Sentinel completes extensive data review on Australian projects, multiple targets identified

2021.02.08

Australia has long been known as a mining country, home to world-class geologists, accessible projects and excellent infrastructure.

Its mining industry dates back to the gold rushes of the 1850s, which has since become a significant contributor to the Australian economy, accounting for 7% of its GDP and more than half of its total exports.

Australia is currently one of the world’s top 3 producers of gold. The country holds – by a wide margin – the largest mine reserves in the world, with 10,000 tonnes of gold or 20% of the global total.

Significant gold endowments are found throughout Australia, many of which are found in the state of New South Wales. The region is home to some of the biggest gold deposits in the world including Newcrest’s Cadia Valley, which has the largest facility of its type in the country.

Sentinel Resources

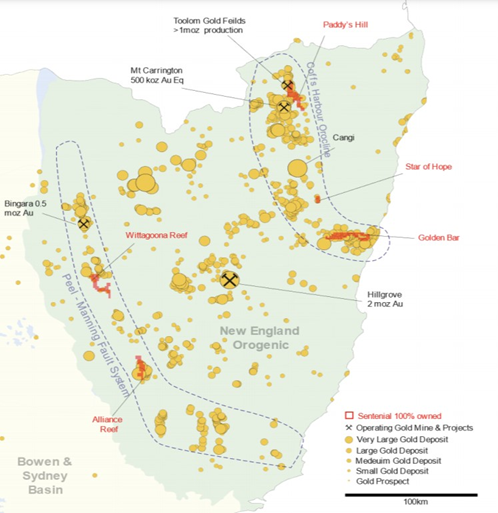

Last fall, junior miner Sentinel Resources Corp. (CSE: SNL, US:OTC PINK: SNLRF) acquired eight gold exploration concessions totaling approximately 94,500 hectares (945 km2) in New South Wales.

These concessions – known as Star of Hope, Golden Bar, Alliance Reef, Stanleys, Lady Mary, Waddery West, Wittagoona Reef and Toolom South – are strategically located within a prolifically mineralized area known as the New England and Lachlan orogenic terranes.

Past record shows at least 198 historic gold mines and exploration prospects present across the project area, many of which had multi-ounce gold grades.

New England Orogen

The New England Orogen is a significant mineral province in Eastern Australia that forms the basement throughout the northeast of New South Wales. It was developed along the eastern margin of the Gondwana supercontinent as a result of convergent tectonic processes during the Paleozoic and early Mesozoic eras.

The orogenic terrane was most likely island arc-related from the Cambrian to the Middle Devonian, changing to a continental margin magmatic arc from the late Devonian onwards. Ophiolites – remnants of the ocean floor – crop out along the regional Peel-Manning suture zone, which is highly prospective for orogenic gold.

The presence of alluvial gold fields and showings, the large number of historic underground mines and the variety of tectonic terranes all indicate that the New England Orogen is highly prospective for gold and silver discoveries.

Major deposits in the past include gold bonanzas at Mount Morgan (> 7moz) and Gympie (> 3moz) (Queensland) and Hillgrove (New South Wales). Significant gold resources have been recently discovered at Gympie, Cracow, Tooloom and Mount Rawdon. Still, many parts of Devonian to Triassic New England Orogen remain underexplored by Australian standards.

Of Sentinel’s eight gold projects, five are found with the New England orogenic terrane. These include:

- Toolom South — This license is located within the historic Toolom goldfield, with reported past production of more than one million ounces. It covers an area of 165.6 km2 and includes over 60 historic gold mines and high-grade gold showings.

- Alliance Reef — This license covers 102.5 km2 in area, along a 12 km strike of the highly mineralized Peel-Manning fault system. It hosts 28 historic mines including the Marquis of Lorne gold mine, with a cited resource estimate of 336,000 tonnes at 4.75 g/t Au for 51,000 ounces of gold.

- Wittagoona Reef — This 150.7 km2 concession also covers part of the Peel-Manning fault system and shares many similarities to Alliance Reef. Records indicate there are at least 11 historic mines and prospects within the area.

- Golden Bar — This concession covers 198 km2 of the eastern part of the New England Orogen, hosting at least 50 historic underground mines and prospects, most of which are structurally controlled with cited grades of up to 184 g/t Au.

- Star of Hope — A 28 km2 license located in the northeastern part of the mineral province, it is host to more than 12 hard-rock mines and many high-grade showings.

Lachlan Orogen

The Lachlan Orogen of New South Wales, Victoria and eastern Tasmania represents a marginal mobile zone developed at the edge of the Australian Plate, during the Ordovician and Early Carboniferous Period.

It comprises a series of prolifically mineralized accretionary terranes hosting a variety of deposit types. In New South Wales, these include: porphyry and related skarn Cu-Au, epigenetic and hydrothermal Au and Pb-Zn-Cu, and orogenic Au, and VHMS style Pb-Zn-Ag-Au.

While the Lachlan Orogen is generally poorly explored for gold, recent discoveries such as Regis Resources’ McPhillamys deposit – estimated to contain over 2moz in reserves – highlight the prospectivity of these provinces.

Sentinel’s three remaining gold projects are found within the Lachlan orogenic terrane:

- Stanleys — This project spans 89.5 km2 across the eastern part of the Lachlan Orogen and includes 17 historic mines and showings. Historic records show production grades of up to 185 g/t Au.

- Lady Mary — This 92.7 km2 concession is located at the centre of the Lachlan orogenic terrane, hosting 15 historic hard-rock mines and prospects.

- Waddery West — The principal target of this 131.3 km2 concession is a 15 km long gold mineralized dyke swarm. Limited exploration in the past has identified a potential Carlin-style mineralization to the northeast of the tenement.

Drill Targets Identified

Following its acquisition of the gold projects, Sentinel Resources subsequently added seven silver exploration concessions, again within the New England and Lachlan orogenic terranes, to bolster its portfolio.

Initial review of available data indicated that the Alliance Reef, Wittagoona Reef and Toolom South gold projects are likely to host extremely robust exploration targets; the Wallah Wallah, Stoney Creek and Carrington silver prospects are also considered high-priority projects.

This week, the company announced it has completed a much more extensive data review program and delineated multiple highly prospective target areas for drill testing within its gold and silver portfolio in New South Wales.

Based on a detailed review of all geological, geophysical and geochemical data available to the company, the Sentinel exploration team has identified three gold projects Golden Bar, Toolom South, Hill End South) and one silver project (Carrington) as strong targets for initial drill testing.

“The high-priority targets outlined here are consistent with our aim of using historic information to help define drill targets at an early stage of exploration. The next steps involve obtaining landowner and native title agreements followed by fieldwork to confirm potential these as drill targets,” Dr. Peter Pollard, Chief Geologist of Sentinel, stated in the February 4 press release.

“Our technical team has worked diligently and methodically to understand the geology and geophysical interpretations to identify the highest potential drill targets at our gold and silver projects in order to increase our odds of success for our maiden drilling at these largely untested target areas,” Rob Gamley, President and CEO of Sentinel, commented.

Salama Gold Project

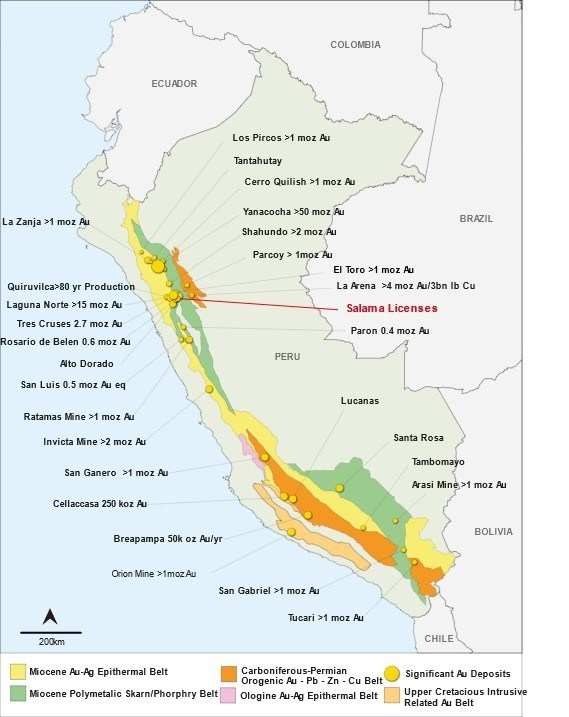

Elsewhere, Sentinel is also exploring for gold at its Salama project in the Anta province of Peru. The property consists of four exploration concessions, covering 2,700 hectares of land.

Preliminary review of the Salama project indicates extensive areas of quartz veins with localized silicified breccias that have been the focus of historic production by artisanal and small-scale miners. These miners targeted high-grade areas where oxidation of bedrock resulted in the formation of free gold amenable to gravity recovery.

Regional satellite imagery indicates that two major structures intersect in the northeast of the concession, in a similar geological setting to La Virgin gold mine 20 km to the north. Historic gold production at La Virgin was reported as 120,000 ounces annually.

Sentinel’s field team will initially comprise three in-country geologists, allowing for rapid first pass reconnaissance and rock chip grab sampling. The field team has robust project review and target generation experience, especially with respect to Peruvian low and high sulphidation epithermal deposits, such as Lagunas Norte, La Arena and Rosario De Belen.

Waterloo Silver Project

Furthermore, the company is also looking to advance its Waterloo silver project located 65 km east of Kelowna, British Columbia.

The 3,130-hectare Waterloo property is underlain by Mesozoic Quesnel Terrane rocks that also host nearby deposits in the variety of porphyry Cu-Au (New Afton, Ajax, Copper Mtn.), Cu-Au skarn (Phoenix), mesothermal-Au (Greenwood camp), polymetallic Pb-Zn-Ag (Slocan camp) and epithermal Au (Knob Hill – Washington).

Review of available data on Waterloo indicates small-scale production from high-grade silver and gold prospects since the early 1900s (Waterloo mine), but the property has never been systematically drill tested.

So far, Sentinel has completed a Phase 1 work program on the property, returning significant assay results of 7,470 g/t Ag and 39.8 g/t Au.

Conclusion

With past production of 40 million ounces and current in-ground gold resources exceeding 68 million ounces, NSW remains largely underexplored, representing opportunities for new discoveries.

With drill targets identified and all cashed up from last year’s $1 million financing, Sentinel is now ready to move onto the next stage of gold exploration within a prolific mining district of Australia.

Given that multiple targets were prioritized, in areas with historic mining and production, Sentinel’s maiden drill program could return compelling results. We believe this could be the beginning of another mining success story in the state of New South Wales.

Sentinel Resources Corp.

CSE:SNL, US OTC PINK:SNLRF

Cdn$0.36 2020.02.05

Shares Outstanding 29,295,264

Market cap Cdn$9.1m

SNL website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Sentinel Resources (CSE:SNL, US OTC PINK:SNLRF). SNL is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.