Max Resource receives upsized $6.5 million investment boost

2020.10.29

Mining is a relatively straightforward business: any producing asset has a limited lifespan and will eventually need to be replaced.

For every ounce or pound taken out of the ground, a mining firm must think about how to replace a mine’s reserves long before it reaches the end of the road. This not only ensures the business keeps pace with the demand-supply market dynamics but also the rest of competition.

However, for metals like gold and copper, the task of replacing reserves has become increasingly difficult as there is a severe shortage of large deposits around the world left to find or buy.

In the gold industry, the substantial decline in new discoveries has led many companies to resort to acquisitions instead of organic exploration to maintain or bolster their production. In 2019, global gold miners completed nearly US$20 billion worth of transactions, the best of any calendar year for nearly a decade.

Hunt for Copper Begins

This brings us to copper, the metal that may dictate mining M&A activity in the foreseeable future. Major copper producers like BHP are already on the lookout for new deposits to replace their declining reserves.

For mining majors, most properties under development must have the scale to match the output of their depleting assets. Any new project must also sit on the lower end of the cost curve to make it a worthwhile investment.

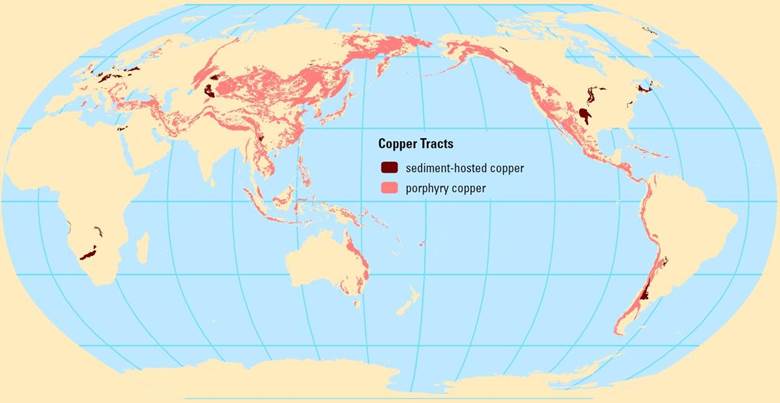

According to the US Geological Survey, three-quarters of the world’s identified copper resources are porphyry deposits (see map below), some of which may contain tens of billions of ore even after operating for several years like Chile’s massive Escondida mine.

USGS map

Copper miners can also lower their costs by taking advantage of these polymetallic deposits with precious metals by-products, which is the secret to success for many operations such as BHP’s Antamina.

Even the gold majors are starting to recognize the value of mining copper porphyry deposits, seeing as the metal has become a cornerstone of the global electric vehicle revolution and large gold deposits are now so hard to find.

This year, the world’s second-biggest gold miner Barrick Gold started eyeing copper deals, specifically Freeport-McMoran and its monstrous Grasberg mine in Indonesia.

This means the copper playing field is about to get even bigger.

Finding the Next Copper Mine

In January, RBC Capital Markets predicted that M&A in the copper space could surge in 2020. “It’s just getting more and more difficult to find copper let alone to mine it and bring it into production,” an RBC analyst quoted.

Now, any M&A deal headline would likely involve a mining junior holding what potentially could become the world’s next copper mine. The question then becomes: what kind of profile are big miners looking for?

As mentioned, any project must have the prospective scale to match a major’s appetite. This project should also have serious backing from investors and related parties to reach that potential. As well, it has to be located in an ideal mining jurisdiction, preferably in an underexplored area.

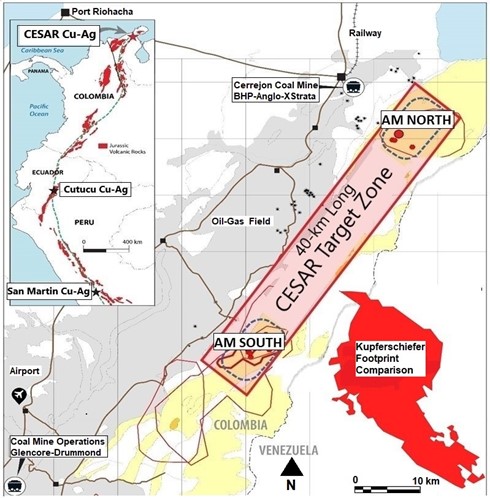

One company that ticks all these boxes is Max Resource Corp. (TSX.V: MXR) (OTC: MXROF) (Frankfurt: M1D2), which is quietly advancing one of the world’s most promising copper-silver projects in northeast Colombia, along the Andean belt that is renowned for its porphyry deposits.

This week, the Vancouver-based miner closed a $6.5 million private placement that included participation from Canadian mining billionaire Eric Sprott, who now holds a near 10% stake in the company. The fact this financing was upsized not once but twice speaks volumes about the level of interest in its CESAR project.

As a matter of fact, Max already has confidentiality agreements signed with two global copper miners, and one mid-tier miner, on this project. Such commitment is almost unheard of for a project that is still in its infancy.

A big part of CESAR’s excitement comes from the untapped mining potential of Colombia, and there are two reasons why that potential may be unlocked sooner rather than later.

Colombia Ties Future to Metals

First of all, the South American nation has become much more pro-mining since President Iván Duque Márquez took office nearly two years ago.

Secondly, and more importantly, Colombia is finally broadening up its mining industry after years of focusing mainly on digging coal.

In a Reuters interview, newly appointed mining minister Diego Mesa claimed that “the country is practically unexplored, almost in its entirety.”

Currently, mining concessions cover just 3% of Colombia’s territory and mining operations less than 1% of the country’s land. So, there is a great opportunity for metals such as copper, gold and even nickel, Mesa said.

As of now, the nation has pinned its economic hopes on the development of four projects including the newly opened Buritica gold mine in Antioquia province. But that number will undoubtedly grow over the coming years, and the government is looking to auction over 30 potential blocks of mining concessions as soon as 2021.

Some of the big gold players have already entered the fray. Recently, Newmont and Agnico Eagle Mines formed a joint venture near the Mid-Cauca belt, focusing on porphyry, epithermal and VMS mineralization.

In December 2019, we saw one of the year’s biggest gold deals happen with China’s Zijin Mining buying Canada’s Continental Gold and its Buritica mine at a premium price of $1.4 billion.

For juniors like Max, which has been exploring the CESAR project since last year, that is already a head start over most of its industry peers.

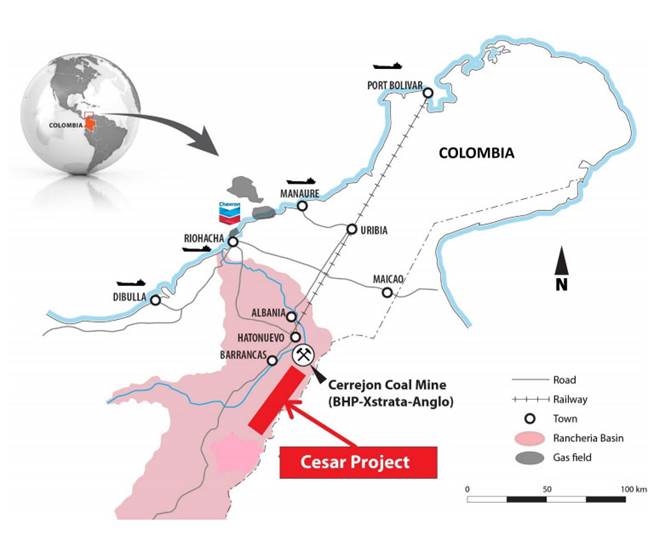

Cesar project map

The project’s location along the world’s #1 copper belt is a big plus, especially when mining giants like BHP and Anglo American that have operated in this region were fixated on its coal in the past.

A Kupferschiefer Discovery?

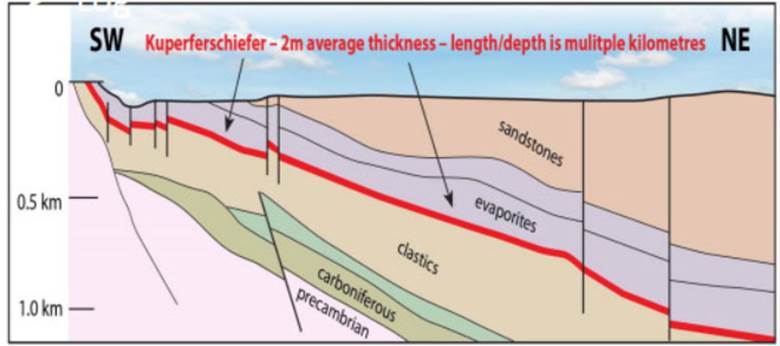

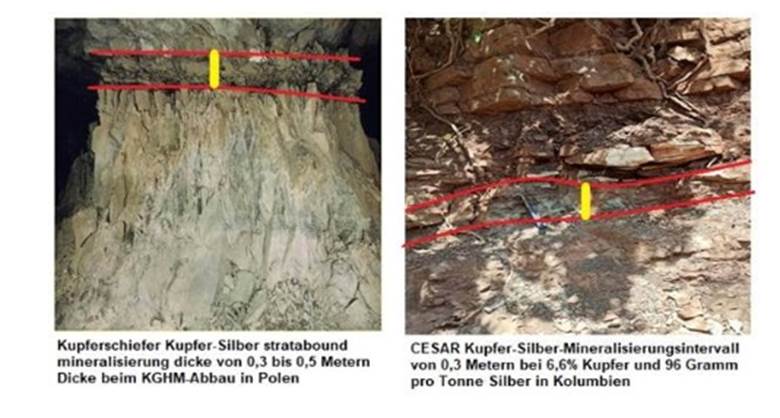

When the CESAR deposit was first discovered in November 2019, Max CEO Brett Matich immediately thought of the famous Kupferschiefer copper-silver deposit in Central Europe.

Kupferschiefer (means “copper shale” in German) is consistently ranked amongst the world’s top copper producers and is by far the biggest global silver producer (World Silver Survey 2020).

Operated by Polish mining giant KGHM, the deposit has recorded bulk mining grades of 1.5% Cu and 49 g/t Ag at an average thickness of 2 m from 500 m below surface, with mineralization spread over an area of 300 km².

Cesar Kupferschiefer comparison

In this way, Max’s 40 km long CESAR target is an almost exact clone with grades of 1.0% Cu and 20 g/t Ag at surface spread over an identical area footprint.

The target hosts two major zones of discovery that are open in all directions:

- The 11 km AM North zone with outcrop values as high as 34.4% Cu and 305 g/t Ag across 0.5 m continuous horizon;

- The 4 x 3 km AM South zone with outcrop values as high 5.8% Cu and 80 g/t Ag from 0.1-25 m horizon intervals.

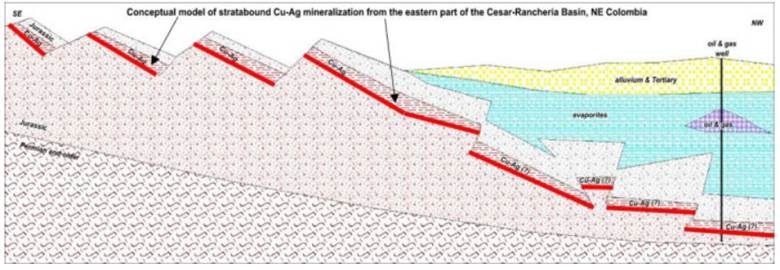

Cesar deposit 1

Of course, these zones are not “set in stone” and will expand with further exploration. Earlier this month, Max discovered a new 400 m mineralization at AM South, extending the stratabound copper-silver horizon to over 6.4 km of cumulative strike.

More work needs to be done still, but the early signs are promising. The company will continue to expand the mineralization at CESAR and build a Kupferschiefer-style geological model.

Cesar rock sample

To help achieve its goal, surface rock samples have been dispatched for geochemical and metallurgical testing at the University of Science and Technology of Krakow, which has a long history of co-operation with KGHM and extensive knowledge of Kupferschiefer deposits.

Conclusion

Almost a year into its discovery, Max’s CESAR project appears to be the type of copper project that mining companies crave; it has both the size and location for a long-term copper play.

The high-value samples resembling a world-class deposit are also revealing, and to have deals signed with multiple majors this early in the project’s development validates what Max has done so far on the property.

With the Colombian government now looking to expand the nation’s metals sector, the value of those few existing projects in the South American nation could only go up.

Max Resource Corp.

TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1

Cdn$0.32, 2020.10.29

Shares Outstanding 55,135,905

Market cap Cdn$17.64m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Millswebsite/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources (TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1). Max is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.