Arcology releases optimized version of CryptoKitties, the most popular game on Ethereum blockchain

2021.03.19

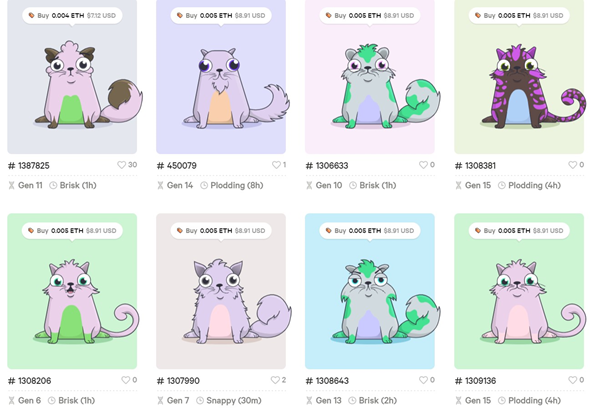

One of the most iconic and successful ventures to come out of the 2017 crypto mania was a blockchain-based game called CryptoKitties.

Developed by Canadian studio Dapper Labs and unveiled in October 2017, CryptoKitties – as its name implies – allows players to join a virtual world in which they can purchase, collect, breed and trade imaginary cats. It is essentially a digital version of popular collectible items like Beanie Babies or Pokemon cards, but instead of spending real money, these “kitties” can be traded with ether, which is the currency generated by the Ethereum blockchain.

While the development of blockchain has been aimed to help with our financial transactions, CryptoKitties is one of earliest attempts to deploy blockchain mainly for recreation and leisure. Data from 2019 showed that the game had 1.5 million users who were responsible for $40 million worth of transactions on its platform. Individual CryptoKitties have been sold for more than $300,000 apiece, according to some reports.

NFT: The Future of Digital Ownership

CryptoKitties operates on Ethereum’s underlying blockchain network as a non-fungible token (NFT) – a digital file whose unique identity and ownership are verified on the blockchain. Unlike fungible commodities such as gold and crude oil, NFTs are not mutually interchangeable.

As such, each digital pet in the CryptoKitties world is unique and owned by the user, validated through the blockchain, and its value can appreciate or depreciate based on the market. The CryptoKitties also cannot be replicated and cannot be transferred without the user’s permission even by the game developers.

As CryptoKitties’ popularity grew, so too did investor interest. In 2018, top venture capital firms Andreesen Horowitz and Union Square Ventures pumped $12 million into the development studio responsible for the original game. The capital raising allowed Dapper Labs to spin off into its own company to make more mainstream Ethereum applications.

The success of CryptoKitties has also led to a rush of new blockchain crypto collectibles, with many believing a market economy driven by NFTs is the way forward to own assets considered to be “one of its kind.”

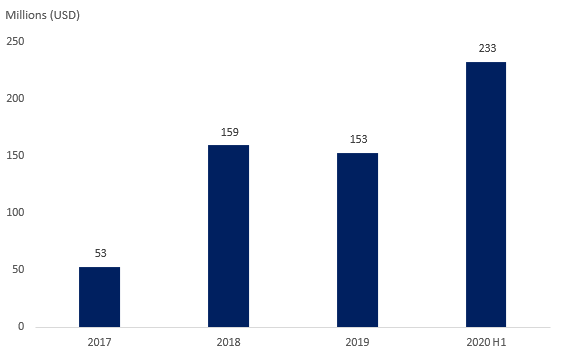

In 2020, NFTs gained further traction among consumers and investors; in the first six months alone, money transferred into the NFT ecosystem reached $233 million — up 52% from the entirety of 2019.

The reach of blockchain-based NFTs now goes well beyond a world of virtual pets; we have witnessed this year that the concept of owning non-fungible assets can even supplant existing physical collectors’ items in arts, music and sports.

Grimes, the Canadian singer who married Tesla boss Elon Musk, put her digital collection of artwork for $5.8 million in a 20-minute auction earlier this month. Days earlier, a Miami art collector sold a 10-second video that anyone could have watched online for an astonishing price of $6.6 million.

The collaboration between Dapper Labs and the National Basketball Association (NBA), which culminated in this year’s successful release of NBA Top shot, has taken the sports memorabilia industry to the next level. In just one week, the Top Shot online marketplace generated more than $65 million in sales of these basketball crypto collectibles.

A study by L’Atelier BNP Paribas last year estimated that the NFT market tripled in size last year, with total value rising to more than $250 million. The research document went on to say that this market could even be considered the core asset class for the so-called “virtual economy.”

However, like many technologies in their infancy stage, a digital marketplace built on NFTs has its drawbacks, mainly its scalability — the ability of that platform to support an increasing load of transactions.

When CryptoKitties debuted in 2017, its popularity and expanding user base congested the Ethereum network significantly, with the number of transactions peaking just two months after the game’s release. This caused noticeable slowdowns that reduced performance for all other applications running on the network.

Dapper Labs also cited Ethereum’s scalability issues as the primary obstacle to building its NBA Top Shot platform, which led the studio to develop a new blockchain.

Arcology: Solution to the Scalability Problem

To address the scalability issue that has impeded many blockchain platforms in their respective paths towards widespread adoption, a new blockchain ecosystem with unlimited scalability has been in the works for years.

Backed by Vancouver-based investment firm Codebase Ventures Inc. (CSE: CODE) (FSE: C5B) (OTCQB: BKLLF), Arcology is a revolutionary blockchain network designed to outperform market leaders like Ethereum that employ smart contracts to host decentralized apps for finance, gaming and other commercial sectors.

In a company press release, Arcology founder CEO Laurent Zhang stated:

“Today as Bitcoin and Ethereum values ascend, blockchain has become topical again. Arcology is focused on the overall importance and significance of blockchain. Our efforts to design and test the technology have been ongoing toward becoming the blockchain solution that results in mainstream adoption.”

According to Zhang, the reason why we have not seen a lot of exciting applications built on decentralized platforms to date is that the benefits of blockchain technology have yet to outweigh its weaknesses, namely the scalability issue.

Using financial institutions as an example, Zhang says this would require a standard of approximately 250,000 transactions per second (TPS), which far exceeds the average throughput of major blockchains like Bitcoin (7 TPS). EOS, currently the fastest cryptocurrency, processes transactions at a speed of only 3,000 TPS.

Therefore, Zhangs regards 250,000 TPS as a key figure, measuring system power and representing a real-world target for its new blockchain technology. To achieve this target, the team at Arcology decided to move beyond sequential ordering to process transactions, a design commonly used by other blockchains, and implemented a more efficient parallel processing method where thousands of transactions can be processed in batches at a time in a distributed, network-wide system.

Testnet results so far have shown Arcology’s compatibility with leading blockchain ecosystems including Ethereum, and supported management’s claim that Arcology can outperform these networks in terms of speed and scale.

Improved Version of CryptoKitties

To demonstrate its superiority to the Ethereum network, Codebase announced last month that Arcology has released an improved version of CryptoKitties. The new game — called LightspeedKitties — was optimized to take advantage of Arcology’s processing power and native ability to dynamically adjust to network demands.

To simulate approximately nine months of gameplay, the Arcology team created 5 million user accounts that generated 2.5 million transactions running on 32 Ethereum virtual machines, or EVMs. Results of the simulation showed that Arcology’s iteration of the virtual pet’s game outperformed the original Ethereum-based CryptoKitties by a significant factor of 1,000-to-one.

“We’ve proven that, with relatively minor modifications to their source code, Ethereum-based applications can be optimized for greater speed on our blockchain,” says Laurent Zhang, Arcology’s founder and lead scientist. “This is just the first of several planned demonstrations of Arcology’s capabilities.”

In this demonstration, Arcology’s game posted nearly 30,000 transactions per second on a one-minute moving average. Further benchmark data and demo videos released this week showed that the network’s TPS can top at more than 40,000.

Demo video: https://www.youtube.com/channel/UCkX5FKU1BU4wTmXZlEbmOhA

In comparison, Ethereum’s original network handles just 15 to 20 transactions per second. The long-awaited Ethereum 2.0 — which is not expected until 2022 — is forecast to process at most 3,000 transactions per second.

Not only is Ethereum prone to network disruptions when transactions start to pile up, but its transaction fees are also seen to increase dramatically during network surges. Arcology solves these problems by using artificial intelligence and adaptive learning to run a blockchain that is faster, more powerful and more flexible.

Following the successful deployment of Testnet 2.0, the release of LightspeedKitties represents significant progress toward Arcology’s goal of becoming a direct competition to Ethereum, the world’s largest smart contract-based blockchain.

Conclusion

Over the recent years, we have been told of blockchain technology’s transformational effect on the financial sector, but that promise hasn’t fully been met because of the scaling problem encountered by major ecosystems. With the right approach and technical team, that could all one day be solved.

Having identified Arcology as a radically new blockchain ecosystem designed to address the technology’s common challenges, Codebase Ventures Inc. (CSE:CODE) (FSE:C5B) (OTCQB:BKLLF) first made its investment in the platform back in 2017 and next looked back. In less than two years, the company has increased its stake to 30%, signaling continued commitment to founder Laurent Zhang’s vision for a new enterprise-tech ecosystem.

With the unveiling of a better version of the popular CryptoKitties game, the Arcology team is showing the world that it can indeed compete with major blockchains, further validating investor confidence in this potentially game-changing blockchain play.

Codebase Ventures Inc.

CSE:CODE, FSE: C5B, OTCQB:BKLLF

Cdn$0.49, 2020.03.17

Shares Outstanding 46,123,011m

Market cap Cdn$22.8m

CODE website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Codebase Ventures Inc. (CSE:CODE). CODE is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.