US transportation electrification and Battery Belt boom can’t continue without graphite – Richard Mills

2024.08.08

In November 2021, the Biden administration passed the Infrastructure Investment and Jobs Act (IIJA), allocating $1.2 trillion for roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways, among other items.

The IIJA is the largest expenditure on US infrastructure since the Federal Highways Act of 1956. Rolled out over 10 years, it includes $550 billion in new spending.

Biden’s other signature piece of infrastructure legislation is the Inflation Reduction Act, passed by Congress in August 2022. It includes more than $150 billion in infrastructure financing, with the bulk of the funding directed towards transportation and clean energy projects.

At last count, 325 new clean energy projects had been announced across 41 states and Puerto Rico.

According to Bloomberg, most of the IRA investment has gone to red and swing states, especially in the Midwest and South, where land, labor and energy are cheaper.

In fact a whole new “Battery Belt” has emerged, including Michigan, Indiana, Ohio, Kentucky, Tennessee, Georgia and the Carolinas. The map below published by Elektrek shows operational and announced gigafactories clustered mostly in the Midwest and South, and near Tesla facilities in California and Texas.

Canary Media notes Georgia is the hands-down winner when it comes to clean-tech investment and new jobs:

With more than $18 billion in investments spread across 19 different battery, EV and solar manufacturing projects, the state has won more than a fifth of all new clean energy manufacturing investments. Two big battery projects account for much of Georgia’s lead: Hyundai and SK have announced a joint investment of up to $5 billion for an EV battery facility, and Hyundai is also partnering with LG Energy Solution to invest $4.3 billion in another EV battery plant.

Unsurprisingly, Georgia is also at the top in terms of expected new jobs, with a total of more than 11,000 clean energy manufacturing positions projected to be created in the state in the next few years. The Hyundai-SK joint venture alone has announced 3,500 new jobs, and two Qcells solar manufacturing plants are together expected to create 2,500 jobs. Michigan comes in second with over 9,000 new jobs, mostly in new EV battery plants and EV assembly facilities.

Of the approximately 70,000 new jobs created by clean energy investments since the IRA passed, many of the districts poised to see the most job growth are represented by Republicans, none of whom voted for the IRA.

Oilprice.com notes that in 2022, red states claimed more IRA funds and installed more wind and solar power than blue states. Republican-held districts are now home to more than 80% of all utility-scale wind, solar farms and battery projects currently under development.

Two of the reddest states, Iowa and Oklahoma, lead the nation in wind power production. Red-colored Texas is a leader in both solar and wind.

Meanwhile, seven swing states could decide whether the Democrats control the White House for a second term: Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin. Collectively, the last three states on the list have seen an influx of nearly 62,000 jobs and roughly $68 billion in private and clean energy funding. Following is a summary of what is happening in each of these swing states.

Arizona has gained 12,270 clean energy jobs and $8.3B in funding since the IRA passed. The state has become a battery manufacturing powerhouse, with two battery makers investing more than $5B. South Korea’s LG Energy Solution last year said it would quadruple a planned EV battery factory outside Phoenix. Kore Power received an $850 million loan to build a battery storage manufacturing plant that will create 3,000 full-time jobs by 2025.

Georgia has gained 16,678 clean energy jobs and $18.8B in funding since the IRA passed. The QCells solar plant employs about 1,300 in Dalton with plans to hire double and make a $2.5B investment to expand the plant and build a new one near Atlanta. Hyundai opened a new EV manufacturing facility and Rivian plans to open a new factory this year, although the latter has been delayed.

Michigan has gained 15,856 clean energy jobs and $21B in funding since the IRA passed. The biggest clean energy project assisted by the IRA is Ford’s $3.5B BlueOval Battery Park Michigan. Billions in other battery-making facilities have been announced, including Next Energy’s $1.6 billion in Wayne County and Gotion’s $2.4 billion factory in Big Rapids.

Nevada has gained 11,500 clean energy jobs and $9.1B in funding since the IRA passed. Unimacts, a company that makes components for solar panel arrays, opened in Las Vegas, hiring 80 people. Panasonic announced an expansion of its battery production at Tesla’s gigafactory outside of Reno.

North Carolina has gained 4,145 clean energy jobs and $9.6B in funding since the IRA passed. The state is also poised for a lithium-mining revival as part of the Biden administration’s efforts to bring critical mineral production back to the US from China.

Pennsylvania has gained 457 clean energy jobs and $197 million in funding since the IRA passed. Re:Build Manufacturing announced an $81 million investment to expand its clean energy component manufacturing campus in Westmoreland County, which will create 300 new jobs.

Wisconsin has gained 500 clean energy jobs and $445 million in funding since the IRA passed. ABB announced a $100 million investment to build electric drive units for EVs in New Berlin, creating 100 jobs, and Ingeteam announced 100 new jobs would be created at a Milwaukee factory that makes EV chargers.

The question is what will happen to all of this clean-tech funding if Donald Trump beats Kamala Harris?

Republicans (the same ones who didn’t vote for the IRA) have a problem. The presidential candidate they support (Trump) has vowed to dismantle Biden’s climate policy, hates electric vehicles, and has asked the oil and gas industry for a billion dollars to help re-elect him.

The latter came about at a dinner with some of the country’s top oil executives at Trump’s Mar-a-Lago Club in April.

According to The Washington Post, in response to complaints from oil execs that they are facing burdensome environmental regulations under Biden, Trump said they should raise $1 billion to return him to the White House.

In exchange, Trump vowed to reverse dozens of environmental rules passed under Biden and stop new ones from being enacted. The former president would also immediately end the administration’s freeze on permits for new LNG exports.

Never mind that the oil industry has never had it better. As reported by WaPo, Despite the oil industry’s complaints about Biden’s policies, the United States is now producing more oil than any country ever has, pumping nearly 13 million barrel per day on average last year. ExxonMobil and Chevron, the largest U.S. energy companies, reported their biggest annual profits in a decade last year.

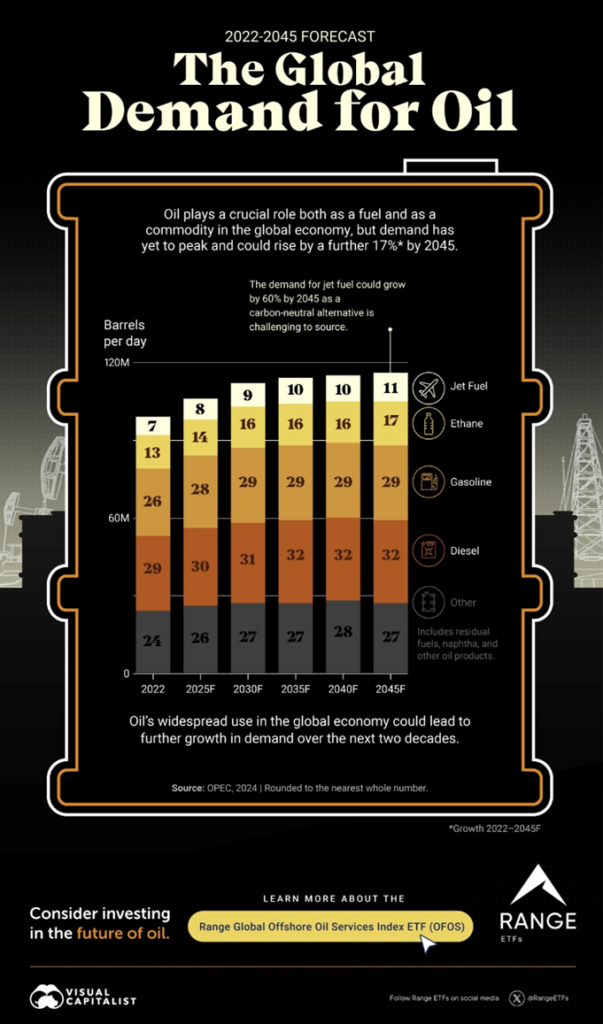

Global demand for oil is yet to peak and could rise by 17% by 2045, according to a recent infographic. Despite greater environmental awareness among flyers, demand for jet fuel could grow by as much as 60% between 2022 and 2045, since there is currently no alternative.

Back to the Battery Belt, ‘Red-State Republicans Say They’ll Defend Biden-Era Green Jobs’ states a recent Bloomberg headline. The article quotes Buddy Carter, a Georgia Republican whose district is home to a gigafactory, saying he doesn’t want to see projects like the new Hyundai Motor Company plant jeopardized.

“I’m going to discourage [the new administration] from making a sudden change,” Carter said.

Ditto for the politicians representing many American small towns which have benefited from Biden-era clean-technology legislation — not just the above-mentioned two laws but the Chips and Science Act aimed at reducing China/ Taiwan’s dominance in semiconductors.

Bloomberg notes spending on the construction of manufacturing facilities reached $198 billion in August 2023, an almost 66% increase from the previous year and the highest level since the 1950s. Note that in the latest jobs report the number of construction jobs was up 25,000 in July.

A White House tally of private investment announced since Biden took office shows $139 billion in commitments for EVs and batteries nationwide and $231 billion for semiconductors and electronics. If communities aren’t seeing the benefits yet, it’s because many of the projects haven’t started or are in the early stages of being built.

GOP politicians are pushing back not only against Trump’s plans to kybosh billions worth of clean-tech investments, but his threats to impose across-the-board tariffs on overseas goods, and levies on Chinese imports up to 60%. Axios reports:

Republicans have made it a cornerstone of their campaigns this year to slam President Biden for policies they argue spurred red-hot inflation. Now, Republican lawmakers are in the tricky position of heading home to meet constituents over the August recess with a candidate at the top of the ticket eyeing trade policies economists believe could trigger a new rise in consumer prices.

This won’t help the Battery Belt – almost all synthetic and natural graphite and anodes (we don’t know how to make them in the west), come from China. The added costs to make batteries and EV’s will make electrification impossible to compete with ICE’s.

“From steelmaking to semiconductors to electric vehicle batteries,” said Morgan Bazilian, a professor at the Colorado School of Mines, “you basically can’t build a lithium-ion battery without graphite, which means you can’t build an EV without graphite.”

Regardless of your politics, what is certain is that America’s manufacturing renaissance, focused on new EV battery and assembly plants, all aimed at knocking China off its pedestal, doesn’t happen without graphite.

Importance of graphite

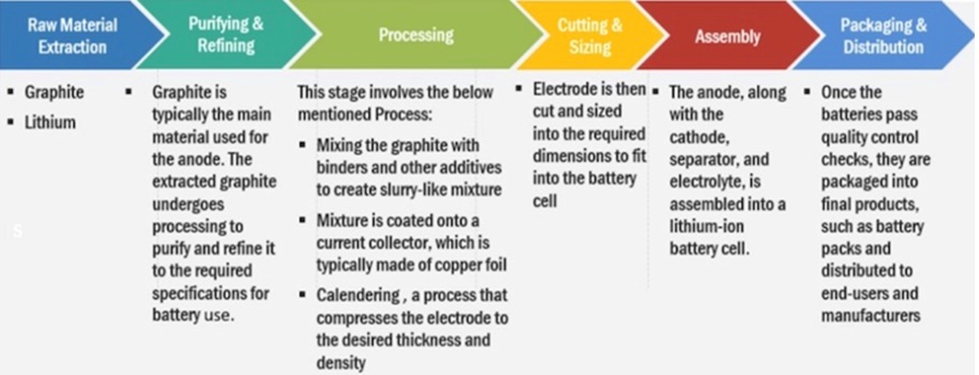

The lithium-ion batteries in electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

An anode is typically made up of graphite powder baked onto copper foil. To be suitable for lithium-ion battery manufacturing, anode materials should meet the following requirements:

- Excellent porosity and conductivity

- Good durability and light weight

- Low cost

- Voltage match with preferred cathode

A report by Polaris Research valued the global anode market at $11.5 billion in 2023. By 2032, revenues should reach $123.7B, with the industry growing at a CAGR of 30.9%.

The main reason for such a high growth rate is increasing EV adoption.

According to Statista, as of this year, 60 countries had set targets, signed pledges or announced plans to phase out gas- or diesel-powered cars and replace them with electric models.

Clean Technica reports global plug-in vehicle registrations were up 15% in June compared to the same month last year. Plug-in hybrids jumped 41% year on year, setting a new sales record of 500,000 units.

“The lithium-ion battery anode market is experiencing notable growth due to electric vehicle acquisition. The growing approval of plug-in hybrids and EVs instantly translates into growing demand for lithium-ion batteries,” states Polaris Market Research via PR Newswire.

Another report by Markets&Markets projects anodes will grow from a $12 billion industry in 2023 to $46.5 billion in 2028.

Anodes made from synthetic graphite are expected to be the largest market from 2023 to 2028. Despite its higher cost compared to natural graphite from graphite mines, “its well-defined structure facilitates smoother lithium-ion movement, enabling faster charging and higher reliability,” states Markets&Markets. An additional advantage of synthetic graphite is its longer lifespan compared to natural.

Unlike metals that go into the battery cathode, there is no substitute for graphite in the anode. Anode technology such as that being proposed by Graphite One (TSXV:GPH, OTCQX:GPHOF) is essential for developing a completely domestic “mine to battery” supply chain.

The importance of graphite to vehicle electrification is highlighted by the fact that EV manufacturers are signing deals directly with graphite miners such as Graphite One.

On July 25, G1 announced it had entered into a non-binding Supply Agreement with Lucid Group, Inc. (NASDAQ: LCID), a California-based electric vehicle manufacturer, for anode active materials (AAM) used in EV batteries.

“This is a historic moment for Graphite One, Lucid and North America: the first synthetic graphite Supply Agreement between a U.S. graphite developer and U.S. EV company,” said Anthony Huston, Graphite One’s President and CEO.

“G1 is excited to continue pushing forward developing our 100% U.S. domestic supply chain. We appreciate the support from our investors and the grant from the Department of Defense. Subject to project financing required to build the AAM facility, the Supply Agreement with Lucid puts G1 on the path to produce revenue in 2027, and that’s just the beginning for Graphite One as work to meet market demands and create a secure 100% U.S.-based supply chain for natural and synthetic graphite for U.S. industry and national security.”

Lucid’s flagship vehicle is the Lucid Air, which has been recognized with a number of awards, including MotorTrend 2022 Car of the Year, World Luxury Car of the Year, and Car and Driver 10 Best. Lucid is preparing a factory in Arizona to begin production of the Lucid Gravity SUV.

The Supply Agreement follows Graphite One’s selection in March 2024 of a site for the company’s proposed AAM facility in Warren, Ohio – the heart of the State’s “Voltage Valley.”

Through its wholly-owned subsidiary, Graphite One Alaska, the Vancouver-based company chose Ohio’s Voltage Valley, entering into a 50-year land-lease agreement on 85 acres. The deal also contains an option to purchase the property once known as the Warren Depot, part of the National Defense Stockpile infrastructure, until the brownfield site was processed through the Ohio EPA Voluntary Action program a decade ago, certifying that the land does not need further cleanup.

Construction is slated to start within the next three years.

The five-year, non-binding Supply Agreement provides for 5,000 tpa of synthetic graphite. Sales are based on an agreed price formula linked to future market pricing, as well as satisfying base-case pricing agreeable to both parties.

The proposed Ohio facility represents the second link in Graphite One’s graphite materials supply chain; the first link is Graphite One’s Graphite Creek mine in Alaska, currently working toward completion of its Feasibility Study in Q4 2024, on an accelerated timetable, mostly funded by a $37.5 million Defense Production Act grant from the Department of Defense in July 2023.

Subject to financing, the plant will manufacture synthetic graphite until natural graphite anode active materials becomes available from the company’s Graphite Creek mine, located near Nome, Alaska, according to the March 20th news release.

The plan also includes a recycling facility to reclaim graphite and other battery materials, to be co-located at the Ohio site, which is the third link in Graphite One’s circular economy strategy.

From EV’s to National Security

Bloomberg observes how graphite “is at the center of the tightening convergence between control of critical minerals, the energy transition, and national security.”

Virtually every US military system requires mineral components, from steel and titanium to graphite composites and cadmium alloys. Global defense spending shows that military demand is increasing for these platforms, munitions, and thus minerals. (Modern War Institute)

Graphite is the ideal material for defense purposes thanks to its unique properties, i.e., it is able to withstand very high temperatures with a high melting point; it is stable at these high temperatures; it is lightweight and easy to machine; and it is corrosion-resistant.

A report last year from the Hague Centre for Strategic Studies found that natural graphite and aluminium are the materials most commonly used across military applications and are also subject to considerable supply security risks that stem from the lack of suppliers’ diversification and the instability associated with supplying countries.

Graphite’s war-fighting capabilities — Richard Mills

Conclusion

China mines about two-thirds of the world’s natural graphite, controls about 60% of synthetic graphite, and almost 100% of coated spherical graphite used in EV batteries. China also accounts for 98% of announced anode manufacturing capacity expansions through 2030, according to the International Energy Agency.

The United States currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

In 2023, the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity, suitable for electric vehicles. And as 2023 ended, China fired a warning shot in the tech and trade wars, subjecting graphite to new and more stringent export controls.

Graphite One could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite anode manufacturing plant in Voltage Valley, Ohio. Initially, G1 will produce synthetic graphite and other graphite products.

Based on G1’s Prefeasibility Study (PFS), not the Feasibility Study which is expected this fall, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

Automakers and defense companies have been raising alarm bells over the fact that the United States hasn’t mined any graphite since the 1950s, and even if it had, it would need to be shipped to China for processing. G1 intends to play a large part in correcting this.

The continental United States, and Canada, cannot be relied upon to mine graphite. A recent Reuters article quotes a report by S&P Global, a consultancy, that says it takes an average 29 years to build a new mine in the US. The is the second-longest in the world behind only Zambia. The report studied 268 mining projects worldwide. Canada, Argentina and Mongolia rounded out the “top 5” countries with the longest mine development periods.

By contrast, G1’s Graphite Creek mine has been given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process. In other words, having HPIP means that Graphite Creek will be fast-tracked to production.

The US Geological Survey has cited Graphite Creek as the country’s largest known graphite deposit, and one of the biggest in the world. With graphite being the indispensable ingredient in EV batteries and multiple defense platforms as well, Graphite One plays a central part in any U.S. strategy aimed at developing resource independence from China.

Graphite One and EV maker Lucid sign historic supply agreement — Richard Mills

Graphite One could take a leading role in loosening China’s grip on the US graphite market — Richard Mills

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.08.07 share price: Cdn$0.85

Shares Outstanding: 137.8m

Market cap: Cdn$117.1m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard does own shares of Graphite One Inc. (TSX.V:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.