Falcon Gold poised to drill Central Canada project, Ontario

June 16, 2021

Drills will soon be turning at Falcon Gold’s Central Canada gold project, located 21 km east of Atitokan and 160 km west of Thunder Bay, Ontario.

The company on May 11 announced its 2021 exploration program, with the outcrop exposures and trench areas taking priority. It is here that the geological team will conduct detailed structural mapping along the 275-meter-long strike of the Central Canada mine trend. The team will also turn its attention to other high-priority gold targets along strike and parallel to the trend.

In addition to mapping the outcrops, Falcon has started interpreting the 2020 heliborne high-resolution magnetic and time-domain electromagnetic survey utilizing artificial intelligent (AI) computer analyses — a technology capable of identifying areas of complex folding and faulting.

The company plans to drill up to 2,000 meters in 20 holes, the goal being to target gold mineralization in the shaft area and to test other gold zones such as mineralized quartz-feldspar porphyries and the Northern Vein also known as the No. 2 Vein. Based on surface mapping and AI analyses, drilling will try to intersect targets recommended by the studies.

“We are looking forward to commencing phase 3 drilling shortly, the intent is to target the historic shaft area initially and complete further infill along the 275m strike of the Central Canada mine trend,” said CEO Karim Rayani. “With the recent airborne and survey interpretations completed we are now gathering the necessary modeling of the folding and faulting structures to better predict how the gold zones behave below surface. We are looking at a very busy season ahead of us.”

Central Canada gold project

Falcon Gold first outlined its 2021 exploration plans in a March 2 news release, explaining that the Central Canada property hosts two types of targets — the high-grade gold zones the 2020 drill campaign focused on, and copper-cobalt sulfides associated with massive iron sulfides and oxides hosted in the Quetico fault.

Notably, Falcon Gold management believe they may be ready for a preliminary resource estimate following analysis of the 2020 core samples and digital modeling.

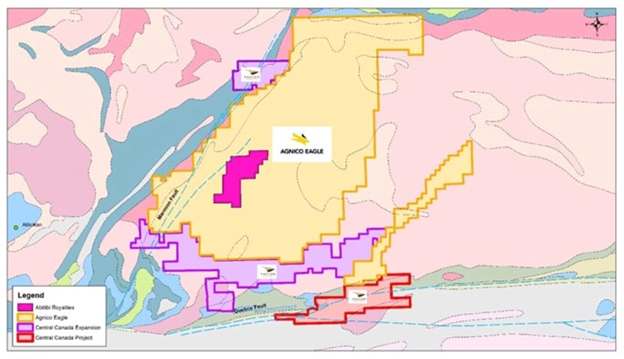

In 2020 Falcon completed an inaugural 17-hole drill program totaling 2,942.5 meters of core and acquired by staking 4,477 hectares of mineral claims south and northwest of Agnico Eagle’s Hammond Reef property. Falcon Gold has the largest land position in the Atikokan gold camp — bested only by Agnico Eagle Mines (TSX:AEM) and its 32,070-ha Hammond Reef exploration project, bought by AEM in 2018.

Open-pit measured and indicated (M&I) resources at Hammond Reef are estimated at 4.5 million gold ounces.

The Central Canada gold mine has an interesting history. Between 1901 and 1907, a shaft was sunk to a depth of 12 meters and 27 ounces of gold from 18 tons were mined using a stamp mill. During the 1930s, the shaft was deepened to 40m with about 42m of crosscuts, and a 75 ton-per-day gold mill was installed. Diamond drilling by Anjamin Mines in 1965 returned a 0.6-meter intersection of 37 g/t Au. Another hole assayed 44 g/t Au over 2.1m.

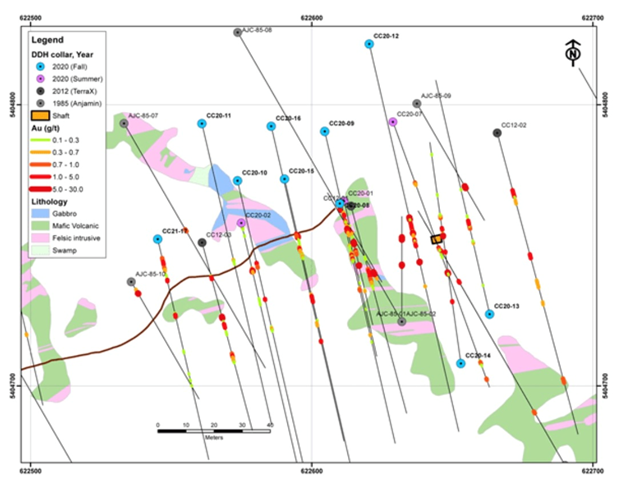

A more aggressive drill program in 1985 saw Interquest Resources punch in 13 holes @ 1,840m, the highlight being a 1.1-meter intercept of 30 g/t Au.

In 2012, diamond drilling was completed by TerraX Minerals, consisting of three holes totaling 363m, spaced 55 meters apart to test a 110m strike length of the main Central Canada structure. The first TerraX hole, CC12-01, cut 10.61m averaging 1.32 g/t Au, including 1.82m of 4.77 g/t Au.

A 7-hole, 1,055m program completed by Falcon Gold in July 2020 featured a 3-meter interval of 10.17 g/t Au, @ 67m down-hole. Falcon also intersected a new mineralized zone, untested by previous operators, at 104m depth, which sampled 18.6 g/t Au over 1m.

Fast forward to the March 19, 2021 news release. The company has delivered 168 samples to be assayed and these samples are the last batch from the 2020 drill program (5 holes completed since last July). Three holes were completed in December, and two in November, of which hole CC 20-12 reported visible gold.

Highlights included:

In hole CC 20-15, the interval from 29.7m to 34.0m averaged 0.75 g/t gold with the first 0.5m grading 5.77 g/t Au. The 4.1m interval beginning at 59.5m returned a grade of 1.35 g/t Au with the last 0.8m assaying 3.95 g/t Au.

In hole CC 20-17, collared 100m west of the shaft, three zones of gold mineralization were intersected between 9.8m and 40.1m and appear to correspond to the Central Canada main gold zone. These results add continuity to the 275m strike length and depth >160m of the mineralized trend that has been intersected by the 2020 drill program.

Acquisitions

Falcon Gold has also been busy on the acquisitions front.

On March 11 the TSX Venture Exchange approved the company’s option to acquire a 100% interest in the Esperanza gold, silver and copper mineral concessions located in La Rioja province, Argentina.

This was followed six weeks later by an announced spin-off, whereby Falcon Gold LatamARG S.A. (LatamARG) will manage the day to day operations headed by country manager Juan Carlos Navas Díaz, a Venezuelan national with permanent residence in Argentina.

Under the option agreement, Falcon Gold will issue the vendors a series of shares and warrants over four years, along with minimal expenditures on the property amounting to US$350,000. This will give Falcon an 80% interest. The remaining 20% may be earned by issuing another 2 million shares and paying US$1.5 million, which includes a 1% NSR (net smelter returns) buyback with the vendors retaining 1%.

Comprising 10 mineral concessions covering 11,768 hectares, Esperanza is within the Sierra de Las Minas district, where there are a number of past-producing gold and silver mines.

In 2018 Falcon Gold completed a limited sampling program as part of its due diligence on the property. Highlights included a trench sample from Callanas East reporting 1m @ 5.61 g/t Au, and a 2.5m continuous chip sample from Callanas East showing 5.90 g/t Au, 20.6 g/t Ag and 0.29% Cu. Surface sampling results featured 27.93 g/t Au across 50cm from Callana III vein; and a 50-cm width of visible gold from the Callana IV vein that assayed 45.71 g/t Au with >100 g/t silver and 0.78% Cu.

Falcon Gold’s second acquisition, the Gaspard Gold Claims, was approved by the exchange in March. Under the terms of the agreement, Falcon Gold agrees to an initial $15,000 cash payment, followed by the issue of 200,000 common shares of FG and 200,000 warrants @ $0.20/sh. Additionally, during this year’s exploration season, Falcon must spend $34,000 on the property. The vendor retains a 2% NSR royalty, of which Falcon may purchase 1% at any time, for $1.5 million.

Comprising three mineral claims (3,955 ha) in the Clinton mining district of central BC, the Gaspard property is located 60 km from Williams Lake and about 16 km from the Blackdome gold mine. Blackdome has indicated resources of 144,500 tonnes grading 11.29 g/t gold and 50 g/t silver, and 90,600t inferred grading 8.79 g/t Au and 18.61 g/t Ag.

Blackdome mineralization is characterized as volcanic-hosted epithermal gold and silver, and according to Falcon, may represent the target type for the Gaspard Gold Claims.

Historical work includes stream sediment and soil sampling in the northern part of the claims, where gold geochemical anomalies were discovered.

Next steps include a helicopter magnetic survey comprised of 320 km of flight lines along 150m spacings; additional stream sediment sampling; and more prospecting, mapping and sampling of the brecciated rhyolite with quartz vein stockwork, needed to determine the source of the stream and soil anomalies. A budget of around $250,000 is expected to yield drill targets.

Conclusion

Falcon Gold has all the elements we like to see in an exploration-stage gold junior. The company is a large landowner in a past-producing mining district, with a mid-tier gold producer, Agnico-Eagle Mines, exploring just off its northern boundary.

Five holes drilled in November and December, that were targeting the main structural trend of the past-producing Central Canada gold mine, all intersected mineralization. The mineralization is proving to be quite robust — over a respectable strike length of 275m. If Falcon Gold is able to put together a maiden resource it will almost certainly add shareholder value.

From the drill map above, most of the gold mineralization appears to be in and around the mine shaft. However, what has not been shown yet, are any structural controls, such as folds or faults. We know the geology is split between the Watigoon sub-province in the north, and the Quetico sub-province in the south. Dividing them is the Quetico fault zone (QFZ), a narrow (under 100 km) zone that has been traced for over 100 km along an area of lakes and swampy ground. The Quetico fault zone is an important structural feature affiliated with a variety of mineral deposits.

A 1985 Ontario Geological Survey report describes the QFZ mineralization near the Central Canada claims as a massive sulphide zone located beneath Sapawe Lake of two parallel sulphide zones.

The lenses or irregular masses of sulphide occur within a volcanogenic environment. There is an ultramafic to mafic intrusive associated with some of the massive sulphide zones. Sulphide mineralization consists mainly of pyrite, pyrrhotite, magnetite, chalcopyrite, sphalerite with associated pentlandite and carrollite.

It’s exciting to think that the Central Canada project could host significant massive sulfide mineralization, trending east-northeast for a strike length greater than 3 km underneath Sapawe Lake — especially considering that a historical drill intersection known as the Staines Occcurence, on Falcon’s claims west of Sapawe Lak,e returned a wide, sulfide-rich zone averaging 0.64% Cu, 0.15% Co, 1.1% Zn and 0.35 g/t Au over a true width of 40m.

Falcon Gold plans to commence permitting a drill program to test the continuation of the sulfide horizon as indicated by geophysical surveys, with drilling likely to occur during the winter when Sapawe Lake is frozen over.

In the meantime, I expect plenty of new flow from FG, including geophysical interpretations, drill results and even a maiden resource estimate at the Central Canada gold property.

Falcon Gold

TSXV:FG, OTC:FGLDF, FSE:3FA.G

Cdn$0.10, 2021.06.15

Shares Outstanding 97.2m

Market cap Cdn$9.7m

FG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Falcon Gold (TSXV:FG). FG is a paid advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.