Backed by up to $47.2 million in non-dilutive funding Graphite One poised to deliver 2023 drill results – Richard Mills

2023.10.16

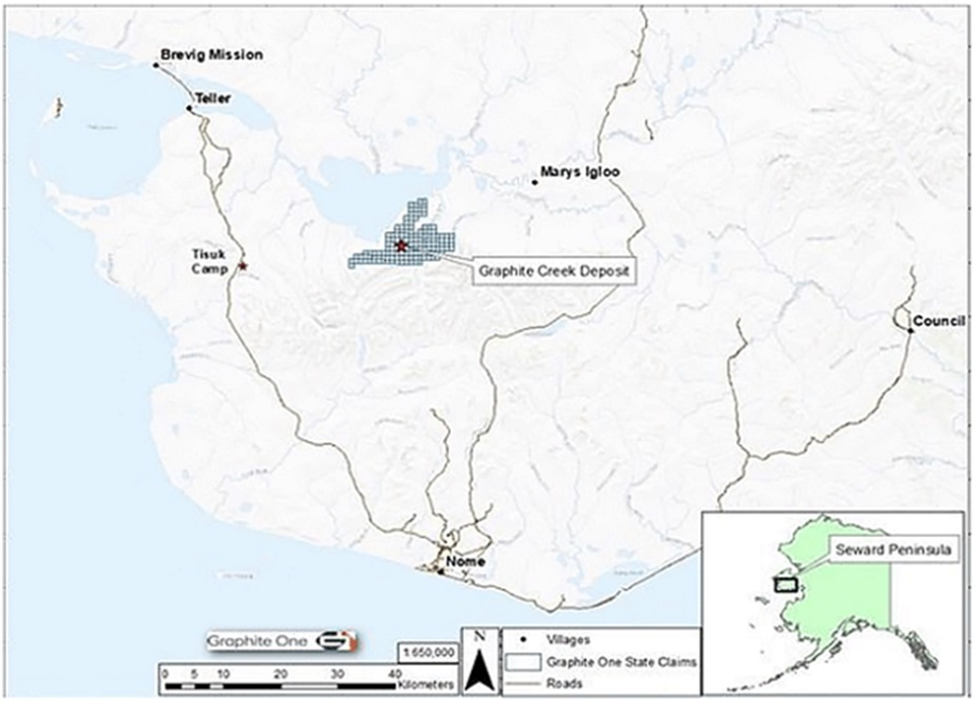

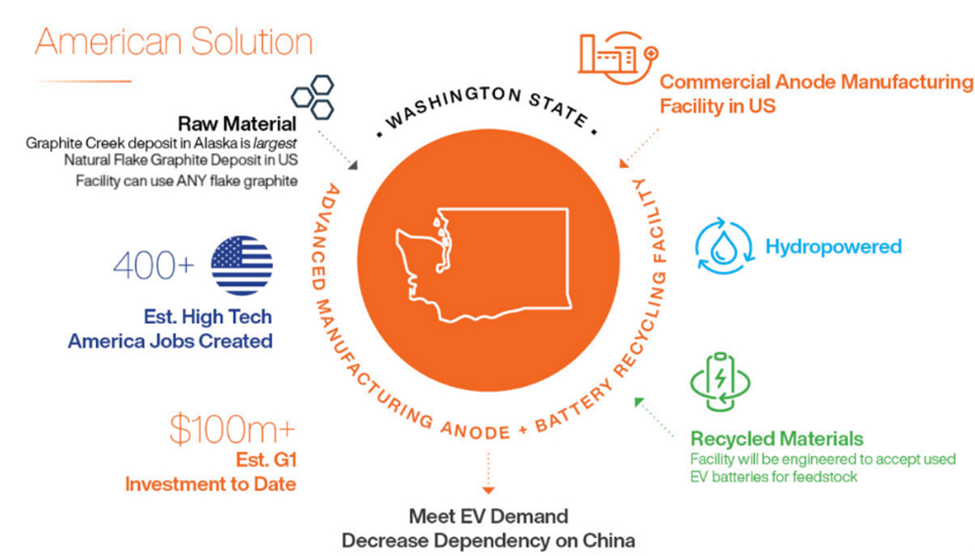

America’s largest graphite resource, and one of the biggest in the world, says the US Geological Survey, is the Graphite Creek deposit in Alaska being developed by Graphite One (TSXV: GPH, OTCQX: GPHOF).

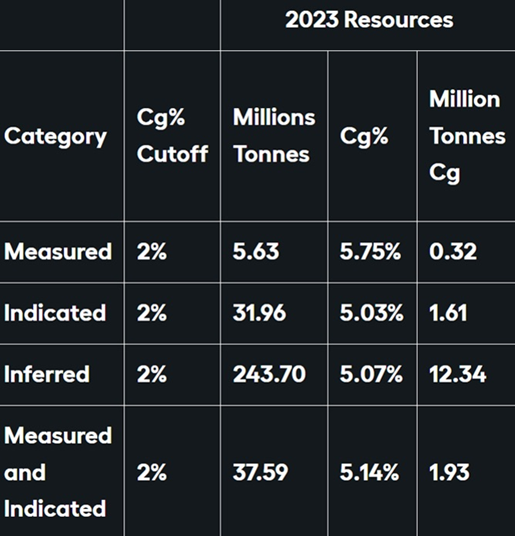

On March 13, 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

2022 Drilling Program Results Increase Graphite One Measured and Indicated Resource by 15.5%

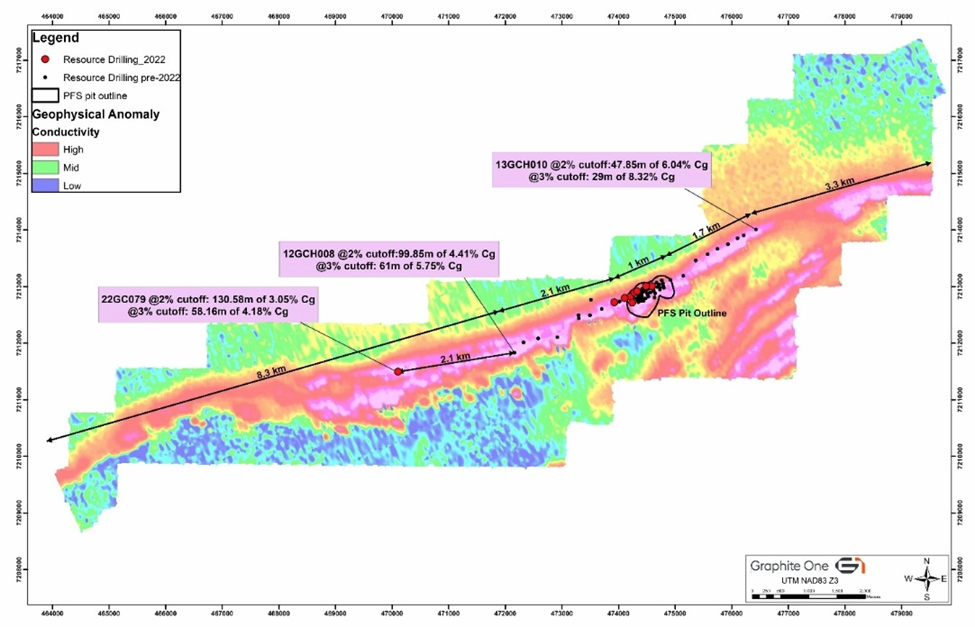

Measured and indicated resources now stand at 37.6 million tonnes at 5.14% graphite, with an inferred resource of 243.7 million tonnes at 5.07% graphite. The updated resource did not include hole 22GC079 (drilled 2.1 km west of the current block model, which encountered 58 meters of 4.18% graphite), due to distance constraints.

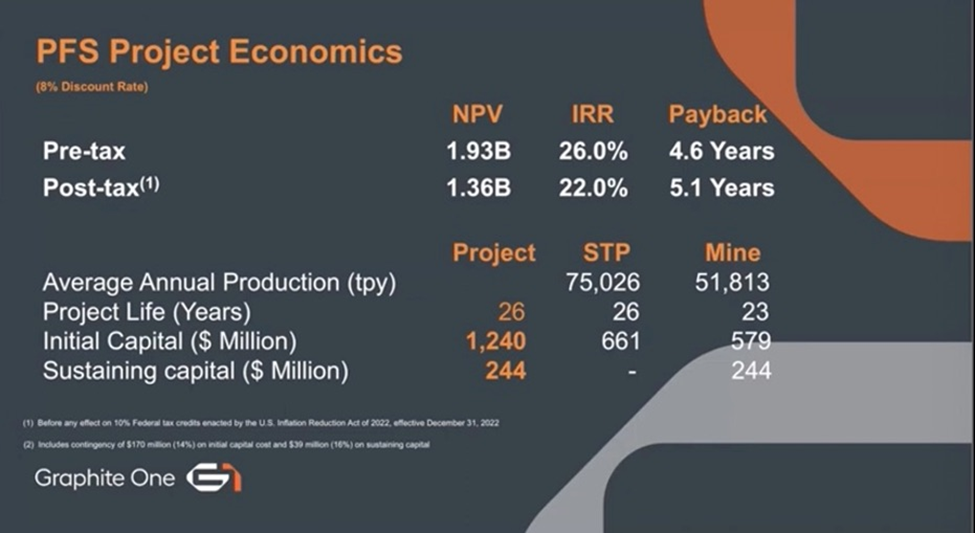

Last fall, Graphite One underwent a major de-risking event with the release of a prefeasibility study (PFS), which portrays the Graphite One project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite price of $7,301 per tonne.

Once up and running, the mine would produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life. The company itself would produce about 75,000 tonnes of products a year, of which 49,600 tonnes would be anode materials, 7,400 tonnes purified graphite products and 18,000 tonnes unpurified graphite products.

The PFS is based on the exploration of only one square kilometer of the 16-km deposit, meaning that it could easily crank up production by a factor several times the proposed run rate of 2,860 tonnes per day.

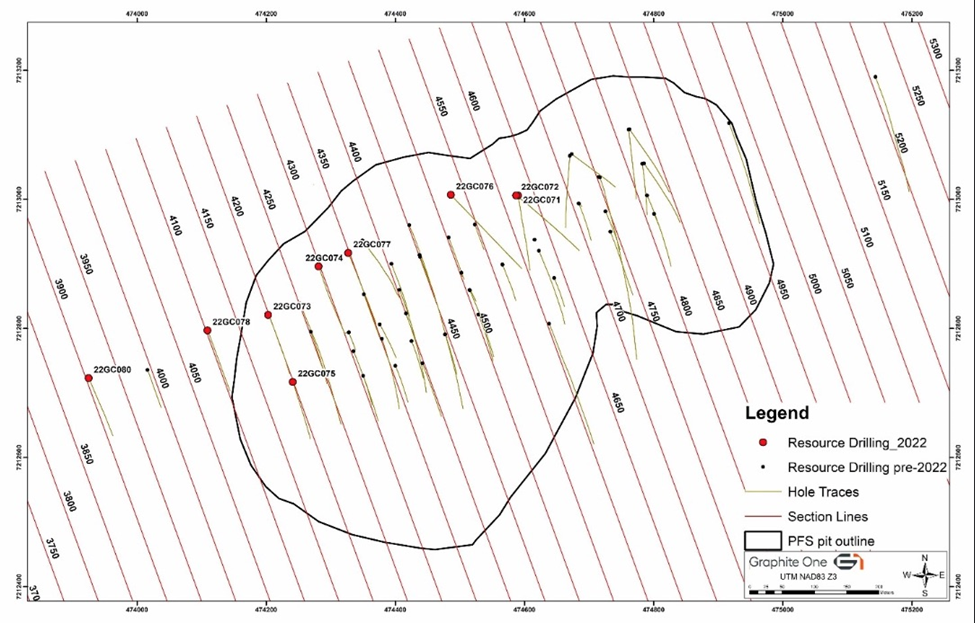

Graphite One announced the results from the 2022 drill program on February 7, 2023. Conducted from June to September 2022, the field program was comprised of increasing the field camp capacity, completing key environmental baseline studies, and drilling 1,940 meters of core for resource definition as well as 210 meters of geotechnical drilling for mill site and tailing area determination.

Graphite One Confirms that Significant Graphite Grade Continues 4 Kilometers from PFS Pit Boundary

Select intervals included:

- Hole 22GC071 returned 18.5m of 4.7% Cg, 22.2m of 6.8% and 20m of 6.7% Cg starting from 19m downhole.

- Hole 22GC072 returned 31.7m of 5.6% Cg, and 37.6m of 5.2% Cg starting from 62m downhole.

- Hole 22GC073 returned 3.8m of 7.6% Cg, 27.6m of 5.1%, 26.4m of 6.2%Cg and17.3m of 4.3% Cg starting from 13m downhole.

- Hole 22GC075 returned 10.5m of 7.7% Cg, 32.9m of 6.4% Cg and 2.1m of 12.0% Cg starting from 3m downhole.

- Hole 22GC076 returned 53.1m of 7.5% including 12.3m of 11.5% Cg including 2.8m of 25.6% Cg starting from 72m downhole.

- Hole 22GC079 located 2 km west of previous closest drilling returned 31.8m of 3.4% Cg, including 6.3m of 6.7% Cg, 21.5m of 2.6% Cg, 10.7m of 2.6%Cg, and 13m of 5.4% Cg starting 5m below surface.

Summing up the drill program:

- Core drilling in the deposit area continued to encounter visible graphite mineralization over wide intervals, consistent with previous drilling.

- Hole 22GC079, drilled 2 km west of the previous resource drilling and 4 km west of the PFS pit boundary, showed significant intervals above the PFS mill cut-off grade. Selected intervals totaled 58.2 m of 4.18% graphite. However, the updated resource did not include the hole due to distance constraints.

- The deposit remains open to the west, east and down dip.

- 2022 drilling sought to extend the inferred resource to the west and upgrade the inferred to measured and indicated around the PFS pit area.

- All holes drilled in the proposed north pit wall encountered significant zones of graphite, which will expand the pit to the north.

Graphite One planned to complete a total of 20,000 meters of drilling in 2023 and 2024 with the objective of increasing the annual concentrate production for the upcoming FS compared to that assumed in the PFS.

The 2023 drill program was designed to double the measured and indicated resources and increasing the inferred resource by infill drilling along trend to hole 22GC079. The results of the program (assays are pending) will feed into the company’s feasibility study, which contemplates increasing production from 50,000 tonnes of graphite concentrate as estimated in the prefeasibility study (PFS) to more than 150,000 tonnes of graphite concentrate per year.

According to a management’s discussion and analysis document:

To reduce costs and improve efficiency, the 2023 drilling program will be converted from a helicopter-based program to a track drill-based program. A bulldozer and excavator have been purchased and staged for transporting to the site which will be used to make drill roads and drill pads to reduce the need for helicopters and pad building crews. The planned 2023 Drilling Program will continue to delineate the scope and size of the resource, as the Graphite Creek deposit remains open to the West, East, and down dip.

The budget for the 2023 field program is up to $37 million subject to funding availability.

Non-dilutive funding

The US Department of Defense, the Alaska government and the Bering Straits Native Corporation (BSNC) have committed to moving Graphite One’s vision of a US-based graphite materials supply chain forward.

In July, the DoD awarded GPH with a technology investment grant of $37.5 million under Title III of the Defense Production Act.

Graphite One Awarded $37.5 Million Department of Defense Grant Under the Defense Production Act

The company subsequently announced it had entered into a one-year $5 million loan agreement with Taiga Mining Company, its largest shareholder.

The proceeds will be used for infill drilling, as Graphite One moves towards its feasibility milestone. The company granted Taiga an option to purchase up to a 1% net smelter royalty (“NSR”) in increments of 0.25% for every $1.25 million advanced to the company on 133 claims owned or lease by the company, which was bought back for approximately $0.5 million on June 21, 2023. The option may be exercised at any time prior to maturity. If and when the option is exercised, the outstanding loan balance and accrued interest will be deemed consideration paid for the purchase of the NSR.

Neither the grant nor the loan was dilutive to shareholders.

In September, Graphite One closed a $2 million strategic investment by way of a private placement from BSNC, with an option to invest a further $6 million over the next 12 months to support the development of the Graphite Creek.

The BSNC investment follows multiple community meetings with local residents and company officials during 2023, Graphite One said.

It also bolsters Graphite One’s position and brings added credibility to the project. With the support of BSNC, the company can proceed with increased confidence as it strives to bring the Graphite Creek project to full-scale operations.

Also in September, Graphite One was awarded a $4.7 million contract from the Defense Logistics Agency (part of the US Department of Defense), to develop a graphite and graphene-based foam fire suppressant as an alternative to PFAS fire-suppressant materials, as required by US law.

Under a signed agreement, Vorbeck Materials Corp of Maryland is the primary sub-contractor on the DLA contract. Vorbeck is a global leader in graphene production and advanced graphene applications. Its graphene offering, VOR-X, can produce the material at large-scale levels and integrate it into numerous solutions.

Conclusion

In total that’s up to $47.2 million in non-dilutive funding to shareholders, so far, for Graphite One, which has the country’s largest graphite deposit and plans to develop it as part of a new US-based graphite supply chain.

In early 2021, after being nominated by Alaska Governor Mike Dunleavy, Graphite Creek was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC), which is responsible for the environmental review and authorization process for certain large-scale critical infrastructure projects.

The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

Given its significant graphite resource, which the USGS now places among the world’s largest, the deposit’s exploration upside, and its anticipated Washington State graphite product manufacturing facility, Graphite One is building the foundation for its goal of becoming the first vertically integrated producer to serve the US EV battery market.

To do that, the company entered into an MOU in April 2022 with Sunrise (Guizhou) New Energy Material Company, a China-based lithium-ion battery anode material producer. The intent is to sign a technology licensing agreement, and to share expertise and technology for the design, construction, and operation of the proposed graphite material manufacturing facility in Washington State.

The Washington facility represents the second link in Graphite One’s advanced graphite materials supply chain. A planned recycling facility to reclaim graphite and other battery materials is to be co-located at the Washington plant, completing the third link.

The world simply needs more graphite, a key ingredient in EV batteries and energy storage systems for which there are no substitutes.

Analysts estimate that by 2030, it will take at least 5 million tonnes of graphite per year to fill battery demand. This is roughly four times the 1.3 million tonnes mined globally, according to the USGS’s Mineral Commodities Summaries 2023.

This is why the DOE, in its assessment, ranked graphite near the top of its list of minerals critical to America’s energy future. The US federal government’s critical minerals list also has graphite as one of five key battery minerals that are at risk of supply disruptions.

The only way to alleviate that risk is for the United States to find its own source of graphite production, and at AOTH we believe a project like Graphite One’s ticks all the boxes.

We look forward to the assay results from the 2023 drill program. If they are anything like 2022’s, GPH will be well on its way to putting out a robust feasibility study that should attract a lot of eyeballs.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2023.10.13 share price: Cdn$1.08

Shares Outstanding: 129.0m

Market cap: Cdn$142.3M

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.