RooGold acquires new exploration license, adding 229 km2 in NSW

2022.05.12

Junior mining is as much about holding land, as hunting for minerals. Australia-focused RooGold (CSE: ROO) (OTC PINK: JNCCF) (Frankfurt: 5VHA) is well aware of this fact.

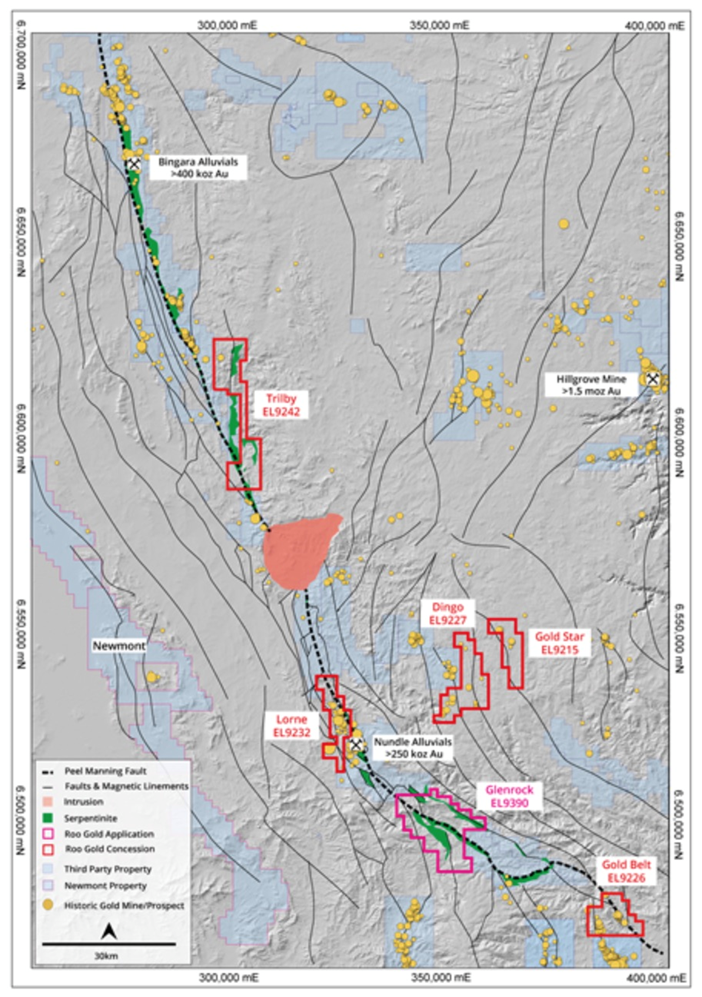

The company has just acquired another exploration license in the highly prospective Peel Manning Suture Zone of the New England Orogen in New South Wales. It now commands a portfolio of 14 gold and silver concessions, spanning a total area of 1,537 square km, and home to 139 historical mines and prospects.

Mineralization across all these properties is associated with largely untested regional structures or contacts, on which gold and silver endowment is underpinned by historical mining activity, thus providing excellent discovery potential.

Glenrock project

The Glenrock project, formally known as EL 9390, spans 229 square kilometers and is positioned between RooGold’s Lorne and Gold Belt projects. Between them, the three projects encompass 435 km2, over a 65-km-long strike within the Peel Manning Suture Zone — well known to host precious and base metal mineral deposits.

“Exploration Licence 9390 is a valuable addition to RooGold’s tenure portfolio. EL 9390 is 100% held by RooGold and was strategically acquired for both its position over the serpentinite package of rocks along the Peel Manning Suture Zone and its close proximity to our Lorne and Gold Belt projects, making logistics and work planning more efficient. We look forward to commencing land access negotiations to facilitate field work as soon as practicable,” RooGold’s CEO Carlos Espinosa said in the May 4 news release.

Glenrock is 15 km southeast of Lorne, 30 km northwest of Gold Belt, and covers >20 km of the Peel Manning Suture Zone’s serpentinite belt.

Lorne comprises 28 historical gold mines and prospects, including the Golden Star mine. It also covers up to 500m of underground workings at the Marquis of Lorne mine, which reported grades of up to 15 g/t Au. The project area spans 12 strike kilometers of the significantly mineralized Peel Manning fault system.

Gold Belt hosts 20 historical gold mines and prospects across the Peel Manning fault. Two parallel gold-controlling regional fault systems have been identified on the property, forming two gold-mineralized corridors with a total strike length of over 7 km. Potential exists for listwanite-hosted gold deposits of the Bralorne and Motherlode types.

According to RooGold,

EL 9390 contains diverse geology that are known elsewhere in the region to host a variety of mineralisation styles that contain Au-Cu and base metal metallic mineral deposits. Rock types include serpentinites, flysch sequences, intrusives, volcanics and volcaniclastics, structurally located within in a complex, highly faulted system. This system may host numerous metallic mineralisation styles including lode gold with associated base metals. The tenement also contains mineral occurrences of copper-rich quartz veins containing malachite, bornite and chalcopyrite in serpentinite dykes up to 150 m long and 12 m wide. The tenement is significantly under-explored, has never been drilled and represents a ground-floor opportunity for the discovery of new metallogenic province.

After reviewing Glenrock’s historical data, and following land access negotiations, RooGold plans to undertake field reconnaissance and rock chip sampling to identify explorations targets at the new property.

Gold portfolio

With the Glenrock project, ROO now has 10 gold properties, all located within the highly mineralized but relatively underexplored New England Orogenic Terrane and prolifically mineralized Lachlan Orogenic Belt.

The mineralization is mostly of an orogenic type associated with large-scale structures, making for large attractive targets and lesser intrusion-related types. There is also potential for listwanite-hosted gold mineralization of the Bralorne and Motherlode type along the regional Peel Manning Suture Zone.

Besides Glenrock, Lorne and Gold Belt, the other properties in ROO’s gold portfolio include:

Goldstar — Six historical silver/gold mines and prospects. Much of the property is unexplored. Mineralization is of a low-sulfide orogenic quartz type associated with regional structures, analogous to the West African and Abitibi-type styles.

Trilby — A 35-km strike length of the Peel Manning fault hosts numerous quartz veins with visible gold. The Peel Manning is a crustal suture zone with ophiolites and abundant gold alluvial deposits, indicating potential for listwanite-hosted gold deposits.

Malebo — Five historical gold mines and prospects. Rock-chip grab sampling of the Malebo mine returned assays up to 71 g/t Au. Mineralization is of a low-sulfide orogenic quartz type associated with the regional Narriah Fault, potentially analogous in geology and structure with the Mount Adrah deposit 50 km to the east.

Eastdowns — 10 historical gold mines and prospects. Records from small-scale production cite grades of up to 384 g/t Au. Mineralization is associated with a sedimentary-intrusive contact zone with a target zone that is several hundred meters wide and over 1 km long.

Bluebell — Nine historical gold mines and prospects north of the Victorian border. Mineralization is a sulfide-poor orogenic type. Small-scale historical production reported assays of up to 87 g/t Au.

Solomons — Eleven historical silver/gold mines and prospects with production grades of up to 132 g/t Au and 1,648 g/t Ag. Mineralization is probably associated with numerous low-sulfidation epithermal veins related to regional northeast-southwest-oriented structures.

Dingo — 17 historic gold mines and prospects including the Golden Star mine. Mineralization is of a low-sulfide orogenic quartz type associated with regional structures, analogous to the West African and Abitibi-type styles of mineralization.

Of the 10 gold concessions, the three located on the Peel Manning Suture Zone (Trilby, Lorne and Gold Belt) are thought to be priorities.

Together, they form the company’s Peel Manning property, a district-scale land position totaling 422 km² that includes 48 historical gold mines and prospects with average production grades up to 83 g/t Au.

The above-mentioned Marquis of Lorne mine, which includes a non-compliant historic reserve of 50,000 ounces Au, is on the property.

The Peel Manning fault system, a crustal-scale structure, is strongly gold mineralized along its 350-km strike length. The system hosts ocean floor mafic and ultramafic rocks present as listwanite (quartz-carbonate) altered serpentinites.

Listwanite-associated gold deposits are considered to be highly attractive exploration targets. Multi-million ounce deposits such as California’s Motherlode, Bralorne (British Columbia) and numerous large high-grade gold systems throughout Saudi Arabia, are hosted in listwanites.

Newmont recently staked a 1,200 km² land package covering 125 km of strike on a parallel structure, located 30 km to the east of the Peel Manning Suture Zone.

Conclusion

RooGold has just under $2 million in cash with a market cap of $5.3 million. Of the 14 projects in its large portfolio, the company plans to focus on the three located on the Peel Manning Suture Zone (Trilby, Lorne and Gold Belt).

In an earlier interview with AOTH, Director Chris Wilson told me,

“These projects are a little more advanced than your normal early-stage. I’ve said we’re not going to settle on one concession with 15 occurrences, we went for as much as we could possibly get, because then statistically you have a real chance at discovery.”

I agree with the “more is better” approach, at least initially. Once the company gets a few discoveries under its belt it could look at selling some of its other concessions to raise cash to concentrate on the most prospective ones.

I particularly like Glenrock for its copper potential, a mineral that for many and obvious reasons, we are quite bullish on.

RooGold has brought together a highly qualified management and technical team that I have a lot of faith in. The company is all about “boots on the ground” prospecting i.e. getting access, hitting the rocks, developing drill targets.

It may take a little time for the discoveries to come but I believe they will. Just look at the area RooGold is operating in: the New England Orogen in New South Wales is highly mineralized but relatively underexplored. The Peel Manning Suture Zone, a major regional structure where different parts of the earth’s crust join together, is an incredible 350 km long.

The mineralization is mostly of an orogenic type associated with large-scale structures, making for large attractive targets and lesser intrusion-related types. There is also potential for listwanite-hosted gold mineralization of the Bralorne and Motherlode type along the Peel Manning Suture Zone.

Both were hard rock deposits that were essentially found on the back of alluvial gold rushes. They tend not to have a lot of quartz at surface, but they shed alluvials, the quartz discoveries come afterwards. In Saudi Arabia explorers consistently found 3 to 5 million ounce deposits.

As Chris Wilson describes it, “The Peel Manning Suture Zone in the New England Orogen has shed over a million ounces of alluvial gold. You have quartz-carbonate altered ophiolites as is the case at Motherlode and Bralorne. All the hallmarks of a very fertile system.”

When the story gets out, and people start to realize what’s going on here, I believe that RooGold is going to be a very popular stock.

RooGold Inc.

(CSE: ROO) (OTC PINK: JNCCF) (Frankfurt: 5VHA)

Cdn$0.09, 2022.05.10

Shares Outstanding 69.7m

Market cap Cdn$5.3m

Roo Gold Inc

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Roogold RooGold Inc. (CSE: ROO). ROO is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.