The coming critical minerals trade war – Richard Mills

- Home

- Articles

- Metals Critical Metals

- The coming critical minerals trade war – Richard Mills

2025.01.16

Critical minerals have become the new frontline of the rivalry between the two superpowers.

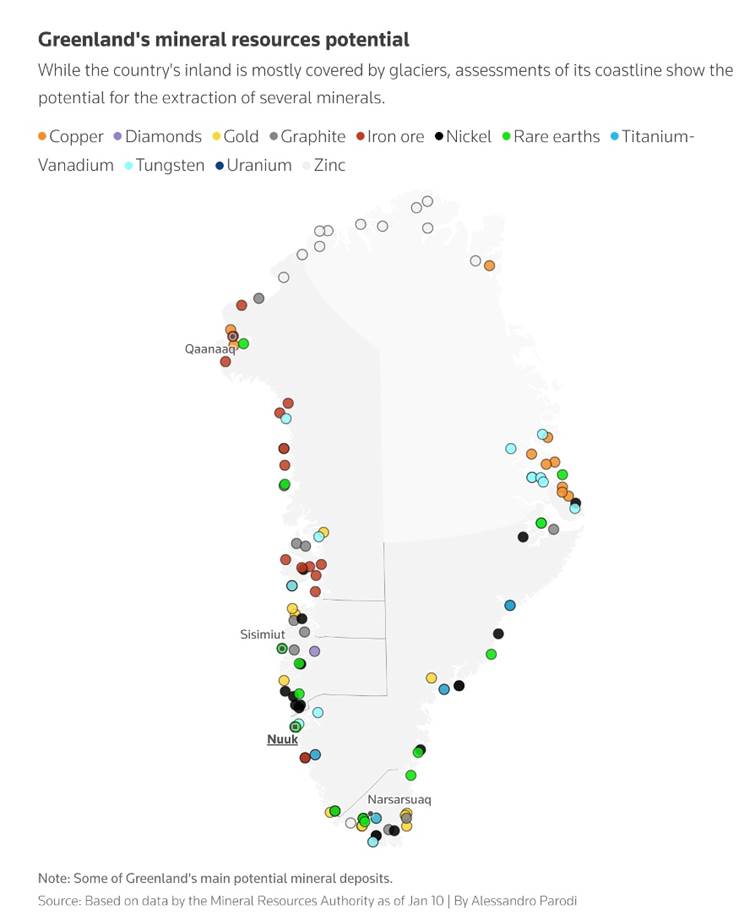

As America gets set to receive Donald Trump as its 47th President — inauguration day is Jan. 20 — a chill has settled over US trade relations, as Trump takes an adversarial approach to long-time trade allies like Canada and Mexico. The president-elect has made outlandish suggestions of making Canada the 51st state, taking back the Panama Canal and of annexing Greenland, a key defensive outpost against Russia in the Arctic, and the biggest island in the world rich in minerals like rare earths and nickel needed to power the new economy.

Trump has threatened 25% tariffs on goods from Canada and Mexico, 60% tariffs on Chinese imports and a 10% levy on global imports. A 100% tariff on Chinese electric vehicles came into effect on Sept. 24. The rate on steel and aluminum products was lifted to 25% from the previous range of zero to 7.5% while duties on solar cells and semiconductors were doubled to 50%.

“China is likely to be the primary target of the Trump trade wars 2.0,” says Goldman Sachs, referring to Trump’s protectionist trade policy during his 2016-20 term.

The motive behind the United States trade strategy is well-documented — to shed itself of dependence on China while loosening the grip its main rival has on the global supply chain of critical minerals.

There is no time to lose, considering that many of these minerals are in short supply.

China’s critical metal dominance

When it comes to raw materials for the electric vehicle industry, China is undisputedly the most dominant force on the planet.

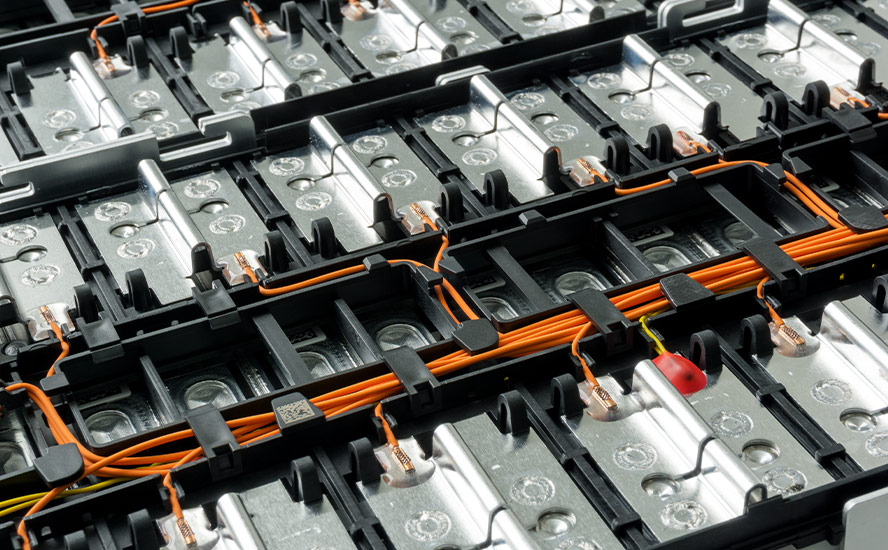

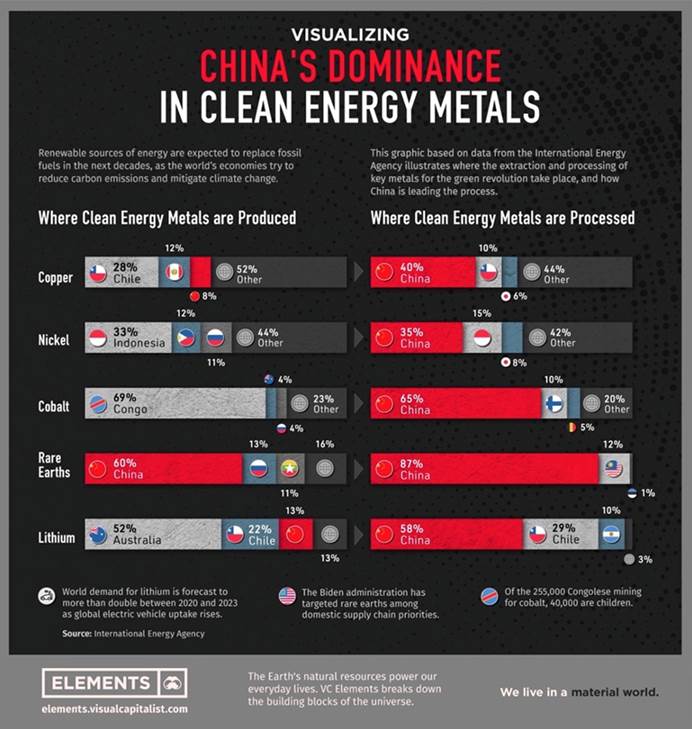

For example, almost every metal used in EV batteries today likely comes from there, either mined or processed. Thanks to its technological prowess in refining, China has established itself as the across-the-board leader in the battery metals processing business (see below).

According to the International Energy Agency, the country accounted for roughly 60% of the world’s lithium chemical supply in 2022, as well as producing three-quarters of all lithium-ion batteries.

It also has a tight grip over the world’s supply of cobalt through its mining operations in the Democratic Republic of the Congo. Over the next two years, China’s share of cobalt production is expected to reach half of global output, up from 44% at present, according to UK-based cobalt trader Darton Commodities.

IEA estimates that China’s share of refining is around 50-70% for lithium and cobalt, 35% for nickel, and 95% for manganese, despite being directly involved in only a small fraction of the mine production.

The nation is also responsible for nearly 90% of rare earth elements, which are essential raw materials for permanent magnets used in wind turbines and EV motors, as well as 100% of graphite, the anode material in EV batteries.

Without rare earths mined and processed in China, America would be unable to manufacture military hardware – rare earths are great multipliers, they are used in making everything from computer monitors and permanent magnets to lasers, guidance control systems and jet engines. There is no substitute and no other supply source is available other than China. Civilian uses of rare earths would also be put in jeopardy. This includes rare earth elements incorporated into electric vehicle motors, computer chips, fiber-optic cables, flat-screen televisions, wind power turbines and nuclear power, just to name a few uses.

Visualizing the Raw Materials in a Laptop

China’s modus operandi is to build mines and provide infrastructure that supports, and gains the favor of, the local population, such as schools, health clinics, roads and clean water systems. Usually in exchange for offtake agreements.

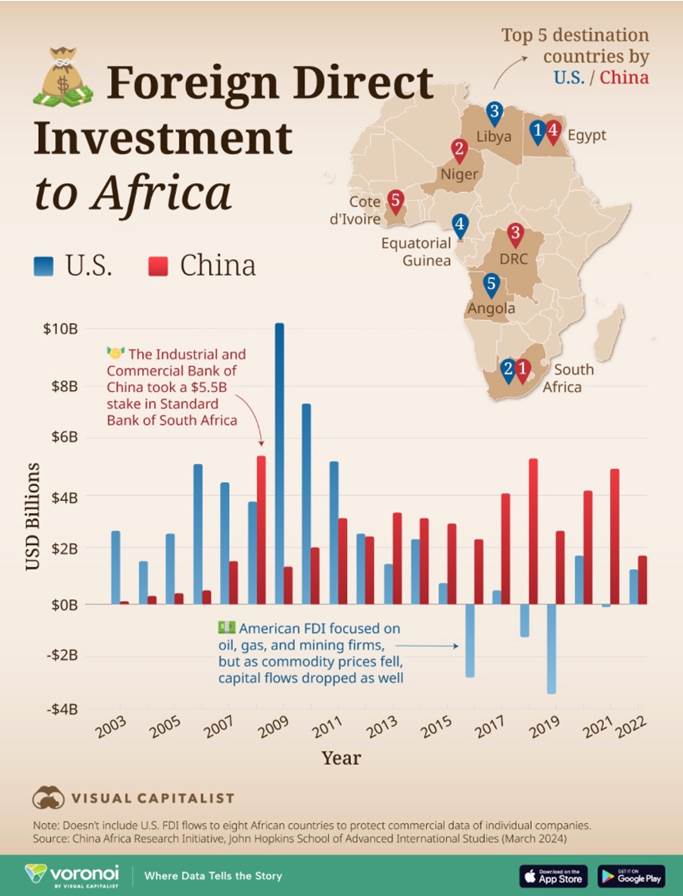

A good example is how China became the dominant foreign mining power in Africa. The country invested over $72 billion in Africa between from 2014 to 2018, creating over 137,000 jobs across 259 projects. China is also Africa’s largest bilateral trading partner. (Google AI Overview)

Visual Capitalist tracked foreign direct investment flows from the US and Canada to Africa between 2003 and 2022. Earlier greenfield investment from both countries poured into oil & gas and mining. Beijing bought up copper mines in the DRC, for example.

The site notes that when commodity prices started trending downwards after 2012, capital flows dropped as well. But when US flows fell off entirely, Chinese FDI in Africa began recalibrating.

Their investments started targeting firms in agriculture, light manufacturing, and services.

The United States and China continue to direct capital to South Africa, with Niger, the DRC, Egypt and Cote d’Ivoire the other preferred Chinese FDI targets, and American FDI flowing to four other top five destinations: Egypt, Libya, Equatorial Guinea and Angola.

As mentioned China has a tight grip over the world’s supply of cobalt through its mining operations in the Democratic Republic of the Congo.

AOL noted in a recent article that Burdensome regulations and decades of lackluster investment have left the US dangerously reliant on China – which mines up to 70% of the world’s critical minerals, controls roughly 90% of the processing capacity and regularly uses unfair trade tactics to press its advantage,

Lawmakers in the US are worried that China could cut off the supply entirely if diplomatic relations worsen or a war breaks out. China threatened to restrict exports of rare earth to the US in 2019 during the trade war, and in 2010 China embargoed shipments of rare earths to Japan, causing rare earth oxide prices to spike.

Says AOL:

China’s decades-long effort to corner the market is heavily subsidized by Beijing, which uses its control over the supply to manipulate prices and enacts ever-tighter export controls to cement its dominance. China has also snapped up mineral rights throughout Africa and other resource-rich locales as part of its Belt and Road Initiative – on highly favorable terms.

When the US or other rivals make progress on mining or processing a particular material, such as gallium or lithium, China often responds by flooding the market – which sends prices tumbling and kills the incentive to invest in projects…

China recently went back to weaponizing its control over critical minerals, implementing export bans on gallium, germanium and antimony, and tightened previously imposed restrictions on graphite exports.

Mining observers know the United States is one of the worst places to build a mine, with a cumbersome permitting process that can take up to two decades for a proponent to overcome. Ioneer’s Rhyolite Ridge lithium-boron project in Nevada still hasn’t begun construction, having been delayed several years due to the existence of a rare plant. The Thacker Pass mine being built by Lithium Americas in the same state is also years behind schedule, due to opposition from indigenous groups.

By comparison, AOL notes China imposes few environmental restrictions on its mining projects – and has built a domestic supply chain “contaminated with forced labor and environmentally degrading mining and refining practices,” according to a recent report by the select committee.

US and Canadian sources

The site notes that China has an estimated 44 million tons of rare earth reserves or 34% of the global total, compared to the US’s 2.3Mt.

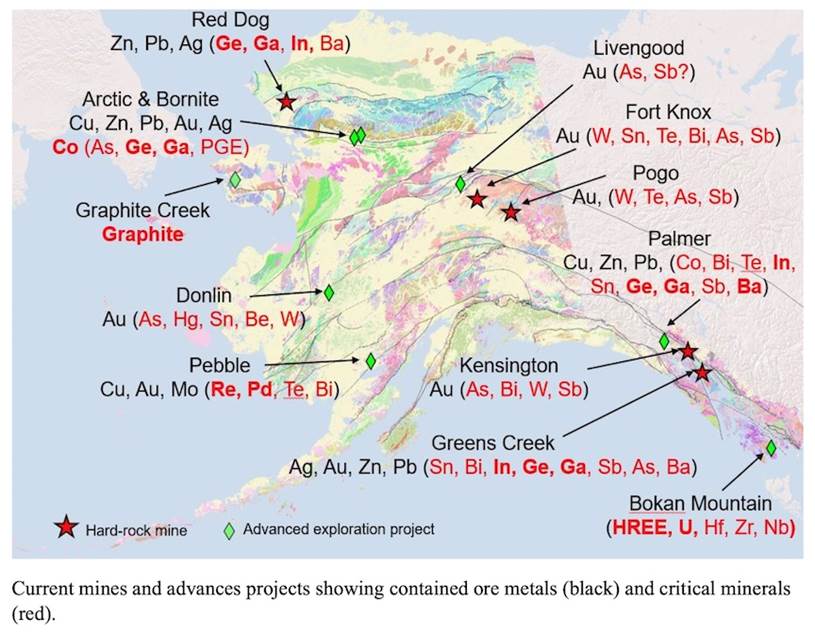

Despite this disparity, there are rare earth reserves in the US, such as in Minnesota, Nevada and California. Alaska hosts the largest graphite deposit in the country and one of the biggest in the world, at Graphite Creek near Nome, AK.

Trump’s threats to slap tariffs on Canadian imports into the US including critical minerals is insane considering how close the two countries cooperate on the valuable commodities.

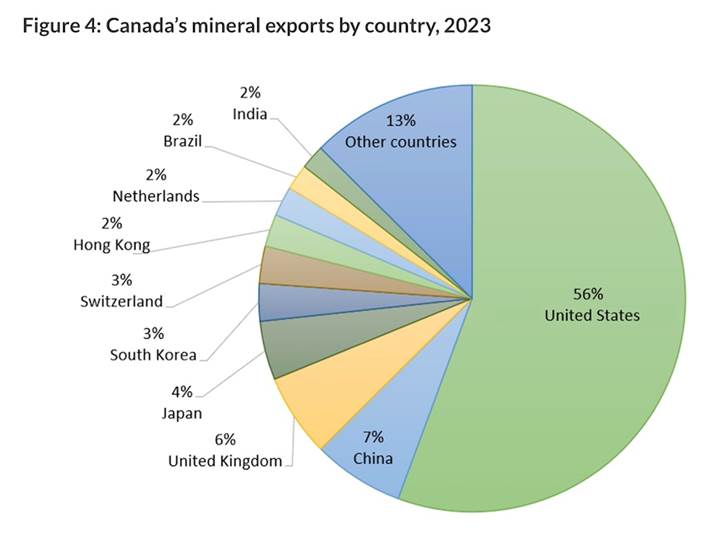

According to Natural Resources Canada, the United States was Canada’s top trading partner for critical minerals in 2023, with total trade valued at $38.2 billion. Canada exported over three times as many critical minerals to the US ($29.8B) as it imported from the country ($8.4B).

Our second largest trading partner for critical minerals was China, followed by Brazil and Norway. In 2023 Canada exported critical minerals worth $3.4B to China compared to imports of $1.7B.

Aluminum was by far the largest critical mineral imported from China, valued at $978 million, followed by magnesium ($315M). Together these products represented just over three-quarters of Canada’s critical mineral imports from China.

Canada’s critical minerals trade is concentrated in Ontario and Quebec, with Ontario also leading mineral imports.

The United States currently doesn’t mine significant quantities of any critical minerals necessary for decarbonization, electricification, their military or civilian uses. The country is 100% dependent on foreign imports of 12 critical minerals, including graphite, and greater than 50% reliant on imports for another 31 critical minerals, including rare earths (95%), cobalt (77%) and nickel (56%). (World Resources Institute)

The Biden administration tried to limit China’s dominance over the electric vehicle supply chain by passing the Inflation Reduction Act, which requires domestic sourcing of critical minerals for EVs sold in America. For a buyer to receive the $7,500 tax credit, a portion of the vehicle’s critical minerals must have been extracted or processed in the United States or in a country with which the US has a free trade agreement.

WRI argues the United States should look for opportunities to support increased mining and processing facilities both domestically and in free trade agreement partner countries. The U.S. has free trade agreements with a few high-producing nations — including Australia, Chile and Peru — but oftentimes these nations still export to China for processing. Compared to mining, mineral processing has a smaller footprint with more manageable environmental risks, and processing facilities can be permitted and built more quickly.

China challenges US in South America with new port in Peru

Two examples of such cooperation are the Minerals Security Partnership, and co-investment in Canadian exploration companies Fireweed Metals and Fortune Minerals.

The Minerals Security Partnership will aim to help “catalyze investment from governments and the private sector for strategic opportunities … that adhere to the highest environmental, social, and governance standards,” the State Department said in a 2022 statement.

In addition to Canada and the United States, the MSP includes Australia, Finland, France, Germany, Japan, South Korea, Sweden, the United Kingdom and the European Commission.

In December 2024 Natural Resources Canada announced that Fireweed Metals will receive up to CAD$12.9 million from Natural Resources Canada for its North Canol Infrastructure Improvement Project in the Yukon Territory.

These funds will be joined by a CAD$22.1 million co-investment from the United States to advance test work, feasibility studies and other pre-construction activities at Fireweed’s Mactung tungsten project.

In May 2024, the Canadian and US governments co-invested CAD$8.74 million in Fortune Minerals Limited to support the development of the company’s NICO cobalt-gold-bismuth-copper project in the Northwest Territories.

Looking elsewhere

Despite these positive developments regarding more domestic mining and mineral exploration, the Biden administration up to its dying days has preferred to focus more on manufacturing than mining.

Rather than permitting more US mines, Biden’s team was more interested in creating jobs that process minerals domestically. The approach would see the United States rely on Canada, Australia, and Brazil – among others – to produce most of the critical raw materials needed, while it competes for higher-value jobs turning those minerals into computer chips and batteries, according to sources who in 2021 spoke to Reuters on condition of anonymity.

“It’s not that hard to dig a hole. What’s hard is getting that stuff out and getting it to processing facilities. That’s what the U.S. government is focused on,” said one of the sources.

‘Not hard to dig a hole’ anti-mining Democrats say

In 2023 the US government followed that philosophy with a deal that built on the 2019 U.S.-Japan Trade Agreement. According to a press release, the agreement “will strengthen and diversify critical minerals supply chains and promote the adoption of electric vehicle battery technologies.”

Nothing wrong with US critical minerals cooperation with its allies including Canada, Japan, South Korea and Europe. The problem is who the US had let into the Minerals Security Partnership. In 2024 the group of 14 countries was expanded by seven additional members including the Democratic Republic of the Congo, the Dominican Republic, Ecuador, the Philippines, Serbia, Türkiye, and Zambia. They join Argentina, Greenland, Kazakhstan, Mexico, Namibia, Peru, Ukraine, and Uzbekistan, who were announced as Minerals Security Partnership Forum members at the inaugural MSP Forum event held in July 2024.

In February 2024 the US State Department announced a collaboration between Gecamines in the DRC and the Japan Organization for Metals and Energy Security (JOGMEC).

“This coordination among MSP partners is a powerful demonstration of the MSP’s efforts to secure and diversify critical mineral supply chains, which bring economic benefits to local communities and source countries such as the DRC,” reads the press release.

A second deal was announced between STL, a subsidiary of Gecamines, and Belgian company Umicore that that advances cooperation on germanium offtake and processing.

The DRC holds two major distinctions. First, it is the richest country in the world in terms of mineral wealth, at an estimated $24 trillion, and it is the country in which the highest number of people — estimates go as high as ten million — have died due to war since World War II.

Allegations of human rights abuses including child labor have put the DRC in the wrong kind of spotlight, Daimler (owner of Mercedes), Volkswagen and Apple are among big-name companies that source raw materials from the DRC and are facing intense pressure to make their supply chains transparent.

Since 1996, conflict in eastern DRC has led to approximately six million deaths. Read more

Graphite is another mineral that has seen the United States take a wrong turn. Syrah Resources was given a $150 million loan by the US International Finance Corporation to supports its Balama graphite project in Mozambique. The company also has a graphite processing facility in Louisiana, for which USIFC loaned Syrah $100 million.

In December 2024 Syrah defaulted on the $250-million loans, due to several closures of the mine. According to the Peterson Institute for International Economics, Syrah Resources pointed to the confluence of local farmer protests over land use and resettlement—an all-too-common conflict in areas affected by extractive industries—and the wave of national protests following contested presidential elections that has so far claimed at least 110 lives since October.

Additionally, Mozambique’s Cabo Delagado province, where the mine is located, was the site of vicious fighting during the Mozambican War of Independence (1964–74), during which Cabo Delgado and neighboring provinces in Tanzania were the operating base of FRELIMO, the Marxist-Leninist insurgent group that has ruled Mozambique since independence. The province is also marked by often tense relations between the predominantly Catholic Makonde and predominantly Muslim Mwani ethnic groups, neither of which is well represented by Tsonga-dominated FRELIMO. Since 2017, the region has been home to an Islamist insurgency being waged by a local franchise of the Islamic State. Insurgent operations caused the Balama mine to suspend operations on several occasions.

Greenland

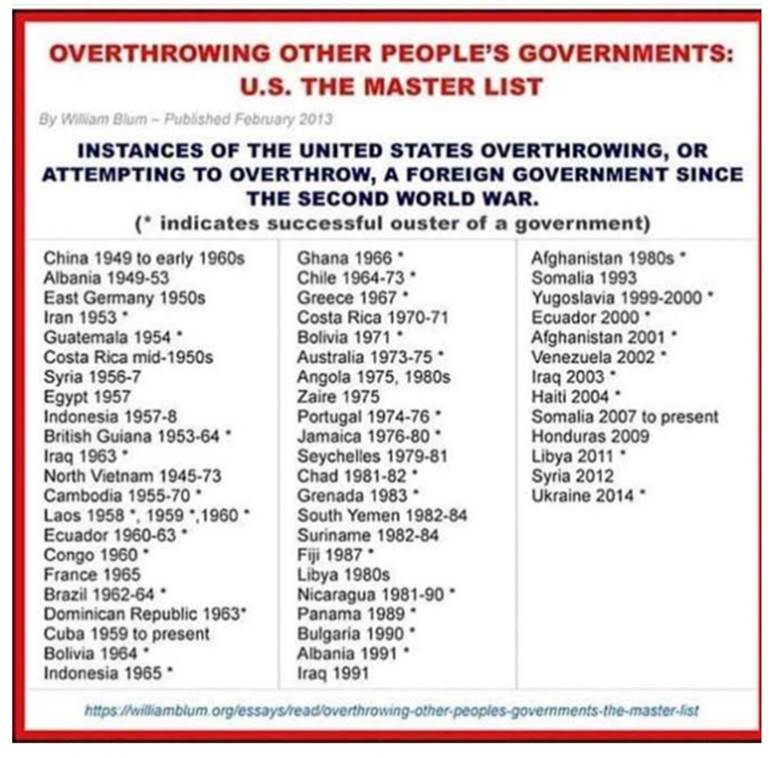

Donald Trump’s recent rant over taking over Greenland — either through economic or military means — may sound absurd but it’s not the first time it’s been suggested and it fits in with the United States’ penchant for going to other countries for its metals rather than mining and processing them at home.

Trump, who floated the idea during his first term (but it didn’t go anywhere), has described US control of Greenland, a semi-autonomous Danish territory, as an “absolute necessity”. There are two reasons why Trump is coveting Greenland: its strategic location and its natural resources.

According to Al Jazeera, Greenland offers the shortest route from North America to Europe. This gives the US a strategic upper hand for its military and its ballistic missile early-warning system.

The US has expressed interest in expanding its military presence in Greenland by placing radars in the waters connecting Greenland, Iceland and the United Kingdom. These waters are a gateway for Russian and Chinese vessels, which Washington aims to track.

While the US has a base on Greenland, called Pituffik Space Base (formerly Thule), it is unlikely to be invaded by the US Army since through association with Denmark it is part of NATO. If the US attacked, the rest of NATO would be forced by its constitution to come to Greenland’s aid.

While the Danish prime minister has rejected the idea of Greenland becoming part of the US, stating that “Greenland belongs to the Greenlanders”, the fact is that since 2009, Greenland has the right to declare independence through a referendum.

Its Prime Minister Mute Egede has said that “Greenland is ours. We are not for sale and will never be for sale,” but he has also called for Greenland’s independence, adding “We must not lose our long struggle for freedom.”

Reuters reported on Jan. 13 that Egede said his government was looking for ways to cooperate with the United States and that it was ready to start a dialogue with Trump’s incoming administration, but stressed it would be up to it to decide how it should proceed.

The greater attraction for Trump and his Republicans is Greenland’s oil and mineral wealth.

According to a 2023 survey, 25 of 34 minerals deemed “critical raw materials” by the European Commission were found in Greenland including rare earths and nickel.

Al Jazeera says Greenland does not carry out the extraction of oil and gas, and its mining sector is opposed by its indigenous population. The economy of the island is largely reliant on its fishing industry.

(Although according to Wikipedia, Greenland “has some of the world’s largest remaining oil resources”:

[I]n 2001, the U.S. Geological Survey found that the waters off north-eastern Greenland (north and south of the Arctic Circle) could contain up to 110 billion barrels (17×109 m3) of oil, and in 2010 the British petrochemical company Cairns Oil reported “the first firm indications” of commercially viable oil deposits.)

The fact is, as global warming melts more of Greenland’s glaciers, exposing the earth and inviting exploration, its economic potential will only grow.

A Reuters Fact Box article states that three of Greenland’s biggest deposits are in the southern Gardar province. Companies seeking to develop rare earth mines there include Energy Transition Metals and Neo Performance Metals. Kvanefjeld is home to one of the world’s largest undeveloped deposits of rare-earth elements outside of China.

Zero Hedge reports Greenland has 38.5 million tons of rare earth oxides, massive uranium deposits, vast oil and gas reserves, precious metals and some of the world’s largest fresh water reserves.

Occurrences of graphite and graphite schist have been reported from various locations on the island. Most copper deposits have seen only limited exploration, with the northeast and central-east areas thought to be of particular interest.

Greenland’s Mineral Resources Authority says traces of nickel accumulation are numerous, and zinc is found in the north in a geologic formation that stretches for more than 2,500 km.

Known deposits of titanium and vanadium are in the southwest, the east and south, tungsten is found mostly in the central east and northeast, and uranium is mined as a byproduct of rare earths at the Kuannersuit rare earths project — although the project has been halted since 2021 when uranium mining was banned.

The Arctic

One more reason for the United States wishing to acquire Greenland is geopolitical. A source close to Trump cited by the New York Post last week said that acquiring Greenland would be “sending a strong, deliberate message to Beijing”.

That’s because, according to the Wilson Center, the United States is locked in a three-cornered fight with China as well as Russia over the Arctic region’s natural resources, such as lithium, cobalt and graphite.

“There are two main reasons [to annex Greenland]. The first is the large deposits of rare earth elements needed for critical defense and electronics manufacturing,” Atlantic Council nonresident fellow Alex Plitsas told The Post.

“Second, Greenland has a legitimately large claim to the Arctic and that would provide the US with a stronger position as competition there heats up for navigation and resources.”

In an earlier article we wrote the Arctic has been transformed by rising temperatures. Once considered too remote, too cold, and too inhospitable for civilization, the Arctic over the past 30 years has warmed more than any other region on earth — by 3.1 degrees in the coldest six months of the year, October to May.

A “territory grab” is happening in the Arctic, as polar nations jostle to control their share of a vast expanse of ocean and land that is rich in natural resources, and as the ice retreats, is beginning to open up new trans-polar shipping routes that hold great promise for seaborne trade.

At Ahead of the Herd we always follow the money to discover the reasons behind most decisions. It’s no exception with the Arctic, which contains a veritable treasure trove of natural resources — mostly oil and gas but some minerals too.

According to the US Geological Survey, the Arctic Circle (areas beyond the 200-nautical-mile economic exclusion zones are international) contains up to 30% of the world’s undiscovered gas and 13% of its oil.

The Beaufort Sea off the coast of the Northwest Territories holds an estimated 56 trillion feet of natural gas and 8 billion barrels of oil.

The New York Post observes that the US has been in a “quiet contest” with China and Russia over access to the Arctic for years, deploying military icebreaker ships to explore the resource-rich frozen tundra.

As suggested, competition has grown more fierce recently due to global warming, which has led to more freedom of navigation.

However, the Americans have so far been outpaced by their Arctic adversaries. Where Russia has dozens of icebreakers for example, the US Coast Guard only has two.

The eight countries that touch the Arctic Circle and one that doesn’t (China) may be friendly to each other now but as new resources are identified, expect there to be conflicts and confrontations.

Russia, China and the United States are on track in beefing up their military and civilian presence in the Arctic. Unfortunately, the same can’t be said of Canada.

While the country has 19 icebreakers, the fleet the second largest after Russia’s, a report by the Standing Senate Committee on National Security, Defense and Veterans Affairs was critical of the Canadian government’s level of Arctic defense. According to the committee, The Government of Canada has taken some actions designed to enhance security and defence in the Arctic – such as the publishing its Arctic and Northern Policy Framework, releasing of the NORAD modernization plan and procuring of Arctic and Offshore Patrol Ships – but more must be done.

Having traveled to the Canadian Arctic, the committee underscores the risks facing the region and the urgency with which the Government of Canada should make investments in security and defence capabilities, as well as in social and economic infrastructure, in the Arctic. We must not let this moment pass by.

Will critical minerals be part of trade war?

Back to the coming trade war, that Trump has promised to start using his favorite word and favorite weapon, tariffs, a question has come up whether critical minerals will be used. Are they too valuable to be messed with, or are they an important source of leverage?

According to sources cited by BNN Bloomberg, Canada is developing extensive tariff measures against US products that go beyond the limited countermeasures used during the 2018 trade dispute.

One government official said a draft plan is being circulated that covers nearly every product exported to Canada, aiming to match Trump’s tariffs “dollar for dollar”.

The lame-duck Trudeau government is also reportedly considering duties on strategic commodities like oil, uranium and potash.

The prime minister and premiers met Wednesday to formulate a plan to deal with the tariffs threat. In the communique signed by 12 of the premiers and Trudeau, the first ministers said they will do all they can to stop Trump from slapping tariffs on Canadian goods in the first place, CBC News said.

Alberta Premier Danielle Smith didn’t sign the document, as she is against the idea of cutting off energy supply to the US and imposing export tariffs on Alberta energy.

Alberta Premier Danielle Smith visits Donald Trump at Mar-a-Lago

A day before the meeting, BC Premier David Eby hinted at a ban on critical minerals produced in the Western-most province, a position held at a national level by NDP leader Jagmeet Singh.

“I’m calling on all political leaders to support turning off the taps on those critical minerals. Let’s stop the flow of those critical minerals into the States. There’s no quicker way to get Donald Trump to back away from tariffs,” Singh told reporters in Ottawa via Global News.

On the other side of the border, there are mixed reports about whether Trump is thinking about exempting Canadian oil and uranium — two commodities vital to US strategic interests.

Canada and Mexico are the top two source of US crude oil, and together account for about 25% of the oil refiners process into fuels like gasoline and heating oil, according to the US Department of Energy.

Many US refineries rely on the two countries and have equipment designed to process their oil types, Reuters noted. The US Midwest is expected to be hardest hit by Canadian export taxes.

A BNN Bloomberg article said that Canadian uranium is the biggest source of fuel for US nuclear power plants, and potash from Canada’s Western provinces is a huge source of fertilizer for American farms. The US Department of Defense has invested in Canadian projects to secure sources of cobalt and graphite and reduce reliance on Chinese supply chains.

For those reasons, some observers have said they expect Trump will exempt commodities from his threat to place 25% levies on goods from Mexico and Canada, and focus instead on using tariffs against their manufacturing industries. In Canada’s case, that includes the auto manufacturing, aerospace and aluminum sectors, which are centered in Ontario and Quebec, where about 60% of Canadians live.

BMO’s 2025 Mining Outlook referenced by Mining.com states that when it comes to threats of 25% on all goods from Canada and Mexico, BMO says “common sense would suggest critical mineral security of supply may be treated a little differently,” not least because so much is national security and defence related.

“As an example, Mexico and Canada also rank first and second for US silver imports last year, which would be required for domestic solar panel production.”

Conclusion: A better way

In F. William Engdahl’s book, ‘Full Spectrum Dominance’, the US pursuit of global hegemony through military, economic, and political means is presented. The book, according to the Lew Rockwell blog, argues that “the US seeks to control the world’s resources and maintain its position as the sole superpower by any means necessary, including covert regime change operations, military interventions, and control of vital energy resources.”

Well that strategy does not seem to be bearing much fruit. China long ago ate the US’s breakfast and lunch when it comes to critical mineral supply. In another respect, Donald Trump’s “suggestions” of annexing Canada and Greenland, taking back the Panama Canal, and erecting tariff walls against China, Mexico, Canada, and well, everybody else, doesn’t come as so much of a shock.

China controls the world’s critical minerals, Greenland has them, so let’s go get ‘em. It could be a simple as that.

But it’s not simple. The critical metals issue goes a lot deeper than just the supply of dysprosium, germanium or graphite. It’s the whole strategy of survival going forward.

In a world of scarce resources, he who has access to the resources wins. Sapiens have an insatiable demand for ‘things.’ But we live in a finite resource world.

This brings us back to Greenland, who owns it, what has it got for resources, and how can we get them? The same for the Arctic, a treasure trove of hidden natural resources that is continuously being uncovered by melting glaciers and sea ice. Again, who owns the oil, gas and minerals and how much is there? The next Great Game could easily be played out over the North Pole.

America appears to have given up on developing its own mines despite having a lot of critical and non-critical minerals within its borders or in “the 51st state” of Canada. And who can blame them? Between fights over flowers, frogs and other endangered species that happen to live on or near mines, restive natives, and NIMBY residents, mining companies rarely have an easy row to hoe when it comes to developing new mines. It can take up to 20 years to put a mine into production. In Canada we’re not much better. Between federal and provincial duplicate permitting, it can take just as long to go mining. The mines being developed today were discovered decades ago.

So if America won’t mine, where is it going to get its critical minerals needed?

China, which controls the mining and processing of critical minerals, is now considered America’s top economic rival and its territorial goals put it in conflict with America and its allies.

The answer is to freeze out China and get its natural resources from elsewhere. The US could go trade with its friends but look what Trump is threatening to do to decades-long friendships. Canada is girding for a trade war with the United States and likely matching tariffs “dollar for dollar”. All options are on the table including banning oil and uranium. 25% tariffs on Canadian and Mexican imports will obviously make goods more expensive. The inflation that the Federal Reserve has fought so hard to control will soon be coming back if Trump’s tariffs come into effect. Remember, it’s also 60% tariffs on Chinese goods (Walmart anyone?) and 10% on everybody else’s. Climbing interest rates, bond yields and a stronger dollar are sure to follow.

If your intent is to acquire critical minerals there are other ways of going about it than threatening your allies with tariffs, bullying NATO members into paying more, pissing off Greenland and Denmark, and irking the BRICS to the point where they stop using the US dollar.

To me, if you can’t mine a mineral locally, mine it from a friendly country, but pay for it, and control the supply chain — all the way from metal extraction to processing to purchasing the end product. Friendshoring is something we should have started doing decades ago but we are already too late — China symbolized by a horse has already left the barn, having been allowed to acquire mines in Africa, Latin America and Australia, and now controls the supply chain for critical minerals, everything from rare earths to graphite to lithium and nickel.

On top of all that, the United States under Trump is threatening to kick out millions of undocumented immigrants, the underclass of their economy. Who is going to harvest the food, make the beds, mow the lawns, take care of the elderly, work on construction sites, etc.? The shortage of workers will push wage inflation higher and cause supply shortages adding to already-higher prices.

Another, better way for the US to get critical minerals is to make arrangements with friendly countries.

The Minerals Security Partnership was a good idea but it’s a lame duck having been diluted by countries that shouldn’t be in there like the DRC. There are more than enough minerals to go around between North and South America, Europe, the UK and Australia.

What we’re lacking is the willingness to support mineral exploration and mining.

A junior resource company’s place in the mining food chain is to acquire projects, make discoveries and advance them to the point when a larger mining company wants to take it over.

Juniors are extremely important to major mining companies because they are the firms finding the deposits that will become the world’s next mines.

When was the last time you heard of a major mining company make a greenfields discovery?

Senior miners allocate a relatively small portion of their revenues to exploration, with most expenditures invested in developing existing mines and measures to reduce operating costs. So it doesn’t happen often, most majors increase their mneable reserves with merger’s and acquisitions (M&A). It increases their reserves, but it does nothing to increase the overall amount of global mineable reserves.

Juniors sit at the very bottom of the mining food chain, their job is to acquire and to advance their project to a resource estimate. Juniors help the majors replace the ore that they are constantly depleting in their operating mines. To be clear, juniors find, and own, the world’s future mines/ resources that majors turn into mineable reserves.

if we’re going to fight China and Russia who now own a considerable amount of the world’s resources, then we have to get out and spend on junior resource companies.

We need to have them financed and out in the bush with good management teams and good geologists, and we’ve got to send young people to school because we’re losing mine managers and geos at a rapid pace.

Vancouver is home to most of the world’s junior mining companies and Toronto is the country’s financial center yet we can’t seem to raise the money right now for juniors to go out and find mineral/metal deposits, let alone smelters to handle the ore. It seems simple but we can’t get agreement on anything, and that’s frustrating.

China, seemingly always one step ahead, has sensed the vexation Canadians are feeling with the US and have offered to help. In a recent statement to The Globe and Mail, China’s embassy in Ottawa said it’s willing to talk about increasing trade and ties, possibly even resuming discussion about a trade agreement with Canada. China knows better than any country that two parties can work together against a common enemy, if that’s what the US has become.

Others agree with me, that we should be working together not fighting each other. In the New York Post article, Pini Althaus, CEO of New York-based Cove Capital, said that

To strengthen its supply chain outside of China, the US should aim to ramp up partnerships with Canada and Australia, according to Althaus. Resource-heavy countries in Central Asia and Africa, which have traditionally fallen under China’s sway, are another option.

On the domestic front, US government support for early-stage exploration of criminal minerals and local processing capabilities would go a long way, he added.

Canada, for example, offers “flow-through shares” that make investments in so-called junior mining outfits tax-deductible. The smaller firms handle site exploration and assess the feasibility of a given site, then approach larger firms to bankroll operations.

Last month, Rep. Rob Wittman, who leads the House Select Committee on China’s Critical Minerals Policy Working Group, and his colleagues introduced a trio of bills aimed at boosting the US critical mineral supply chain and limiting dependence on China.

The bills would authorize more funding for US collaboration with friendly nations on critical mineral supply chains; impose export controls on domestic battery and magnet materials; and set up a “Resilient Resource Reserve” that would help protect US producers from China’s price manipulation.

“We are not going to combat them in any other way other than having an alternative to what China does. And I think we can do that, and I think we can do that quickly,” Wittman said.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.