Renforth’s sulfide nickel play showing huge promise

2021.02.19

Nickel is an interesting metal to watch, considering the challenges that nickel mining companies face in ramping up production to meet skyrocketing demand for high-purity nickel required in electric vehicle batteries.

In addition to its traditional role in stainless steelmaking, the base metal is becoming more and more important due to its use in nickel-cobalt-aluminum (NCA) and nickel-cobalt-manganese (NCM) lithium-ion batteries. NMC 811 battery cells (8 parts nickel, 1 part each lithium and cobalt) are being produced on a greater scale, because they deliver higher energy density and greater storage capacity, at lower cost.

Nickel: under-supplied, over-demanded

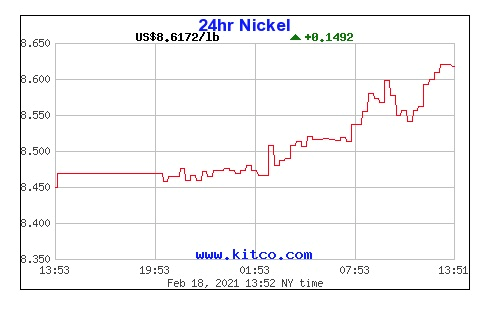

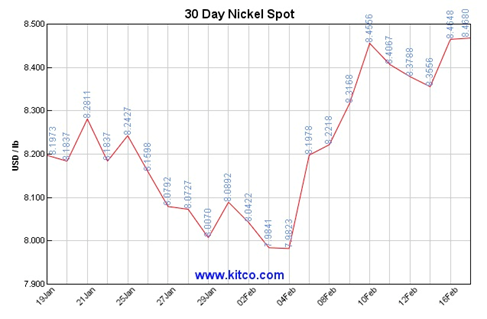

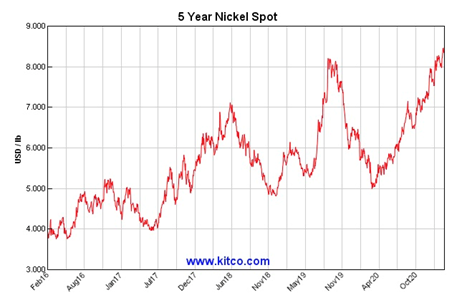

However, the nickel market is currently under-supplied, in relation to demand, a condition that is supporting higher prices. Spot nickel recently hit a six-year high of $18,534 per tonne ($8.40 a pound). It is up 30% compared to the same time last year, amid rising demand expectations pertaining to the electric vehicle battery sector, and strengthening macroeconomic conditions (especially in Asia) as some economies lift coronavirus-related restrictions, that have led to higher consumption of raw materials for making stainless steel.

In fact nickel market participants are eyeing the $20,000/tonne threshold that analysts believe could spur investment in new supply. What could push nickel to such lofty heights? In a word: EVs.

According to a recent report by Roskill, released by the European Commission’s Joint Research Centre, nickel demand is in for an exponential growth spurt.

Based on the premise that automotive electrification will represent the better part of global nickel demand for the next two decades, the report says demand will shoot from 92,000 tonnes in 2020, to 2.6Mt in 2040, a 28X increase!

In 2020, global production of mined nickel was 2.5 million tonnes.

“Underpinning this growth is our expectation for EU27 OEMs to increasingly utilize high-nickel cathode chemistries from the mid-to-late 2020s and throughout the 2030s,” the report states.

In fact, the authors anticipate that, unless a sizeable “end of life” recycling industry is established, which would be a source of materials to produce nickel sulfate, “we expect a supply deficit to form in 2027 and then remain over the rest of the outlook period [to 2040].”

The research firm also believes that the availability of feedstock (ie., nickel sulfide mines), not processing capacity, will be the biggest bottleneck in the nickel sulfate supply chain and is the cause of the market potentially going into a structural deficit after 2027. For Europe, this means finding and securing sources of primary nickel supply outside of the EU’s 27 member countries.

But nickel producers need not wait that long to feel the pressure of tighter supply. Although the market could see a surplus of 75,000 tonnes this year, supply needs to increase by 4% just to keep pace with demand, according to Nornickel, the world’s second largest nickel miner.

The trend of increased nickel use in EV batteries is changing the product mix among some nickel miners. According to a recent Reuters article, producers of nickel pig iron in Indonesia, exported mainly to China for use in steelmaking, are looking to convert NPI material into an intermediate product that can be turned into nickel chemicals for the lucrative EV market. The price of nickel sulfate, the material used in electric vehicle batteries, has jumped about 40% since last April to around $18,000 per tonne.

“Given the spread between sulfate and NPI prices at the moment, about $4,000, it makes economic sense,” Reuters quoted Macquarie analyst Jim Lennon, who added that the NPI would be converted into matte, which can be refined into metal or battery-grade nickel sulfate.

“Nickel demand for batteries is accelerating much faster than we were assuming even a few months ago,” he said.

According to a February 2021 report by Adamas Intelligence, over 60% of passenger EV battery capacity deployed in 2020, was in the form of high-nickel cells, such as the above-mentioned NCA batteries or NCM 6 to 8 series cells. The research firm also found that less than 10% of electric car battery capacity last year was in the form of no-nickel cells such as lithium iron phosphate (LFP), lithium manganese oxide (LMO) or lithium tinanate batteries (LTO) chemistries.

The shift in nickel demand dynamics is being reflected in China’s nickel imports. Although nickel usage by the world’s top consumer of the metal is still dominated by stainless steel, Chinese nickel sulfate imports registered the second highest year on year growth, up 30% to 5,600 tonnes.

Sulfides vs laterities

To understand concerns by Tesla and other EV makers over whether there will be enough high-purity “Class 1” nickel needed for batteries, we need to know about the two types of nickel deposits, sulfide or laterite. About 60% of the world’s known nickel resources are laterites. The remaining 40% are sulfide deposits.

Large-scale sulfide deposits are extremely rare. Historically, most nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Norilsk in Russia and the Bushveld Complex in South Africa, known for its platinum group elements (PGEs). However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Reuters has reported on the multi-billion-dollar Chinese-led project to produce battery-grade nickel chemicals, that Indonesia, the top nickel producer, hopes will attract EV manufacturers to the country. At least four

high-pressure acid leach (HPAL) plants are currently under construction, led by Chinese stainless steel producers and battery makers.

The country expects to double investment in nickel processing from 2020 to $35 billion in 2035. Jakarta has also signed a $9.8 billion EV battery deal with South Korea’s LG Energy Solution.

While the Indonesian government is happy to accept the foreign investment in its burgeoning EV industry, it is no longer willing to tolerate the environmental degradation that laterite nickel production entails.

The Southeast Asian nation recently announced it will forbid mining companies from dumping mining waste into the ocean, a practice known as deep sea tailings (DST). To clarify: the government hasn’t actually banned DST, but by not issuing new permits, it could delay planned projects and complicate efforts to dispose of waste, Reuters reported. The lengthy wait means land tailings will eventually become “the only option,” a mining company source told the news outlet.

That, in turn, could affect the economics of any new projects — disposing of the tailings on land, in a nation of islands where space is at a premium — will surely throw a wrench into operations and significantly add to their costs per tonne.

Along with the disposal issue, it is also very expensive to process nickel from laterites due to the complex metallurgy.

HPAL – whose performance record has been highly mixed – involves processing ore in a sulfuric acid leach at temperatures up to 270 degrees C and pressures up to 600 psi to extract the nickel and cobalt from the iron-rich ore; the pressure leaching is done in titanium-lined autoclaves.

Counter-current decantation is used to separate the solids and liquids. Separating and purifying the nickel/cobalt solution is done by solvent extraction and electrowinning.

The advantage of HPAL is its ability to process low-grade nickel laterite ores, and recover nickel and cobalt. However, HPAL is unable to process high-magnesium or saprolite ores, it has high maintenance costs due to the sulfuric acid, and it comes with the cost, environmental impact and hassle of disposing of the magnesium sulfate effluent waste.

According to S&P Global Market Intelligence, technical difficulties, high costs and low nickel prices in previous years led to problems at several HPAL projects, including First Quantum Minerals’ Ravensthorpe mine, put into care and maintenance, Sherritt International having to write down CAD$1.723 billion of its Ambatovy mine, and Vale reviewing its Goro operation in New Caledonia.

In comparison, the main benefit to sulfide ores is that they can be relatively easily concentrated using the traditional flotation technique. Most nickel sulfide deposits have been processed by concentration through a froth flotation process followed by pyrometallurgical extraction.

Will annual world nickel production of around 2.5 million tonnes be enough to satisfy both stainless steel and battery demand? Less than half of total nickel output is Class 1, suitable for conversion into nickel sulfate used in battery manufacturing. Only around 6% of nickel ends up in EV batteries; remember, 70% of supply goes into making stainless steel.

Class 1 nickel powder for sulfate production enjoys a large premium over LME prices, but for miners to switch to battery-grade material requires huge investments to upgrade refining and processing facilities. We’re talking in the hundreds of millions of dollars.

According to BloombergNEF, demand for Class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers. Nickel’s inroads are due mainly to an industry shift towards “NMC 811” batteries which require eight times the other metals in the battery. (first-version NMC 111 batteries have one part each nickel, cobalt and manganese).

From this analysis, it’s clear that more sulfide nickel deposits suitable for Class 1 battery-grade nickel will need to be found.

Battery growth

Currently, less than 1% of the world’s vehicles are electric, but by 2030 they are expected to represent about 11% of new car sales, according to commodities consultant Wood Mackenzie.

And while there are a number of obstacles to increasing that percentage of EVs to regular vehicles, including charging station infrastructure and making the sticker prices of electric vehicles affordable to the average person, recent research suggests the battery storage market is growing in leaps and bounds.

According to an analysis by Adamas Intelligence, in 2020 a total of 134.5 gigawatt hours (GWh) of battery capacity was deployed globally into newly sold passenger BEVs, PHEVs and HEVs, an increase of 39.6% compared to 2019. The figure would be up to 40 GWh higher, if additional capacity in sales channels and automaker assembly lines were factored in, said the Toronto-based firm, which tracks demand for EV batteries by chemistry, cell supplier and capacity in over 90 countries.

Yet despite the nearly 40% rise in battery capacity to meet surging demand by automakers for EV battery packs, the industry appears unable to keep pace. In a call to investors last month, Tesla’s CEO Elon Musk said the company does not have enough battery cells to put new models like its Semi truck into production.

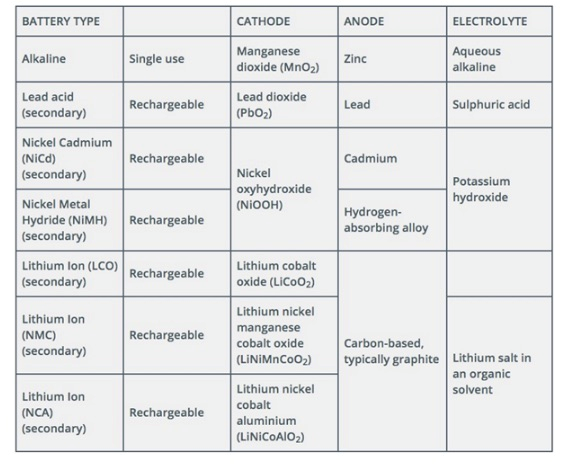

The Nickel Institute informs us that nickel has long been widely used in batteries, most commonly nickel cadmium (NiCd) and in longer-lasting nickel metal hydride (NiMH) rechargeable batteries. The major advantage of nickel in batteries is it helps to deliver higher energy density and greater storage capacity, at a lower cost.

As the table below shows, nickel is an essential component for the cathodes of many secondary battery designs. (“secondary” refers to batteries that can be recharged and re-used)

Another demand driver for nickel (and other battery metals, like lithium and graphite) is utility-scale energy storage. Researchers at Imperial College London developed a model to determine the lifetime costs of nine electricity storage technologies for 12 applications, between 2015 and 2050. The model predicted that the cost of lithium-ion batteries would fall far enough to beat pumped hydro energy storage – currently the cheapest way to keep energy on ice, as it were.

The finding opens up a potentially lucrative market for lithium and other metals that go into lithium-ion batteries, beyond electronics and EVs. The energy storage market was just 1.4 gigawatts (GW) worldwide in 2017 but it could reach 8.6GW by 2022, according to GTM Research. The US and China are currently the biggest supplies of stored energy and are expected to remain so until 2022, GTM Research said in a 2018 report.

Beyond batteries, lot of nickel will still need to be mined for stainless steel and other uses. The nickel industry’s dilemma is therefore how to keep the traditional market intact, by producing enough nickel pig iron (NPI) and ferronickel from laterites to satisfy existing stainless steel customers, in particular China, while at the same time mining enough nickel sulfides to surf the coming wave of EV battery demand.

Sulfide cupboard is bare

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically and technically feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Since 1990, the only large discoveries that have occurred, happened when exploration was going on for other metals.

Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia. Capital expenditures on nickel projects plummeted from $7 billion in 2012 to $2 billion in 2017.

The result of such limited nickel exploration is a very limited pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will be extremely attractive to potential acquirers.

Surimeau

One company that plans to take full advantage of the change in the nickel market towards greater demand for nickel sulfates, is Renforth Resources (CSE:RFR, OTC:RFHRF, WKN:A2H9TN)

The Quebec and Ontario-focused company is fortunate enough to have a nickel sulfide deposit at surface whose secrets it is just starting to reveal to the market.

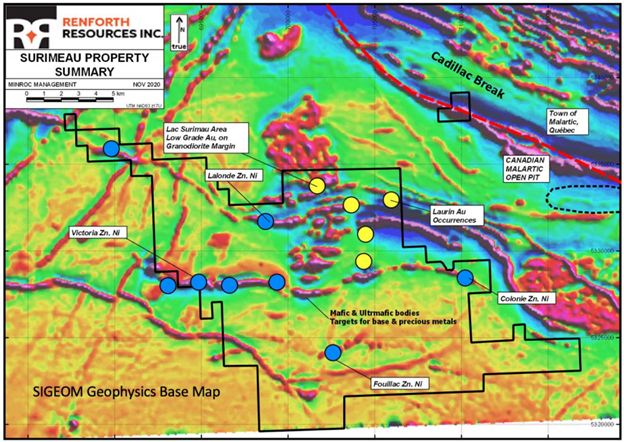

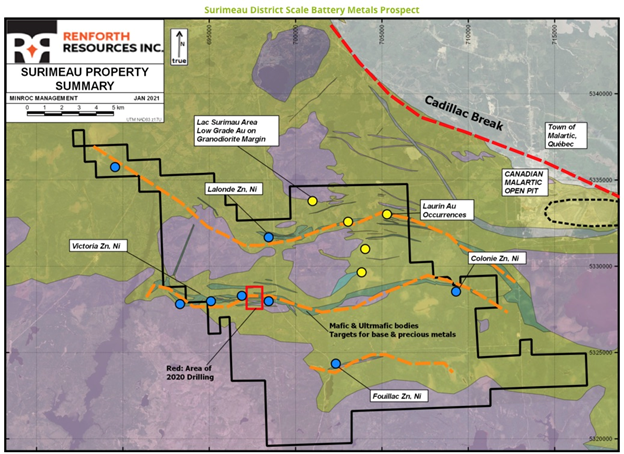

This Surimeau property — now covering a total area of 215 km2 — is host to a known polymetallic (copper and zinc) mineralized system with additional geophysical anomalies. There is also an ultramafic sulfide nickel system nearby.

It is adjacent to the Canadian Malartic Mine, currently the largest gold mine in Canada, and about 20 km south of Agnico Eagle’s LaRonde Mine.

The 5 km of mineralized strike forms the western end of an ~20km trend of ultramafic and volcanic intrusives, occurring with a pronounced magnetic anomaly which is also mineralized at its eastern end.

Drill holes have been sited to undercut the Victoria West nickel-copper-zinc trend to obtain new mineralized intervals, fresh rock and a more complete picture of the area than can be obtained by surface prospecting.

Historically, parts of the Victoria trend were initially identified as a strong airborne conductor. Follow-up drilling during the 1950s and 1970s identified a strong multi-kilometer zone of strong disseminated sulfides mineralization, without the ability to determine a genetic model.

According to Renforth, this is a very large geophysical trend that is mostly under cover, which may pose exploration challenges for an anomaly this size.

Nickel sulfide system

Aside from the known copper-zinc mineralization, Surimeau also hosts a large-scale nickel sulfide-PGE system with nickel-hosted ultramafic rocks and VMS features typical of the Cadillac-Larder Lake fault zone.

Historic surface sampling in the Victoria area of Surimeau had values as high as 0.503% Ni. A team of Renforth geologists previously visited three of the four areas and took grab samples that support such findings.

Just how large this nickel sulfide system remains to be seen, but the newly acquired Fouillac showing gives an indication that there could be a large nickel deposit waiting to be outlined.

Initial prospecting at this showing resulted in several samples being taken from potential gold-hosted environments and a nickel target similar to the Victoria West portion of the Surimeau property.

Drill results

Two hundred meters of a planned 1,000m was completed at Surimeau to get a more complete picture of the nickel-zinc-copper mineralized trend. The first drill test, completed on the historical Victoria nickel-zinc-copper showing, successfully identified polymetallic mineralization in core.

In drill holes SUR-20-001 and SUR-20-002, visual description identified intervals of strong stringer zones and disseminated sulfides, mainly pyrrhotite, on multiple intervals varying between 1m and 13m of core length. Overall, the sulfide-bearing envelope makes respectively 26.5m and 60m for the two holes, which are located about 220m apart.

“We consider our achievement to be a new discovery at Surimeau, where we have proven over 200m that the geophysical anomaly and its associated surface mineralization carries metal sulfides sub-surface, at some initial depth,” Renforth’s CEO Nicole Brewster stated in a media release.

On Feb. 9 Renforth added detail to its discovery by releasing assay results from the first three holes. The results featured 0.156% nickel over 13 meters, including a higher-grade 1-meter section of 0.483% Ni in hole 3; and 0.126% Ni over 20.5m, including 0.209% over 2.4m in hole 2.

In hole SUR-20-001, a near-surface section from bedrock down to 4 meters returned 1.16% zinc, and 1.132% copper, followed by 0.147% Ni over 7.9m.

According to Renforth, information gleaned from drilling and trenching the Victoria West target, along with surface sampling, create an area of interest that includes about 5 kilometers of strike on the western end of ~ 20-kilometer central anomaly at Surimeau.

The company interprets this anomaly to be a nickel-bearing ultramafic body, which occurs alongside, and is intermingled with, sediment- and volcanic-hosted copper-zinc VMS-style mineralization. In fact Renforth considers the style of mineralization to be an “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold. About 50 million tonnes of ore averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined from three deposits between 1913 and 1988.

“Like Surimeau, the Outokumpu district is located in a deformed high grade metamorphosed terrain where volcanic and ultramafic units form intercalated lenses in a sediment dominated environment,” the news release states.

Renforth is clearly hoping to find high-sulfidation nickel appropriate for batteries that would make the project and/ or the company attractive to potential acquirers. Evidence of the nickel purity was announced on Feb. 18. According to the company, grab samples taken from surface at Surimeau showed an average 68% sulfide nickel content, supporting its exploration thesis that “with 5 kms of mineralization observed at Victoria West alone, is a large scale battery-grade nickel discovery on surface.”

Interestingly, all of the samples except one were taken from Victoria West. The other lone sample taken from Lalonde, a target about 3.5 km north of Victoria West, returned the highest sulfide percentage, suggesting the possibility of higher nickel sulfidation in the northern part of the anomaly.

Porphyry comparisons

What to make of this potentially large nickel sulfide system, which if the mineralization stays close to surface, could be open-pittable? It helps to compare it to other large-scale mineral deposits in Canada that have been developed into operating mines.

British Columbia is best known for its porphyry copper/ gold mineralization. These deposits contain the largest resources of copper, significant molybdenum and 50% of the gold in the province. Examples are big copper-gold and copper-molybdenum porphyries, such as Red Chris and Highland Valley. Large, undeveloped porphyry deposits along the North American Ring of Fire include Galore Creek in BC and the Pebble project in Alaska.

Porphyry deposits are usually low-grade but large and bulk-mineable, making them attractive targets for mineral explorers. In British Colombia the average is 0.40 copper equivalent (CuEq) – other metals such as gold, molybdenum and silver are byproducts.

A little back-of-the envelope math by yours truly shows the potential for an impressive sulfide nickel/ VMS deposit of significant scale at Surimeau, to interest a major mining company or funding partner.

From the Feb. 9 drill results, we have:

- 0.156% nickel over 13m, including a higher-grade 1-meter section of 0.483% Ni in hole 3

- 0.126% Ni over 20.5m, including 0.209% Ni over 2.4m in hole 2

- 1.16% zinc, and 1.132% copper over 4m, followed by 0.147% Ni over 7.9m in hole 1

Setting an average grade of 0.224% Ni at current nickel prices of US$8.47 per tonne works out to US$41.83/ Cdn$53.04 per tonne rock.

Of course, a percentage of the rock will not be ultramafic and some of it will not be recoverable. But even at a very conservative potentially mineable estimate we are talking about belonging to an enviable peer group!

The latest mineral reserve estimate for the Gibraltar Mine in BC showed a copper grade of 0.25% Cu, or US$21.55/tonne.

Highland Valley’s proven and probable reserves in 2018 showed 383 million tonnes at 0.32% Cu and 0.003% Mo. Kitco’s “rocks in the box” calculator values this rock (copper only, not moly) at US$27.58 per tonne.

At the Red Chris Mine, a 2010 feasibility study showed reserves of just over 300 million tonnes grading 0.349% copper and 0.274 g/t gold. A 2012 reserve estimate – the latest – is virtually unchanged. Rocks in the box values this ore at US$45.71 per tonne.

Copper Mountain near Princeton, BC, shows proven and probable reserves of 593.8 million tonnes, with grades of 0.26% copper, 0.10 g/t gold and 0.73 g/t silver. (rock value US$28.75/tonne)

If the Surimeau property can manage an only nickel grade – using no other metal credits like the contained copper and zinc – of 0.224%, the in-situ value per tonne would be equivalent to a copper deposit of 0.48% Cu (US$41.38/tonne rock).

Conclusion

Though early stage, the possibility of widespread sulfide nickel mineralization at Surimeau looks promising. The grades and rock value given here are conservative; the 0.224% Ni used to calculate the rock value of US$41.83 per tonne is based on only three intercepts from three holes drilled at Surimeau, less than 500m. Highlights from summer 2020 grab sampling show grades up to 0.495% Ni. If those grades start showing up in drill core, Renforth could really be onto something.

The company plans to complete drilling at its Parbec gold property, after which its crew will head back to Surimeau to carry out the next phase of drilling. Up to 2,500m are planned for late April or May. Can’t wait to see what they come up with.

Renforth Resources

CSE:RFR, OTC:RFHRF, WKN:A2H9TN

Cdn$0.075 2021.02.18

Shares Outstanding 251m

Market cap Cdn$17.0m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard does not own shares of Renforth Resources (TSX.V:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.