Undervalued Palladium One continues to impress, with high-grade assays from Tyko and open-pit potential at LK

2021.07.01

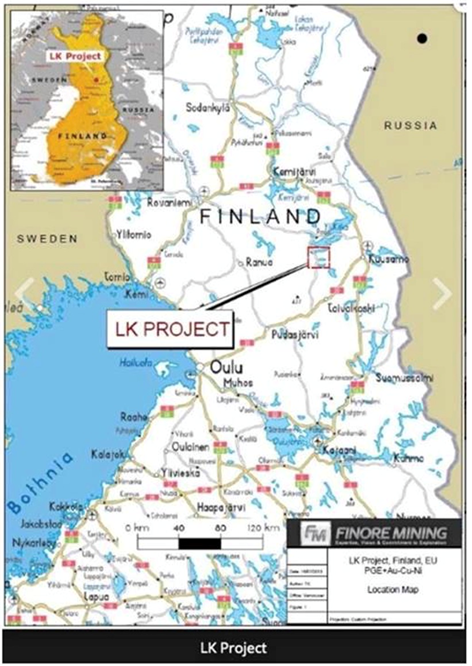

Palladium One Mining (TSXV:PDM, OTC:NKORF, FSE:7N11) is exploring for platinum group elements (PGEs) in north-central Finland, and for nickel, copper and PGEs on the shores of Lake Superior, in Eastern Canada.

LK project

At its LK (Läntinen Koillissmaa) project in Finland, the geology dates back to the early Palaeoproterozoic era, ~2.4 billion years ago, during which igneous activity produced mafic-ultramafic rocks containing palladium-rich sulfide minerals, chromium, as well as iron-titanium-vanadium.

The LK project is a “basal Cu-Ni-PGE bearing sulphide accumulation within the larger Koillismaa Layered Mafic Intrusion”

In 2019 Palladium One published the first (maiden) NI 43-101-compliant resource at the Kaukua zone. Using a 0.3 g/t Pd cut-off grade, the optimized pit-constrained mineral resource at Kaukua includes:

- 635,600 Pd_Eq ounces of Indicated resources grading 1.80 g/t Pd_Eq (“palladium equivalent”) contained in 11 million tonnes, and

- 525,800 Pd_Eq ounces of Inferred resources grading 1.50 g/t Pd_Eq contained in 11 million tonnes.

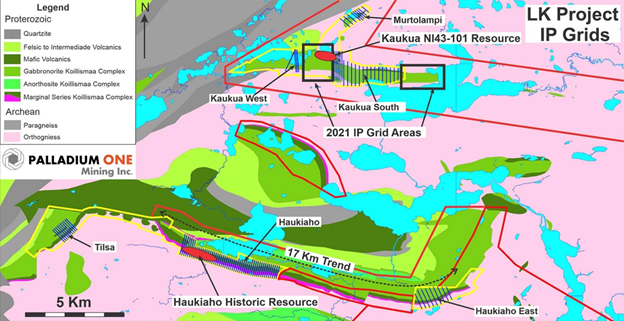

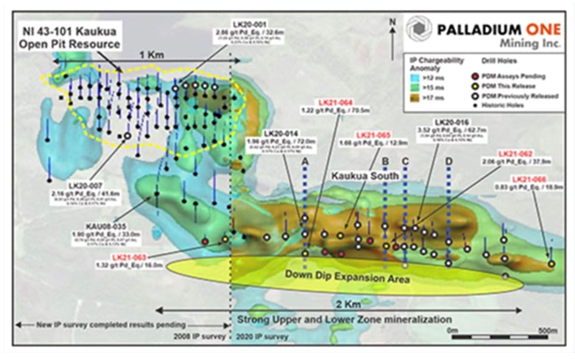

In addition to Kaukua, Palladium One also has about 900,000 ounces Pd_Eq in a historical resource at the Haukiaho zone, which the company plans to convert to 43-101 standards in the second half of this year; perhaps ~3-500,000 oz at Murtolampi, also referred to as the northern satellite pit; and a street expectation of what could be an additional 2.5Moz at Kaukua South, where a maiden resource is expected either in the first quarter of 2022.

In total, the company has amassed perhaps 4-5Moz of open pittable resources at its wholly-owned LK project in Finland.

In a December 2020 AOTH video, Palladium One’s CEO, Derrick Weyrauch makes the following points regarding why the LK project should be of interest to investors, and how the company is de-risking the project:

- “What makes the LK project of interest is we have a 38-kilometer stretch along the favorable basal contact, that’s the unit where the intersection of mafic-ultrafmafic rocks happens, from a large magma flow.”

- “The project is disseminated mineralization that is quite shallow, it’s a layered complex, there’s been some stacking that has taken place, but most importantly this is a high-tenor palladium-dominant sulfide situation, where we have a 3:1 ratio of palladium versus platinum.”

- “There are many similarities to the Platreef-type deposits of the Bushveld [complex in South Africa, the largest known igneous intrusion within the Earth’s crust], and what we particularly like is the mineralization is quite shallow, our existing NI 43-101 resource [at Kaukua] is an open pit-constrained resource where mineralization is coming right to surface, the pit only goes down about 275m, that pit is contained within 1 km of strike length, we believe we have a very clear path to growing the resource.”

- “Part of the de-risking exercise given we know that the entire 38 km is mineralized, is to focus in on the higher-grade pods of mineralization. To do that de-risking we conducted an extensive induced polarization (IP) survey over five areas of the contact. We covered 12 km in particular, all of which returned excellent anomalies, (they’re referred to as chargeability anomalies), they’ve been shown at LK to correspond very well with mineralization. However given the strength of the anomalies we found just south of Kaukua, what we’re terming the Kaukua South zone, our focus post the covid shutdown [in March 2020] when we had to suspend our drilling, is to focus our drilling efforts on Kaukua South and build out a resource and see how many Kaukua’s we have in the Kaukua South zone.”

2021 drilling

Fast forward to May 2021, when the first results (seven holes) from a 2,000-meter drill program at the Haukiaho zone were announced on May 26, including 72m @ 1.8 g/t Pd_Eq at LK21-071 — one of the 12 holes, or 1,943m, drilled at Haukiaho.

According to PDM, the results from the first seven holes of the program are enough to build an NI 43-101-compliant resource estimate, anticipated sometime in the third quarter. The five remaining holes, released on June 1, featured 8m @ 2.2 g/t Pd_Eq within a wider 116-meter zone grading 1.2 g/t Pd_Eq. Notably, the results filled in a 200-meter gap in the historical resource drilling, and delivered average grades and widths above those of the historical resource estimate.

“These latest results also extended the core Haukiaho zone to the east and into a second large IP anomaly that was delineated in 2020. This extension indicates substantial near-term upside at Haukiaho,” said Weyrauch, adding:

“At 17 kilometers in length, the Haukiaho trend currently represents the largest continuous patch of blue-sky potential on the LK property.”

At the Kaukua South target, drilling returned grades of 47m @ 2.6 g/t Pd_Eq, including a higher-grade core of 12m @ 4.2 g/t Pd_Eq. IP surveys have begun to expand the strike length by up to 3 km, from the current 4 km.

Assay results have been reported from 34 holes of 46, with the remaining 12 holes pending. They feature 38m @ 2.1 g/t Pd_Eq in the Lower Zone at Kaukua South, announced on May 11. Drilling also expanded the strike length of the Upper zone having intersected robust mineralization of 51 meters @ 0.9 g/t Pd_Eq.

In my opinion this was the major news in the release. The Upper Zone, with it’s robust mineralization, could have a significant economic impact on future pit modeling by significantly reducing the open-pit strip ratio, thus allowing for deepening of the targeted pit depth. PDM has moved from a target depth of 200m to 300m.

According to Palladium One, “drilling demonstrates significant continuity of open pit grades and widths in both the Upper and Lower Zones at Kaukua South. Results to date are highly encouraging and show a clear path toward a maiden open pit resource at Kaukua South.”

Finland

Palladium One is exploring the palladium-rich LK project, in one of the world’s best places for mineral exploration.

In 2017 Finland claimed the number one spot on the Fraser Institute’s ranking of investment attractiveness for mining jurisdictions, up from fifth place in 2016.

Among the factors that set Finland apart from its country peers, according to the annual Canadian survey, are its mineral endowments, relatively low 20% corporate income tax rate, and clear rules surrounding mining and exploration.

World-class infrastructure is another selling point to mining companies. Electricity is reliable and inexpensive, and there are paved roads even in remote areas, along with a comprehensive network of railways, canals and sea lanes. Finland boasts one of the highest living standards in the world, which attracts a strong pool of skilled and well-educated workers.

Lastly, Finland has one of the better geological databases available to junior explorers. The icing on the cake: nearly everyone speaks English.

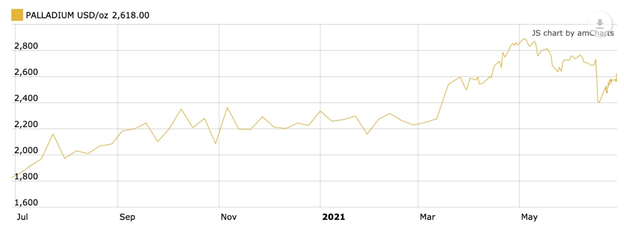

Palladium market

As the world transitions from fossil-fueled “ICEs” to battery-powered electric vehicles, the internal combustion engine is unlikely to be resigned to the scrap heap, just yet. Gasoline vehicles and gas-electric hybrids will gradually displace more-polluting diesels, the former equipped with catalytic converters to filter out pollutants like NoX and particulate matter.

This means growing demand for materials that go into gas-powered autocatalysts, including palladium.

The platinum group metal is set for a supply deficit for the 10th straight year. Driving palladium demand are higher sales of gasoline vs diesel units and tighter pollution controls.

Palladium use in hybrid vehicles, seen as a bridge between gas-powered cars and pure electrics, is a growing source of demand. The lustrous metal is also used in electronics, surgical instruments, jewelry, watch making, aircraft spark plugs, hydrogen purification and groundwater treatment.

Supply, meanwhile, is being challenged by production disruptions, for example flooding at Arctic mines.

On May 4 palladium hit a new record of $2,890/oz. Over the past year, Pd is up a sizzling 44.5%.

Tyko project

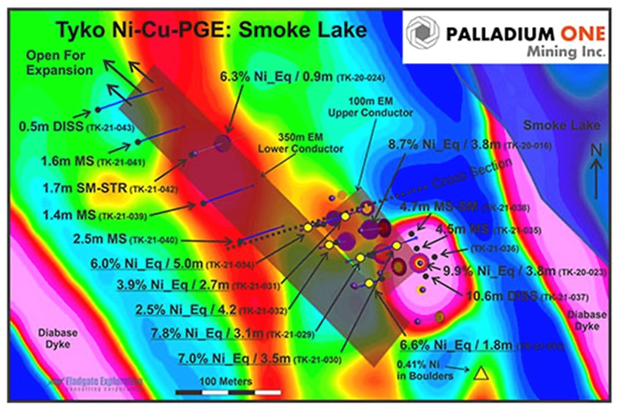

Palladium One continues to outline a high-grade sulfide nickel system at its Tyko nickel-copper-PGE project in Ontario.

Initially,mineralized boulders with high nickel (up to 0.41% Ni) and copper values were discovered, indicating potential for high-grade massive sulfide mineralization.

The Phase I Nov/Dec 2020 drill program was designed to test the Smoke Lake electromagnetic (EM) anomaly.

Potential was validated by the first two diamond drill holes, which intersected massive magmatic sulfides grading 8.7% nickel equivalent (Ni_Eq) over 3.8 meters, and 4.8% Ni_Eq over 2.3m, both at less than 30m true depth.

This was the first confirmed occurrence of massive sulfides on the Tyko project.

Subsequently the remaining 11 drill holes were announced, each was a resounding success and intersected massive magmatic copper-nickel sulphides, confirming the extremely high-grade nature of the deposit.

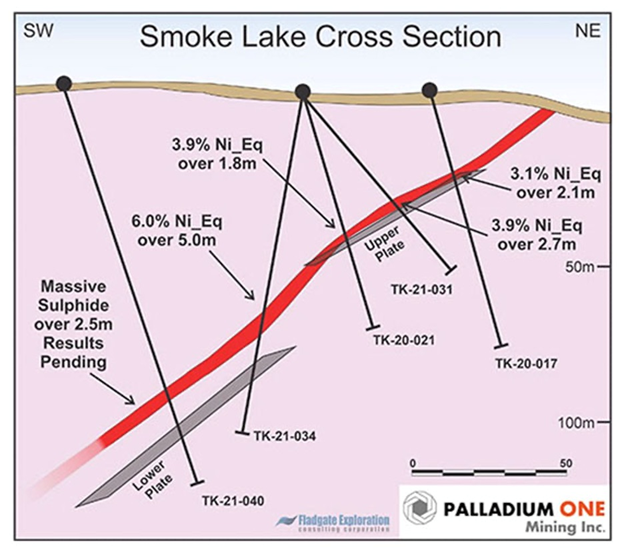

Additional EM surveys then identified two near-surface, closely spaced conductors (or plates, described and pictured below), the largest of which had a strike length over 300m.

A second-phase, 2,000m drill program started in April, following up on high-grade hits of 9.9% Ni_Eq (23% Cu_Eq) (30 g/t Au_Eq) over 3.8m – US$1,765.70 per tonne at a price of US$8.09/lb and 6.3% Ni_Eq (US$1,123/ tonne) over 0.9m, published on Jan. 19.

The objective of the phase 2 drill program was to test the down-dip continuity of the two EM “plates” (an upper plate and a lower plate) that Palladium One modeled after the first-phase drill program in the fourth quarter of 2020.

On April 28 PDM announced that 11 of 14 holes completed so far intersected massive sulfides, ranging from 1.3 to 5.0 meters in length.

Assay results from the first six holes (TK21-029 to TK21-034) were delivered earlier this month.

Final phase 2 results were released June 23rd, they continue to be spectacular.

A number of high-grade intersections were reported, all near surface, including:

- 1.7m @ 10.2% Ni_Eq (or 31g/t Au_Eq) within 4.5m @ 7.5% Ni_Eq (or 22 g/t Au_Eq)

- 1.7m @ 8.3% Ni_Eq (or 25vg/t Au_Eq)

- 1.7m @ 9.5% Ni_Eq (or 29g/t Au_Eq)

These are some of the highest sulfide nickel grades in the world.

According to Palladium One, the two most important results of the phase 2 program were, number one, to extend the strike length of the lower conductor to 350 meters, and number two, linking the high-grade massive sulfide mineralization between the upper and lower conductors.

“Smoke Lake continues to deliver exceptional nickel grades. These results, notably hole TK21-034 indicate that the upper and lower plates are in fact one continuous sulphide lens. Additionally, evidence exists that the high-grade mineralization has been remobilized, thus seeking the source of mineralization is our top priority,” Palladium One’s President and CEO Derrick Weyrauch stated in the June 17 news release.

Nickel market

Nickel is a tricky metal to hunt for, because not all nickel is created equally.

There are two kinds of nickel deposits in the world, sulfides and laterites, but only nickel sulfides can be easily (and inexpensively) processed to create battery-grade nickel used in lithium-ion batteries needed for electric vehicles.

While Indonesia, the top nickel producer, has an abundance of nickel supply in laterite deposits, it is very expensive to produce, creates a lot of greenhouse gas emissions, and carries with it the added burden of tailings waste disposal, which in the archipelago nation has meant dumping it into the sea.

Any battery company or automaker in the least bit concerned about its green credentials which, when it comes to EVs, is the whole point, will have a hard time justifying a nickel laterite supply chain.

The main benefit of nickel sulfide ores is they can be concentrated using simple flotation.

Yet large-scale sulfide deposits are extremely rare. Existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically and technically feasible? The pickings are slim.

Limited nickel exploration in recent years has resulted in a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

Conclusion

Palladium One in January secured a C$12.5 million ‘bought deal’ financing from Sprott Capital Partners, that was over-subscribed and upsized to C$15 million. The additional funding in conjunction from warrant exercising has ensured a healthy treasury that PDM can draw from, as it continues to explore its projects in Canada and Finland. 27,000 meters is planned this year from a total exploration budget of $11.5 million.

The company is currently sitting on C$18 million in cash, trades at $0.29/sh and has a market capitalization, as of Monday, June 28, of $69.1 million. Billionaire resource investor Eric Sprott is the largest shareholder.

Palladium One’s low stock price is something of a mystery, especially considering the value of the nickel sulfides at Tyko.

For example at today’s metal prices, 6.0% NiEq over 5.0m is worth $1,319.79 per tonne (total gross metal value in $USD), calculated using Kitco’s “Rocks in the Box” tool. This is the dollar equivalent of a 23 g/t gold deposit, or a 50 ounce per tonne silver deposit. (28.3 grams in an ounce)

Palladium One’s LK project is one of very few palladium dominant plays, meaning it stands to benefit greatly from continued palladium price strength. It’s hard to imagine a scenario where Pd prices fall; the platinum group metal is set for a supply squeeze for the 10th straight year. Driving palladium demand are higher sales of gasoline vs diesel units and tighter pollution controls. This is not likely to change.

Palladium is currently trading at $2,620 an ounce, around one and a half times higher than the price of gold.

The company is making great progress at Kaukua South and Haukiaho, where a maiden resource is expected as early as the third quarter.

When you consider all that Palladium One has going for it — the right metals at the right time, ie., sulfide nickel for EV batteries, and palladium, used in gasoline-powered catalytic converters that will be needed for years during the transition from fossil fueled to electric vehicles — and killer deposits with top of the class grades in safe jurisdictions, Palladium One is a stealth company ripe for an acquisition.

Junior mining companies are currently out of favor, but base metal prices, including nickel, are way up, after briefly pitching lower, having experienced covid-related demand shocks in early 2020.

Last year investment capital rushed into the gold space and I believe it’s only a matter of time before sulfide nickel/ palladium-focused PDM gets the re-rating it deserves.

Palladium One Mining

TSX.V:PDM, OTC:NKORF, FSE:7N11

Cdn$0.28 2021.06.30

Shares Outstanding 241m

Market cap Cdn$67.5m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Palladium One Mining (TSXV:PDM). PDM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.