Getting ahead of the precious metals and commodities rebound – Richard Mills

2022.10.14

This year has seen a correction in the gold price, commensurate with rising interest rates/ bond yields, and the spectre of more to come. The precious metal has also been hammered by a strong US dollar, which is negatively correlated to the gold price.

Spot gold has fallen from $1,801.40 at the start of the year, to $1,666.45 currently, a drop of 8%. On Sept. 15, gold plunged to its lowest level since April, 2020, on expectations of a 0.75% interest rate increase by the Federal Reserve, which happened on Sept. 21.

In fact the Fed has raised interest rates an astounding five times this year, to combat 40-year high inflation. The CME FedWatch Tool expects at least another 0.75% increase when the Federal Open Market Committee meets in early November.

Gold investors are being warned the gold market could continue to struggle through year-end as higher interest rates support the US dollar.

“The longer the Fed continues on its current path, the longer that a strong dollar will depress the gold price,” commodity analysts at Heraeus Precious Metals wrote in a report. Also weighing on gold is the fact that the markets keep pushing out any “Fed pivot”, referring to a shift from monetary tightening to easing, as a result of poor US economic performance and/or the widely anticipated recession. According to Kitco News, the markets don’t see a pivot until the end of 2023.

But it’s not all gloom and doom for the gold price. In our last article, we identified three new trends pointing to light at the end of a tunnel: investors bailing on US Treasuries; a shift in gold-buying from Western markets to Eastern/Asian; and the fact that we appear to be at a point in the “gold cycle” just before gold turns upward.

The gold cycle has been repeated several times over the past few decades, and we see a fundamental shift happening again, as global growth grinds to a halt and the Fed’s tightening efforts fail, resulting in recession. History tells us that gold does well during economic downturns and particularly in stagflationary environments.

The Great Stagflation 2.0 and gold

For these reasons, and others, we are supportive of gold going forward. The “others” include the following:

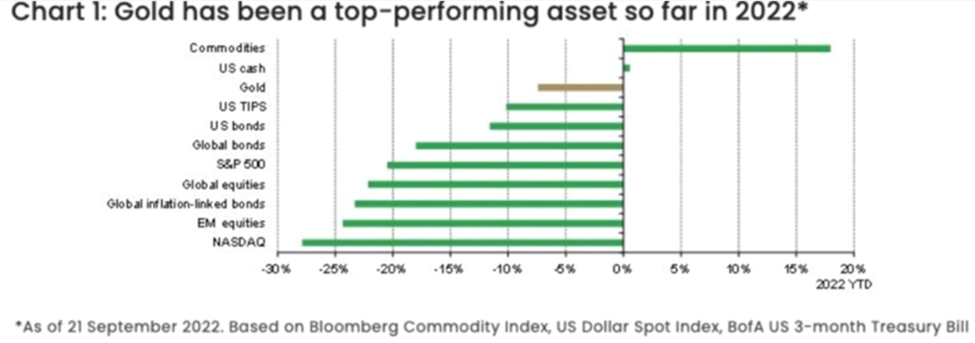

- When weighed against other asset classes, gold has actually been one of the better performers of 2022. Gold has outperformed US bonds, foreign bonds, the S&P 500, foreign stocks, the NASDAQ, and US Treasury Inflation-Protected Securities (TIPS). The only things that have outperformed gold are commodities, especially oil and agricultural goods, and the US dollar.

This is confirmed in the chart below by the World Gold Council.

- Soaring bond yields indicate that investors think the Fed will do whatever is necessary to bring down inflation, and will succeed, without crashing the economy. But, once the Fed can no longer deny that it’s wrong about being able to control inflation, and that the economy is weaker than they think, it will go back to loose monetary policy, i.e., quantitative easing (good for gold).

- In the meantime, other central banks are playing catchup. The ECB for example has gotten more aggressive in its inflation fight. The World Gold Council argues this will begin to curb dollar strength, as the value of other currencies rise. Longer-term, dollar dominance continues to erode.

How much longer can the dollar trade last? – Richard Mills

- Positioning in gold futures has turned net short again and this, historically, has not lasted long — often mean-reverting in subsequent weeks. At the same time, central bank demand for gold remains quite strong. The World Gold Council said central banks added 20 tons to their net gold holdings in August, making it the fifth straight month of additions. Finally, as recessionary and geopolitical risks increase, investors may shift to more defensive strategies, looking for high-quality liquid assets such as gold to reduce portfolio losses. Given these factors, the World Gold Council said it is optimistic that gold’s headwinds may start to subside, but that supportive factors will remain, “thus encouraging demand for gold as a long-term investment hedge.”

- Global leading indicators are turning down, hard. The United States is already technically in recession, and China may not be far behind. Corporate profit margins are under downward pressure from a toxic mix of rising input costs and tepid demand.

- The US government would be forced to default on its $31 trillion debt if it actually let interest rates rise high enough (say, 7.5%) to bring inflation down to 2%.

2% inflation target blinding the Fed to economic reality

- Although nominal interest rates have been climbing since March, real rates remain negative because inflation is so high (3.25% – 8.3% = -5.05%). Historical charts prove that practically every time yields fall below the rate of inflation, i.e. they turn negative, gold goes up.

- The yield curve has inverted 28 times since 1900, and in 22 of those times, a recession followed. The yield curve (the difference between the 2-year and the 10-year Treasuries) has been negative since July 8. On average historically, a recession occurs 11 months after the yield curve inverts, meaning we may not be far away from the Fed pivot that results in a tremendous upswing for gold.

I see us going into a rising gold price environment and historically the greatest leverage to an increasing gold price is a quality junior. Below are three gold exploration companies I’ve been following closely. If you agree with my thesis that we are about to undergo a fundamental shift in the gold cycle, I recommend you take a close look at them.

RooGold (CSE:ROO) (OTC PINK:JNCCF) (Frankfurt:5VHA) has been making remarkable progress on its New South Wales, Australia properties, delivering sample after sample of high-grade gold.

RooGold racking up high-grade rock chip sample assays in NSW

The company has identified three very good prospects in Gold Star, Lorne and Arthurs Seat, all of which have delivered high-grade rock chip sample assays. And they’ve only just scratched the surface.

At Arthurs Seat, very little historical work has been done at the Murrays and Co Mine; the gold assays are the first to be reported from there. At Lorne, the field team has identified numerous other highly prospective gold targets covering a further 10-km strike distance. And at Gold Star, there are several highly prospective gold targets that the field team is looking to sample as soon as surface access is available.

RooGold commands a portfolio of 14 gold and silver concessions that span 2,696 square kilometers. The district-scale property is home to 139 historical mines and prospects. Yet despite its massive size, only 28 historical holes have been drilled across the entire land position.

That kind of upside doesn’t come along often in a gold junior. I like how RooGold is approaching its field program, by going out and sampling historical mines and prospects, with an eye to working up high-priority exploration targets.

RooGold Inc.

(CSE:ROO) (OTC PINK:JNCCF) (Frankfurt:5VHA)

Cdn$0.04, 2022.10.13

Shares Outstanding 69.7m

Market cap Cdn$2.9m

RooGold Inc

Getchell Gold (CSE:GTCH, OTCQB:GGLDF) continues to pull up spectacular drill intercepts from its Fondaway Canyon Project in Nevada, in September releasing the results from drill hole FGC22-19 that successfully extended the North Fork Zone.

Getchell Gold intersects 1.82 g/t Au over 107 meters at the North Fork Zone of Fondaway Canyon

So far in 2022, eight holes have been completed in the Central Area of the property, totaling 3,260m. Assay results have been released for three holes, with assays remaining for holes FCG22-20 to 25.

Drilling continues to expand the North Fork Zone, which remains open in most directions. Assay results from holes FCG22-16, 17, 18 and 19 will be incorporated into a new resource estimate, expected this fall.

The revised estimate should significantly improve upon the 2017 resource estimate, which showed 409,000 oz indicated gold resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au, for a combined 1.1 million oz.

Results are also expected from a maiden drill program at nearby Star, a copper-gold-silver project where multiple priority drill targets have been identified.

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.35, 2022.10.13

Shares Outstanding 105m

Market cap Cdn$41.4m

GTCH website

For the past year and a half, Goldshore Resources (TSXV:GSHR, OTC:GSHRF, FRA:8X00) has been advancing its flagship Moss Lake Project located near Thunder Bay, Ontario, through detailed field work including a massive 100,000-meter drill program.

In September, Goldshore reported assay results from eight holes drilled into the East Coldstream deposit, adding to the eight holes confirming high-grade gold in the Main Zone.

Drilling so far has demonstrated that the property contains a significant volume of +1 grams per tonne (g/t) Au mineralization that underpins a meaningful gold deposit.

The Moss Lake Project consists of 282 mining claims for a total area of 14,292 hectares, hosting a number of gold and base metals-rich deposits, all of which occur over a mineralized trend exceeding 20 km.The property is in an excellent jurisdiction with a number of major gold deposits nearby.

Moss Lake’s historical (2013) resource estimate is 1.47Moz measured and indicated at 1.08 g/t Au, and 2.51Moz inferred at 0.98 g/t Au, for a combined 3.98Moz. This estimate covers the Moss Lake and East Coldstream deposits, both of which have expansion potential as confirmed by previous drilling.

“As we have been discussing for some time, the continued results of intersecting wide zones of +1 g/t Au mineralization underpin our belief that the Moss Lake Deposit has potential to develop an initial high-grade phase 1 open pit within the larger low-grade open pit operation,” President and CEO Brett Richards said in the Sept. 29 news release. “It can be seen that the projected grade shell of +1.0 g/t Au is significant at this early stage, and we will look to further explore these high grade areas, as we continue with our program.”

Goldshore Resources Inc.

TSXV:GSHR, OTC:GSHRF, FRA:8X00

Cdn$0.18, 2022.10.13

Shares Outstanding 143.8m

Market cap Cdn$27.0m

GSHR website

Gold isn’t the only metal to we’re investing in during these turbulent times. Battery & electrification metals copper, nickel and graphite are also good candidates. While commodities including metals have been tanking in the second half of this year due to a strong US dollar and rising interest rates, the sector historically does well during economic downturns and recessions.

Commodities protect investments from rising prices and currency debasement, making them a good place to park your hard-earned cash, The thing to remember, is when investing in natural resource equities, the commodity capital cycle is more important than the business cycle.

Buy signal flashing for undervalued commodities

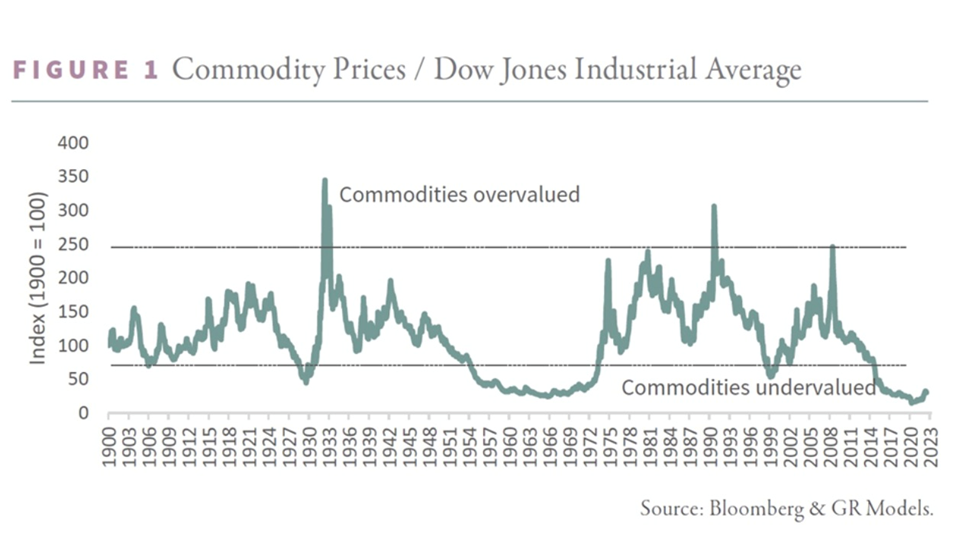

The chart below by Wall Street natural resource investment firm Goehring & Rozencwajg shows the relationship between the Dow Jones Industrial Average and a commodity index going back several decades. It indicates periods when commodities are undervalued or overvalued — compared to the Dow. Where the green line dips below 75, commodities are cheap relative to financial assets. These periods typically represent bear markets for commodities. The chart shows the most undervalued years for commodities were 1929, 1969, 1999 and 2020.

What makes commodities cheap, relative to financial assets? According to G&R, it has to do with natural resource capital spending:

A commodity price cycle usually follows a typical path. The industry might enjoy a period of very high energy or metal prices. Given their fixed cost base, the higher commodity prices fall directly to the bottom line resulting in a period of super-normal profits. High returns attract new capital and before long the industry begins a new cycle of exploration and development. Over time, increased spending leads to new supply which eventually outpaces demand growth and ushers in a period of commodity surplus. Prices fall, causing projects that were underwritten at higher prices to become impaired and written off.

Often, another industry or investment strategy falls into favor around this time and investors rush to reallocate capital towards hot new speculative areas, leaving the resource industry even more capital starved. As depletion takes hold, supply falters, demand grows, and inventory gluts eventually get worked off. The stage is set for the next bullish cycle to start.

Their advice is to buy resource stocks when commodities are cheap, and during bottoms in the natural resource capital investment cycle.

The above chart shows that there hasn’t been a better setup for commodities than now, over a time frame spanning 120 years.

In terms of G&R’s commodity capital cycle, we are currently in the stage of depletion, when supply falters, demand grows, and inventory gluts get worked off. The stage is, imo, set for the next bullish cycle to start.

In fact there are many reasons to be bullish on commodities and, a lot to indicate that inflation is not going away anytime soon, thus setting up the conditions for a multi-year commodities up-trend.

First, there has been a lack of spending on exploration and development, leading to current and looming supply shortages for a number of metals. The mining companies in the mid-2010s basically ate each other and by shutting down exploration there was no accretive increase in reserves. Lower ore grades have also become an issue.

Second, natural resources are being used up faster than they can be replenished; this is another theme driving commodity prices higher.

Third, countries that have the metals needed to fuel economic growth are guarding them more closely than previously; resource nationalism is on the rise.

Bloomberg New Energy Finance estimates this transition will require about $173 trillion in investments over the next 30 years.

We are looking at elevated prices for certain critical and industrial metals that are central to the new green economy, like copper, lithium and graphite, for years if not decades to come.

Simultaneous and dramatic price increases for energy and food are part of a ballooning cost-of-living crisis in much of the developed world, as inflation continues to wrack economies and central banks try to control it through interest rate increases that are impeding growth, and threaten to plunge the global economy into a deep recession.

The bottom line? Even if the recession is long, commodities should be practically bullet-proof.

Right now the Fed is aggressively raising rates and that’s good for the dollar and bad for commodities, including gold. The dollar is the only game in town but that could change in a hurry if the Fed fails to execute a “soft landing” for the economy and instead the plane lurches into a hard landing, or worse, a “coffin corner” which kills all on board (investors).

That is the scenario that would cause the Fed to pivot, from monetary tightening to loosening.

Imo, three of the best metals to invest in now, while they are out of favor, are copper, nickel and graphite. Consider the following:

- As previously reported, global mined copper production will drop from the current 20Mt to below 12Mt by 2034, resulting in a supply shortfall of 15Mt. By then, over 200 copper mines are expected to run out of ore, with not enough new mines in the pipeline to take their place. S&P Global estimates that new copper discoveries have fallen by 80% since 2010.

- Nickel supply is facing increasing political risk as Indonesia now dominates nickel supply growth. Just three countries are expected to control as much of the nickel supply as OPEC did of global oil supply at its peak in 1973: New Caledonia, the Philippines and Indonesia. Every country needs to secure nickel at competitive prices yet supply is increasingly constrained and demand is growing, especially for nickel used in electric-vehicle batteries. Wood Mackenzie estimates that of the 2.8 million tonnes demanded last year, 69% was used to make stainless steel and 11% to make batteries, up from 71% and 7% respectively in 2020. Batteries’ share of demand is expected to rise to 13% in 2022. According to Rystad’s latest report, nickel demand from the stainless-steel industry should grow at about 5% per year, while the market for batteries is poised to explode. “In an unconstrained supply scenario, batteries could require more than 1Mt of nickel metal by 2030, quadrupling from the current demand of 0.25Mt,” the energy research firm said.

- The lithium-ion battery used to power electric vehicles is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. At the moment, graphite is the only material that can be used in the anode, there are no substitutes. It is also the largest component in lithium-ion batteries by weight, meaning a battery takes 10 to 15 times more graphite than lithium. Analyst Visual Capitalist Elements, via Battery & Energy Storage Technology, says demand for graphite from battery makers is expected to expand 10.5-fold to 2030. They forecast the natural graphite market could be in deficit as early as 2023, due to a shortage of new sources outside China.

I’m taking advantage of what I know, getting Ahead of the Herd, by buying private placements and shares in quality junior resource companies. For electrification and battery metals, three of my favorites are Max Resource, Renforth Resources and Graphite One. I also like above-mentioned Goldshore Resources for the significant copper component in its Moss Lake Project.

Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) is currently drilling its highest-priority target, URU, within its CESAR copper-silver project in northeastern Colombia. Earlier this month, Max reported its ground-based Induced Polarization (IP) and Total Magnetic Intensity (TMI) anomalies correlated well with surface geochemical targets, and successfully defined new drill targets at URU-C and URU-CE.

For the past three years, Max has not only been discovering high-grade copper zones on its flagship CESAR property, but expanding these areas, moving ever closer to confirming the existence of a huge copper-silver system.

The project sits on a massive sedimentary system covering a significant portion of the 200-km-long Cesar Basin, a geological feature that extends for over 1,000 km from the northern tip of Colombia southwards through Ecuador and Peru.

The inaugural drill program at URU-C and URU-CE consists of at least 2,000m of drilling on four pads with eight drill holes, testing to a maximum depth of 350m. This is the first-ever drill program within the 20-km-long copper-silver URU District. A second-phase drill program will immediately follow and continue through to year-end.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.40 2022.10.13

Shares Outstanding 160.2m

Market cap Cdn$60.2m

MAX website

Exploration results to date have reinforced Renforth Resources’ (CSE:RFR, OTCQB:RFHRF, FSE:9RR) view that its flagship Surimeau Project in Quebec is richly endowed with battery metals like nickel and cobalt.

However, a significant amount of ground remains untested, leaving heaps of upside for Renforth shareholders, in a project that is already showing district-size scale.

According to Renforth, new outcrop mineralization discovered near the center of the ~20 km Victoria mineralized structure, delivered a grab sample of 0.71% Ni (nickel) in rock described as “albitized ultramafic with sulfides”. This is the second band of mineralization found north of previous drilling at the Victoria target.

At the Lalonde target, two assay results of 0.32% nickel from two separate grab samples were obtained within the current stripping area at Lalonde West. According to Renforth, the sampling program at Lalonde has delivered consistent elevated values from the exposed mineralized horizon.

Renforth samples 0.71% nickel from unexplored part of Surimeau

The case for low-grade sulfide nickel deposits

Victoria is estimated at about 20 kilometers long, and Lalonde now measures 9 km in length. The company continues to define the surface and sub-surface polymetallic mineralization, evidenced by outcrops, drill results and geophysics.

The project hosts several areas prospective for gold/silver and battery/ industrial metals (nickel, copper, zinc, cobalt and lithium). It is located south of the Cadillac Break, a major regional gold structure. Surimeau occurs within a unique geological setting where two types of mineralization, formed from different geological processes, are “mashed together” in one distinct orebody. It is best described as a magmatic nickel sulfide deposit, juxtaposed with a copper-zinc volcanogenic massive sulfide (VMS) deposit.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.03; 2022.10.13

Shares Outstanding 262.3m

Market cap Cdn$8.4m

RFR website

Recently, the US Geological Survey cited the Graphite Creek resource near Nome, Alaska, as the largest known graphite deposit in the country. It is part of an integrated project proposed by Graphite One (GPH:TSXV; GPHOF:OTCQX), which aims to mine and process the graphite and build an advanced materials and battery anode manufacturing plant in Washington State. Graphite One was granted “High-Priority Infrastructure Project” status in January by the Federal Permitting Improvement Steering Committee (FPISC), which would allow the company’s approval process to be streamlined.

Over the summer Graphite One underwent a major de-risking event with the release of the prefeasibility study (PFS) for its Graphite One Project. 2021 drilling has successfully upgraded the 2019 resource estimate, delivering nearly a 200% increase in measured and indicated resources. The PFS also portrays the Graphite One Project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite product price of $7,301 per tonne.

“With the growing demand for graphite in electric vehicle batteries and other energy storage applications – and recent actions by the Biden administration to secure U.S. supply chains for critical minerals – we see Graphite One’s aim to produce a U.S.-based supply chain solution becoming increasingly significant as a new potential source of advanced graphite products for decades to come,” says Anthony Huston, Graphite One’s President & CEO.

On Aug. 29 GPH announced an up-size of its previously posted $15.525 million non-brokered private placement, to $21.275 million. Up to 18,500,000 units will be issued and offered for $1.15 per unit.

This follows a shares-for-debt arrangement reported between Graphite One and Taiga Mining Company, Inc. Relieved of its debt obligations, and a private placement in the offing that could fill Graphite One’s coffers with up to $21.2 million, I feel confident about the company’s financial wherewithal to advance the Graphite One Project through to its next stage of development, a feasibility study.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.17, 2022.10.13

Shares Outstanding 83.3m

Market cap Cdn$123.8m

GPH website

Assay results from Goldshore Resources’ (TSXV:GSHR, OTC:GSHRF, FRA:8X00) initial scout drilling campaign, testing the historical North Coldstream copper mine at the company’s Moss Lake Project, include significant copper, cobalt and gold mineralization hosted within a sheared volcanic massive sulfide deposit:

- 62.8m @ 0.88% copper-equivalent (CuE) (0.36% Cu, 0.06% Co, 0.30 parts per million (ppm) Au and 3.1 ppm Ag) from 8.2m depth in CND-22-006, including:

- 13.35m @ 1.18% CuE (0.54% Cu, 0.07% Co, 0.39 ppm Au and 3.5 ppm Ag) from 8.2m;

- 14.65m @ 1.30% CuE (0.57% Cu, 0.09% Co, 0.39 ppm Au and 4.4 ppm Ag) from 23.1m.

These copper and cobalt results confirm that multiple deposit styles exist, which is a hallmark of important mineral districts worldwide.

Goldshore Resources Inc.

TSXV:GSHR, OTC:GSHRF, FRA:8X00

Cdn$0.18, 2022.10.13

Shares Outstanding 143.8m

Market cap Cdn$27.0m

GSHR website

Conclusion

I have no problem admitting that the dollar trade is the only trade right now, with the US Federal Reserve and other central banks intent on raising interest rates. The question on my mind, though, is when the trade flips to gold (and commodities). There is no doubt in my mind the Fed will be forced to once again reduce interest rates and implement another round of QE.

In a recent interview with Fox Business’s Charles Payne, he reminds us that a year ago, Treasury Secretary Janet Yellen said there’s no need to worry about inflation because interest rates were so low:

When Yellen made that comment, the yield on a 1-year T-bill was about .25%. Now it’s 4%. Says Schiff:

“You’ve got a 16-fold increase in the cost of funding that debt. And remember, that debt keeps having to be rolled over. The government has very short financing on this national debt. So, it’s already a problem. And it’s going to become a much bigger problem. It’s one of the reasons the Fed is going to chicken out in the fight against inflation. Because the US government would be forced to default on that debt if it actually let interest rates rise high enough to bring inflation down to 2%.”

Is the Fed really going to keep raising interest rates like the Volcker Fed did in 1981, until it crashes the economy and causes a recession?

Very likely, the latest inflation numbers, 13th October inform us the overall CPI is up 8.2% yoy. Core inflation is the highest since 1982. A 75 point rate in November is now certainly the minimum with traders now calling for an 18% chance of a 100 basis point increase. When the only tool you have is a hammer, everything is a nail.

When, and not until, the Fed pivots to lowering interest rates, gold, silver and commodity prices will turn sharply higher. Meanwhile there’s blood in the streets, buy low sell high is how we at AOTH make money in the market. We’re currently slowly buying our favorite juniors to take advantage, and be positioned properly, for what we think we know is coming.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of RooGold (CSE:ROO), Getchell Gold (CSE:GTCH), Max Resource (TSXV:MAX), Renforth Resources (CSE:RFR) and Graphite One (GPH:TSXV).

RooGold (CSE:ROO), Getchell Gold (CSE:GTCH), Max Resource (TSXV:MAX), Renforth Resources (CSE:RFR), Graphite One (GPH:TSXV) and Goldshore Resources (TSXV:GSHR) are paid advertisers on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.