007, has severely curtailed governments’ ability to deal with a major financial crisis such as the coronavirus. Interest rates are already so low, that central banks are limited in how much they can cut (the Fed has already “used up all its bullets” in setting interest rates at 0 to 0.25%).

A cross-the-board ‘Debt Jubilee’ might sound radical, but a reading of history shows that retiring debt can actually make a country’s economy, and its indebted citizenry, all the better for it. There is even a relatively recent example. In 2000, U2 front man Bono launched a campaign to provide debt relief to developing countries. The Jubilee 2000 coalition managed to get the G8 to agree to write off $100 billion in debts that developing countries owed to developed nations.

The term ‘Jubilee’ comes from the Old Testament. The book of Deuteronomy refers to a sabbath year during which any slaves would be freed, and everyone would be allowed to return to their family farms and live off the land. During the Jubilee, all debt obligations would be forgiven — such as land or crops that debtors had pledged to creditors.

In those days, the main creditors were royal families and their close supporters — religious orders and wealthy nobles. Thus, canceling debts really only meant snuffing out debts owed to themselves. As explained by Vox, What the king lost in immediate payment, he got back in encouraging a land holding peasantry, who could pay future taxes and provide the backbone of the army. Moreover, rivals to the Crown, foreign enemies or internal upstarts, could foment rebellion by threatening to cancel debts themselves, if the new Monarch did not do so first.

The main economic justification for a modern Debt Jubilee is simple. With debts forgiven, governments could spend the money currently devoted to interest and principal repayments on worthwhile programs; businesses would suddenly be freed from debt bondage and could expand/ hire more staff; and households would have more disposable income, all of which would, in turn, increase aggregate demand and encourage economic growth.

Billionaire investor and hedge fund manager Ray Dalio, in his book ‘Principles for Navigating Big Debt Crises’, argues that when interest rates can’t go any lower and QE has already been tried (ie. right now), a central bank’s last resort is to provide relief for the common people.

We have already reached this point. Within President Joe Biden’s $1.9 trillion covid-19 relief package passed earlier this year, was $1T in direct relief to taxpayers, including increased stimulus checks up to $1,400 per person. This is the last resort.

Central bank stimulus, to deal with the covid-19 crisis, should involve buying/ forgiving student loans, delinquent car loans, personal lines of credit, credit card debt and mortgages (in August the Biden administration announced it will cancel another $5.8B of student loan debt by the end of this year).

Canadian students leaving university owe an average $28,000; it’s not uncommon for law or medical students to carry a debt load into their first job surpassing $100,000. Student loan debt is a major inhibitor to college/ university grads being able to obtain a mortgage.

During the financial crisis, the Obama administration tried bringing in mortgage forgiveness, but was unable to get it through Congress. Ironic that in 2008 the Federal Reserve printed $4 trillion to buy up the banks’ bad debts, while Congress sat back and allowed 10 million American homeowners to be foreclosed.

Canadian families are carrying nearly $2 trillion in mortgage borrowing and home equity lines of credit (HELOC). This debt grew by $18 billion in April, the biggest monthly gain ever.

Garth Turner, former Conservative politician, in his popular real estate blog, Greater Fool, writes:

It’s everywhere. You know the numbers. Four in ten people have less than $200 a month after servicing their debts and buying yogurt and street cannabis. The debt-to-income ratio has never been higher. Borrowing is running four times hotter than inflation. Even when house values go down, mortgage debt goes up. It’s hopeless. Addicted. We’re pickled in the stuff.

An outright cancelation of sovereign debt shouldn’t be ruled out. During the Great Depression, France and Greece had about half of their national debts written off completely. In 1953, the London Debt Agreement between Germany and 20 creditors wrote off 46% of its pre-war debt and 52% of its post-war debt. The country only had to repay debt if it ran a trade surplus, thus encouraging Germany’s creditors to invest in its exports, which fueled its post-war boom. As we pointed out, in 2000, $100 billion worth of debts owed by developing countries were wiped off the books.

Again, this is not as far-fetched as it sounds. Because we live in a fiat monetary system, currencies are not backed by anything physical; the reserve currency, the US dollar, was de-coupled from the gold standard in the early 1970s. It’s not like a raid on vaults full of gold, which have an inherent, physical store of value.

In reality there is nothing preventing central bankers from doing a complete global reset, putting all debt back to zero.

The benefits of a Debt Jubilee would accrue to governments no longer bound to austerity programs; businesses that could invest in their operations instead of paying interest and principal to corporate bondholders; and taxpayers, who would benefit from increased social spending and higher household disposable income.

Garth Turner argues that erasing people’s debt is the same as cutting their taxes, the effect being the same — a marked increase in spending:

It actually means interest rates can go up to stem the tide of new borrowing because the economy gets a shot from the jubilee…. Indebted consumers spend money on loan payments, not on new Silverados, appliances or (in Alberta’s case) weapons. So, a debt holiday would actually boost the economy as a whole, helping employment, corporate profits, wages, markets and investors.

Of course, not everyone wins from a Debt Jubilee. The losers would include credit card companies, auto manufacturers and banks, all of which would lose the value of the debt which for them is an asset.

Conclusion

We and others have been warning about debt for quite a while.

People are being misled into believing that the US Federal Reserve is going to scale back its $120 billion per month asset purchase program (QE) and raise interest rates. The Fed can telegraph its intentions all it wants, the fact remains that at such unsustainably high debt levels, the interest payments will eventually cripple the federal government.

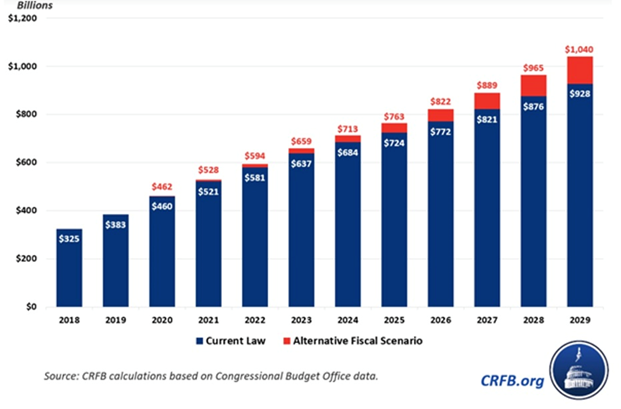

In 2019, before the coronavirus crisis, the Committee for a Responsible Federal Budget (CRFB) calculated that under current law, net interest payments will nearly triple over the next decade, to $928 billion by 2029. In 2019 the national debt stood at $23.2 trillion compared to the current $28.7 trillion, so already we know the projections are too conservative.

Remember the current debt doesn’t include the $1 trillion infrastructure bill before the House; nor the $3.5T anti-poverty and climate plan; nor President Biden’s budget for full year (FY) 2022 totaling $6 trillion, more than any other previous budget.

Under the CRFB’s “Alternative Fiscal Scenario” which assumes that lawmakers extend the tax cuts and spending passed under the Trump administration, interest on the debt will exceed $1 trillion by 2029.

(As a concession to Senate Republicans, Joe Biden earlier this year proposed keeping intact Donald Trump’s 2017 tax cuts. Instead of raising corporate taxes to pay for the $1 trillion infrastructure plan, his administration would work to ensure corporations don’t exploit tax loopholes)

Again, this is before the $4.5 trillion already spent on covid and the trillions more to come. The way we’re going, interest payments on the debt will almost certainly top $1 trillion by the end of the decade if not before.

Some see the national debt going much higher, given that the way it is calculated now, doesn’t include unfunded Social Security and Medicare promises. When that $129 trillion worth of bills is added, “the truth” is closer to $133 trillion.

Now we are talking about interest payments of four to five times the current $300 billion, ie., $1.2T to $1.5T. The people supposedly represented by the government can’t afford that level of interest (they will suffer higher interest payments on their own debt), same as businesses cannot afford higher interest payments on their debt. Corporations will simply pass on the higher interest obligations to their customers, cut dividends or in the worst case scenarios, lay off staff.

But there is a way to avoid this slow-moving car crash – a global debt reset – a Debt Jubilee, if you will. Imagine what could be achieved if all the central banks acted together in retiring all the world’s debt — all $281 trillion of government, corporate and consumer loans. Of course the financial institutions would balk; their hands would need forcing. But the effects on the economy would be immediate and profound.

Governments, businesses and households would finally be free of the debt shackles that constrict their ability to grow. Governments, business and people can start borrowing and spending all over. And why not? What most think of money isn’t money, its credit created by a bank, it’s ones and zeros on a computer represented by paper and coins. The world will get to do it all over again, after all it’s not like there’s a day of reckoning in the future.

The coronavirus is the perfect opportunity to reset the global monetary system through a Debt Jubilee. Without a plan to reduce the debt, the era of “free money” will continue, benefiting gold and silver prices for the foreseeable future.

The Debt Trap: Part One of Three

The Debt Trap Part Two: 50 years of fiat folly

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.