Mountain Boy details 2021 exploration plans for multi-element Theia project

2021.06.24

Following an earlier update on the company’s exploration plans in the prolific Golden Triangle of BC, Mountain Boy Minerals Ltd. (TSXV: MTB) (OTCQB: MBYMF) (Frankfurt: M9UA) has added another project to its “to-do” list during the busiest time of the year.

The multi-element Theia project, where fieldwork in 2020 identified a 500m long trend of silver-bearing mineralization, is the focus of MTB’s latest exploration program.

This program is intended to define drill targets in multiple areas on the property, with a focus on delineating and extending the high-grade silver trend that produced several grab samples in excess of 1.0 kg/t silver.

The exploration program will include re-interpretation of previous geophysics, detailed mapping and sampling, as well as channel sampling. This would help the company develop a better geological understanding of the potential of this well-mineralized area.

About Theia Property

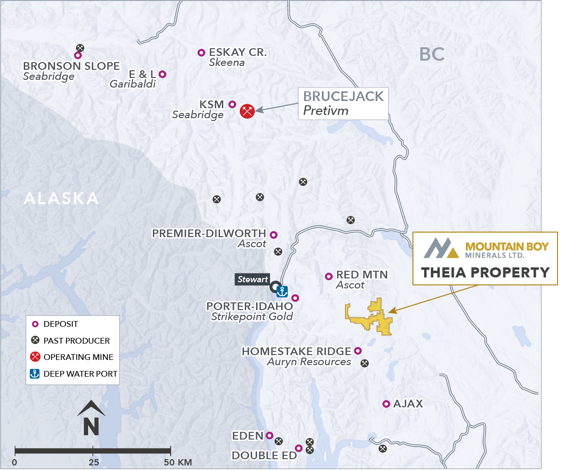

MTB’s Theia property covers an area of 9,028 hectares in the Golden Triangle region of British Columbia.

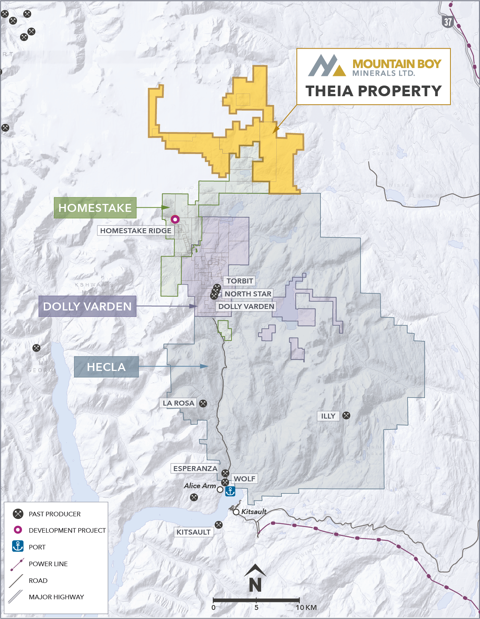

It is located 30 km east-southeast of Stewart, BC, and 15 km north of the historic Dolly Varden silver mine. There are logging roads within 10 km of the eastern boundary of the claims and the proposed Homestake Ridge Road is 12 km to the west.

The property shares a southern claim boundary with Hecla Mining Company’s Kinskuch property, which, according to Hecla, hosts potential for the discovery of epithermal silver-gold, gold-rich porphyry and volcanogenic massive sulfide (VMS) deposits.

Teuton Resources Corp.’s Konkin silver property shares a northern claim boundary, where two gold target areas have been defined.

Field work by Mountain Boy in 2020 followed up on the high-grade silver occurrences identified in the 1990s on the western part of the project as part of a reconnaissance program looking for gold.

Since that time, extensive glacial retreat has opened up areas that have not previously been explored. The MTB geological team confirmed the historic occurrences and extended the mineralized trend to 500 metres.

Recent grab samples include the following: 39 kg/t silver, 3.45 g/t gold, 45.8% lead,1.25% copper and 2.57% zinc; and 1.68 kg/t silver, 3.46% lead and 2.7% zinc.

The area covered by the present Theia property was first explored in the 1960s by a unit of Kennecott as a copper and molybdenum porphyry prospect. Subsequent work by Bond Gold in the 1990s was successful in identifying precious and base metal mineralization.

The property hosts a variety of styles of mineralization, including several stages of quartz veining and associated vein style mineralization, local sulphide-rich breccia zones, local disseminated sulphides associated with veins, dykes and intrusions, and shear hosted precious metals.

This year’s program is intended to develop a more comprehensive geological understanding of the several styles and areas of mineralization through detailed mapping and sampling and to develop potential drill targets.

American Creek Exploration

Elsewhere in the Golden Triangle, Mountain Boy recently announced the start of fieldwork at its flagship American Creek silver-gold project, located 20 km north of Stewart.

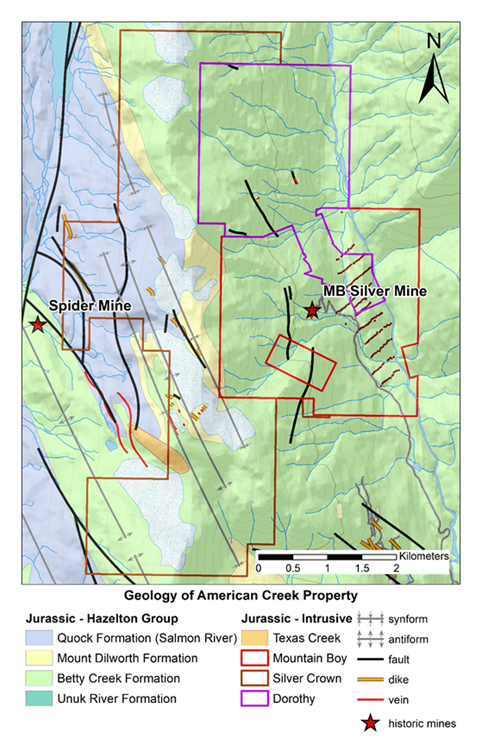

Covering more than 2,600 hectares of land, MTB considers the American Creek property to have “real potential to host one or more deposits.”

The presence of numerous nearby past producers, an evolving understanding of the geology, and encouraging results and discoveries in the region all support the highly prospective nature of the area, the company said.

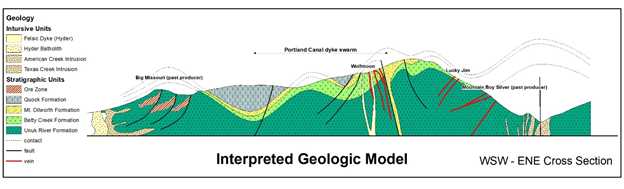

Mapping and prospecting on the project so far have led to multiple discoveries, including a new area of gold-silver-base metal mineralization on Bear River Ridge, a silver and base metal intermediate epithermal system along an approximate 2 km trend, and — more importantly — an Early Jurassic latite porphyry intrusion below the epithermal system.

This previously unrecognized intrusion is similar in age to the many Jurassic Intrusions that are related to several deposits in the area, including the Premier porphyry, which is directly related to what was once considered North America’s largest gold mine.

Ascot Resources is currently focused on restarting the historic Premier mine, which has produced over 2 moz gold and 45 moz silver.

The Stewart mining camp — where American Creek and many other MTB projects are found — is part of the larger Stikinia Golden Triangle and is known to contain well over 200 mineral occurrences.

The initial fieldwork at American Creek, which is now underway, is intended to refine follow-up drill targets around the High-Grade zone at the historic Mountain Boy silver mine.

Drilling last year demonstrated that the shallow structures intersected in drill holes are base metal rich and likely represent one of several mineralizing pulses in the epithermal system. This season’s drilling will target steeper cross structures and localized ore shoots and will be guided by additional mapping.

A detailed structural mapping and 3D modelling initiative will take place before an initial phase I drill program of up to 1,500 metres commences.

In 1999-2000, about 51.6 tonnes of material were extracted from the High-Grade vein and sent to the Cominco smelter in Trail, BC. The documented grades of 13.6 tonnes of this material were 18.854 kg/t silver, 1.1% zinc and 2.5 % lead.

These exceptional grades demonstrate why MTB believes it is still such a compelling target.

Mineralization at American Creek

Lead isotope studies in the American Creek area have identified two distinct mineralizing events characterized by different base and precious metal suites.

One ore-forming episode occurred in the Early Jurassic; the other episode occurred in the Paleogene. Both episodes were relatively brief geologically, but regional in scale. The current working deposit model for American Creek West includes two styles and both ages of mineralization.

The first style consists of multi-pulsed epithermal mineralization telescoping off a porphyry hydrothermal system, with the Early Jurassic intrusion identified on the property providing the magmatic heat source for circulating metal-bearing fluids.

The second style consists of structurally controlled mineralization associated with the emplacement of Middle Eocene dyke swarms and stocks of the Coast Plutonic Complex.

MTB believes the American Creek project has district-scale potential for both ages of mineralization.

The property is strategically located amongst many world-class deposits including the aforementioned Premier mine 11 km to the southwest and the Big Missouri 3 km to the west. The latest mine in the area is Pretium’s Brucejack deposit, located 30 km to the north.

Other past producers in the immediate area include the Silver Coin, Red Cliff, Scottie Gold, Dunwell and Mountain Boy mines.

In 2020, Ascot released robust results on an independent feasibility study that would involve developing four underground mining operations at the past-producing Silver Coin, Big Missouri and Premier, and the new Red Mountain deposit. The four mines would feed a refurbished 2,500 tpd mill at Premier. All these deposits are part of the Early Jurassic mineralizing event.

The historic Porter Idaho, Silverado and Riverside mines are examples of Paleocene high-grade silver-lead-zinc vein deposits within the Stewart camp.

Conclusion

The Golden Triangle is one of the most richly mineralized areas on the planet, hosting large deposits of gold, silver and copper. Historically, some of the world’s largest deposits were discovered in this area.

At present, there are only two mines operating in the region (Brucejack and Red Chris), with a third (Premier) on its way. Several more are in various stages of being put into production.

All of the mineral deposits formed in the Golden Triangle can be found near surface, making them easily accessible to up-and-coming miners.

Recognizing, for the first time, that the many mineralized occurrences are part of one large geological system, Mountain Boy Minerals has been actively acquiring and exploring properties (including an exceptionally rich historic silver mine) in the American Creek corridor, forming part of its flagship project.

An experienced team has spent the last two years working on this project after compiling a wealth of historic information. Geological work to date suggests strong similarities to the adjacent Premier camp, one of the richest mining camps in the province.

Plus the recently announced exploration program at Theia — and at the Southmore copper-gold project located 40 km northwest of the historic Eskay Creek mine — we may just be looking at one of BC’s most active and diversified exploration/ development companies over the coming years.

Mountain Boy Minerals

Cdn$0.20, 2021.06.22

Shares Outstanding 53,992,151m

Market cap Cdn$10.7m

MTB website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.