Copper now classified as US critical mineral, and rightly so – Richard Mills

2023.08.25

Before we realize it, the global copper market is approaching an inflection point.

On one hand, as one of the most widely used metals on the planet, demand for copper has been consistently on the rise, matching the growth of economies step by step. Now, there’s an added layer of demand due to the increasing need for electrification.

This is because copper offers excellent electrical conductivity properties, making it a key component in the construction of renewable energy sources such as wind, solar, hydro, and thermal, as well as in electric vehicles.

On the other side of the equation, supply is becoming a widespread concern as energy infrastructure takes up more of the metal, leaving the world’s producers playing catch up to the fast-rising demand.

Chances are, very soon we’re going to see an undersupply of copper that puts global efforts to decarbonize into serious doubt. In fact, a shortfall could arrive as early as 2025, as some of the world’s largest mining companies and metal traders have warned.

Copper Required for Electrification

Forming the basis of this projection is a sizable, never-seen-before rise in copper demand expected in the forthcoming years.

Along with the usual applications of copper in construction wiring and plumbing, transportation, power transmission and communications, there is now an additional demand for electrification purposes.

To keep the energy transition going, it’s estimated that millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms.

According to the Copper Development Association, a 3-megawatt onshore wind turbine takes up to 4.7 tons of copper, with offshore wind turbines requiring even more at approximately 8 tons per MW. The CDA estimates that wind farms use approximately 7,766 lbs of copper per megawatt, while an offshore wind installation uses 21,068 lbs per MW.

More copper tonnage is required for solar power systems, approximately 5.5 tons per megawatt, states the CDA, with the red metal used in heat exchangers, wiring and cabling. An estimated 1.9 billion lb. of copper will be needed to power 262 gigawatts of new solar installations between 2018 and 2027 in North America.

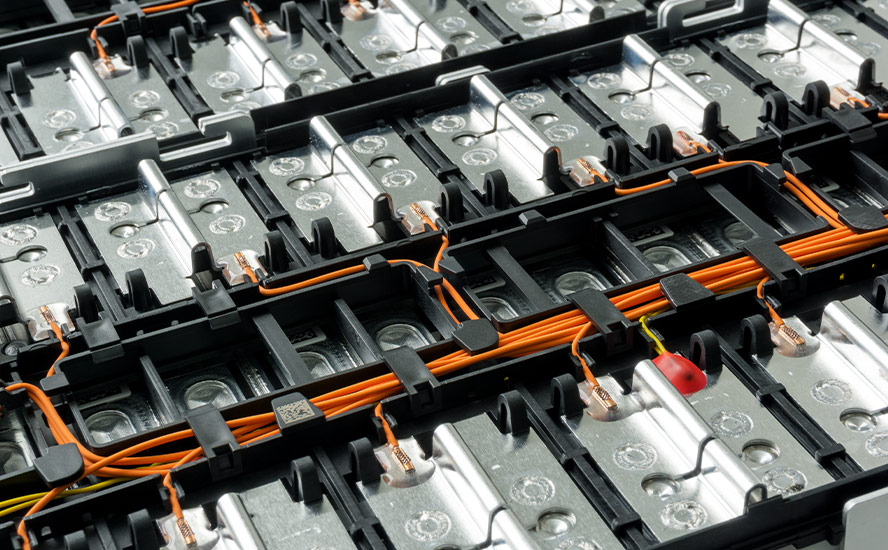

Copper is also used in energy storage made necessary by the intermittent nature of solar and wind power. A lithium-ion battery, for example, contains 440 lbs of copper per megawatt, with a flow battery needing 540 lbs/MW.

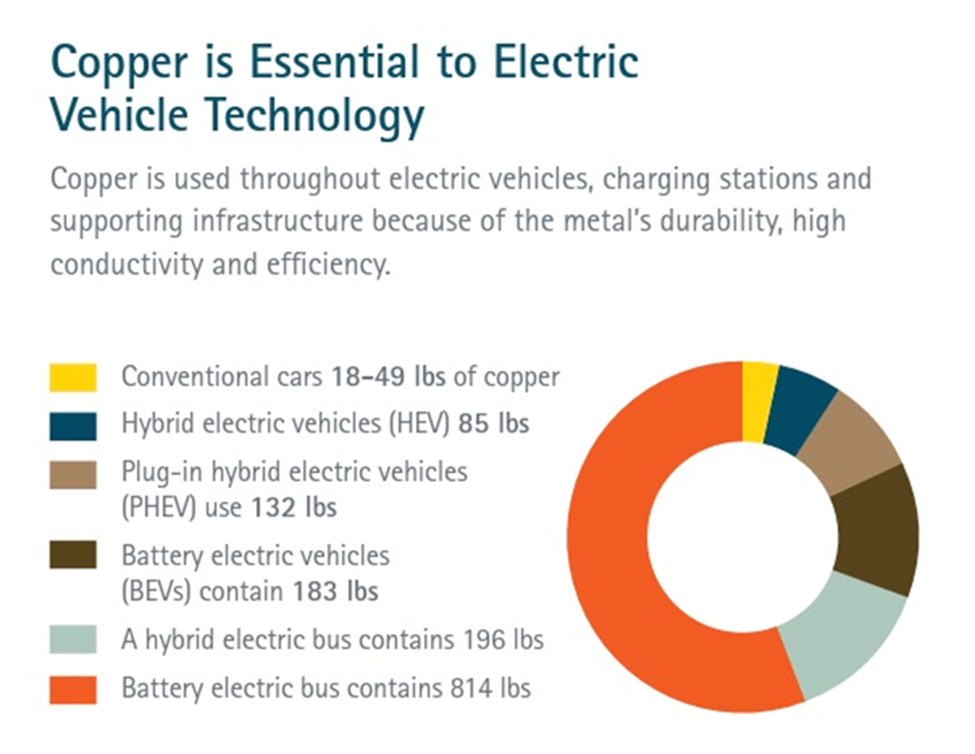

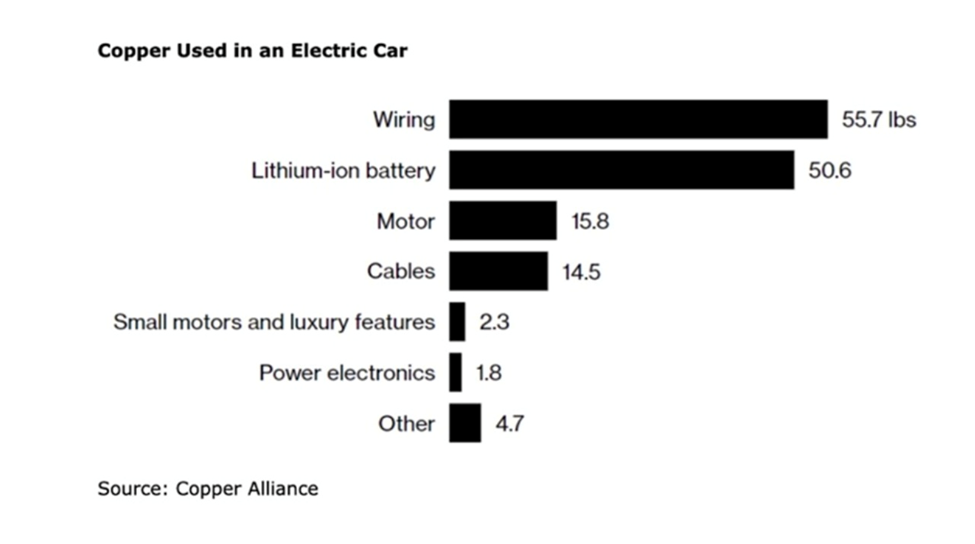

Speaking of Li-ion batteries, EVs now represent a fast-rising source of copper demand, using over twice as much of the metal as gasoline-powered cars (85 kg versus 30 kg), according to the Copper Alliance. Not to mention, more would be needed to build related EV infrastructure, namely charging stations, which can take 0.7 kg (for a 3.3 kW slow charger) or 8 kg (for a 200 kW fast charger).

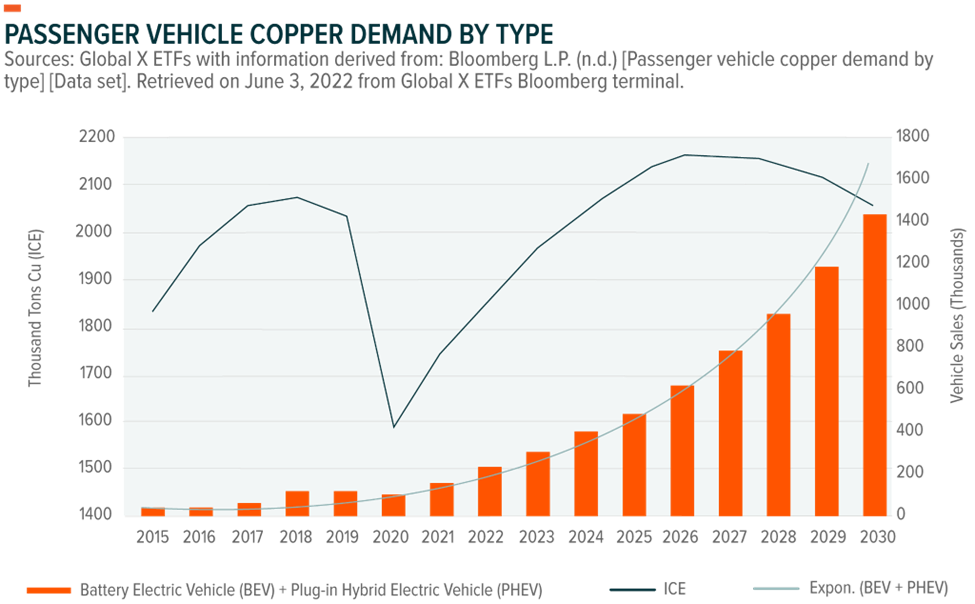

Those at Goldman Sachs see the rise of electric vehicles as a “key pillar of copper’s bullish story”, recently forecasting copper demand from the sector to amount to 1 million tonnes this year, rising to 1.5 mt in 2025.

Last year, EV production accounted for about two-thirds of the increase in global copper demand, with EVs likely accounting for about 27% of additional copper consumption over the next decade, the bank predicted.

Goldman said its analysts were optimistic about EVs, anticipating “strong sales in China, driven by lower prices and a high demand for EVs that has been building up over the rest of 2023.”

For a long time, analysts at Goldman have been bullish on the metal due to its high demand, predicting earlier that “we’ll be at the lowest observable inventories that have ever been recorded at 125,000 tonnes” this year.

BloombergNEF isn’t shy about going further in its projections, stating that copper demand will jump by a significant 53% to 39 million tons by 2040, driven by various clean energy initiatives like EVs.

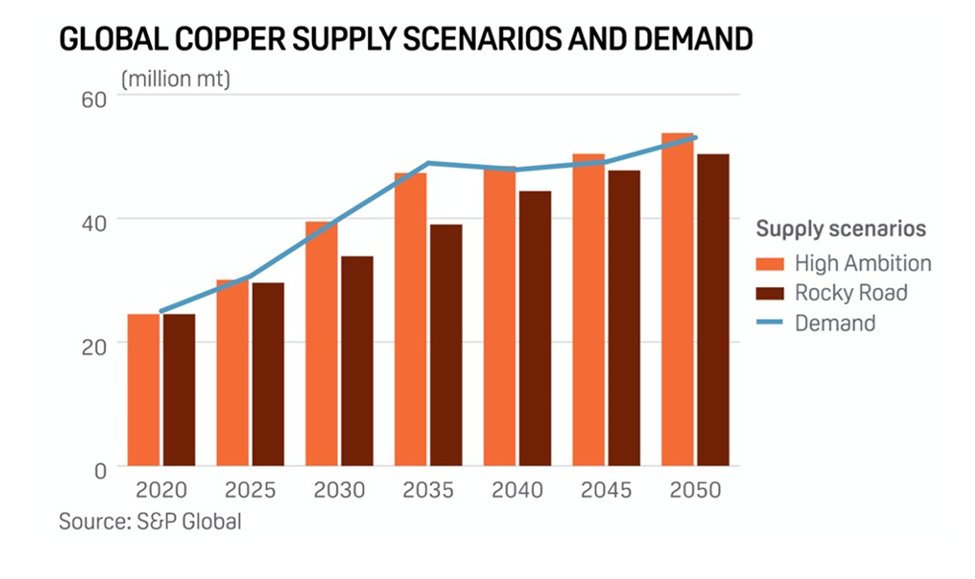

Analysts at S&P Global are expecting an even quicker and bigger jump, with copper demand set to double to 50 million tonnes as early as 2035.

Widening Copper Supply Gap

With this much future demand, which is unprecedented, it’s natural to raise concerns about whether supply can keep up.

According to McKinsey, global electrification is expected to increase annual copper demand to 36.6 million tonnes by 2031, compared to the current demand of roughly 25 million tonnes. However, the consultancy forecasts copper supply to be around 30.1 million tonnes, leaving a gap of 6.5 million tonnes by the start of next decade.

But if we use S&P Global’s projection of demand reaching 50 million tonnes by 2035, then the supply shortage could get even larger.

“Assuming mining output continues to grow at a rate of 2.69% annually (as it has done for the past decade), global output will reach a mere 31 million tonnes, a far cry from the 50 million figure that we’d need as previously mentioned,” S&P said.

“The challenge is that if current trends continue … there’s a huge gap,” said S&P Global vice chair Daniel Yergin upon the release of the copper analysis.

“We have two scenarios, one being the ‘rocky-road’ scenario, which is business-as-usual with a continuation of current trends where we are,” he said during a virtual panel discussion the company hosted, “but then we have the ‘high-ambition’ scenario, in which everything goes right, and we are at the very outer bounds of what is realistic in terms of supply growth.”

Either scenario, according to S&P, could lead to a historic copper deficit (see above). Its report estimates that the copper market in 2035 could see a deficit of up to about 1.5 million tonnes in the high-ambition supply scenario and up to a 9.9-million-tonne deficit in the rocky-road supply scenario.

Of course, S&P is not the only one sensing a significant shortage of copper in the years ahead.

“The market overall is pretty tight,” Robert Edwards, copper analyst at CRU, mentioned in a recent Wall Street Journal piece. “Longer term there’s a narrative around resource scarcity and the green transition with EVs and renewables as well as the build-out of electricity grids. On paper it’s quite a substantial supply gap opening up over the next 10 years.

By year-end, the copper market is expected to be undersupplied, and some time in 2024, peak copper will arrive, generating deficits from that point, analysts at Goldman Sachs previously predicted.

All this means that an era of copper supply deficits is upon us, if it hasn’t arrived already.

Supply Disruptions Remain Prevalent

The International Copper Study Group (ICSG) says the copper market is set to face another year of deficits. The group’s April forecast, via Reuters, calls for a supply shortfall of 114,000 tonnes in 2023, compared to a 431,000-tonne deficit in 2022.

When ICSG last met in October, it was expecting global mine production to grow by 3.9% in 2022 and 5.3% this year. It now thinks growth was 3% last year, and revised its forecast down to 3% in 2023.

The Reuters story says the expected wave of new supply from four new mines — the DRC’s Kamoa-Kakula, Quellaveco in Peru, along with Quebrada Blanca II and Spence-SGO in Chile – is being offset by multiple hits to existing operations:

The ICSG cites as reason for its lowered mine growth expectations “operational and geotechnical issues, equipment failure, adverse weather, landslides, revised company guidance in a few countries and community actions in Peru”.

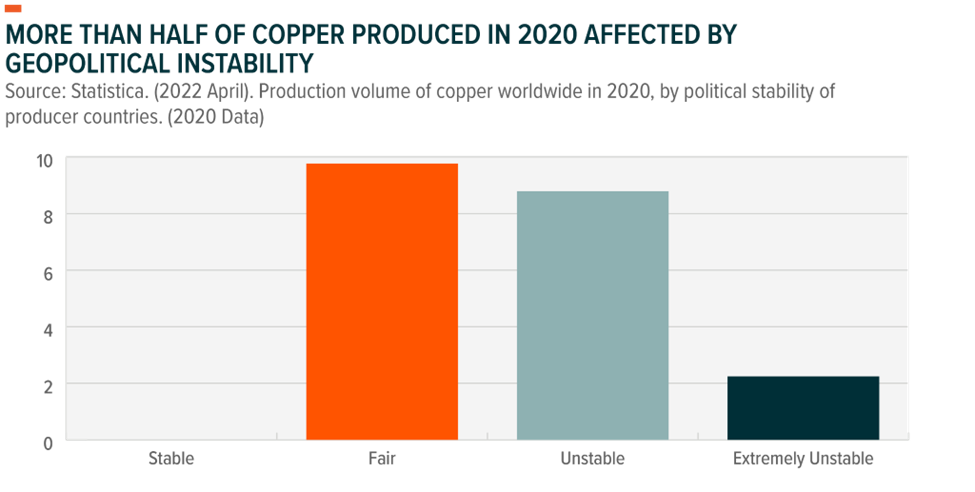

Those at S&P view geopolitics as a major contributing factor to the shortfall in global copper supply. For example, of the 20 million tonnes of copper produced in 2020, more than half were from nations categorized as “Unstable” or “Extremely Unstable” (see below).

Since late 2022, Peru, the second-largest producer, has been rocked by political turmoil. The nation has experienced daily rioting, meaning supply chains across the country have been crunched. In January, experts estimated roughly 30% of Peru’s production was at risk

Multiple world-leading mines such as Glencore’s Antapaccay and MMG’s Las Bamba – combining for 2.5% of global copper output, were either shut down or restricted by protestor roadblocks.

Perhaps no country serves a better example of how vulnerable the copper supply chain is than Chile.

As the world’s No.1 producer, Chile’s output has stagnated due to deteriorating ore quality and water restrictions in the arid north. Permitting is also getting tougher. Research firm Fitch Solutions estimates 2023 copper production in the world’s top producer will be about 5.7Mt, the same as in 2020.

In 2021, leftist candidate Gabriel Boric was elected president of Chile, on a mandate to impose higher taxes, sending a chill through the mining industry which argued the change would impede competitiveness. Constitutional reform was also on the agenda.

Since then, cooler heads have prevailed, but in the eyes of major miners like BHP and Glencore, the risk of disruption in Chile remains.

Copper: Officially a US Critical Mineral

Given the key role copper plays in the energy transition and uncertainty surrounding its future supply, it would be safe to call the red-colored metal a “critical mineral”. Yet in the United States, that hasn’t been the case, at least until recently.

According to the US Geological Survey, a “critical mineral” must meet the following three criteria: 1) It is essential to economic and national security; 2) It plays a key role in energy technology, defense, consumer electronics, and other applications; and 3) Its supply chain is vulnerable to disruption.

While copper qualitatively does satisfy all of those, quantitatively though, its risk score has been below what the USGS uses as a cut-off, rendering it somewhat of a “pseudo critical mineral”.

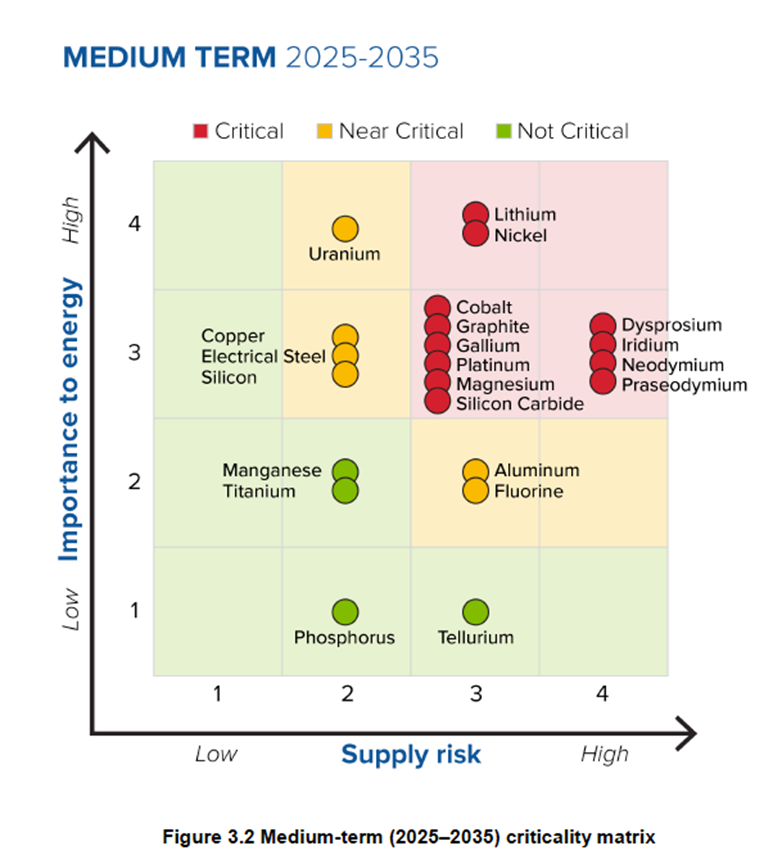

But that all changed on July 31, 2023, when the US Department of Energy (DOE) officially put copper on its critical materials list, marking the first time a US government agency has included copper in a “critical” list, following the examples set by the EU, China, Canada, and many other major economies.

Also included in the DOE’s list are aluminum, cobalt, copper, dysprosium, electrical steel, fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, terbium, silicon, and silicon carbide.

As the information services arm for the North American copper industry, the CDA has long vouched for copper to be included in the US critical minerals list. “Copper is and always has been critical to our economic and national security, but now to the clean energy transition as well,” the association stated.

Earlier this year, the CDA, citing a “dramatic supply risk”, sent a bipartisan request to the USGS to add copper to its official critical minerals list. The request, later denied by the USGS, was made following analysis of new data showing that copper meets the USGS supply risk score cutoff.

According to the CDA, the current USGS list is based on “copper trade data that represents supply risk from 2014 to 2018, which is five to nine years out of date, and too old to be meaningful”.

At the time, the CDA’s president Andrew Kireta criticized the decision as not being “consistent with the spirit or the letter of the law”. Several large copper miners including Rio Tinto, BHP and Freeport-McMoRan are CDA members.

In response to the DOE’s inclusion of copper in its 2023 Critical Materials Assessment, which evaluates materials based on whether they “serve an essential function” in the production of energy transition technologies such as EVs, the CDA stated:

“Copper is a major contributor to US economic and national security, and with copper demand projections doubling by 2035, primarily due to plans for the clean energy transition, electrification and clean water infrastructure. The nation would be defenseless without electricity and copper’s vital role in its generation, transmission, and distribution.”

Conclusion

With the energy transition in full force, copper without a doubt should be classified as a critical mineral. Many of the big economies have recognized that, and now, so has the US.

Perhaps years of steady global copper production have covered up any concerns of a supply crunch. But the metal’s role in decarbonizing the planet has been more than apparent, and now demand has caught up; 2023 would represent another year of copper deficits.

As a matter of fact, this year’s deficit is catching analysts off guard, according to those at S&P Global. This is due exactly to the supply risks that the US had overlooked.

Supply has been weaker than expected in top producer Chile, which downgraded its production forecast to 5.5 million tonnes for the year, after already recording a decade-low output in 2022. Zambia, another major player, is also expected to underperform this year, S&P analysts said.

According to S&P’s most recent forecast, there is an expected deficit of 16,000 tonnes copper opening before year-end, then rising to 217,000 tonnes by 2025. After that, it could further intensify to a staggering 2.2 million tonnes by 2032, the firm forecasts. That’s exactly one-tenth of last year’s global production, meaning that within a span of 10 years, the world’s copper supply could find itself 10% short!

This also falls in line with the views of RBC Dominion Securities analyst Sam Crittenden, who recently estimated that the energy transition’s copper requirements will mean an additional 1% of supply, the equivalent of one large copper mine (a la Escondida), coming online every year.

And with the US government officially (finally) placing copper on its critical minerals list, it leaves no room for debate that more copper mines must be developed, and fast. In North America, 20 years can elapse between initial discovery and first production. We’ve got less than seven years.

Remember, a lot of market projections were made before the US Inflation Reduction Act was enacted in August 2022. A separate S&P study finds that US energy transition demand will continue to accelerate and be materially higher, about 12% to be exact, post-IRA.

“This new comprehensive analysis shows that the Inflation Reduction Act is indeed transformative on the demand side. However, challenges remain in securing supply of critical minerals needed to meet growing demand and achieve its goal of accelerating the energy transition,” S&P vice chair Yergin said in the report.

Investments in mine development and supply chain derisking will likely be a common theme moving forward.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.