Mountain Boy completes 2020 drilling at American Creek, financing arranged

2020.11.14

With the winter season looming, Mountain Boy Minerals Ltd. (TSX.V: MTB) has wrapped up its 2020 drill program on the American Creek property, located in the Golden Triangle of British Columbia. The drill program consisted of 10 diamond drill holes (nearly 2,100 metres) over three known targets and the newly discovered Upper Ruby zone.

While assay results are still pending, the initial observations are very promising. Sulphide minerals including argentite, acanthite, tetrahedrite, tennantite, galena, chalcopyrite and sphalerite have been seen in drill core from all four target areas.

Presence of silver-bearing minerals in the widely distributed targets is “highly encouraging” with potential for size in the system, the company said. Arrangements have already been made to resume drilling as soon as next season.

2020 Drill Program

The first phase of drilling on the American Creek project focused on testing the extent of the epithermal-related silver and base metal mineralization associated with property-wide veining and vein breccia.

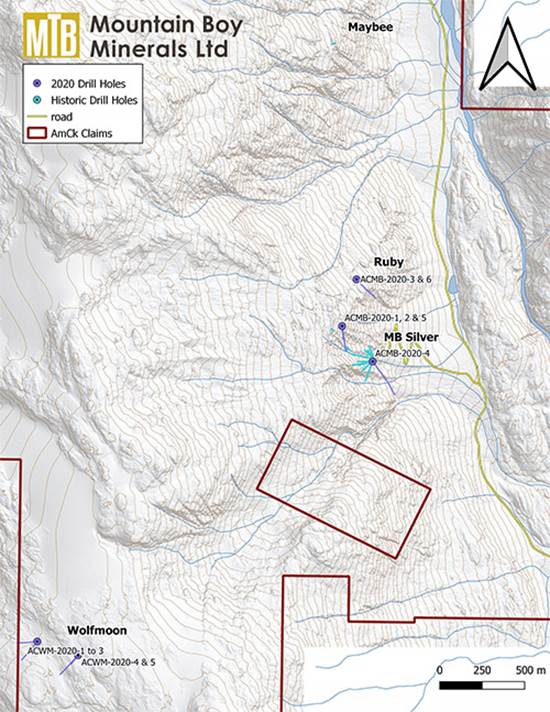

Drill hole locations

The target area to be drilled on the property was the Wolfmoon zone, where select grab samples from 2019 and geophysical anomalies from the 2020 IP survey concurrently occur. Five holes were drilled; mineralization consisting of galena, chalcopyrite and sphalerite was observed in quartz veins in drill core.

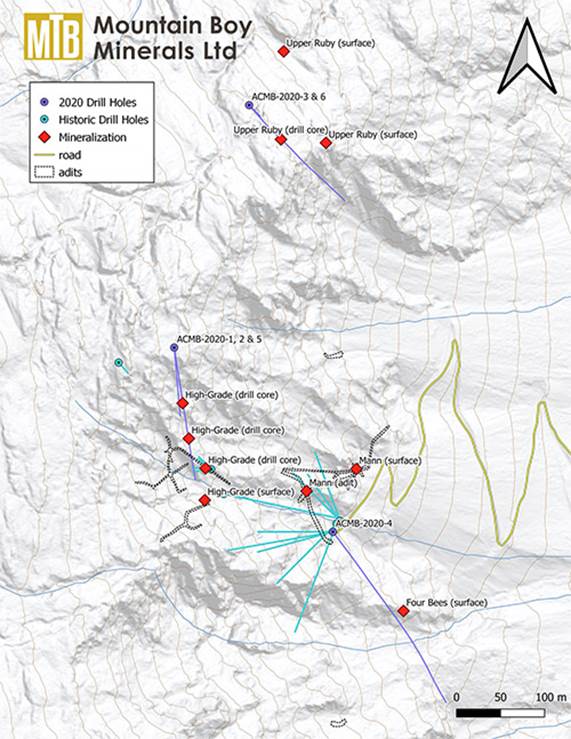

Three holes were drilled targeting the MB Silver high-grade zone, where kilogram silver values were drilled back in 2006. Two of the three holes intersected the zone, with the third failing to reach its target depth due to bad ground conditions. The two holes that intersected the high-grade zone extended the known mineralization over an additional 81 metres along strike.

Significant mineralization was also encountered in the new Upper Ruby zone located 430 metres north of the MB Silver zone. This zone was discovered in September when the company was exploring the Dorothy target area. Based on the observed mineralization and the trend of the veining, the geological team at Mountain Boy decided it was a meaningful drill target.

MB Silver & Upper Ruby drill locations

The drill hole intersected silver-bearing sulphides at Upper Ruby, which has been traced for 115 metres on surface and 52 metres into the hill. The geological team believes the mineralization is similar to the high-grade zone drilled in 2006 and is either an extension of this zone or a separate but related parallel zone located below.

The Four Bee’s zone, previously thought to be the Franmar zone, was targeted using a track-mounted drill from the MB Silver road. Although mineralization occurs in this hole, it is believed the drill hole paralleled the zone and hole failed to adequately test it. A helicopter supported drill pad exists for this targeting this zone next season, which is better located for testing this zone.

Commenting on the initial observations, CEO Lawrence Roulston states:

“We know this geological system carries high grades: We see that in the historic workings, in the surface showings and from the 2006 drilling. Initial review of the core shows that there is also potential in the system for size. We are already making arrangements to re-start the drilling as early as possible next season.”

The company now eagerly awaits assays from these 10 drill holes. This data will be compiled and modeled together with the new 3D IP geophysical data, structural data derived from the LiDAR survey and surface and subsurface lithological and hydrothermal alteration data to refine a comprehensive exploration model.

American Creek Property

The American Creek project is situated in the renowned Golden Triangle area of the Skeena mining division, about 22 km north of Stewart and 7 km from Highway 37A.

Several world-class deposits exist around the project area, including the historic Premier mine 11 km to the southwest and the Big Missouri mine 3 km to the west. The former was once the largest gold mine in North America, producing 2 million ounces of gold and 45 million ounces of silver.

The historic Eskay Creek mine — which went on to become Canada’s highest-grade gold mine and the world’s fifth-largest silver producer — is also part of the Golden Triangle.

Despite more than 150 years of rich mining history, many parts of the Golden Triangle remain largely untouched by humans. A combination of factors, including low gold prices and a lack of infrastructure, caused the area to become dormant for decades, with many gold mines being forced to shut down during the 1990s.

But things have changed over recent years, with the next wave of gold explorers in the area looking to take advantage of a resurgent gold market and the promise of new exciting discoveries in the modern era.

Mountain Boy Mine

Recognizing the region’s immense mining history and its unexplored potential, Mountain Boy and its predecessors began picking up claim areas around the historic Mountain Boy mine beginning in the early 2000s.

In an interview with Ahead of the Herd, Mountain Boy chief executive Lawrence Roulston, who already worked in the industry for 40 years with junior miners and several major companies, reveals why he could not turn away from such an opportunity:

“I saw Mountain Boy and the enormous potential of its properties, and I was really keen to get involved. So, I took control over the company and gathered a really exceptional geological team.”

That geological team includes VP exploration Lucia Theny, who has served as a field geologist for several junior exploration companies, focusing mainly on the Golden Triangle area.

“The Golden Triangle is exciting because it has yielded several world-class deposits. It’s an area that’s extremely well endowed with silver, gold, base metals. People continue to have success exploring in the area now,” Theny tells AOTH.

The Next Premier Discovery?

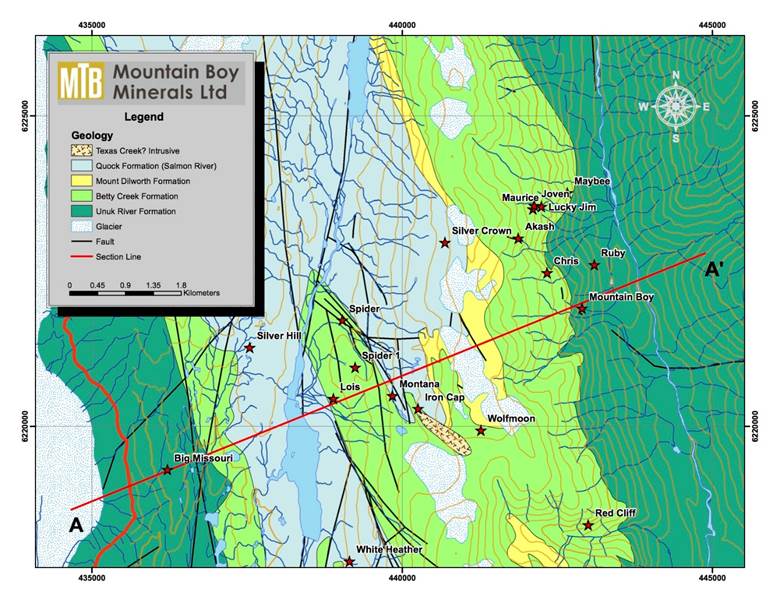

Mountain Boy has accumulated a significant land package in what is known as the American Creek corridor. The entire project area has favourable host stratigraphy, including rocks from the Lower to Middle Jurassic Mount Dilworth formation and Lower Jurassic Hazelton Group.

The company considers this corridor to have “real potential” to host one or more deposits, pointing to the presence of numerous nearby past producers including Premier and encouraging discoveries over recent years. The large, continuous regional and property scale faults, folds and shear zones are often related to mineralization in the region.

American Creek Geology

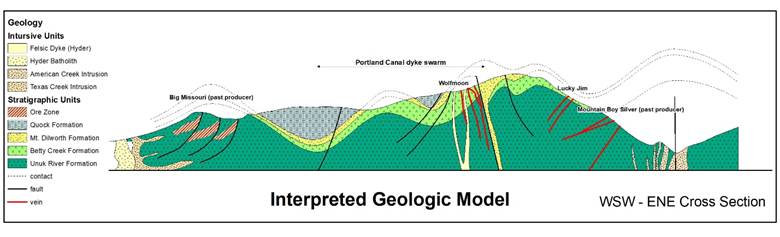

Geologic Model

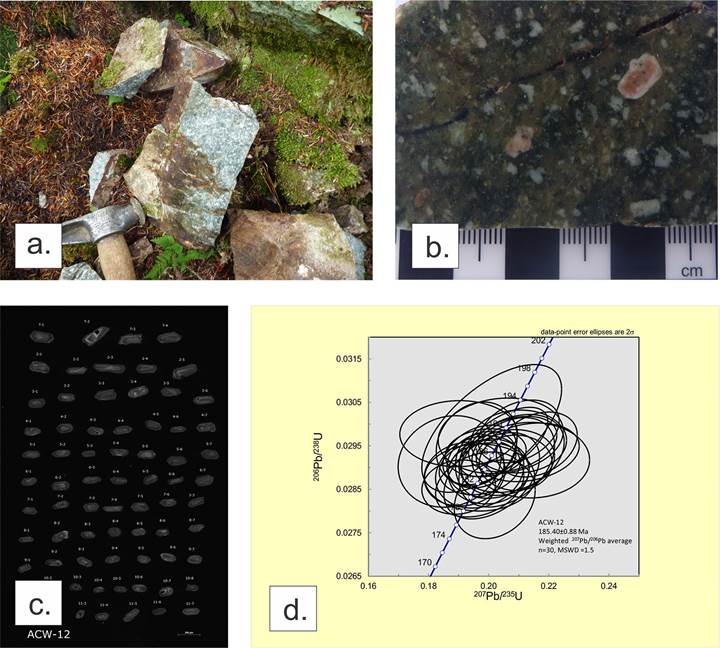

The company’s exploration breakthrough came in 2018, when Theny and her team carried out the first systematic exploration along the American Creek valley, resulting in a few findings including dykes.

“Those dykes were interesting to us because we thought that they might be related to the Texas Creek plutonic suite,” explains Theny. This plutonic suite is known to be associated with important vein deposits like the old Premier gold mine.

To confirm the significance of these intrusive dykes, Theny and her team went back in 2019 with a much more significant mapping and sampling program. A soil grid was put over the gossanous rocks, which later resulted in gold and copper anomalies.

Field sample – American Creek

‘The beauty of that soil grid was it led us to what we now call the American Creek intrusion,” says Theny. “You’d hold it up and you’d say wow, that could have come straight out of the Premier porphyry.”

Geochronology analysis later confirmed that the intrusion was of Early Jurassic age — the same age as the intrusion at the heart of the Premier district, with similar alteration and scale. Further prospecting and mapping demonstrated that the intrusion runs along American Creek for several kilometres.

Conclusion

With this year’s drilling campaign drawing to a close, Mountain Boy is now looking forward to the spring of 2021, when drilling is scheduled to restart.

With three distinct target areas as well as a newly discovered zone, CEO Roulston believes that “any one of these can be a company maker.”

To prepare for its next phase of exploration at American Creek, the company wasted no time in announcing a private placement of units for gross proceeds of just over $1.67 million. These units are priced at a 50% premium over the existing common share price, an indication of market interest.

“More targets will be worked on in the coming months,” Roulston affirms, as his company wants to demonstrate that this is a district-scale project exactly like the Premier, where multiple high-grade deposits lie over an extensive area.

Two of the targets on the property are likely there because of an intrusive heat source discovered to be Early Jurassic. This is a good sign that it is onto something big.

Mountain Boy Minerals

TSX.V:MTB, Frankfurt:M9UA

Cdn$0.365, 2020.11.14

Shares Outstanding 49,988,051m

Market cap Cdn$18.24m

MTB website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security.

AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Mountain Boy Minerals (TSX.V:MTB, Frankfurt:M9UA). MTB is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

![[Silver Stocks to Watch]: Mountain Boy Minerals TSX.V MTB. Due Diligence on Silver Stocks 2020](https://aheadoftheherd.com/app/uploads/2020/12/image007-43.jpg)