Renforth Resources well funded for fall/winter exploration at Surimeau – Richard Mills

2023.09.02

Great news just came out of Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) with the announcement that it has fully liquidated its shareholding in Radisson Mining Resources for proceeds of $1.4 million. This transaction, according to Renforth, removes any uncertainty regarding the company’s ability to raise funds in what it calls a “challenging” junior exploration market.

Renforth previously acquired a minority stake in Radisson back in 2020 following its sale of the New Alger gold property, which is located next to the Radisson’s O’Brien project in the Canadian province of Quebec.

In a note to shareholders, Renforth’s CEO Nicole Brewster said that the divestment of Radisson eliminates any financing risk that the company would face moving forward. “The company is going nowhere,” she wrote, given it now has cash on hand coupled with a low sustaining cost to unlock value out of its proven set of exploration assets.

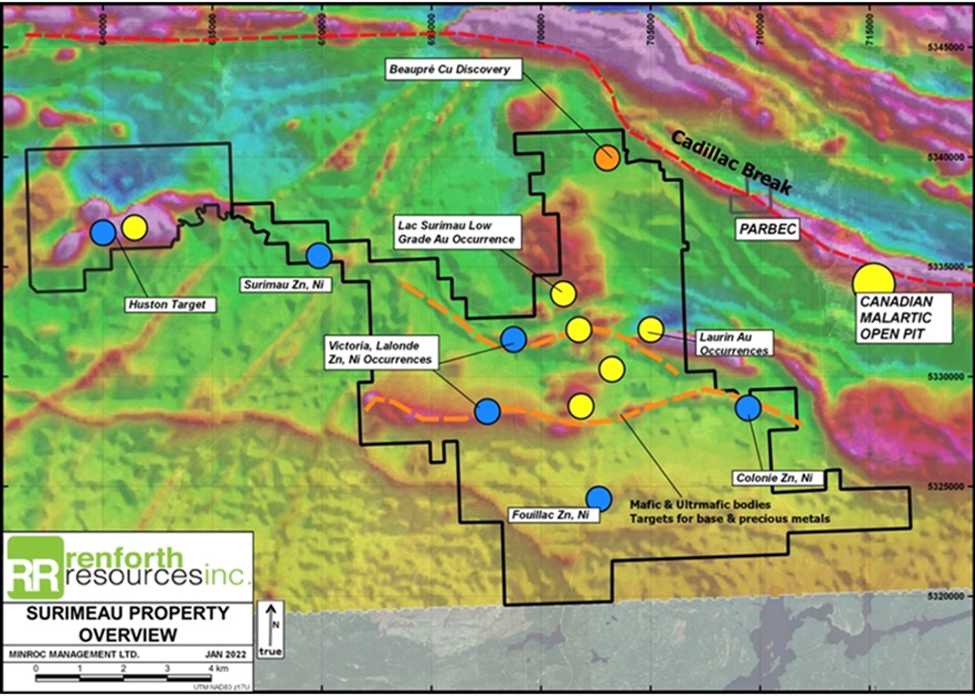

These include the Parbec open pit gold deposit located on the Cadillac Break in Malartic, Quebec, with an estimated resource of 104,000 oz. indicated at a gold grade of 1.78 g/t and 177,000 oz. inferred at a grade of 1.78 g/t. It is contiguous to the Canadian Malartic, one of Canada’s largest gold mines.

But the most prominent project in Renforth’s portfolio is the Surimeau polymetallic property, also in Quebec, where it has discovered a nickel-bearing ultramafic, coincident with a copper/zinc VMS (volcanogenic massive sulfide), over around 5 km of strike in the western end of a 20 km central anomaly.

“We have significant dollars in the bank, and we have gold ounces in the ground, we are actively exploring our district-scale battery metals property in Quebec. Surimeau hosts numerous pegmatites and is already proven to carry nickel, copper, zinc, and gold…along with other metals in large mineralized systems on a property 4.5 times the size of the island of Manhattan,” Brewster stated in the August 30 press release.

“Our cash on hand represents almost 50% of our current market capitalization, our other assets build on that base. Our plans for the rest of the year will build upon that combination again.”

Regarding its ongoing exploration, Renforth said field work is continuing at Surimeau, with geologists following up on target areas that were identified based on the summer 2022 prospecting program in search of lithium mineralization.

According to the company, the team has identified multiple pegmatite outcrops in areas that were previously not explored. The field work is facilitated by easy road access and abundant outcrops. A total of 100 samples have been submitted to the ALS analytical lab in Val d’Or, Quebec, and assays are pending. Field conditions are ideal for boots on the ground prospecting work.

Renforth anticipates that after a first round of prospecting there will be follow-up, with assays in hand before the snow flies.

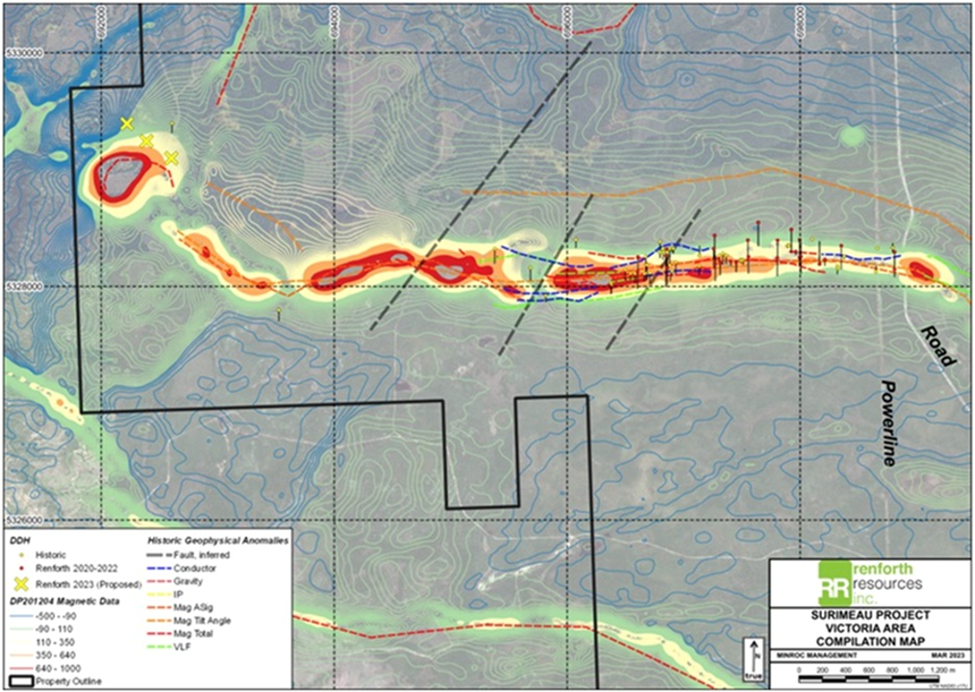

The company is also designing a drill program for this winter that will focus on the central area of the ~20 km long Victoria mineralized structure, with step-outs from the 2021 and 2022 drilling in that area which encountered a mineralized package that included a graphitic shale horizon in the south, a main zone composed of nickel/cobalt/platinum and palladium mineralization interlayered with zinc/copper/silver/gold and, discovered in 2022 drilling, additional mineralized horizons north of the main package.

About Surimeau Property

Renforth’s Surimeau project is a district-scale property hosting several areas prospective for gold/silver and battery/industrial metals (nickel, copper, zinc, lead, cobalt, lithium and manganese). It is located south of the Cadillac Break, a major regional gold structure.

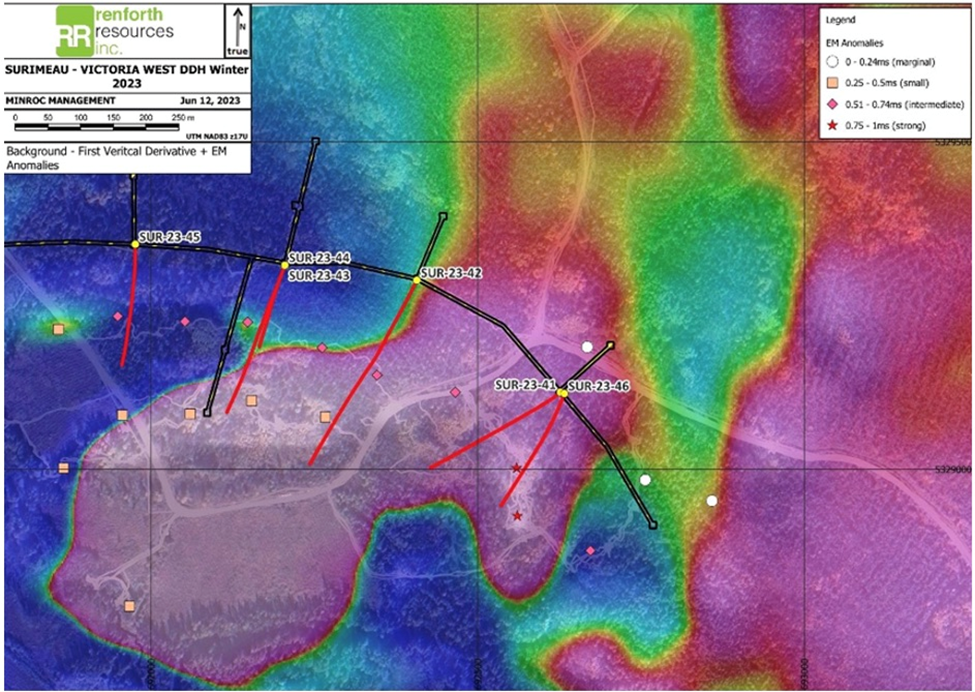

For the better part of two years, Renforth’s exploration focus has been on the more advanced Victoria mineralized battery metals horizon and parts of the longer Lalonde horizon lying parallel to the north (see map below).

Victoria is a ~20km long “ground truth” magnetic structure bearing nickel, copper, zinc and cobalt mineralization at surface. It stretches between the Victoria West mineralization, which has been drilled over 2.2 km in the west, and the Colonie mineralization, drilled and surface sampled by Renforth in the east.

The Lalonde mineralization, located ~3 km north of Victoria West, was only recently drilled by Renforth. This surface mineralized system, similar to Victoria, currently stretches over ~9 km of ground-truthed strike.

Both zones are about 250-500 metres in thickness, running east-west across the central portion of the property. The two systems are interpreted by the company as two arms of a fold, with the fold nose located off the property and to the east.

While the defined area of mineralization spans a total length of ~29 km, which by industry standards is a long distance to cover, this is still just a small portion of a district property that remains underexplored.

2023 Exploration Recap

Earlier this year, the Renforth team started to move farther out, drilling in an area about 4 km west of the Victoria structure where work first began on the property.

An airborne electromagnetic/magnetic survey interpreted the western end of Victoria as showing an interesting curvature, possibly representing folding which may have resulted in mineralized fluid entrapment.

As far as we know, the ~20 km Victoria trend consists of ultramafic flows intercalated with graphitic mudstones, albite shears and calc-silicate rocks. The ultramafics and calc-silicates are what host most of the higher-grade nickel and cobalt mineralization, while the graphitic mudstones and albite shears host most of the higher-grade zinc and copper mineralization as sphalerite and chalcopyrite, respectively.

Surface sampling identified mineralization within the ultramafic rocks, with bands of calc-silicates typical of the Victoria system. Except for Renforth’s prospecting, the western end of Victoria had not been previously explored or drilled.

A six-hole drill program was carried out in March/April, with each hole encountering graphitic mudstones hosting copper, zinc and nickel. These holes were drilled over an approximate 700-meter strike length.

The main finding of the drill program, as indicated by Renforth in a June press release, is an increase in the frequency and thickness of the graphitic mudstone layers. Moreover, this mudstone is similar to the mineralization seen in the first holes drilled at Surimeau, about 6 km to the east, and it is also exposed at surface south of the previously drilled 2.2 km of Victoria strike.

Based on visuals and XRF readings, the mudstones deliver a consistent nickel value, along with higher levels of zinc and copper.

Beginning in 2022, Renforth also started paying more attention to the potential presence of lithium, separate from Victoria and Lalonde, through the sampling of pegmatites — coarse-grained intrusive igneous rocks formed from crystallized magma below the Earth’s crust — and anomaly clusters with the potential to contain lithium.

Pegmatites can contain extractable amounts of lithium, most commonly found in the mineral spodumene. This is why pegmatite lithium deposits are also known as hard-rock lithium.

Renforth commissioned J.J. Minerals Inc. of Sudbury, Ontario, to write a report interpreting the lithium assays, to help the company plan its summer 2023 prospecting season for lithium.

Based on a review of Renforth’s and Quebec government data sets, J.J. Minerals identified three exploration targets:

- Within 1 km of the contact between the metasedimentary rocks and the Decelles Batholith on both sides of the contact.

- The biotite granite bodies north of the metasedimentary-Decelles Batholith contact.

- Anomalies E and J occur in the metasedimentary rocks and granitic batholith rocks, respectively; both are near diabase dikes. The diabase dikes are regional deep-seated structures that could act as pegmatitic fluid pathways. The orientation of the Cadillac spodumene pegmatite dikes is NW-SE, which is the same orientation as the regional diabase dikes.

Adding to the project’s commodity exposure, Renforth announced in February that gold has been intersected during drilling at Victoria — the first such instance of the precious metal within the 20-km-long mineralized system.

Also, Lalonde has been confirmed as a mineralized system with drill results similar to surface samples. Renforth’s first drilling at Lalonde, in December 2022, delivered grades and widths that justify further exploration.

These include one hole which yielded 26.7m of 0.21% nickel and 159 parts per million (ppm) cobalt, as well as 1m of 0.41% nickel. This hole also returned 52.75m of 0.45 g/t silver. A lengthy intercept, albeit at a relatively low grade, that Renforth says is indicative of a silver-endowed zone, including 1.1m of 1.10% zinc. It may also signal a VMS system; Renforth is working with an expert to vector in on the mineralization.

Unique Combination

What Renforth has done so far demonstrates that it has removed any exploration risk. As its CEO had noted, there’s no question as to whether its Surimeau property has mineralization to be uncovered, and there’s indeed lots of it, in great varieties. There’s also zero doubts over the company’s gold mining potential, given its Parbec project already has a resource estimate.

The presence of both industrial and precious metals on its Quebec properties makes Renforth a fascinating proposition because this combination is rather unique for a junior explorer.

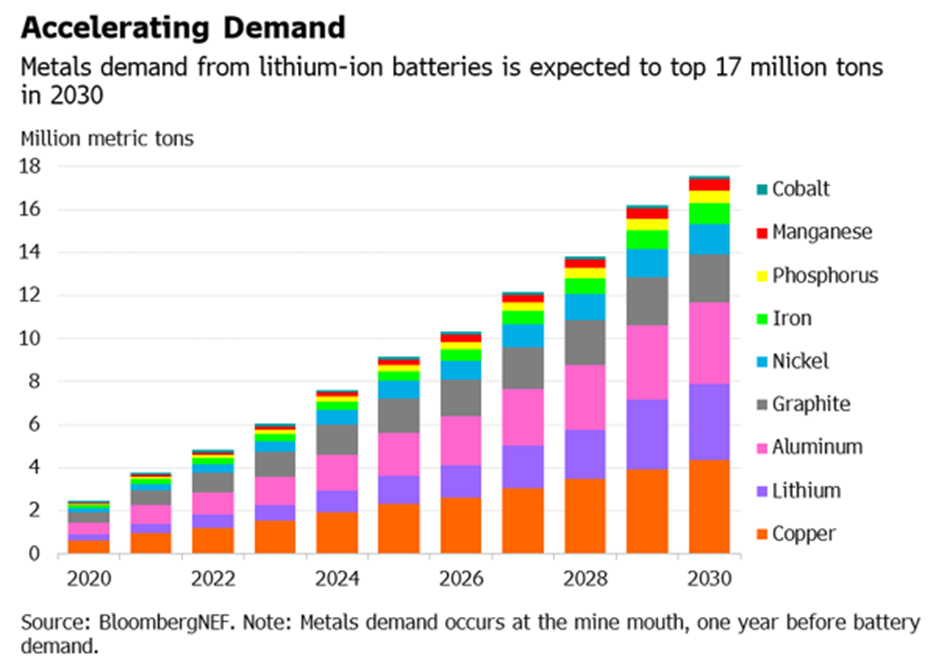

As discussed in an earlier article, the urgency to expand and diversify the world’s critical minerals supply chain has become a major investment theme in recent years, driven by strong demand for raw materials to feed the global energy transition in the years ahead.

BloombergNEF estimates that total demand for battery metals could surpass 17.5 million tons by the end of the decade, with lithium set to grow the fastest, surging more than sevenfold between 2021 and 2030.

The International Energy Agency, which provides analysis and data on the entire global energy sector, forecasts that mineral demand for use in electric vehicles and battery storage will grow at least 30 times by 2040.

Lithium should see the fastest growth, with demand growing by over 40x in its Sustainable Development Scenario, followed by graphite, cobalt and nickel (around 20-25 times). The expansion of electricity networks also means that copper demand could more than double over the same period, the Agency estimates.

To reach net-zero, demand for these key metals needed for the deployment of energy transition technologies such as solar, wind, batteries and electric vehicles will grow fivefold by 2050, BloombergNEF research finds.

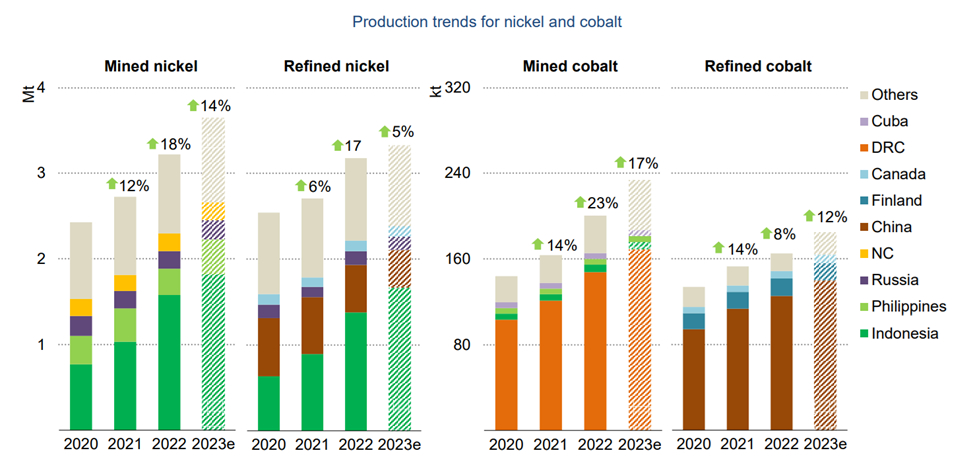

The challenge now for the industry is to develop more mines. For nickel alone, as many as 60 new mines would be needed by 2030 to meet global net carbon emissions goals, the IEA estimates.

Diversification is also a growing challenge, as a highly concentrated critical minerals supply endangers the future supply security. The latest edition of the IEA’s Critical Minerals Market Review revealed that supply sources of key EV metals like nickel and cobalt remain heavily concentrated (in Indonesia and DRC, respectively), despite efforts to rectify that.

A key takeaway from that report is that the Western world still has a long way to go before having a reliable, sustainable supply of critical minerals, and more mining projects must be developed domestically. A potential hotspot is Quebec, and Renforth stands to benefit from its continued exploration of the Surimeau property.

Another major investment theme is precious metals, in particular gold, which Renforth also has exposure to. With the latest cues pointing to another rate pause by the Federal Reserve, gold is set to get another short-term boost.

Longer term, the prospects of gold investment are even greater. There are few trends developing around the world that are supportive of bullion, such as the increased central bank buying, expectations of a recession, a weakening US dollar, and more.

Conclusion

In the current market, it’s all about value hunting; the junior exploration space is the epitome of that.

As far as commodity exposure goes, few could match that offered by Renforth, which has found mineralization for gold, zinc, nickel, copper, cobalt, and potentially, lithium. This, as we’ve talked about, removes any sort of exploration risk associated with the company.

With the latest transaction to raise as much as $1.4 million in funds, its financial risk has also been eliminated, as it would give Renforth the best guarantee to get exploration done; as the saying goes: cash is king in the mining business.

Now, the company can focus 100% on value creation for the rest of the year and beyond. As noted by its CEO, RFR has about half its enterprise value in cash, meaning the stock is certainly being undervalued. At a current price of $0.015 a share and an average target price of $0.07, its triple-digit growth upside is evident.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.015; 2023.08.30

Shares Outstanding 326.3m

Market cap Cdn$4.9m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of RFR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.