New copper discoveries becoming pressing matter with production from top producer drying up

2022.03.04

The global copper supply crisis is getting deeper with each passing day.

Even disregarding the military crisis in Europe and the piling sanctions against Russia that have rocked the commodity markets, copper has always been in a tough spot simply because of its fast-rising demand and the critical role in the modern economy.

More than 20 million tonnes of the metal are being consumed each year across a variety of industries; these include building construction, power generation and transmission, and electronic product manufacturing.

Roskill forecasts total copper consumption will more than double and exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand.

In recent years, the global transition towards clean energy has stretched the need for metals even further. More copper will be required to feed our renewable energy infrastructure, such as photovoltaic cells used for solar power and wind turbines.

The metal is also a key component in transportation vehicles, and with increasing emphasis on “electrification”, its demand will likely explode as the modern EV uses about four times as much copper as regular internal combustion engine vehicles.

In fact, analysts at Goldman Sachs are already calling copper “the new oil”, as the metal is a key part of sustainable technologies, including electric vehicle batteries and deriving clean energy.

Growing Copper Crisis

Success of the clean energy transition, though, depends on whether we can supply enough copper to meet future demands.

Copper consumption by green energy sectors alone is expected to jump five-fold in the 10 years to 2030, data from mining and metals consultancy CRU Group shows.

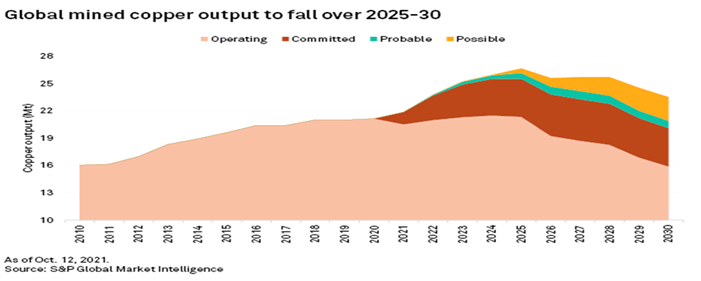

S&P Global Market Intelligence predicts that due to a shortage of projects, copper supply will lag demand starting as early as 2025, with global mine production dropping from last year’s 21.5Mt to roughly 15.9Mt in 2030.

Diminishing supply from currently operating mines, combined with the projected increase in demand for copper concentrate over 2021-2030, would result in a 3.85Mt production shortfall in 2025, S&P Global estimates.

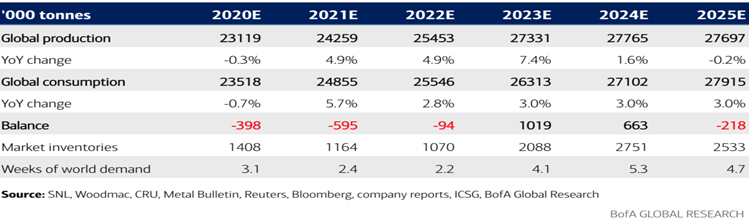

A similar timeline was given by Bank of America in a recent report, which predicts the copper market to flip into a deficit as early as 2025 following the completion of the current wave of project buildouts.

“While visibility over the near-term project pipeline is good, activity increases come with a wrinkle,” the bank’s analysts say. “Indeed, many of the projects currently developed have been in the making for almost three decades, and with exploration activity relatively limited in recent years, supply increases may fade from 2025.”

BloombergNEF estimates that in 20 years, the world’s copper miners must double the amount of global production — from the current 20 million tonnes annually to 40 million tonnes — just to match the demand for a 30% penetration rate of electric vehicles.

This is a tough ask considering some of the world’s largest mines are seeing depleted copper reserves and lower ore grades, so it would be difficult for global production to even maintain a 20-million-tonne-per-year pace.

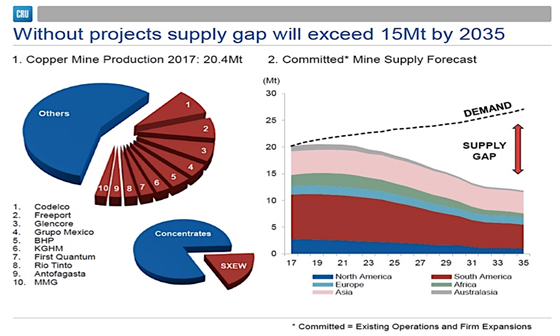

CRU estimates that without new capital investments, global copper mined production will drop below 12 million tonnes in 2034, leading to a supply shortfall of more than 15 million tonnes. According to CRU, there are over 200 copper mines that are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Evidence of a growing copper crisis can be found in Chile, the world’s biggest producer of the metal.

Recent data from Chile’s statistics bureau shows that the nation’s copper output tumbled 15% in January from December, and 7.5% from January 2021, after weak performances from some of its biggest mines. Escondida, the world’s largest deposit, saw its production fall 4.4% year-on-year, while the Collahuasi mine recorded a 10% drop.

At just under 430,000 tonnes, Chile’s January copper output represents its lowest monthly output since 2011, a sign of what’s to come in the copper market and a harbinger of declining mine production. Chile is already coming into this year having experienced a 2% drop in its 2021 copper output.

While no clear reason was given for Chile’s production drop, it’s safe to assume that copper mines are indeed running out of ore. Given Chile accounts for 30% of the world’s supply, the negative impact would be felt the hardest there.

As AOTH have written before, reserves at copper mines are dwindling worldwide, and so are the grades. Copper grades have declined about 25% in Chile over the last decade, bringing less ore to market.

Making matters worse, after more than a decade of drought, freshwater supplies are becoming a big problem in Chile. Copper mines there happen to require lots of water to process sulfide ores, and the lower the grade, the more water must be used.

Since major copper miners are increasingly turning to low-grade sulfide deposits to beef up their production, their water consumption is expected to jump up to 20.9 cubic meters per second (about half an average household pool). Water scarcity in effect hinders their ability to produce.

Another event that has yet to come into play is Chile’s proposed nationalization of its copper industry. While the constitution still has several hurdles to overcome, the idea itself has already started to cause jitters and make miners nervous about their Chilean operations. Similar fears exist in neighboring Peru, the second-largest copper producer.

Copper Hunting in Scandinavia

What this all means is that, sooner or later, the industry has to turn to projects in other regions of the world that are also richly endowed with copper mineralization but with minimal risk affecting mine operations.

This points us to Europe, which has a rich copper mining history and a wealth of copper porphyry deposits that can be traced back to the Paleozoic and Late Cretaceous to Miocene ages.

The US Geological Survey (USGS) estimates that the continent has at least 1 million tonnes of copper reserves. However, as much as 46 million tonnes of copper can be associated with the undiscovered porphyry copper deposits from this geological eon.

Europe also has large scatters of volcanogenic massive sulfide deposits, which like porphyry ores have proven to be major sources of the world’s copper metal and are often associated with major +100Mt mining camps around the world.

VMS mineralization is commonplace in many European regions including Scandinavia, whose mining history dates as far back as 6,000 years from today. The Skellefte district in northern Sweden, for example, has a rich endowment of volcanogenic massive sulfides. Sweden’s first mine, the Falun copper mine in Dalarna county, was a giant VMS deposit that produced as much as two-thirds of Europe’s copper for hundreds of years.

Most of Sweden’s landmass is geologically part of the Baltic Shield, which also covers other Fennoscandia nations (Finland, Norway) and northwestern parts of Russia, and has the oldest rocks in Europe.

The Baltic Shield is currently one of the largest and most active mining areas on the continent, and has often drawn comparisons to the Canadian Shield and cratons in South Africa.

Norden Crown Metals

Due to its favorable geology and past mining success, it’s only a matter of time before Scandinavia emerges as a prime destination for miners looking to unlock its vast copper resources, on top of its already steady production of iron ore and other base metals (zinc, lead).

Recognizing the importance of early-mover advantage, Norden Crown Metals Corp. (TSXV: NOCR) (OTC: NOCRF) (Frankfurt: 03E) has specifically identified its exploration focus on this part of the European continent.

The company has two projects that it is actively exploring: the Gumsberg VMS property in Sweden, hosting a past-producing zinc-lead-silver mine located near Falun, and the Burfjord iron-oxide-copper-gold property in Norway. The latter is a joint venture project with Boliden AB.

Last month, the joint venture committee approved a significant exploration initiative at Burfjord, setting the budget for this year at nearly CAD$2 million. This amount almost matches the US$1.9 million that Boliden has spent on the Burfjord property so far.

Planned activities at Burfjord in 2022 would include diamond drilling, ground electrical and airborne magnetic geophysics, mapping, sampling (rock and soil), and prospecting.

Under the terms of their 2020 JV agreement, Boliden has the option to earn a 51% stake in the project by spending US$6 million in exploration within a four-year period. The latest budget approval puts the Swedish mining giant more than halfway through its spending commitment, and places Norden Crown even closer to a significant discovery.

Boliden can also increase its stake in Burfjord by an additional 29%, should it exercise its 51% option, by solely funding the project through a NI 43-101 and PERC compliant feasibility study. This would allow Norden Crown to retain a 20% interest in what could be a quality project funded and operated by a leading company in the region.

Boliden, a top 5 mining company in Europe by revenue, currently has six active base and precious metals mines, as well as five smelters across Norway, Sweden and Finland.

Commenting on the 2022 exploration initiative at Burfjord, Norden Crown’s president and CEO Patricio Varas said in a news release: “Drilling, geological and geophysical results have led the technical committee to put together an exciting exploration program that has potential for new discoveries of IOCG copper mineralization.”

Previous drilling at Burfjord (2019) returned compelling results, including an intercept of 32 m averaging 0.56% copper and 0.26 g/t gold (including 3.46 m of 4.31% copper and 2.22 g/t gold) at shallow depths below a cluster of historic mine workings.

About Burfjord Property

Burfjord is located 32 km west of the Kåfjord copper mines, the first major industrial enterprise north of the Arctic Circle. The road-accessible project is 40 km from Alta, where there is a regional airport, and 7.5 km from tidewater.

The property comprises six exploration licenses totaling 5,500 hectares. Mineralization at Burfjord belongs to the IOCG deposit clan; this portion of northern Fennoscandia is a key IOCG province globally.

Copper was mined in the Burfjord area during the 19th Century, with over 30 historical mines and prospects developed along the flanks of a prominent 4 x 6 km anticline.

IOCG deposits are among the most valuable concentrations of copper, gold and uranium ores. These orebodies, ranging from around 10 million tonnes of contained ore to 4 billion tonnes or more, have grades of 0.2 to 5% copper, and gold from 0.1 to >3 grams per tonne. Their tremendous size, relatively high grades and simple metallurgy give IOCG deposits the potential for making extremely profitable mines.

High-profile examples include BHP’s Olympic Dam complex in Australia, and the Candelaria undeveloped copper-gold deposit in Chile.

Burfjord is characterized by broad arrays of copper-, gold- and cobalt-bearing veins dominated by iron-oxide and iron-carbonate-rich mineral assemblages reminiscent of IOCG mineral deposits. The large associated alteration system and widespread copper mineralization support the project’s potential to host a large copper deposit.

Norden Crown chief executive Patricio Varas had previously found success with IOCG projects when he headed Far West Mining. That company formed a strategic alliance with BHP, the world’s largest miner, exploring and drilling properties in Australia, Sweden, Argentina, Chile and Canada. Varas’ team carries that experience with them as they aim to solve the mysteries underlying Burfjord.

“We know these deposits really well, we know what we’re looking for, the tools you need to find them, the kinds of alteration systems you need to have, the type of mineralization — of course this deposit has all of that in spades,” Varas said in an earlier AOTH interview.

Conclusion

With the world’s copper supply drying up, there would have to be more investments into new discoveries and turning them into producers of tomorrow.

According to reports, the mining industry must double the current production of 20Mt by 2040 to have a chance of coming close to meeting demand. This equates to one new Escondida mine (1Mt annual production) every year for the next 20 years.

We’re already seeing reserves dwindle at the biggest mines, with lower ore grades each year. Chile’s production has declined sharply is indicative of the pending supply crunch, which is once again driving copper prices toward record highs.

While getting 1Mtpa of additional output is difficult to achieve, finding the right investments in projects leading to copper discoveries would help to close the supply gap. According to CRU, the copper industry needs to spend upwards of $100 billion to erase what it estimates to be a 4.7Mt deficit by 2030.

Some major miners have already taken the necessary steps, like what Boliden has done with the Burfjord project in Norway. The fact it has committed to spending as much as $6 million on exploring this project is a tremendous vote of confidence for its future prospects.

Exploration activities at Burfjord are likely to provide additional information on the copper mineralization, which has seen production in the past and has shown signs of a large deposit in the making.

Norden Crown Metals

TSXV:NOCR, OTC:BORMF, Frankfurt:03E

Cdn$0.125, 2022.03.03

Shares outstanding: 53m

Market cap: Cdn$6.6m

NOCR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown Metals (TSX.V:NOCR). NOCR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.