Max in the chips at North Choco with high-grade gold/copper

2019.05.24

Max Resource (TSX-V:MXR) has delivered strong assay results from chip samples taken from the North Choco project in Colombia, which the company is in the midst of acquiring through an option agreement.

Now three weeks into a 10-week exploration program, Max said seven of 23 chip samples returned grades ranging from 2.9 grams per tonne (g/t) gold, to a glittering highlight of 155.27 g/t over a 0.4m intersection. Of the seven samples, three showed decent copper grades in excess of 1% Cu, in a vein zone containing pyrite, chalcopyrite (the copper mineral) and galena.

Max reported the chip samples were taken over various widths from four locations within a 400- by 700m exploration area centered on North Choco’s historic gold mine.

“We are very pleased with this first round of assays from our intensive exploration campaign. The assay results are delivering significant grades of gold and we expect the copper re-assay results very soon,” Max CEO Brett Matich said in a news release. He added, “Our strategy is to expand our exploration efforts in all directions within the 500 sq. km land package.”

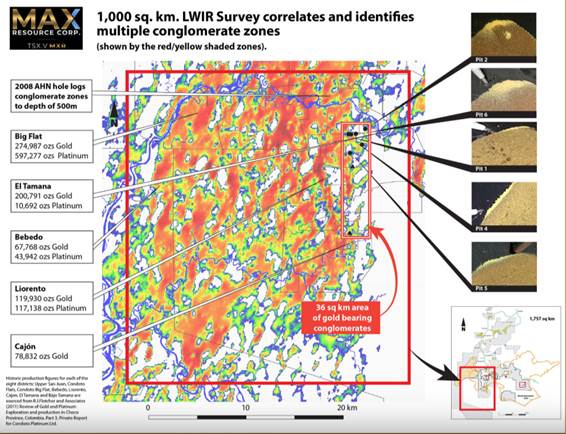

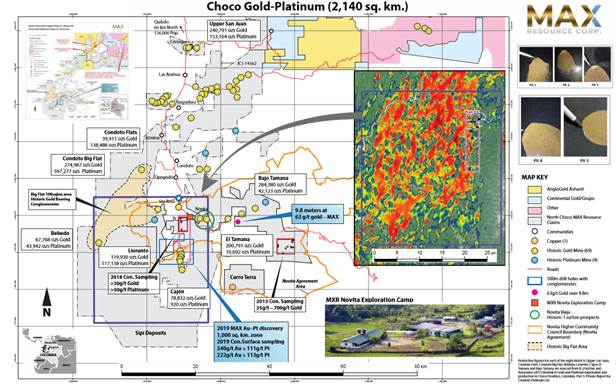

Max is the company with a conglomerate gold project in the Choco region of Colombia; conglomerated free gold, at surface, is potentially spread across 1,000 kms, as shown in an LWIR (long wave infrared) satellite survey below.

While Max continues to work the Choco Precious Metals Project, which has attracted serious investor interest due to its potentially large (we’re talking a gold elephant) scale, the company has been busy acquiring new prospective ground.

On May 8 Max announced it entered into a binding letter of intent (LOI) with Noble Metals and Buena Fortuna Mining, to acquire 100% of those two companies’ interest in Andagueda Mining, which has an agreement with the Tahami indigenous group – the landowner – to explore and exploit a 72.5 square kilometer mining area.

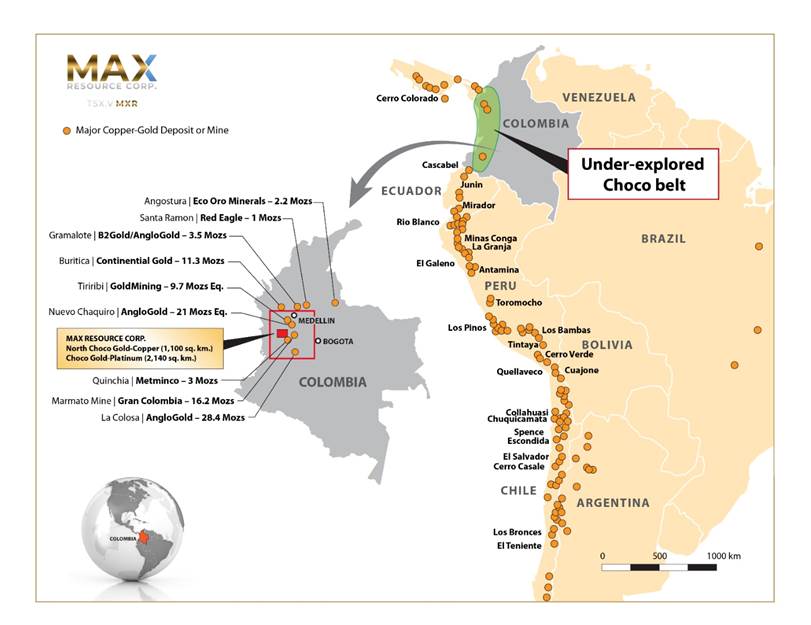

When added to Max’s Choco Precious Metals Project, the 500 square kilometer North Choco property expands Max’s land holdings in the department of Choco, Colombia, from 2,140 square kilometers to 2,640 sq. km.

Historic exploration

Of note to Max investors is historic exploration at North Choco and environs.

First, North Choco is contiguous to properties held by AngloGold Ashanti and Continental Gold. Forty-seven kilometers to the northeast, AngloGold’s Nuevo porphyry copper discovery has an inferred resource containing 3.95 million tonnes of copper (@0.65% Cu) and 6.13 million ounces of gold (@0.32 g/t); it is one of five known porphyry centers concentrated within a 15 sq. km area.

Second, AngloGold’s initial reconnaissance work at North Choco, in 2005, identified pyrite, chalcopyrite, galena, sphalerite and arsenopyrite, in a matrix of quartz and calcite from historic gold mines and copper porphyry prospects. However, there was no follow-up because of access restrictions.

Fast forward to January 2019, when Andagueda Mining took 14 channel samples from historic gold mines located on the property. Among the assays, highlights included 0.3m at 262.0 g/t gold + 0.57% copper + 941 ppm cobalt, and 0.3m at 49.3 g/t gold + 11.4% copper + 502 ppm cobalt.

Max says its initial exploration at North Choco focuses on verifying historic mining at North Choco, and the AngloGold and Andagueda exploration data.

Choco Precious Metals Project

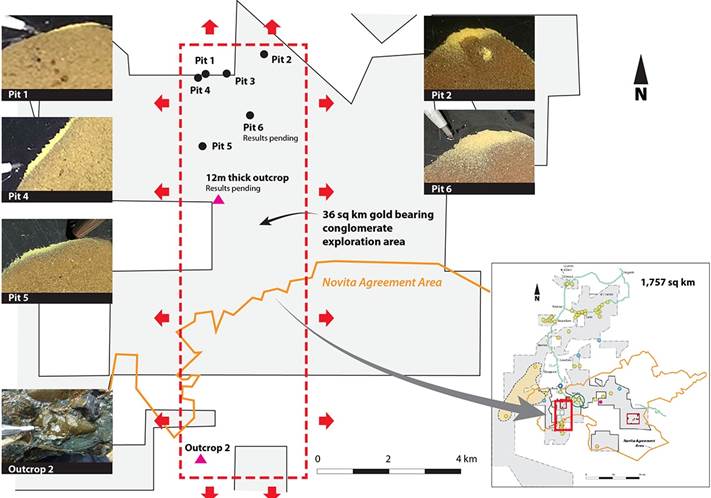

Max has bulk-sampled an area of historical alluvial gold mining (the conglomerate gold underneath has never been fully explored), by digging and sampling six pits (2m by 2m by 30cm-deep) spread over a 36 sq. kilometer area.

The plan for the bulk sampling program is to 1) substantiate reports of free gold within the hard rock conglomerate and 2) determine the thickness of the gold conglomerate and how far it extends laterally.

The company has determined that the best way to obtain the grade of the gold-bearing conglomerates is to crush the conglomerate and then process the material to recover the free gold from the sample, rather than assaying the samples.

About 2,000 kilograms of hard rock conglomerate was randomly collected from each pit, then a 50-kg sample from each pit was sent to a lab in Medellin, where it was crushed to <2mm, then gravity-separated to reveal the gold.

The grams per tonne of free gold of the minus-two-millimetre concentrate are being calculated and will be released as initial sample results. The final results of the entire 50-kg sample will be released later.

A concentrate made from the first sample graded 340.84 grams per tonne (g/t) gold and 111.03 g/t platinum, for a combined 451.87 g/t gold and platinum.

The second concentrated sample was 222.06 g/t gold and 113.83 g/t platinum.

It’s important to note that these two samples were taken from surface, within a 36-square-kilometer area initially identified by Max as potentially containing conglomerate gold. The samples are also near the six test pits dug as part of the bulk sampling program, described above.

The geological theory Max is operating under, is there is a precious metals intrusive (gold, platinum, palladium) that runs right up to surface. In some areas there is more platinum than gold (80-20%) and in others the ratio is reversed (20% platinum to 80% gold).

The conglomerate gold is fine-grained free gold whereas the overlaying alluvial gold and platinum is coarse-grained. If the conglomerate gold is indeed the source of the alluvial gold (and platinum), the company thinks that the grades will increase as the conglomerate is explored deeper, Max’s CEO, Brett Matich, told Ahead of the Herd in an earlier interview. Matich added that by assaying the concentrate samples at surface, it allows MXR to more quickly identify the enrichment zones over the 1,000 sq. km target zone.

To learn more about Max’s Choco Precious Metals Project, read our Max Resource has found it El Dorado

Gachala

In April Max Resource publicized a deal regarding its Gachala project located 60 kilometers east of Colombia’s capital, Bogota.

The company announced it will hive off a portion of Gachala to Universal Copper (TSX-V:UNV). Under the terms of a non-binding letter of intent (LOI), Universal agreed to issue Max 6 million shares, in exchange for the North Block of the Gachala Copper Project, which contains seven mineral license applications comprising 13,280 hectares.

Located in a sedimentary copper basin comparable to the Zambian Copper Belt, historical sampling has identified a 24-kilometer strike length, with copper grades ranging from 0.5% to 13%. Anything over 1% is considered high-grade copper. A 4-km cobalt anomaly has also been identified.

Max retains three-quarters of the Gachala Copper Project (40,258 ha) as Universal Copper begins exploring the highly prospective North Block. The deal for UNV to acquire the North Block was finalized on April 24.

Perhaps the most exciting thing about Gachala, other than the potential for high-grade copper, is the geology. Those who studied earth science may recall that millions of years ago, the continents were stuck together in one giant super-continent known as Pangea. Plate tectonics gradually moved the continents apart. At the time, the east coast of South America fit like a piece of a jigsaw puzzle into the underside of the west side of Africa that is shaped like a hammer.

In the case of Gachala, the sedimentary-hosted copper mineralization in Colombia, is similar to the large-scale, near surface copper mineralization found in Poland and Zambia.

In fact, the Gachala Project underlies a 250-km by 120-km belt of Devonian Cretaceous rocks in a geological setting believed to be analogous to the Zambian copper belt. This belt hosts Zambia’s “Big Four” copper mines – Barrick Lumwana, FQM Kansanshi, Mopani and KCM (Konkola Copper Mines) – which account for around 80% of Zambia’s annual copper production.

We know that Cretaceous-age rocks are conducive to sedimentary copper deposits.

“The Gachala project is a very attractive type of deposit,” Universal Copper’s President and CEO Clive Massey told Ahead of the Herd in a recent interview. “It’s a flat-lying, sedimentary oxide deposit. These types of deposits are the least expensive to mine. Ultimately, it’s a potential SXEW (solvent extraction, electrowinning) operation.”

Universal hasn’t yet decided on its 2019 work program at Gachala, but Massey expects exploration to include grid soil and stream sampling.

The company has already begun work on the project – having released the results of an LWIR survey conducted over the North Block. The best spectral match from the high-tech satellite survey suggests the main Devonian-Permian/Cretaceous contact is anomalous along much of its over-40 km strike length within the North Block applications, supporting the company’s belief that this contact area is highly prospective for sedimentary copper deposits.

Copper output tanking

Back to Thursday’s chip sample results, the high gold-copper values discovered at North Choco come at a very interesting time in the copper market.

Base metals copper, zinc and lead are coming under price pressure due to the escalated trade war between China and the United States.

Prices will rise and fall, but it’s long-term supply and demand that copper miners and explorers look to, as far as planning expansions and development properties. Here the market is extremely bullish on copper.

As we wrote in The coming copper crunch, copper mine production is expected to increase for the next year or so, then drop off significantly. By 2035, without major new mines up and running to replace the ore that is being depleted from existing copper mines, we are looking at a 15-million-tonne supply deficit by 2035. Four to six million tonnes of added capacity are needed by 2025.

Copper grades have declined about 25% in number one producer Chile in the last decade – highlighting the urgent need for grassroots exploration to arrest the trend.

Over in Chile, which produces 10% of the world’s copper, state miner Codelco said recently that it produced less copper in 2018 versus 2017, owing to declining ore grades at its aging mines. We’re talking a 3.3% drop, from 1.8 million tonnes to 1.6 million tonnes, resulting in $0.8 billion less profit, before taxes.

This week, Codelco said it is looking at a 40% cut in production over the next two years at its Chuquicamata mine, as operations switch from open-pit to underground.

The $5-billion undertaking is needed to prolong the life of Chuquicamata which is running out of economically extractable ore. The century-old mine has an above-ground pit the size of 3,000 American football fields.

According to Reuters, output at the revamped “Chuqui” mine is expected to fall to 1.66 million tonnes by 2021, compared to 1.73Mt this year – causing Codelco’s total copper production to slip 4%. It will take until 2027 for output at Chuqui to reach 2019 levels.

Taking a look at Zambia – Gachala’s geological analog – we see a similar story unfolding.

Africa’s second largest producer is expecting copper production this year to be up to 100,000 tonnes less than in 2018, due to a change in the tax law.

Zambia’s Chamber of Mines attributes the production drop to changes in mining taxes which have driven up costs and forced copper miners to reduce output. The country’s copper production has already tumbled 11.3% in the first quarter of 2019 versus the last quarter of 2018.

Looking at global copper production, MINING.com reported a 2.4% fall in February, with Chile and Peru hit the hardest, at a respective 7.1% and 5.1% reduction, year on year.

The big question for the copper price is, when will lower supply catch up to sagging demand, owing to economic growth slowing amid the ramped-up trade war? Right now lower demand is winning the race but it’s only a matter of time before supply tightens to the point where its intersection with low demand lifts the copper price. And if a trade deal is reached, expect the price to move even higher.

Either way, it’s a win for the copper price, copper mining companies and copper bulls like us at Ahead of the Herd.

Max Resource Corp

TSX-V:MXR Cdn$0.155 May 23

Shares Outstanding 65.9m

Market cap Cdn$10.2m

Max website

*****

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Max Resource Corp (TSX.V:MXR), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of MXR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.