NOCR: Geophysical survey results provide further evidence of BHT mineralization at Fredriksson Gruvan, Sweden

2022.05.11

Norden Crown Metals (TSXV:NOCR, OTC:NOCRF, Frankfurt:03E) is searching for high-grade silver and zinc deposits in Scandinavia. The Canadian firm last year started drilling at Fredriksson Gruvan, a past-producing zinc-lead-silver mine, as part of an 11-hole, 2,365-meter diamond drill program at its Gumsberg volcanogenic massive sulfide (VMS) property in southern Sweden.

The drill program’s objective was to demonstrate that the mineralization continues below the Fredriksson mine workings, which extend to 91m depth, and to confirm historical silver-zinc-lead grades, thicknesses and continuity.

Results from the first three holes confirmed that Norden Crown is into a “Broken Hill-type (BHT)” deposit such as those found in Australia, South Africa and parts of the Bergslagen mining district of southern Sweden, where the Gumsberg VMS project is located.

Reported grades from mined ore are remarkably consistent, and past drilling rarely missed mineralization, which Norden Crown’s Executive Chairman Patricio Varas says is very encouraging for further resource expansion.

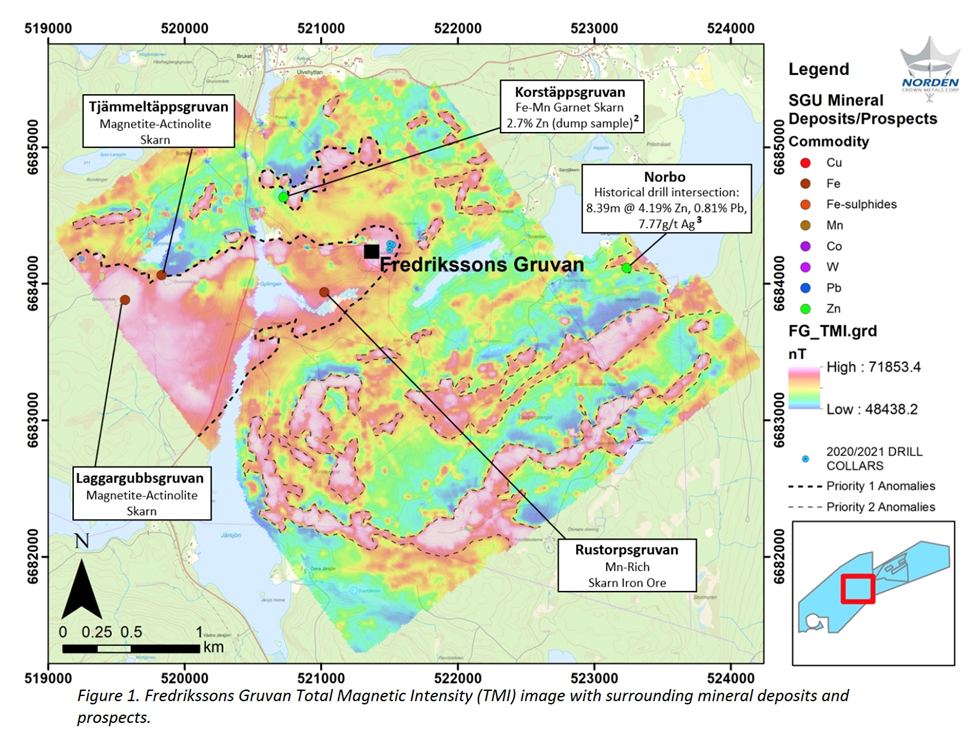

On Monday, May 9, Norden Crown announced the completion of a 450 line-km geophysical survey, done to follow up these three holes.

“The preliminary results of this large ground-based magnetic survey are exciting and provide new prospective on the potential for additional BHT mineralization” Varas stated in the May 9 news release. “This high-resolution magnetic survey allows us to track magnetite-rich bands of sedimentary rocks that we know are associated with BHT mineralization which we will refine in the coming weeks and use to guide additional exploration drilling at Fredriksson Gruvan.”

The seven-week survey, completed on April 2, 2022, was comprised of northwest-southeast survey lines, spaced 25 meters apart, perpendicular to the regional magnetic trend at Gumsberg West.

Gumsberg VMS project

The Gumsberg VMS property is located within the Bergslagen mining district, between the past-producing Falun and Saxberget mines, and the active Garpenberg (Boliden) and Zinkgruvan (Lundin) mines.

The 18,300-hectare land package, with five exploration licenses, was mined from the 13th century through to the 1900s, with an astounding 30 historic mines on the property including Östra Silvberg — the largest silver mine in Sweden from 1250 to 1590.

Last summer, Norden Crown began surface exploration at Gumsberg, where the objective is to enhance existing drill targets through mapping, sampling and airborne geophysics.

Fredriksson Gruvan target

Fredriksson Gruvan is one of four prospects at Gumsberg and is the latest to reach the drill-testing stage.

Based on historical drilling data and 3D modeling, the company has identified a series of targets, to be the focus of drilling.

Exploration on the property carried out during the 1970s included surface trenching, sampling and nine diamond drill holes, which identified precious metals-enriched base metal mineralization.

Test mining conducted by AB Statsgruvor, a state-owned mining company and the project’s previous owner, in 1978 produced 21,500 tonnes grading 53 g/t Ag, 5.13% Zn and 1.7% Pb from an open pit. An additional 11 holes were drilled in 1979 to test the down-plunge extent of mineralization.

After a short pause, mining resumed in 1980-81 with the installation of an underground tram, 45,000 tonnes grading 49 g/t Ag, 5.77% Zn and 1.84% Pb from underground workings, to a depth of 91m.

Norden Crown acquired the Fredriksson Gruvan prospect as part of a larger staking acquisition in March 2017. This licence, referred to as “Gumsberg West”, forms the western half of the Gumsberg project.

Drilling has penetrated to 300 meters below surface, though most of the holes are concentrated between surface and a 100-meter depth. Past drilling has defined significant silver-zinc-lead mineralization over an area measuring 300 meters (east-west), 200 meters (north-south) and 300 meters vertically.

According to the company, magnetic geophysical data sourced from the Geological Survey of Sweden suggests that the prospective magnetic anomaly (and coincident magnetite-bearing iron formation) extends over 21 kilometers across the Gumsberg West licence, greatly enhancing the exploration potential for additional BHT discoveries.

Historical open-pit and underground mining has removed mineralization in the top 91 meters of the deposit. Mineralization at Fredriksson Gruvan extends for a minimum of 200 meters below the historical workings and is open in all directions.

Norden Crown has said it will use this historical data as a guide for its exploration programs.

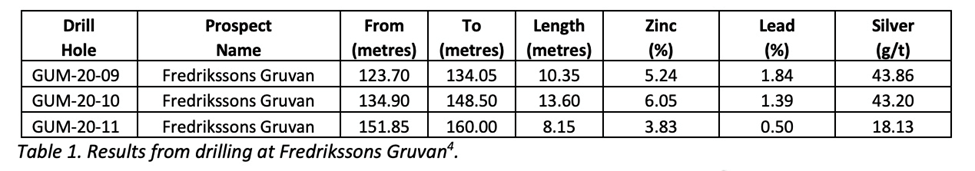

The three holes drilled last year at Fredriksson Gruvan delineated up to 13.60 meters of 6.05% zinc, 1.39% lead and 43.20 grams per tonne (g/t) silver, confirming the prospect’s expansion potential (see table below).

“Surface exploration work at Gumsberg will focus on expanding the current footprint of silver-rich base metals mineralization at Fredriksson Gruvan,” said Varas, in the July 26, 2021 news release. “Broken Hill Type deposits have the potential to yield large tonnages from comparatively small drill footprints due to the high density of the mineralization, so we are conducting detailed geological mapping and tightly spaced airborne magnetic geophysics to delineate mineralization in advance of additional diamond drilling.”

BHT deposits

Apart from the past mining success at Fredriksson Gruvan, a big reason why the company has committed to advancing this prospect is due to its resemblance to the famous Broken Hill ore deposit found in New South Wales, Australia.

Broken Hill Types are some of the largest and highest-grade ore deposits in the world. They are distinguished from other silver-zinc-lead deposits by the chemistry of the sediment that hosts them, and they are usually associated spatially and temporally with volcanism.

BHT deposits have been discovered in Australia — the Broken Hill mining property in New South Wales, a large silver-lead-zinc deposit from which BHT Billiton takes its name — South Africa, and parts of the Bergslagen mining district of southern Sweden, where Gumsberg is located.

There are two settings where mineralization in BHT deposits occurs: in calc-silicate rocks and in banded iron formations (BIF) (most Broken Hill Types contain both calc-silicates and BIF, but usually one is more prevalent than the other).

Examples of the calc-silicate type are the Broken Hill mine in Australia, Zinkgruvan in the Bergslagen mining district of Sweden, currently being mined by Lundin, and the Franklin zinc-iron-manganese deposit in New Jersey, USA.

Banded iron formations known to host Broken Hill Type mineralization include the Dammberg deposit in Sweden which is close to Norden Crown Metals’ Fredriksson Gruvan target; Gamsberg and Aggeneys in South Africa, Pegmont at Mount Isa, Australia; and Boquira in Brazil.

Conclusion

The presence of BHT mineralization hosted in banded iron formations could be an important characteristic at Fredriksson Gruvan to trace and find deposits with the potential for scale — something a junior like Norden Crown Metals must be able to demonstrate to a prospective acquirer. It’s encouraging that another banded iron formation, the Dammberg Zn-Pb-Fe sulfide deposit, is in close proximity to Fredriksson.

I’m convinced that being part of the BHT pedigree will be of interest to a major or mid-tier miner, so it will be exciting to see them continue to characterize it and delineate it, hopefully to scale, as exploration there continues.

Norden Crown Metals

TSXV:NOCR, OTC:BORMF, Frankfurt:03E

Cdn$0.08 2022.05.10

Shares Outstanding 53m

Market cap Cdn$4.2m

NOCR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown Metals (TSXV:NOCR).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.