Palladium One’s survey says big new anomaly

- Home

- Articles

- Uncategorized

- Palladium One’s survey says big new anomaly

2020.02.29

The first results of Palladium One’s (TSX-V:PDM) IP survey are in, and they’re excellent.

The Vancouver-based exploration company is pursuing PGEs, copper and nickel at its LK project in north-central Finland, where nine exploration permit applications (totaling 2,500 hectares) feature three mineralized zones: Kaukua, Murtolampi and Haukiaho.

In January PDM commenced an induced polarization (IP) survey, designed to zero in on shallow zones of conductivity, containing higher sulfide concentrations. These zones will then be drill-tested with up to 5,000 meters of diamond drilling.

Last year the company published the first (maiden) NI 43-101-compliant resource at Kaukua, putting Palladium One on track for developing an open-pit PGE-nickel-copper mine in Finland.

Palladium One wishes to add up to a million more ounces of palladium-equivalent resources (Pd_eq) to the Kaukua optimized pit.

The three-dimensional, geophysical study is being conducted by Vancouver-based SJ Geophysics. Its Volterra 3-D IP system is surveying five separate grids for a total of 75 line kilometres – reading five lines simultaneously to show high-resolution 3-D data.

IP surveys are commonly done in base metals exploration to locate ore deposits such as disseminated sulfides.

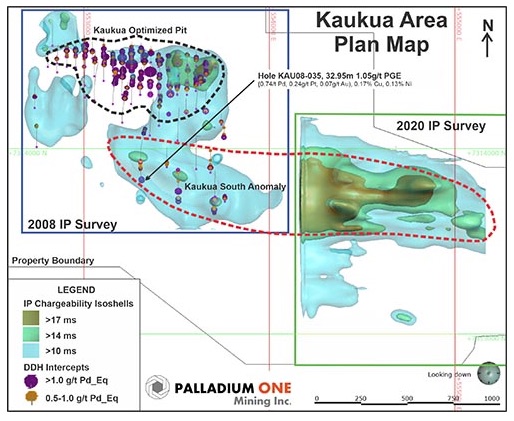

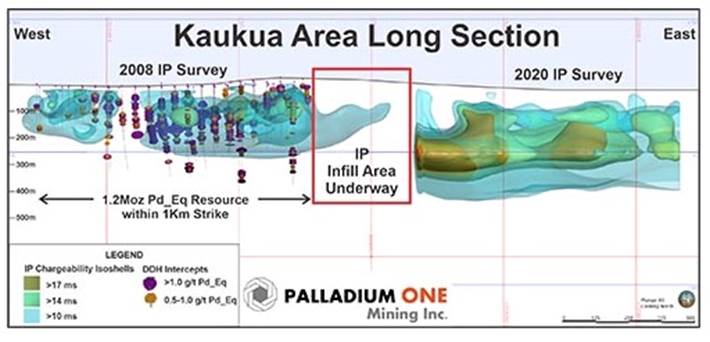

A previous IP survey worked well in identifying the core of the Kaukua deposit, which hosts 1.2 million Pd_eq ounces and has a strike length of one kilometer.

The five grids represent about 12 kilometers of strike length, of what PDM believes is the highly prospective basal (base) unit of the Koillismaa mafic-ultramafic complex, that hosts the Kaukua deposit.

In its Feb. 25 news release, Palladium One says initial results from the first grid, Kaukua East, have discovered a large chargeability anomaly. Finding the anomaly, which is indicative of underground mineralization, means the palladium-dominant Kaukua South Zone now extends over a 2-km strike length.

“Significantly, the chargeability anomaly on the new Kaukua East survey appears to be more intense and wider than the one on the 2008 survey, making it a very high priority drill target,” President and CEO Derrick Weyrauch stated.

Areas of high chargeability show up green, in the figure below.

The anomaly is also significant because it amends an earlier theory that the Kaukua South Zone was “cut-off to the east,” suggesting the Kaukua mineralized system is much larger than previously thought.

To explain, the 2008 IP survey did not identify any chargeability anomalies on the far eastern end of the Kaukua East grid. At the time, drilling was therefore directed away from the area, on the premise that mineralization must not exist to the east.

However, several holes on the western edge of this “gap zone” (illustrated by the area within the red rectangle in the figure below) delivered highly anomalous mineralization. These holes were never followed up on to the east, and the 2020 IP survey provides strong evidence that Kaukua-type mineralization could extend well to the east.

According to the news, the four most easterly lines of the 2008 IP survey are therefore being re-surveyed, with the Kaukua South’s eastern extension now a top-priority drilling target.

“The current IP survey has experienced excellent ground contact and has resulted in the collection of very clean, high-quality data.” VP Exploration Neil Pettigrew commented.

Palladium market update

Currently and for the foreseeable future, palladium is facing constricted supply. The palladium market has been in deficit for eight straight years. The reason has mostly to do with structural problems in South Africa. About 90% of palladium is mined as a by- product of nickel and copper in Russia, and platinum in South Africa. These two countries dominate the market.

South Africa’s platinum mining companies are under constant pressure to contain costs, because their mines are very deep, hot and labor-intensive. They also face frequent strikes. In 2014 workers at the country’s three major producers – Lonmin (now Sibanye-Stillwater), Anglo American Platinum and Implats – downed tools for five months demanding that wages be doubled. Additionally, there are significant infrastructure constraints; the country has limited processing capacity and water is a constant concern.

On the demand side, diesel engines are being phased out in favor of gas-powered cars and trucks that meet stricter emission regulations, particularly in Europe and China. As drivers shift from diesel to gas-powered cars or hybrids, demand for palladium has buoyed the price. Despite a global downturn in auto sales in 2018 and 2019, palladium prices have stayed strong, on concerns that the mining industry will be unable to meet the demand for cleaner-burning vehicles.

Spot palladium is currently trading at $2,699 an ounce compared to gold’s $1,642/oz, as of this writing.

Recently Nornickel, one of the world’s largest palladium producers with mines on the Taimyr and Kola Peninsulas in Siberia, said it is planning to ease market tightness by shifting more production to investment-grade palladium ingots, from the powdered form required by industrial end users.

The company is expected to deliver three tonnes of ingots to help meet demand from palladium bullion investors.

Conclusion

At AOTH, we see that induced polarization surveys are a great tool for pinpointing high-grade targets (for at least 5,000 meters of drilling slated to begin shortly) – the 2008 IP survey at Kaukua is an example.

And while it’s a bit early to say, we see the potential for a second open pit, or an extension of the Kaukua constrained pit, should drilling at Kaukua South hit mineralization matching the chargeability anomaly identified by the IP survey.

It’s exciting to consider that Palladium One may already be well on the way to fulfilling its ultimate goal of finding, and defining, more than 3 million ounces of Pd eq in open-pit resources at LK.

As palladium prices continue their multi-year run, amid supply constraints, new sources of palladium are needed to meet demand for gas-powered auto-catalysts, and thereby help achieve stricter air quality standards.

This bodes well for explorers like PDM whose deposits contain significant amounts of palladium, as well as nickel and copper, which are also required by electric vehicles and their lithium-ion batteries.

We look forward to more survey results and seeing how the upcoming drill program will unfold.

Palladium One

TSX.V:PDM, Frankfurt:7N11, OTC:NKORF

Cdn$0.15 2020.02.28

Shares Outstanding 114,393,599m

Market cap Cdn$17,159,039m

PDM website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Palladium One (TSX.V:PDM), PDM is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.